Sustainable Airport Market Report, 2032

The global green airport market size was valued at $4.6 billion in 2022, and is projected to reach $12 billion by 2032, growing at a CAGR of 10.2% from 2023 to 2032.

Report Key Highlighters:

- The green airport market studies more than 15 countries. The research includes a segment analysis of each country in terms of value ($ million) for the projected period 2022-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The green airport market share is moderately fragmented, with several players including SITA, TKH Airport Solutions, ABB, Schnieder Electric, Acciona, Collins Aerospace, Honeywell International Inc., IBM Corporation, Siemens AG, and Thales Group. Key strategies such as contract, collaboration, expansion, agreement, partnership, and other strategies of the players operating in the market are tracked and monitored.

A green airport refers to an airport that prioritizes sustainability by minimizing its environmental footprint, aiming to decrease the impact of airport operations on the environment and contribute to the fight against climate change. According to the International Energy Agency findings in 2022, aviation was responsible for 2% of global energy-related carbon dioxide (CO2) emissions. This sector experienced faster growth in recent decades compared to rail, road, or shipping. A green airport is characterized by the adoption of sustainable measures to diminish its environmental impact and foster sustainable development. These airports strive to decrease their carbon footprint, conserve energy and water resources, and minimize waste and emissions.

Factors such as stringent environmental regulations, increase in demand for operational cost savings and efficiency, and rise in awareness and concerns about environmental issues drive the growth of the green airport market. However, high initial costs, and challenges in technology adoption and integration hinder the growth of the market. Furthermore, inclination toward adopting automation and business intelligence solutions, and technological advancements offer remarkable growth opportunities for the players operating in the market.

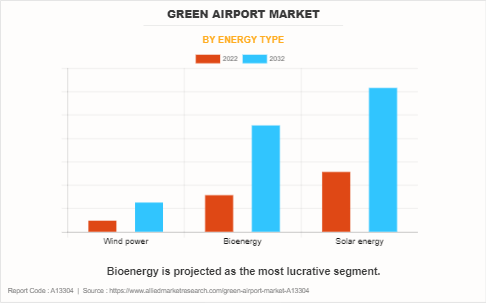

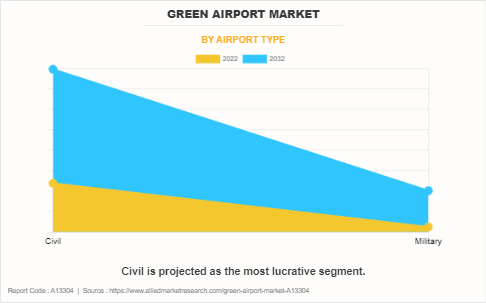

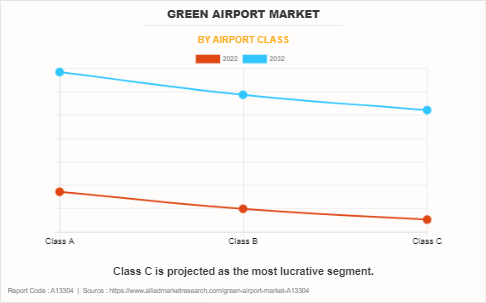

The green airport market is segmented on the basis of energy type, airport type, airport class, and region. By energy type, it is divided into wind power, bioenergy, and solar energy. As per airport type, the market is classified into commercial and military. Depending on airport class, it is fragmented into Class A, Class B, and Class C. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading companies profiled in the green airport market report include SITA, TKH Airport Solutions, ABB, Schnieder Electric, Acciona, Collins Aerospace, Honeywell International Inc., IBM Corporation, Siemens AG, and Thales Group.

North America includes the U.S., Canada, and Mexico. The factors contributing to the growth of green airports includes rise in the number of airports in the region adopting renewable energy sources, such as solar and wind power, to reduce their carbon footprint. Aviation association and government supports airports in the adoption of technologies and practices that align with net-zero emissions target. For instance, in July 2023, FAA announced to invest over $90 million to support 21 U.S. airports in achieving net-zero emissions by 2050. A significant portion, around $46.8 million, is allocated for sustainability projects focusing on solar energy initiatives, including the installation of solar panels. Moreover, about $44.5 million is expected to be directed towards electric vehicles and transportation infrastructure development.

The analysis of the green airport market trends reveals a prominent shift towards sustainable practices, emphasizing eco-friendly initiatives and innovative solutions for environmental conservation. In addition, airports are dedicating investments to technologies that optimize energy consumption, thereby lowering operational costs. Carbon offset programs have been implemented by airports in the region to counterbalance their carbon emissions. These programs involve supporting projects aimed at reducing or capturing an equivalent amount of carbon to offset the airport's environmental impact. The rise in awareness among passengers regarding environmental concerns has resulted in elevated expectations for sustainable practices at airports. In addition, there is rise in the demand for sustainable practices and programs to create eco-friendly airports. For instance, Changi Airport Group (CAG) aims to minimize its environmental footprint and palces high priority on sustainable design, the reuse of materials, careful procurement choices. Moreover, in November 2023, the Civil Aviation Authority of Singapore (CAAS) concluded a 20-month pilot test of sustainable aviation fuel (SAF) at Changi Airport. Such broader adoption of sustainable aviation practices is expected to accelerate the green airport market growth.

Stringent environmental regulations

Regulatory bodies enforce rigorous environmental standards and rules for airports to mitigate the environmental consequences of their activities. Numerous environmental regulations are in harmony with worldwide initiatives and accords designed to tackle climate change and foster sustainable practices. Moreover, aviation associations develop frameworks to evaluate and improve the environmental performance of airports. For instance, in November 2022, the International Air Transport Association (IATA) has introduced the IATA Environmental Assessment for Airports and Ground Service Providers (IEnvA for Airports and GSPs), with Edmonton International Airport (YEG) being the inaugural participant in this expanded program. The initiative signifies a commitment to fostering sustainability throughout the air transport sector.

Airports are required to adhere to these regulations, necessitating the incorporation of eco-friendly practices and technologies. In addition, the airports actively embrace green initiatives to meet environmental standards and assessment. Airports adopt sustainable practices and technologies to comply with the stringent rules and directives established by governmental authorities and regulatory bodies to guarantee that airports prioritize sustainability and environmental accountability.

Increase in demand for operational cost savings and efficiency

Airports are increasingly realizing that embracing environmentally friendly practices and sustainable technologies can result in enduring cost efficiencies. These green initiatives yield benefits such as enhanced energy efficiency, minimized waste, and more streamlined processes, directly translating into financial advantages for airports. The integration of energy-efficient technologies, such as solar power or energy-efficient lighting systems, empowers airports to curtail their overall energy consumption.

This adoption aligns with sustainability objectives and brings about considerable cost savings in terms of energy expenditures. Green airports frequently in state programs for waste reduction and recycling, contributing not only to environmental preservation but also to the reduction of waste disposal expenses. Additionally, the construction and retrofitting of airport facilities with sustainable building practices, such as the use of eco-friendly materials or the incorporation of energy-efficient designs, can lead to diminished construction and maintenance costs over the long term.

High initial costs

Implementing green technologies and infrastructure in airports often demands significant financial investments, covering areas such as solar panels, energy-efficient lighting, and waste management systems. The initial expenses related to the installation of these technologies pose a considerable financial challenge for airports, especially those operating within constrained budgets. Moreover, the upgradation of existing infrastructure or constructing new environmentally friendly buildings may result in extra costs compared to conventional construction methods.

The utilization of specialized materials and technologies to meet green standards contributes to elevated initial expenditures. In addition, ensuring the successful implementation of green practices requires staff training and awareness programs. The costs associated with educating personnel and integrating new operational procedures may increase the overall cost which is expected to hamper the growth of the green airport industry.

Challenges in technology adoption and integration

The seamless integration of new green technologies into existing airport infrastructure may present challenges due to compatibility issues. Retrofitting or upgrading systems to accommodate these technologies is a complex task that often requires additional investments.

The adoption and integration of new technologies may lead to disruptions during the transition period. The initial investment in technology may include additional costs associated with the integration process. The critical consideration of ensuring the security and privacy of data generated by these technologies may complicate the integration process. Successfully implementing these technologies requires overcoming resistance and fostering a positive attitude toward technological advancements.

Inclination toward adopting automation and business intelligence solutions

The implementation of automation and business intelligence solutions plays a pivotal role in streamlining diverse processes within airports, contributing to an increase in the operational efficiency. These technologies optimize resource utilization, reduce energy consumption, and elevate overall sustainability practices. The deployment of business intelligence solutions empowers airports with data analytics capabilities, facilitating well-informed decision-making. Green airports can capitalize on data-driven insights to pinpoint areas for environmental enhancements, execute targeted strategies, and assess the efficacy of sustainability initiatives. In addition, the rise in the integration of automation into vehicles enables airports to optimize the overall operation.

For instance, in October 2023, International Airlines Group (IAG), the parent company of British Airways and Aer Lingus entered into a partnership with Aurrigo International, a transport technology developer, to introduce autonomous aviation solutions and vehicles across the UK airports. Moreover, the incorporation of automation in passenger services, including self-check-in kiosks and automated baggage systems, not only amplifies operational efficiency but also contributes to an enriched overall passenger experience. For instance, in September 2023, Air India, airline based in India implemented an integrated self-baggage drop and self-kiosk check-in service at Terminal 3 of Delhi airport. This marks a significant advancement in passenger services, making Air India the first Indian carrier to offer such a service. The integrated self-service system is designed to enhance the check-in process for passengers, providing greater convenience and efficiency. Such developments are expected to provide lucrative opportunities for the growth of the market.

Recent Developments in the Green Airport Industry

- In June 2023, Honeywell International, Inc. introduced an updated suite of airside solutions, focusing on enhancements in its gate, turnaround, and airfield lighting portfolios. The new offerings include the Honeywell Navitas Smart Visual Docking system, Turnaround Manager, Single Lamp Control and Monitoring System (ASDv5 SVL), and Loop Sensor.

- In March 2023, SITA received a contract from Hong Kong International Airport to provide a carbon management platform to monitor and manage data on carbon emissions across the airport. The platform aims to help HKIA track key performance indicators (KPIs) as it works towards its net zero carbon goal.

- In August 2023, Siemens Logistics received a contract with Aena, the Spanish airport operator, to operate and maintain the baggage handling system at Palma de Mallorca Airport (PMI) in Spain. The service contract encompasses the airport's conveyor system, two tilt-tray sorters, 192 check-ins, and various baggage reclaim carousels.

- In January 2023, Schneider Electric, through its joint venture AlphaStruxure entered into an agreement to develop, build, and operate an integrated microgrid infrastructure at the New Terminal One (NTO) at John F. Kennedy International Airport. The project includes plans for a 13,000-panel solar array, covering all available and viable rooftop areas.

- In November 2022, Siemens Logistics received a contract from Noida International Airport (NIA) in Jewar, India to supply VarioTray baggage handling system (BHS) for its Terminal One. Siemens Logistics will handle the design, supply, installation, commissioning, and maintenance of the BHS.

- In August 2020, TKH Airport Solutions acquires contract for airfield ground lighting based on CEDD technology for Istanbul Sabiha Gökçen International Airport. The contract includes a hybrid solution, whereby the taxiways and all other addressable light fixtures will be provided in CEDD AGL technology.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the green airport market analysis from 2022 to 2032 to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global market trends, key players, market segments, application areas, and market growth strategies.

Green Airport Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 12 billion |

| Growth Rate | CAGR of 10.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Energy Type |

|

| By Airport Type |

|

| By Airport Class |

|

| By Region |

|

| Key Market Players | Honeywell International Inc., ABB, Acciona, IBM Corporation, Thales Group, SITA, TKH Airport Solutions, Collins Aerospace, Schnieder Electric, Siemens AG |

The global green airport market was valued at $4,604.1 million in 2022, and is projected to reach $11,956.2 million by 2032, registering a CAGR of 10.2% from 2023 to 2032.

The leading companies profiled in the report include SITA, TKH Airport Solutions, ABB, Schnieder Electric, Acciona, Collins Aerospace, Honeywell International Inc., IBM Corporation, Siemens AG, and Thales Group.

The largest regional market for Green Airport is North America.

The leading airport type of Green Airport Market is Civil.

The upcoming trends of Green Airport Market in the world are inclination toward adopting automation and business intelligence solutions, and technological advancements.

Loading Table Of Content...

Loading Research Methodology...