Green Steel Market Research, 2032

The Global Green Steel Market Size was valued at $200 million in 2022, and is projected to reach $364.5 billion by 2032, growing at a CAGR of 113.6% from 2023 to 2032.

Green steel is expected to reduce carbon emissions and serve as a valuable tool for achieving the sustainable development goals of various countries in the future. Green steel is made from green hydrogen, which comes from renewable sources without the use of fossil fuels. Consumer and producer motivation for sustainable products and increasing government initiatives globally have contributed significantly to boosting the growth of the global green steel market.

Green Steel Market Dynamics

Increasing awareness of the green production of steel in prominent industries is driving the growth of the green steel market. In addition, market players are increasingly investing in launching greenfield projects and building partnerships and strategic alliances to transform their businesses into green steel, thus driving green steel market growth. Government support and investment in green steel manufacturing increase the demand for the green steel market. The high production cost of green steel, determined by renewable energy & electrolyze costs and product efficiency are expected to pose challenges to the growth of the global green steel market in the future.

The industry is being driven by market participants' increased investments in greenfield ventures, collaborations, and strategic alliances to change their companies. The demand for green steel is being driven by government assistance and investment in green steel manufacturing. For instance, in 2021, the Government of India announced the National Hydrogen Mission to support the country's energy transition goals across all industries. Furthermore, automotive units, such as BMW, in October 2021, announced to use green steel (to be procured from a Swedish steel manufacturer, H2 Green Group) in their automobiles, with an intent to reduce up to 95% greenhouse gas (GHG) emissions by 2025. Hence, such government assistance can increase the demand for the green steel.

In Europe, there are several projects such as HYBRIT and H2 Greensteel that aim to replace fossil fuels with green hydrogen, while in the U.S., Boston Metal, a company that emerged from the Massachusetts Institute of Technology (MIT), is developing direct electrolysis from iron ore, a process similar to that currently used for aluminum. In both cases, the electricity used would be from renewable sources, ensuring sustainability and no emissions during the process. All such factors are expected to boost the demand for the green steel market. In addition, the HYBRIT project in Sweden is a joint venture between an iron ore producer, a steel manufacturer, and a power utility, with the aim of replacing one blast furnace with zero-carbon steel technology by 2030.

Moreover, the Green Steel for Europe project is a European Union-funded initiative that aims to develop a fossil-free steel production process by 2030. This project involves a consortium of 12 partners from seven European countries, including steel producers, research institutes, and universities. It also focuses on developing new technologies for the production of green steel, such as hydrogen-based direct reduction and carbon capture and storage.

The rise in urbanization globally has increased the demand for infrastructure such as residential and commercial, which is expected to provide lucrative opportunities for the growth of the market. By 2040, the global population is estimated to grow approximately by two billion with the urban population growing by over 40%. In addition, the technology used in green steel production includes hydrogen direct reduction (HDR) and molten oxide electrolysis (MOE), which are low-carbon primary steelmaking technologies. Carbon capture and storage (CCS) can also be applied to blast furnaces to reduce emissions. In addition, increasing the use of electric arc furnaces, for steel production, which rely on recycled scrap steel, reduces emissions. Moreover, green steel offers various advantages such as reduced carbon emissions, reduced energy consumption, resource conservation, improved air and water quality, and others.

The green steel market is witnessing various obstructions in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdowns resulted in reduced industrial activities, eventually leading to reduced demand for green steel from various sectors such as construction and industrial. However, COVID-19 has subsided, and the major manufacturers in 2023 are performing well. However, the rise in global inflation is a new major obstructing factor for the entire industry. The inflation, which is a direct result of the Ukraine-Russia war, and few long-term impacts of the coronavirus pandemic, have introduced volatility in the prices of raw materials used for manufacturing green steel.

In addition, the cost of oil & gas has also increased substantially, and many countries, especially, the countries in Europe, Latin America, and developing economies in Asia-Pacific are experiencing severe negative impacts on industrial production, including the production of green steel. However, India and China are performing relatively well. In addition, inflation is expected to worsen in the coming years, as the possibility of the ending of the war between Ukraine and Russia is less. Moreover, the cost of construction has increased substantially, discouraging builders from initiating new projects, which is expected to negatively affect the green steel market growth. However, a peace agreement between Ukraine and Russia can be devised, with continued talks between different countries.

Segmental Overview

The green steel market is segmented into Type, End User, and region. By type, the market is divided into electric arc furnaces (EAF) and molten oxide electrolysis (MOE). By end user, the market is divided into construction, automotive, electronics, and others. Region-wise, the market is analyzed across North America, Europe, and Asia-Pacific.

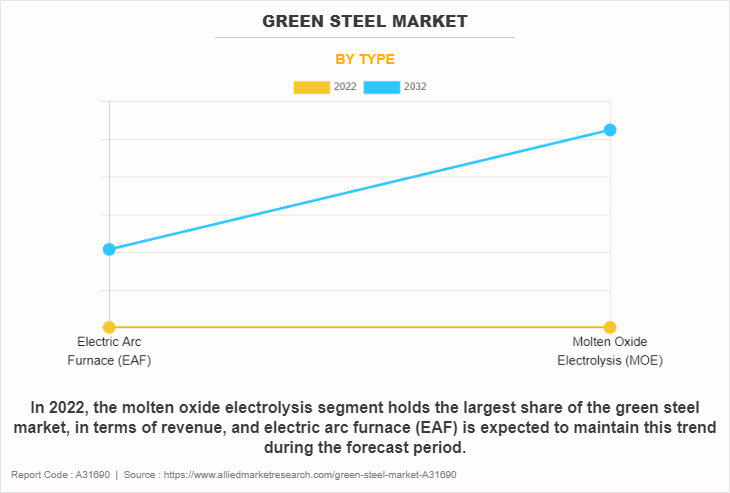

By Type:

The green steel market is divided into electric arc furnaces (EAF) and molten oxide electrolysis. In 2020, the molten oxide electrolysis segment dominated the green steel market, in terms of revenue, and electric arc furnace (EAF) is expected to maintain this trend during the forecast period. The electric arc furnaces segment is expected to grow at the highest CAGR during the forecast period. Manufacturing of carbon-free metals, generation of oxygen for extra-terrestrial exploration, and the control of CO2 emissions in the steel industry are all potential uses for MOE. MOE has been shown to utilize anode materials that are either unsuitable for use in terrestrial applications (such as titanium and graphite for use with ferro-alloys) or consumable (iridium for use with iron). MOE requires an anode material that resists depletion while sustaining oxygen evolution to enable metal synthesis without process carbon. For instance, in April, 2021, Kobe Steel Japan launched “Kobenable Steel” Japan’s first low COâ‚‚ blast furnace steel, which cut Co2 emission by 20%. Such instances are expected to drive the growth of the market.

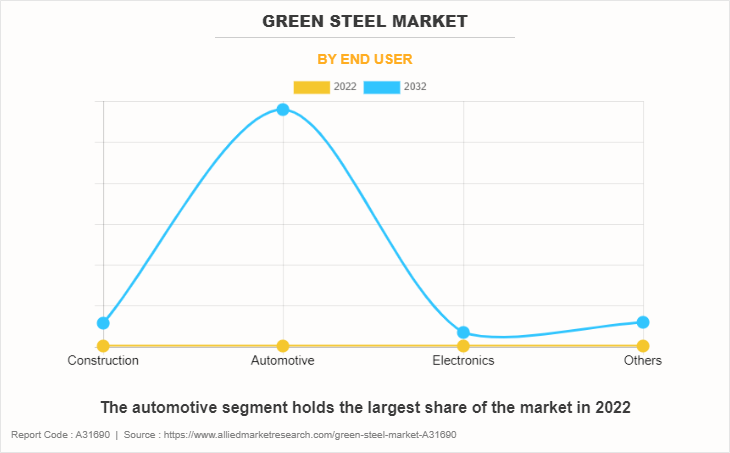

By End User:

The green steel market is categorized into construction, automotive, electronics, and others. The automotive segment dominated the market and is expected to dominate during the forecast period. An increase in demand for customized parts and metal products for the automotive industries drives the green steel market. An increase in manufacturing and industrial activities around the globe led to a rise in demand for green steel products, which is expected to cater to the growth of the market. Major players are adopting strategies such as innovation in the manufacturing process to reduce carbon footprint and make steel environmentally sustainable. For instance, in July 2022, Volvo announced be use of 100% green steel in its manufacturing process by 2050 as part of the industry-led SteelZero initiative. All such instances drive the growth of this segment.

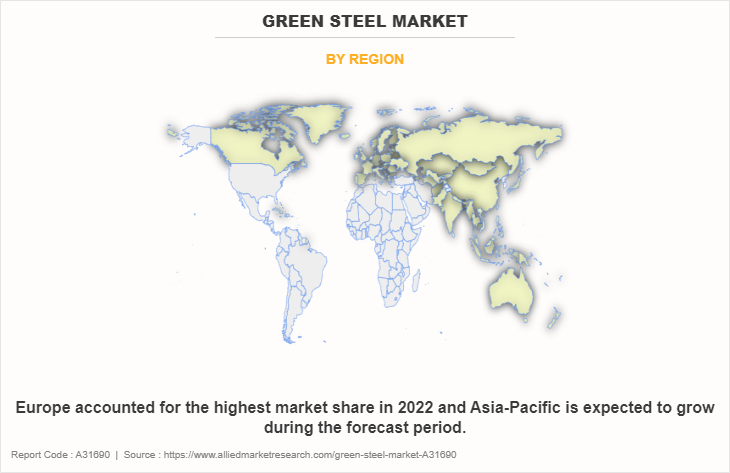

By Region:

The green steel market is analyzed across North America, Europe, and Asia-Pacific. Europe accounted for the highest share of the Green Steel Market Share in 2020 and is expected to maintain its dominance during the forecast period. The increased building activities in Europe have resulted in a significant increase in demand for green steel on the European market. The market is predicted to develop as a result of a rise in residential and non-residential building activities and rising home improvement spending, particularly in eastern European nations.

The majority of this growth is attributed to Bulgaria, Romania, and Slovakia, where it is anticipated that increasing infrastructure building investment would positively affect the market for green steel. In addition, rising building costs fuel market expansion. Due to the creation of both, infrastructure and structures, such as stadiums, hotels, and retail buildings, Russia contributes to almost 50% of the total construction spending in Eastern Europe, and this expenditure is anticipated to increase; thereby, accelerating the green steel market.

Competition Analysis

Competitive analysis and profiles of the major players in the green steel include Arcelor Mittal, Green Steel Group, H2 Green Steel, Emirates Steel, Jindal Steel and Power, JFE Steel, Nippon Steel, Poco, U.S. Steel Corporation, and Nucor are provided in this report. There are some important players in the market such as ArcelorMittal, Green Steel Group, and H2 Green Steel. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the green steel market.

Some examples of collaboration in the market

In September 2022, H2 Green Steel collaborated with GreenIron H2 for the recycling of iron residual and waste and emission reduction and increased circularity in H2 Green Steel's plant in Boden in Northern Sweden.

In June 2022, Hitachi Energy collaborated with H2 Green Steel for equity investment, energy solutions, and green steel.

In August 2022, H2 Green Steel collaborated with BMW Group for the delivery of CO2-reduced steel. The collaboration addresses BMW Group's upstream scope 3 emissions and includes recycling and end-of-life management measures.

In September 2022, Jindal Steel and Power expanded its greenest steel plant in Odisha to fulfill green steel demand in India.

Expansion in the market

In February 2021, H2 Green Steel expanded its building large-scale fossil-free steel plant in northern Sweden.

Partnership in the market

In June 2022, United States Steel Corp. and SunCoke Energy, Inc. signed a non-binding agreement of intent for SunCoke to acquire the two blast furnaces at Granite City Works and construct a 2-million-ton granulated pig iron manufacturing facility in the U.S.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging green steel market trends and dynamics.

- In-depth green steel market analysis is conducted by constructing market estimations for the key market segments between 2020 and 2032.

- Extensive analysis of the green steel market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all regions is provided to determine the prevailing opportunities.

- The Green Steel Market forecast analysis from 2023 to 2032 is included in the report.

- The key market players within the green steel market outlook are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the green steel industry.

Green steel Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 364.5 billion |

| Growth Rate | CAGR of 113.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 298 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Emirates Steel Arkan, H2 Green Steel, U.S. Steel Corporation, NIPPON STEEL CORPORATION, JFE Steel Corporation, Nucor Corporation (Nucor Tubular Products), Jindal Steel & Power Ltd., Green Steel Group Inc., Arcelor Mittal, POSCO International |

Analyst Review

The green steel market has a significant growth in Europe followed by North America and Asia-Pacific. The Asia-Pacific is expected to grow at the highest CAGR during the forecast period.

Making steel without using fossil fuels is known as green steel. In place of the conventional carbon-intensive manufacturing method involving coal-fired facilities, it may be accomplished by employing low-carbon energy sources like electricity, hydrogen, or coal gasification. In addition, governments globally are creating important hydrogen policies and taking the required steps to encourage economies toward adopting green hydrogen in sectors including automobiles, building and construction, refineries, and industrial units. High costs associated with green hydrogen production are expected to slow down the market growth. Asia-Pacific nations including China, Japan, Singapore, and Korea advance relevant technology and support global supply chains. To reduce the 8% of CO2 emissions that steel contributes to the atmosphere, scientists, investors, and government groups are focusing on the use of green hydrogen in the steel-producing sectors. For instance, in 2021, India announced the National Hydrogen Mission to make the country a global green hydrogen production and export hub. Also, the Ministry of New & Renewable Energy is working on a mission to develop ethical competencies and make optimum use of green hydrogen in potential industries by lowering its costs. Such instances are expected to offer lots of opportunities for the market during the forecast period.

The global green steel market was valued at $200.0 million in 2022, and is projected to reach $364,493.53 million by 2032, registering a CAGR of 113.6% from 2023 to 2032.

The base year considered in the global green steel market report is 2022.

Increasing awareness of environmentally friendly steel manufacturing in various sectors such as construction, automotive, and manufacturing are the upcoming trends of the Green steel Market in the world.

The automotive sector is the leading end user of the Green Steel Market.

Europe is the largest regional market for Green steel.

Arcelor Mittal, Green Steel Group, H2 Green Steel, Emirates Steel, Jindal Steel and Power, JFE Steel, Nippon Steel, Posco, U.S. Steel, and Nucor are the top companies to hold the market share in Green steel.

The latest version of the global green steel market report can be obtained on demand from the website.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...

Loading Research Methodology...