Green Bonds Market Research, 2033

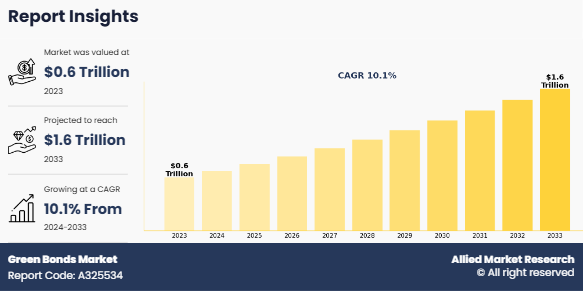

The global green bonds market was valued at $582.6 billion in 2023, and is projected to reach $1,555.1 billion by 2033, growing at a CAGR of 10.1% from 2024 to 2033. The Green Bonds market refers to a segment of the bond market where funds are raised specifically to finance environmentally sustainable projects. These bonds are issued by governments, corporations, or financial institutions with the objective of funding initiatives aimed at addressing environmental challenges such as climate change, renewable energy, energy efficiency, and sustainable agriculture. Investors in green bonds receive regular interest payments and are repaid the principal amount at maturity, just like traditional bonds. However, the key distinguishing factor is that the proceeds from green bonds must be directed towards projects that have a positive environmental impact, such as reducing carbon emissions or conserving natural resources. The green bonds industry has seen significant growth in recent years as investors increasingly seek ways to align their portfolios with environmental, social, and governance (ESG) objectives. The growth of the green bonds market is also driven by a global push towards sustainable investment practices. Investors in green bonds receive the same financial returns as traditional bonds, including regular interest payments and repayment of the principal at maturity. However, the distinct feature of green bonds is their focus on financing projects with tangible environmental benefits. With growing awareness of environmental issues, the green bonds industry has expanded rapidly as institutional investors, asset managers, and even retail investors seek to support sustainable development while achieving financial returns. Additionally, as the world moves toward a low-carbon economy, green bonds are becoming an essential tool for financing the transition to a more sustainable future.

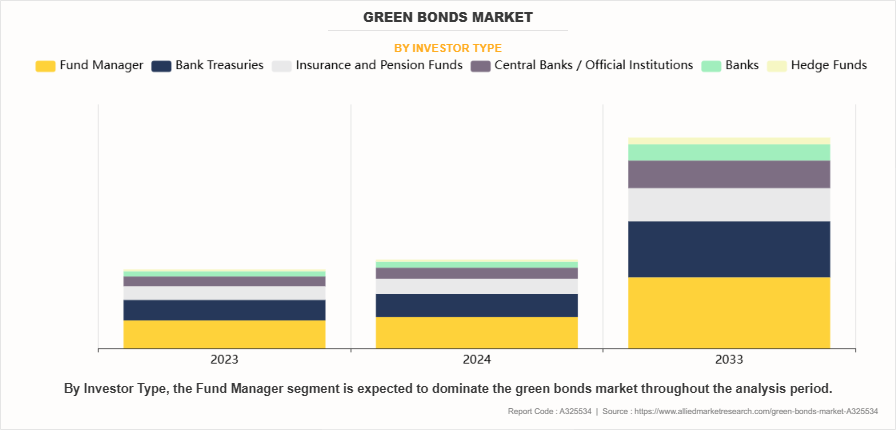

On the basis of investor type, the fund manager segment dominated the green bonds market size in 2023 and is expected to maintain its dominance in the upcoming years as well. Fund managers, including large institutional investors, asset management firms, and pension funds, are increasingly allocating capital to green bonds as part of their portfolios. This is driven by a growing focus on sustainable investment strategies and the increasing demand for environmental, social, and governance (ESG)-aligned assets. However, the central banks / official institutions segment is expected to witness the highest growth in the upcoming years, owing to several key factors. Central banks and official institutions are increasingly adopting sustainable bonds as part of their broader strategy to promote sustainable economic growth and environmental stability. With the growing emphasis on climate change mitigation and the transition to a low-carbon economy, these institutions are using green bonds to align their monetary policies with climate objectives and reduce exposure to environmental risks.

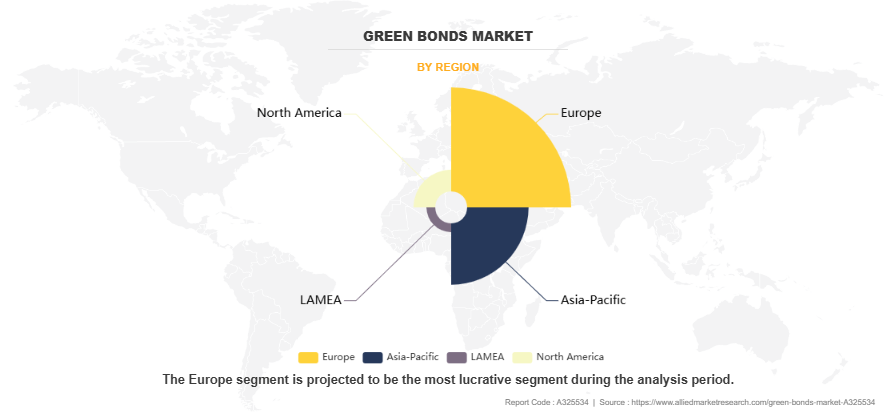

On the basis of region, Europe attained the highest green bonds market share in 2023, owing to several factors that position the region as a leader in green finance. Europe has long been at the forefront of environmental policies, with strong commitments to climate action and sustainability. The European Union’s Green Deal, which aims to make Europe the world’s first climate-neutral continent by 2050, has significantly bolstered the demand for green bonds. This regulatory support, along with initiatives like the EU Green Bond Standard, has created a favorable environment for the growth of the green bonds market in the region. On the other hand, LAMEA is projected to dominate the green bonds market growth during the forecast period, owing to increasing awareness of climate change, the growing need for sustainable infrastructure, and rising support from governments and financial institutions for green initiatives. As countries in Latin America, the Middle East, and Africa seek to transition to cleaner energy sources and address environmental challenges, the demand for green financing is expanding rapidly. Additionally, international climate agreements and global ESG investment trends are encouraging local governments and private institutions in LAMEA to issue green debt to fund eco-friendly projects. The region is also seeing an increase in institutional investor interest, supported by favorable regulatory frameworks and the growing availability of green bond products.

The report focuses on growth prospects, restraints, and trends of the green bonds market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the green bonds market.

Segment Review

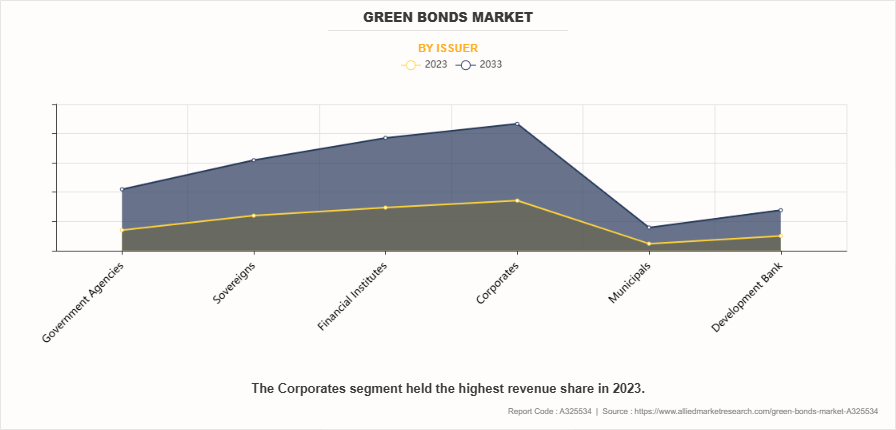

The green bonds market is segmented on the basis of investor type, issuer, and application. By investor type, the market is divided into fund managers, bank treasuries, insurance and pension funds, central banks/official institutions, banks, and hedge funds. In terms of issuer, the green bonds market is segmented into government agencies, sovereigns, financial institutions, corporates, municipals, and development banks. Based on application, the Green Bonds market is further categorized into energy, building, water, transport, waste, land, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The report analyzes profiles of key players operating in the green bonds market such as KfW, Frankfurt Am Main, Abu Dhabi Future Energy Company, China Development Bank, Bank Of China, European Investment Bank, World Bank Group, Equinix, Inc., Deutsche Bank AG, Engie Group, Iberdrola, S.A. These players have adopted various strategies to increase their market penetration and strengthen their position in the green bonds market.

Competition Analysis

Recent Initiatives

On December 16, 2024, Climate Bonds Initiative, Hokkaido government and the City of Sapporo jointly called for the acceleration of regional revitalisation in Hokkaido and Sapporo through the promotion of Green Transformation (GX) in the region. This will be achieved with government support and through collaboration to develop the GX Finance and Asset Management Special Zone in Hokkaido. The Hokkaido government anticipates that the growing demand for energy, particularly renewable energy, will drive the development of renewable energy-related supply chains in the region. This growth will also strengthen the presence of Green Transformation/Digital Transformation related industries, such as the semiconductor sector and data centres, which will be highly dependent on renewable energy. These present a significant opportunity for regional revitalization. By promoting GX/DX through the utilisation of the Special Zone, Hokkaido will continue to develop as a vibrant region where the environment and economy are in a virtuous cycle. It will contribute to GX efforts both in Japan and globally as a base for the supply and utilisation of renewable energy.

Furthermore, on January 23, 2025, Jamaica has formally launched its Green Bonds, offering and trading in green bonds. This initiative encourages businesses to utilize the platform to raise capital for sustainable development projects. The Green, Social, Sustainability and Sustainability-Linked Bond Guide was developed with the support of IDB Invest and other local and international partners. Given the global challenges posed by climate change and social inequality, investors are showing a growing interest in supporting the global sustainability agenda and aiding the shift towards a low-carbon, equitable economy through the provision and investment in Green Bonds.

Furthermore, on January 22, 2024, The African Development Bank, rated Aaa/AAA/AAA/AAA (Moody’s/S&P/Fitch/Japan Credit Rating, all stable), has launched and priced a USD 2 billion 3-year Social Global Benchmark due 25 February 2027, its first social bond issued under its new Sustainable Bond Framework, established in September 2023. The Sustainable Bond Program seamlessly consolidates and enhances the African Development Bank’s existing Green and Social Bond programs, facilitating the issuance of green bonds, social bonds, and sustainability bonds. This new 3-year Social Benchmark is the Bank’s first global benchmark of the year, strategically aligning with the robust reopening of primary markets in January 2024. This issuance is a significant highlight amid a dynamic week in the USD SSA markets, witnessing the launch of 8 benchmarks totaling USD 17.25 billion within a span of two days.

Top Impacting Factors

Increasing Demand for Sustainable Investment

The growing demand for sustainable investment has emerged as a significant driver for the green bonds market. Over the past few years, there has been a noticeable shift in investor preferences, with a heightened focus on Environmental, Social, and Governance (ESG) factors. This shift is largely driven by the growing awareness of climate change, environmental degradation, and social responsibility, prompting investors to seek opportunities that align with their values while also offering financial returns. Institutional investors, including pension funds, asset managers, and insurance companies, are increasingly incorporating ESG criteria into their investment strategies. These investors are motivated by the desire to support projects that contribute positively to environmental sustainability, such as renewable energy, green infrastructure, and energy-efficient technologies. The demand for green bonds, which are fixed-income securities used to raise capital for environmentally sustainable projects, is a direct result of this trend. Green bonds not only provide a mechanism for financing environmentally beneficial initiatives but also offer a way for investors to diversify their portfolios while addressing global challenges like climate change. Furthermore, the rise of individual investors, particularly millennials, who prioritize sustainability, has amplified the demand for green investments. These investors are more likely to choose investment products that have a positive social and environmental impact, leading to increased participation in the green bonds market. As this demographic continues to grow, it is expected that the demand for green bonds will continue to rise. In addition, the financial performance of green bonds has demonstrated that they can offer competitive returns, which further supports their appeal. With the increasing recognition of sustainable investment opportunities, the green bonds market is projected to experience continued growth, making it an integral part of the global financial landscape.

Regulatory Support and Policies

Regulatory support and policies have played a pivotal role in accelerating the growth of the green bonds market. As climate change and environmental concerns continue to dominate global agendas, governments and regulatory bodies worldwide are implementing policies to facilitate sustainable investments. These initiatives aim to provide clear guidelines, ensure transparency, and enhance investor confidence in green financial products, thereby fostering the development of the green bonds market. One of the most significant regulatory moves in recent years has been the introduction of green bond standards and frameworks. In Europe, the EU Green Bond Standard, established as part of the European Green Deal, has created a comprehensive framework for what qualifies as a green bond. This initiative ensures that the funds raised through green bonds are used exclusively for projects that contribute to the EU's climate objectives, such as renewable energy, energy efficiency, and sustainable infrastructure. By creating uniform standards, regulatory bodies have reduced ambiguity and enhanced the credibility of green bonds, attracting both institutional and retail investors. Additionally, the establishment of tax incentives and subsidies by various governments has further encouraged the issuance and investment in green bonds. These fiscal policies provide issuers with financial benefits and reduce the cost of green bond issuance, making it an attractive option for businesses and governments to raise capital for environmental projects. Furthermore, countries such as China and India have also introduced their own green bond frameworks, aligning their regulatory frameworks with global sustainability goals. In many regions, regulatory bodies have also made ESG (Environmental, Social, and Governance) disclosures mandatory, requiring companies and financial institutions to disclose their sustainability-related financial risks and opportunities. This increased emphasis on sustainability in reporting has boosted investor demand for green bonds, as they offer a clear and accountable way to support sustainable projects.

Corporate and Institutional Commitment to Sustainability

Corporate and institutional commitment to sustainability has emerged as a critical factor driving the growth of the green bonds market. As environmental concerns such as climate change, resource depletion, and pollution have become more pressing, both corporations and financial institutions are increasingly recognizing the importance of integrating sustainability into their operations and investment strategies. This commitment is significantly influencing the demand for green bonds as companies and institutions seek to align their financing with their sustainability goals. Corporations, particularly those in high-impact sectors like energy, manufacturing, and transportation, are under growing pressure from regulators, investors, and consumers to adopt more sustainable business practices. Many companies are setting ambitious sustainability targets, such as achieving net-zero emissions or investing in renewable energy projects, which require significant capital investment. Green bonds provide an ideal financing tool for such initiatives, as they enable companies to raise funds specifically for projects that support environmental sustainability. By issuing green bonds, companies can attract environmentally conscious investors, enhance their reputation, and demonstrate their commitment to climate goals. Institutional investors, including pension funds, asset managers, and insurance companies, are also increasingly prioritizing sustainability in their investment portfolios. These institutions are under pressure from stakeholders, including clients and beneficiaries, to invest in projects that contribute positively to environmental and social outcomes. As a result, many institutional investors are actively seeking green bonds as a way to finance renewable energy, energy efficiency, and other climate-resilient projects. Green bonds offer institutional investors an opportunity to meet their sustainability targets while achieving competitive returns. Furthermore, financial institutions themselves are becoming more active in the green bonds market. Banks, asset management firms, and insurance companies are not only investing in green bonds but also facilitating their issuance. By supporting green bond issuances, financial institutions contribute to the overall growth of the market and reinforce their commitment to sustainable finance.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the green bonds market forecast from 2024 to 2033 to identify the prevailing green bonds market opportunity.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the green bonds market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global green bonds market outlook.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as global green bonds market trends, key players, market segments, application areas, and market growth strategies.

Green Bonds Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 1555.1 billion |

| Growth Rate | CAGR of 10.1% |

| Forecast period | 2023 - 2033 |

| Report Pages | 250 |

| By Investor Type |

|

| By Issuer |

|

| By Application |

|

| By Region |

|

| Key Market Players | Abu Dhabi Future Energy Company, Equinix, Inc., Deutsche Bank AG, Bank of China, Iberdrola, S.A., KfW Group, The World Bank Group, China Development Bank, European Investment Bank, Engie Group |

Analyst Review

The green bonds market has emerged as a pivotal segment within the sustainable finance industry, offering innovative funding mechanisms to support environmentally friendly projects and initiatives. This market is growing rapidly as governments, corporations, and financial institutions prioritize sustainability and align their investments with global climate goals. Green bonds are primarily issued to finance projects that address renewable energy, energy efficiency, sustainable water management, waste reduction, and other environmentally beneficial activities. The adoption of green bonds is driven by increasing awareness of climate change, the demand for sustainable investments, and regulatory frameworks that encourage green financing. These bonds attract environmentally conscious investors by providing transparency and accountability, ensuring that funds are directed toward sustainable projects. Technological advancements, including blockchain for enhanced transparency and data analytics for impact measurement, are transforming the green bonds ecosystem, improving investor confidence and market efficiency.

The demand for green bonds is further propelled by international agreements such as the Paris Climate Accord, regional sustainability policies, and corporate commitments to achieving net-zero emissions. By channeling investments into green projects, green bonds not only contribute to environmental sustainability but also offer issuers an opportunity to enhance their brand reputation and attract a broader pool of socially responsible investors. Key players in the green bonds market differentiate themselves by adhering to globally recognized standards such as the Green Bond Principles (GBP) and offering rigorous reporting mechanisms that track the impact of funded projects. Features such as third-party certifications, clear use-of-proceeds frameworks, and post-issuance transparency are essential for maintaining investor trust and fostering market growth. Despite the robust growth trajectory, challenges persist in the form of regional regulatory disparities, a lack of standardized definitions for “green” projects, and the need for increased transparency and verification mechanisms. However, these challenges are being addressed through collaborative efforts among policymakers, financial institutions, and sustainability organizations.

As the global demand for sustainable financing solutions continues to rise, the green bonds market is expected to expand consistently, playing a vital role in combating climate change and supporting the transition to a low-carbon economy. By bridging the gap between sustainability goals and investment opportunities, green bonds are transforming the financial landscape and promoting environmentally responsible economic development.

Some key players profiled in the report include KfW, Frankfurt Am Main, Abu Dhabi Future Energy Company, China Development Bank, Bank Of China, European Investment Bank, World Bank Group, Equinix, Inc., Deutsche Bank AG, Engie Group, Iberdrola, S.A. These players have adopted various strategies to increase their market penetration and strengthen their position in the green bond market.

The Green Bonds Market is estimated to grow at a CAGR of 10.1% from 2024 to 2033.

The Green Bond Market is projected to reach $1,555 billion by 2033.

The Green Bonds Market is expected to witness notable growth, driven by increasing demand for sustainable investments and regulatory support and policies.

The key players profiled in the report include KfW, Frankfurt Am Main, Abu Dhabi Future Energy Company, China Development Bank, Bank Of China, European Investment Bank, World Bank Group, Equinix, Inc., Deutsche Bank AG, Engie Group, Iberdrola, S.A.

The key growth strategies of green bonds market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...