Grid Scale Battery Market Research, 2032

The global grid scale battery market was valued at $4.2 billion in 2022, and is projected to reach $31 billion by 2032, growing at a CAGR of 18.2% from 2023 to 2032.

Key Report Highlighters:

- The grid scale battery has been analyzed in terms of value ($ million), covering more than 15 countries.

- For growth prediction, we have looked into historical trends including present and future activities of key business players.

- The report covers detailed profiling of the major 10 market players.

A grid scale battery, also known as a utility-scale battery, is a large-scale energy storage system designed to store and release electricity on a massive scale. These batteries are integrated into the electrical grid infrastructure and play a crucial role in stabilizing the grid, managing peak demand, integrating renewable energy sources, and ensuring a reliable and resilient energy supply. Grid scale batteries store excess electricity when demand is low and supply is high (e.g., during periods of high renewable energy production), and release it when demand is high (e.g., during peak hours). This helps balance the supply and demand on the grid.

These batteries are essential for integrating variable renewable energy sources like wind and solar into the grid. They store excess energy produced during times of high renewable output and release it when renewable generation is lower, ensuring a consistent power supply. During periods of high electricity demand, such as hot summer afternoons when air conditioning usage is high, grid scale batteries can discharge stored energy to supplement the grid and prevent blackouts. Grid stability requires a consistent frequency (usually 50 or 60 Hz). Grid scale batteries can provide a rapid response by injecting or withdrawing power to maintain this frequency within the acceptable range. Grid scale batteries offer ancillary services like voltage control, reactive power support, and ramp rate control, helping to maintain the overall stability and reliability of the grid.

Market Dynamics

In case of grid outages or emergencies, grid scale batteries can provide backup power to critical facilities, helping to maintain essential services. As the world moves toward cleaner energy sources, grid scale batteries play a crucial role in reducing the reliance on fossil fuels and enabling a smoother transition to a more sustainable energy mix. By storing excess energy and releasing it during peak demand, grid scale batteries can help reduce the need for building new power plants or upgrading transmission lines, saving costs for utilities and consumers. Grid scale batteries allow for load shifting, which means consuming electricity during off-peak hours when it is cheaper and storing it for use during peak hours when electricity prices are higher. Such benefits of grid scale battery act as driving factors for the market growth.

The increasing deployment of intermittent renewable energy sources like solar and wind requires energy storage solutions to balance supply and demand. Grid-scale batteries provide the flexibility to store excess energy during periods of high generation and release it when needed, ensuring a stable and reliable energy supply. Countries around the world are setting ambitious energy transition goals to reduce greenhouse gas emissions and combat climate change. Grid-scale batteries enable the integration of clean energy sources and play a pivotal role in transitioning away from fossil fuels.

Grid scale batteries can use various technologies, including lithium-ion, flow batteries, advanced lead-acid batteries, and more. The choice of technology depends on factors such as capacity, discharge duration, response time, and cost. Overall, grid scale batteries are a vital component of modern electricity grids, helping to create a more flexible, reliable, and sustainable energy system.

While grid scale batteries offer numerous advantages for energy storage and grid stability, they also have certain disadvantages and challenges. Grid scale batteries can be expensive to install and maintain. The upfront investment for the infrastructure, equipment, and technology required to implement these large-scale storage systems can be substantial. Despite their large size, grid scale batteries have limitations in terms of energy density compared to other forms of energy storage, like fossil fuels. This means they might require significant physical space to store large amounts of energy.

The upfront investment required for installing grid-scale battery systems can be substantial. This includes the costs of batteries, power electronics, site preparation, and integration with the grid. High initial costs can deter potential investors and limit the adoption of grid-scale batteries. Many battery technologies used in grid-scale applications experience degradation over time due to charging and discharging cycles. This can impact overall capacity, efficiency, and lifespan, leading to the need for replacements and affecting long-term economic viability.

Most battery technologies used in grid scale applications experience degradation over time due to repeated charging and discharging cycles. This degradation can impact the battery's overall capacity and efficiency, leading to a shorter lifespan and potentially necessitating costly replacements. While grid scale batteries are essential for renewable energy integration, the production and disposal of some battery technologies can have environmental impacts. For instance, the extraction of raw materials and manufacturing processes for certain battery types can contribute to carbon emissions and other environmental issues. Many grid scale battery technologies rely on specific resources, such as rare minerals or metals. This dependence can lead to supply chain challenges, price volatility, and geopolitical concerns. Such challenges hamper the grid scale battery market growth.

Grid-scale batteries are expected to support the production of green hydrogen through electrolysis during periods of excess renewable energy generation. Integrated systems combine the batteries and electrolyzers to produce hydrogen for industrial processes, fuel cells, and energy storage. Grid-scale batteries aid the transition to a low-carbon energy system by enabling higher shares of renewables, reducing emissions, and improving energy security. Collaborative efforts among governments, industries, and investors drive investment in battery technologies and supportive policies. This acts as a lucrative grid scale battery market opportunity for growth.

The grid scale battery market size is studied on the basis of battery type, deployment network, application, and region.

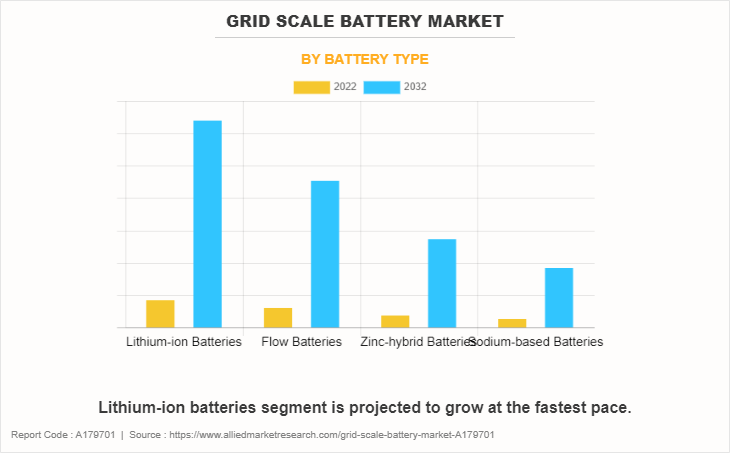

By battery type, the grid scale battery market is divided into lithium-ion batteries, flow batteries, zinc-hybrid batteries, and sodium-based batteries. The lithium-ion batteries segment dominated the grid scale battery market share for 2022. It is also expected to dominate the growth during the grid scale battery market forecast period. This is attributed to the fact that they provide rapid response to grid demand fluctuations, making them suitable for services like frequency regulation and grid stability. They have a good cycling performance, meaning they are capable of undergoing many charge and discharge cycles without significant capacity degradation. Moreover, unlike fossil fuel-based energy sources, lithium-ion batteries produce no emissions during operation, contributing to cleaner energy integration.

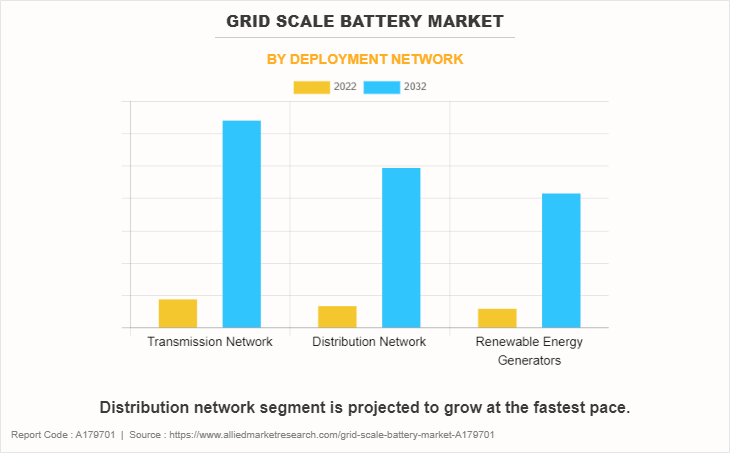

Based on the deployment network, the grid scale battery market analysis is done for transmission network, distribution network, and renewable energy generators. The transmission network segment dominated the grid scale battery market size for 2022 with a CAGR of 18.1%. This is attributed to the capability of transmission networks to enable the integration of renewable energy sources by transporting electricity generated from remote wind farms or solar installations to areas of demand. However, during the forecast period, the distribution network system is projected to grow at the fastest pace of 18.4%. The distribution network offers the benefit of battery-supported demand response programs that incentivize consumers to reduce energy consumption during peak periods. Batteries assist in maintaining proper voltage levels, improving the quality of power delivered to consumers. Such factors offer lucrative grid scale battery market opportunities for distribution network growth.

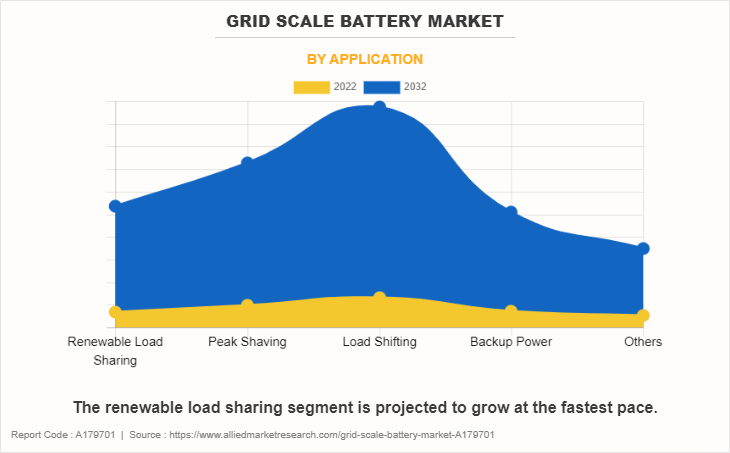

As per application, the market is categorized into renewable load sharing, peak shaving, load shifting, backup power, and others. The load shifting dominated the market share for 2022 in terms of revenue. Load shifting encourages more efficient use of electricity resources, aligning consumption with times when energy is more abundant. Load shifting assists in managing demand spikes, avoiding grid congestion, and reducing the need for costly infrastructure upgrades. Such factors help in driving the grid scale battery market growth. However, renewable load sharing segment dominated the grid scale battery industry growth during the forecast period. Renewable load sharing enhances grid stability by absorbing excess energy during periods of high generation and injecting it during low generation times. Furthermore, load sharing increases the potential for higher penetration of renewable energy sources into the grid, promoting cleaner energy generation. Such factors are projected to contribute to the growth of the grid scale battery market growth.

Region wise, the grid scale battery market analysis is done across North America, Europe, Asia-Pacific, and LAMEA (Latin America, the Middle East, and Africa). North America dominated the market share 2022 in terms of revenue owing to the recent grid scale battery market trends. Grid scale battery deployment in North America is becoming increasingly prominent as the countries in the region are striving to enhance grid reliability, integrate renewable energy, and achieve energy transition goals. However, Asia-Pacific is projected to grow at a higher CAGR during the grid scale battery market projection period. This is attributed to grid scale battery deployment due to its vast renewable energy resources and efforts to transition to a low-carbon energy system. Moreover, many projects are being developed to enhance grid stability, support renewable energy, and promote energy self-sufficiency in the region.

The major players operating in the grid scale battery industry are ABB Ltd., BYD Company Limited, General Electric, LG Energy Solution, NGK INSULATORS, LTD., Panasonic, S&C Electric Company, Samsung SDI CO., LTD., Tesla, and Fluence Corporation. The companies adopted key strategies such as collaboration to increase their market share. In May 2022, ABB Ltd. Electrification has entered a grid scale battery project in partnership with Ecotricity at the energy company's 6.9MW wind farm in Gloucestershire. The two companies' unique partnership is expected to help National Grid's transformation to Net Zero by 2050.

In June 2022, General Electric expanded its solar and battery energy storage power electronics systems manufacturing capacity to 9 GW per annum.

In June 2023, LG Energy Solution, a leading global manufacturer of advanced lithium-ion batteries, announced to launch a new residential storage system brand LG Energy Solution enblock, along with several new residential and Grid scale energy storage system products at Europe's largest and most diverse international exhibition and conference for batteries and energy storage systems.

Policies Across Globe:

- IEEE 1547:

IEEE 1547 is a standard developed by the Institute of Electrical and Electronics Engineers (IEEE) that establishes technical requirements for the interconnection of distributed energy resources, including grid scale batteries, with electric power systems.

- FERC Order 841 (United States):

FERC Order 841, issued by the Federal Energy Regulatory Commission (FERC) in the United States, aims to remove barriers to the participation of energy storage resources, including grid scale batteries, in wholesale electricity markets. It mandates that grid operators must allow energy storage to compete fairly in these markets.

- California Energy Storage Mandate (United States):

California has established an energy storage mandate requiring utilities to procure a certain amount of energy storage capacity to support grid reliability, renewable integration, and emissions reduction goals.

- Grid Code Requirements (Various Jurisdictions):

Many countries have grid codes that set technical standards for grid connection and operation. For example, Germany's grid code, VDE-AR-N 4105, includes provisions for the integration of energy storage systems, including grid scale batteries, into the distribution grid.

- ISO 27001 (Information Security Management System):

ISO 27001 is an international standard for information security management systems. While not specific to grid-scale batteries, it's often applied to ensure cybersecurity and data protection for energy storage systems connected to the grid.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the grid scale battery market analysis from 2022 to 2032 to identify the prevailing grid scale battery market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the grid scale battery market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global grid scale battery market scope, key players, market segments, application areas, and market growth strategies.

Grid Scale Battery Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 31 billion |

| Growth Rate | CAGR of 18.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 297 |

| By Battery Type |

|

| By Deployment Network |

|

| By Application |

|

| By Region |

|

| Key Market Players | NGK INSULATORS, LTD., Tesla, Panasonic Holdings Corporation, ABB Ltd., S&C Electric Company, SAMSUNG SDI CO., LTD., BYD COMPANY LIMITED, Fluence Corporation, General Electric, LG Energy Solution |

Analyst Review

According to the insights from the CXO’s, the grid-scale battery market has grown at a higher pace as grid-scale battery facilitates the integration of intermittent renewable sources, reducing dependence on fossil fuels and lowering carbon emissions. Grid-scale battery also provides a rapid response to fluctuations in supply and demand, enhancing grid stability and reducing the risk of blackouts. This led to an increase in the grid-scale battery market growth. The market faces challenges from high upfront costs for installation and maintenance that limit widespread adoption. Certain battery technologies have environmental concerns related to resource extraction, manufacturing, and disposal. Moreover, the physical space required to store large amounts of energy can be substantial which hampers the grid-scale battery market growth. However, grid-scale batteries are estimated to play a key role in establishing resilient microgrids and enhancing energy security in isolated areas. The development of innovative business models, such as energy storage as a service, can make grid-scale batteries more accessible to a wider range of sectors. This offers lucrative opportunities for grid-scale battery industry growth.

Renewable energy integration & energy transition goals, technological advancements & cost benefits, energy market boosted by government policies, incentives, & regulatory support, and electric vehicles & demand for energy flexibility are the upcoming trends of Grid Scale Battery Market in the world.

Load shifting is the leading application of Grid Scale Battery Market.

North America is the largest regional market for Grid Scale Battery.

The estimated industry size of Grid Scale Battery by 2032 is $31.0 billion.

ABB Ltd., BYD Company Limited, General Electric, LG Energy Solution, NGK INSULATORS, LTD., Panasonic, S&C Electric Company, Samsung SDI CO., LTD., Tesla, and Fluence Corporation are the top companies to hold the market share in Grid Scale Battery

Loading Table Of Content...

Loading Research Methodology...