Green, Social, Sustainability, And Sustainability-linked Bond (GSSSB) Market Research, 2033

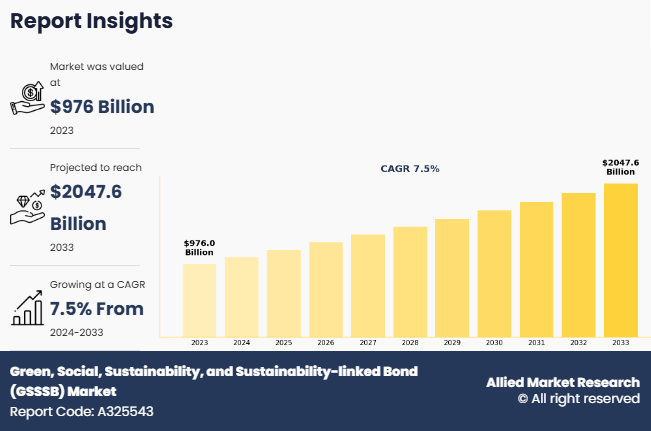

The global green, social, sustainability, and sustainability-linked bond (GSSSB) market size was valued at $976 billion in 2023, and is projected to reach $2,047.6 billion by 2033, growing at a CAGR of 7.5% from 2024 to 2033. Green, social, sustainability and sustainability-linked bonds are traditional financial instruments with an emphasis on sustainability, which are helping to channel investment to sustainable infrastructure, and essential services. It is a type of bond tool where the funding will be exclusively applied to eligible environmental and social projects or a combination of both. Green bonds are used to finance new and existing projects or activities with positive environmental impacts. Also, to qualify as a social bond, the borrower must finance or refinance social projects or activities that achieve positive social outcomes and address a social issue. The rise in ESG awareness, increase in regulatory support, and policies are expected to boost the green, social, sustainability, and sustainability-linked bonds market growth. In addition, an increase in technological advancements are the major factors that drive the green, social, sustainability, and sustainability-linked bond (GSSSB) market growth. However, high transaction costs and economic uncertainty are some of the factors that hamper the market growth. On the contrary, several regulatory bodies are implementing strategies and investing in green, social, sustainability, and sustainability-linked bond (GSSSB) market solutions for their business processes to expand product lines in the green, social, sustainability, and sustainability-linked bond (GSSSB) market.

In addition, increase in government guidelines has become a mandatory application for consumers' personal data. As a result, green, social, sustainability, and sustainability bond solution providers take various guidelines into account for certain sustainability-related activities, which is expected to boost market growth in the forecast period.

The report focuses on growth prospects, restraints, and trends of the green, social, sustainability, and sustainability-linked bond (GSSSB) market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as the bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, the threat of substitutes, and bargaining power of buyers, on the green, social, sustainability, and sustainability-linked bond (GSSSB) market.

Key Findings:

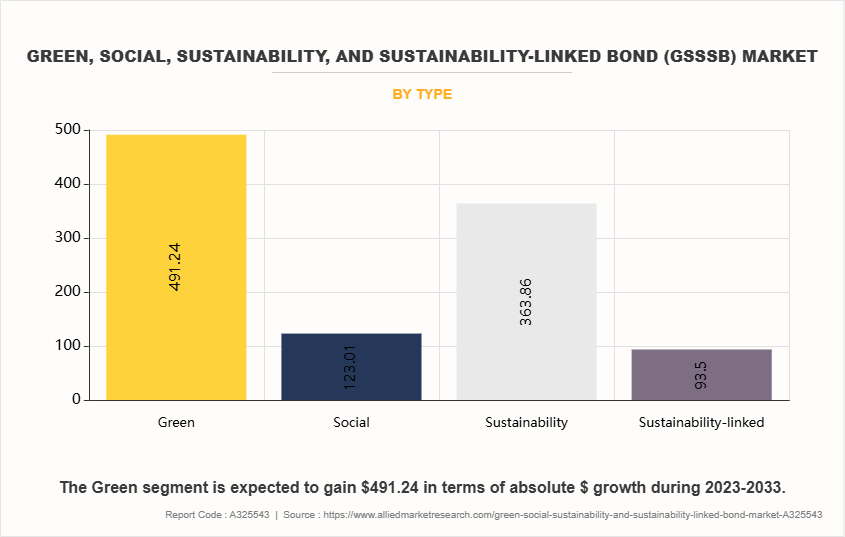

By type, the green segment accounted for the largest market share in 2023.

By issuer, the corporates segment accounted for the largest market share in 2023.

By industry, the energy segment accounted for the largest market share in 2023.

By application, the others segment accounted for the largest market share in 2023.

By investor, the fund manager segment accounted for the largest market share in 2023.

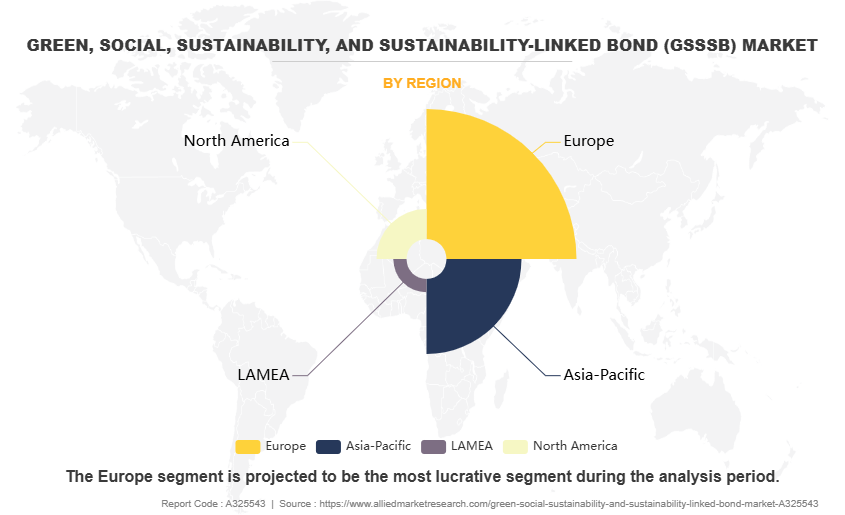

Region-wise, Europe generated the highest revenue in 2023.

Segment Review

The green, social, sustainability, and sustainability-linked bond (GSSSB) market share is segmented on the basis of type, issuer, industry, investor, and region. By type, the market is segmented into green, social, sustainability, and sustainability-linked bond (GSSSB) industry. By issuer, it is divided into government agencies, sovereigns, financial institutes, corporates, municipals, and development bank. By industry, it is segmented into energy, transport, water, waste, and others. In terms of investor, it is divided into fund manager, bank treasuries, insurance and pension funds, central banks/ official institutions, banks, and hedge funds. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the green segment dominated the green, social, sustainability, and sustainability-linked bond (GSSSB) market in 2023, as governments and corporations accelerated their commitments to net-zero emissions and climate action goals, fueling demand for green financing. Large corporations, financial institutions, and sovereign issuers increased green bond issuances to finance renewable energy, sustainable infrastructure, and low-carbon projects. However, the sustainability-linked segment is projected to attain the highest CAGR during the forecast period, unlike traditional Green or Social Bonds, SLBs are not restricted to financing specific sustainability projects. Instead, they allow issuers to use proceeds for general corporate purposes, making them more attractive.

By region, Europe dominated the market share in 2023, the European Central Bank (ECB) integrates climate risks into monetary policy, encouraging sustainable investments. Large European corporations, including those in energy, banking, and infrastructure, issued Sustainability-Linked Bonds (SLBs) and Green Bonds at record levels. However, the Asia-Pacific is projected to attain the highest CAGR during the forecast period. This growth is driven by the increasing popularity of green, social, sustainability, and sustainability-linked bond (GSSSB) industry in countries like China, South Korea, and Japan, where security culture is deeply embedded. The region is also witnessing significant investments in security infrastructure.

Competition Analysis:

Competitive analysis and profiles of the major players in the green, social, sustainability, and sustainability-linked bond (GSSSB) market growth include Asian Development Bank, European Investment Bank, African Development Bank, International Finance Corporation, KfW, HSBC, Fannie Mae, Bank of America, BNP Paribas, BARCLAYS, JPMorgan Chase & Co., and World Bank Group. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the green, social, sustainability, and sustainability-linked bond (GSSSB) market trends globally.

Top Impacting Factors

The rise in ESG awareness

The awareness of ESG (Environmental, Social, and Governance) is a key driver for the growth of the green, social, sustainability, and sustainability-linked bond (GSSSB) market. This surge in awareness reflects the increasing recognition by governments, corporations, and investors of the need to address global challenges such as climate change, social inequality, and sustainable economic development. Institutional and retail investors are increasingly prioritizing ESG-aligned portfolios, seeking opportunities that combine financial returns with positive societal and environmental impacts. Such factors are further expected to significantly contribute to the huge potential for the growth of the green, social, sustainability and sustainability bonds market. In addition, GSSSBs provide a transparent and measurable way for investors to align their investments with their ESG values, making them an effective financial tool. Hence, several companies and government authorities are leveraging the green, social, sustainability, and sustainability-linked bond (GSSSB) market intending to improve funding operations. For instance, in September 2024, International asset manager Robeco launched the High-Income Green Bonds strategy, investing in high-yielding green bonds by corporate issuers globally. Therefore, such initiatives are expected to further drive the growth of the green, social, sustainability, and sustainability-linked bond (GSSSB) market.

Increase in regulatory support, and policies

Rise of regulatory support and efficient policies is a significant driver of the green, social, sustainability, and sustainability-linked bond (GSSSB) market. Governments, international organizations, and regulatory bodies are creating frameworks and incentives to promote the issuance and adoption of sustainable financial instruments, fostering investor confidence and market expansion. For instance, the Paris Agreement and United Nations Sustainable Development Goals (SDGs) has established global benchmarks for climate action and social equity, prompting countries to adopt policies that promote sustainable financing. Such factors are further expected to significantly contribute to the huge potential for the growth of the green, social, sustainability and sustainability bonds market. In addition, integration of regulatory support ensures alignment between green, social, sustainability, and sustainability-linked bond (GSSSB) market issuance and these international objectives, creating a cohesive approach to sustainability. Policies like the Sustainable Finance Disclosure Regulation (SFDR) in Europe require financial institutions to disclose the sustainability impact of their investments. Therefore, such initiatives are expected to further accelerate the use of technologies, which play a significant role in the continued growth of the green, social, sustainability, and sustainability-linked bond (GSSSB) market opportunity.

High transaction costs

High transaction cost associated with issuing and managing green, social, sustainability, and sustainability-linked bond (GSSSB) market forecast presents a significant challenge to the growth of the market. These costs include expenses related to due diligence, reporting, certification, and compliance with various regulatory frameworks. Issuers must allocate substantial resources to ensure transparency and adherence to standards such as the green bond principles or sustainability-linked bond principles, which can be both time-consuming and expensive. In addition, the complexity of measuring and verifying the social and environmental impacts of projects adds to the overall cost, further limiting green, social, sustainability, and sustainability-linked bond (GSSSB) market expansion, especially for smaller issuers or those in emerging markets. As a result, higher transaction costs may deter potential participants from entering the GSSSB market, potentially limits the overall growth of the global green, social, sustainability, and sustainability-linked bond (GSSSB) market outlook. However, advancements in technology, such as blockchain, and increased regulatory support are gradually mitigating these costs, fostering more widespread adoption.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the green, social, sustainability, and sustainability-linked bond market forecast from 2024 to 2033 to identify the prevailing market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities of green, social, sustainability, and sustainability-linked bond market outlook.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the green, social, sustainability, and sustainability-linked bond industry segmentation assists in determining the prevailing green, social, sustainability, and sustainability-linked bond market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as green, social, sustainability, and sustainability-linked bond market trends, key players, market segments, application areas, and market growth strategies.

Green, Social, Sustainability, and Sustainability-linked Bond (GSSSB) Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.1 trillion |

| Growth Rate | CAGR of 7.5% |

| Forecast period | 2023 - 2033 |

| Report Pages | 397 |

| By Type |

|

| By Issuer |

|

| By Industry |

|

| By Investor |

|

| By Region |

|

| Key Market Players | BNP Paribas, Bank of America, European Investment Bank, JPMorgan Chase & Co., HSBC, Barclays, World Bank Group, Asian Development Bank, African Development Bank, KfW, International Finance Corporation, Fannie Mae |

Analyst Review

As the green, social, sustainability, and sustainability bonds (GSSSBs) industry continues to evolve, CXOs are evaluating the opportunities and challenges regarding these emerging tools. The regulatory bodies across several countries frequently revisit regulations to keep up with new tools, and industry-based risks. This, as a result, is becoming a major trend in the global green, social, sustainability, and sustainability bonds market. Businesses are considering the benefits that green, social, sustainability and sustainability bonds can offer, such as the ability to provide unified and scalable tools for managing and processing the funding. In addition, next-generation digital businesses are leveraging cloud capabilities and preparing for a future of integrated solutions. Such factors are expected to provide lucrative opportunities for market growth during the forecast period.

In addition, from a strategic standpoint, GSSSBs are no longer optional but essential tools in achieving environmental, social, and governance (ESG) objectives. For businesses, these bonds offer an innovative way to finance large-scale sustainable projects while diversifying funding sources. Issuers leverage these tools to demonstrate accountability and commitment to stakeholders, especially as investors increasingly demand transparency in sustainability practices.

The green, social, sustainability and sustainability bonds market is fragmented with the presence of regional providers such as M&G and responsibility, and Equinix, Inc. Europe and Asia Pacific dominated the green, social, sustainability and sustainability bonds market, in terms of revenue in 2023, and are expected to retain their dominance during the forecast period. However, Asia-Pacific is expected to experience significant growth in the future, owing to emerging economies, and an increase in government support toward banking & financial industries for implementing green, social, sustainability and sustainability bond tools in the region. Some of the key players profiled in the report include Asian Development Bank, European Investment Bank, African Development Bank, International Finance Corporation, KfW, HSBC, Fannie Mae, Bank of America, BNP Paribas, BARCLAYS, JPMorgan Chase & Co., World Bank Group. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry. For instance, in October 2024, M&G and Swiss impact asset manager responsAbility launched a strategy for sustainable corporate bonds. The M&G responsAbility Sustainable Solutions Bond Strategy is an SFDR Article 9 fund and has been developed in response to demand from institutional and wholesale investors seeking actively managed sustainable fixed-income strategies.

Sustainability-linked bonds are also gaining traction as corporations integrate broader environmental and social targets into their financing structures.

Green bond is the leading type of Green, Social, Sustainability, and Sustainability-linked Bond (GSSSB) Market.

Europe is the largest regional market for Green, Social, Sustainability, and Sustainability-linked Bond (GSSSB) in 2023.

$2,047.6 billion is the estimated industry size of Green, Social, Sustainability, and Sustainability-linked Bond (GSSSB) in 2033.

Asian Development Bank, European Investment Bank, African Development Bank, International Finance Corporation, KfW, HSBC, Fannie Mae, Bank of America, BNP Paribas, BARCLAYS, JPMorgan Chase & Co., and World Bank Group are the top companies to hold the market share in Green, Social, Sustainability, and Sustainability-linked Bond (GSSSB).

Loading Table Of Content...

Loading Research Methodology...