Group Health Insurance Market Research, 2031

The global group health insurance market size was valued at $744.04 billion in 2021, and is projected to reach $1,800.08 billion by 2031, growing at a CAGR of 9.4% from 2022 to 2031.

Group health insurance covers medical expenses of employees incurred during treatment of any disease, injury, or other mental & physical impairment. It acts as compensation in exchange for a monthly/semi-annual/annual premium or a payroll tax to provide healthcare benefits, which is incurred by the employer. The insurer is obliged to cover medical expenses for the policy holder up till the tenure and coverage of the policy. Depending on the policy, the coverage may vary owing to numerous factors, including diseases, age group, and government policies.

The right group health insurance plan acts as a great motivation tool for employees. It makes them feel valued, which eventually leads to higher productivity as well as an increase in employee engagement. In addition, the increase in group health insurance adoption and hassle-free claim settlement is some of the major factors that propel the group health insurance market growth. However, increase in group health insurance premium cost and invalid liability for retired employees are some of the factors that limit the market growth. On the contrary, rise in the geriatric population and demand for better employee benefits in corporate is expected to grow tremendously in the coming years.

Segment Review

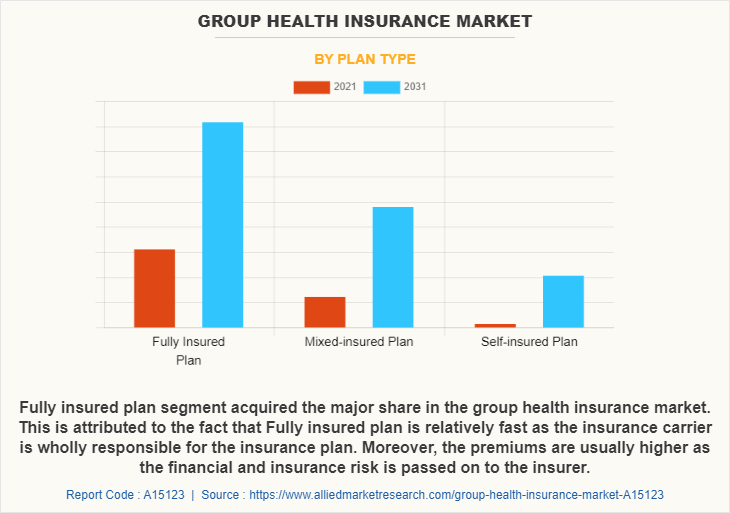

The group health insurance market is segmented into plan type, enterprise size, distribution channel, and region. By plan type, it is segmented into fully insured plan, mixed-insured plan, and self-insured plan. By enterprise size, it is bifurcated into large enterprises, and micro, small, & medium enterprises (MSMEs). By distribution channel, it is segregated into agents, direct sale, banks, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of plan type, the fully insured plan segment accounted for the highest revenue in 2021. This is attributed to the fact that fully insured plan is relatively fast as the insurance carrier is wholly responsible for the insurance plan. Moreover, the group health insurance premiums are usually higher as the financial and insurance risk is passed on to insurers. However, the self-insured plan segment is expected to grow at a significant rate during the forecast period. This is attributed to the fact that it results in higher savings as it does not pay for the profit of insurers, flexibility to choose limited benefits, and has lower admin costs in group health insurance programs.

On the basis of region, North America accounted for the highest revenue in 2021. This is attributed to growing corporate culture and presence of large number of multinational companies in North America is a major factor for growth of group health insurance in the region. However, Asia-Pacific segment is attributed to grow at a significant rate during the group health insurance market forecast. This is attributed to the fact that Asia-Pacific group health insurance market has increased as there has been surge in demand to provide insurance to employees in MNCs in the region. In addition, growth in awareness among people about group healthcare insurance is expected to fuel growth of the market in coming years.

The report analyzes the profiles of key players operating in the group health insurance market such as Anthem Insurance Companies, Inc., Allianz Care, AXA, Aetna Inc., ACKO General Insurance Limited, American International Group, Inc., Cigna, Chubb, IFFCO-Tokio General Insurance Company Limited, and United HealthCare Services, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the group health insurance industry.

Top Impacting Factors

Rise in Employee Retention

Group health insurance provides coverage to a group of members, usually comprising of company employees or members of an organization. Employees are the most valuable resources in any company. Since, companies are increasingly focusing on their employees these days, and corporate health insurance has emerged as one of the most appealing benefits for attracting new employees. It plays an important role in influencing an employee's psychology of employees. It makes employees feel like a part of the company, which reduces employee turnover and unrest in labor unions. Moreover, with the increase in employment in various industries, employee retention has become a difficult task. However, if the employer provides benefits such as health insurance coverage to all its employees and employee’s their families then the likelihood of an employee remaining with the company increase. Therefore, these are the major growth factors for the group health insurance industry.

Increase in Insurance Premium Costs

Group health insurance policy covers many individuals under a single policy. An optum unitedhealth group issues a group medical insurance policy to recognized groups. It has the names of all insured members. When new individuals join the group, the policy covers them by default. Hence, there are various factors affecting the premium costs of a group health insurance policy. Such factors include type of group being insured, for example, the members of trade unions, farmers, or other groups are seen as having many health risks because of old age. Thus, they have a higher group health insurance cost. In addition, as the number of members covered increases, the group health insurance premium rises. Furthermore, a high sum insured means the premium for group health insurance policy will also be high. Therefore, these factors limit growth of the group health insurance market outlook.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the group health insurance market analysis from 2021 to 2031 to identify the prevailing group health insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the group health insurance market share assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global group health insurance market trends, key players, market segments, application areas, and market growth strategies.

Group Health Insurance Market Report Highlights

| Aspects | Details |

| By Plan Type |

|

| By Enterprise Size |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | ACKO General Insurance Limited, American International Group, Inc., Anthem Insurance Companies, Inc., IFFCO-Tokio General Insurance Company, Cigna, Allianz Care, Aetna Inc., AXA, United HealthCare Services, Inc., Chubb |

Analyst Review

With increase in healthcare cost, insurers are facing huge challenges, in terms of managing their claim process efficiently and reducing administrative cost. In addition, insurers are prioritizing real-time interaction management to keep customers engaged and providing mandatory provision of group health insurance to public & private sectors, which are some of the major trends in the group health insurance market. Moreover, a better healthcare insurance policy for employees promotes economic balance by providing medical assistance during emergency to employees. Since the outbreak of the COVID-19 pandemic, group health insurance has become priority for corporate offices both in private as well as public sector; therefore, demand for group health insurance has significantly accelerated.

Availability of favorable group health insurance landscape and access to multilevel group health insurance policies accelerates the market growth in North America, particularly in the U.S. In addition, provision of group health insurance to employees as a job benefit contributes toward growth of the market. Furthermore, advantages of group health insurance are not just for employees, they are also available for employers in the form of small business health care tax credit. This is offered to businesses that give their employees insurance and pay part of their premiums. These businesses may qualify to get a credit back on their taxes, so they can be compensated for the money they are paying out toward insurance premiums. This is one of the biggest advantages of group health insurance from perspective of an employer. Some of the key players profiled in the report include Anthem Insurance Companies, Inc., Allianz Care, AXA, Aetna Inc., ACKO General Insurance Limited, American International Group, Inc., Cigna, Chubb, IFFCO-Tokio General Insurance Company Limited, and United HealthCare Services, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Surge in employee retention, especially after decision of various governments to mandate all employers to provide health insurance to their employees, which leads to increase in offering corporate health insurance from a variety of industries as an employee benefit scheme.

Agents segment accounted for the highest revenue in group health insurance market. With an increase in demand for customized and personalized services, group health insurance agents are utilizing several websites and online selling platforms, which is becoming a major trend in the group health insurance market.

North America accounted for the major share of group health insurance market. Growing corporate culture and presence of large number of multinational companies in North America is a major factor for the growth of group health insurance in the region.

The global group health insurance market size was valued at $744.04 billion in 2021, and is projected to reach $1,800.08 million by 2031, growing at a CAGR of 9.4% from 2022 to 2031.

AXA, Aetna Inc., American International Group, Inc., and Cigna are major companies holding large market share in group health insurance market.

Loading Table Of Content...