Gynecological Devices Market Research, 2032

The global gynecological devices market was valued at $8.5 billion in 2022, and is projected to reach $17.3 billion by 2032, growing at a CAGR of 7.3% from 2023 to 2032.The aging population is a significant driver of the gynecological devices market. As women age, they are more susceptible to various gynecological conditions, such as uterine fibroids, pelvic organ prolapse, and cancers. The increasing prevalence of these conditions among older demographics fuels the demand for diagnostic, therapeutic, and surgical gynecological devices. Moreover, the aging population often requires specialized healthcare, including gynecological interventions, contributing to a growing patient pool. For instance, according to World Health Organization (WHO), women comprised 55.7% of persons aged 65 or older in 2022. As life expectancy rises globally, the demographic shift toward older age groups continues to propel the demand for gynecological devices, shaping market trends and encouraging the development of innovative solutions tailored to the needs of an aging female population.

Key Takeaways

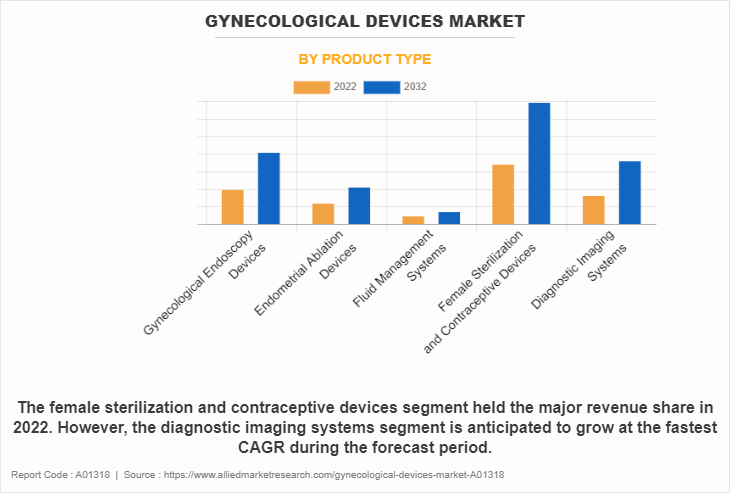

On the basis of product type, female sterilization and contraceptive devices segment dominated the gynecological devices market size in terms of revenue in 2022. However, the diagnostic imaging systems segment is anticipated to grow at the fastest CAGR during the forecast period.

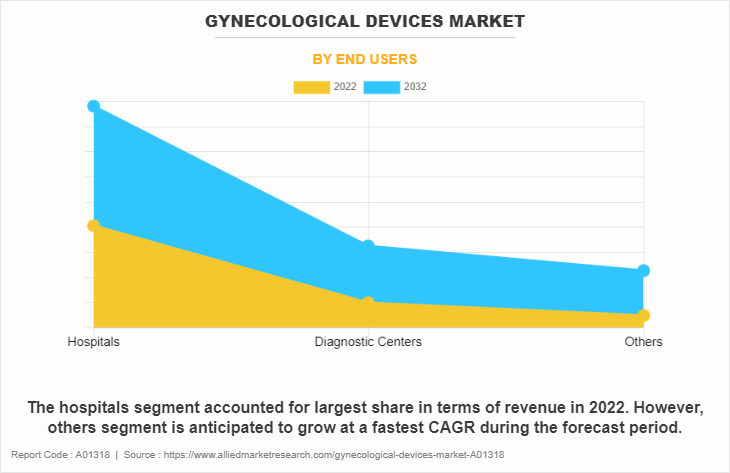

On the basis of end user, the hospitals segment dominated the gynecological devices market size in terms of revenue in 2022. However, the others segment is anticipated to grow at the fastest CAGR during the forecast period.

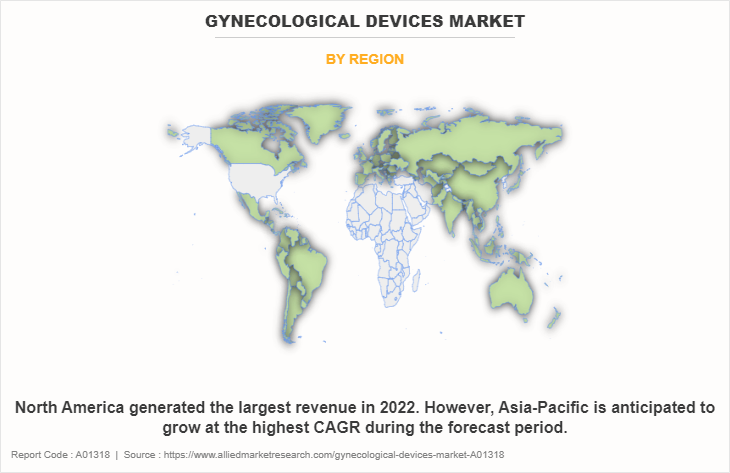

Region wise, North America generated the largest revenue in 2022. However, Asia-Pacific is anticipated to grow at the highest CAGR during the gynecological devices market forecast period.

Gynecological devices are medical instruments, tools, or equipment designed for the diagnosis, treatment, and monitoring of various conditions and diseases related to the female reproductive system. These devices are used by healthcare professionals, primarily gynecologists and obstetricians, to provide medical care for women at different stages of life. Gynecological devices encompass a wide range of products designed for both diagnostic and therapeutic purposes.

Market Dynamics

The increasing incidence of gynecological disorders serves as a prominent driver propelling the gynecological devices market growth. This trend is influenced by various factors, including changing lifestyles, environmental factors, and genetic predispositions. Conditions such as cervical cancer, endometriosis, uterine fibroids, and pelvic organ prolapse are becoming more prevalent, necessitating a heightened focus on gynecological healthcare. For instance, according to (WHO) World Health Organization, in 2021, endometriosis affects roughly 10% (190 million) of reproductive age women and girls globally. As awareness grows and healthcare infrastructure improves, there is a corresponding surge in the demand for diagnostic and treatment devices.

Furthermore, technological advancements represent another critical driver shaping the gynecological devices market. Ongoing innovations in medical technology have led to the development of sophisticated devices and procedures, enhancing the diagnosis and treatment of gynecological conditions. Minimally invasive surgical techniques, robotic-assisted surgeries, and advanced imaging technologies have revolutionized gynecological practices. These advancements not only improve the precision and effectiveness of procedures but also contribute to reduced patient discomfort, shorter recovery times, and improved overall outcomes.

Growing preventive healthcare practices further drive the demand for gynecological devices. With an increasing emphasis on early detection and intervention, women are more inclined toward regular gynecological check-ups and screenings. Diagnostic devices, such as ultrasound machines and colposcopes, play a pivotal role in the early identification of potential issues, allowing for timely and effective treatment. Preventive healthcare measures, including vaccinations for certain gynecological conditions like Human papillomavirus (HPV), contribute to a proactive approach in managing women's health.

Moreover, the shift toward preventive care aligns with broader healthcare trends, emphasizing the importance of early intervention to improve patient outcomes and reduce the economic burden associated with advanced-stage treatments. Routine screenings, such as Pap smears (involves collecting cells from cervix) and mammograms, contribute to the early detection of cervical and breast cancers, respectively, fostering a culture of proactive gynecological healthcare.

However, the stringent regulatory approval processes act as a significant restraint on the growth of the gynecological devices market. These processes, designed to ensure the safety and efficacy of medical devices, often involve lengthy and complex evaluations. Delays in obtaining regulatory approvals can hinder the timely introduction of innovative gynecological devices to the market, impacting manufacturers' ability to respond quickly to evolving healthcare needs. High compliance standards also pose financial and resource challenges for companies, potentially limiting investments in research and development. While crucial for patient safety, navigating rigorous regulatory pathways can slow down market entry, stalling advancements and innovation in the gynecological devices sector.

During a recession, the gynecology devices market may experience both positive and negative impacts. On the negative side, economic downturns may lead to reduced healthcare budgets, limiting investments in new devices and technologies. Patients may also postpone elective procedures due to financial constraints. Conversely, a positive impact could be increased focus on cost-effective, minimally invasive solutions. As healthcare providers seek more efficient options during economic challenges, there may be a greater emphasis on preventive care and outpatient services, potentially driving demand for certain gynecological devices that align with cost-effective and patient-friendly healthcare delivery models.

Segmental Overview

The gynecological devices industry is segmented on the basis of product type, end user, and region. On the basis of product type, the market is segmented into gynecological endoscopy devices, endometrial ablation devices, fluid management systems, female sterilization and contraceptive devices, and diagnostic imaging systems. The gynecological endoscopy devices segment is further segmented into laparoscopes, and others. The endometrial ablation devices segment is further segmented into Hydrothermal endometrial ablation devices radiofrequency endometrial ablation devices, balloon endometrial ablation devices, and others.

The female sterilization and contraceptive devices segment is further segmented into permanent birth control devices, and temporary birth control devices. The diagnostic imaging systems is further segmented into Ultrasound and Mammography. On the basis of end user, the market is segmented into hospitals, diagnostic centers, and others. Region-wise, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea, and rest of Asia-Pacific), and LA (Brazil, Colombia, Argentina, and rest of LA) and MEA (GCC, South Africa, North Africa and rest of MEA).

By Product Type

Depending on product type, the market is segmented into gynecological endoscopy devices, endometrial ablation devices, fluid management systems, female sterilization and contraceptive devices, diagnostic imaging systems and others. The female sterilization and contraceptive devices segment accounted for the largest share in terms of revenue in 2022 and is expected to maintain its lead during the forecast period owing to being a key component of family planning. With a high prevalence of female sterilization and the ongoing demand for contraceptive devices, it is anticipated to maintain its leading revenue share. Factors such as increasing awareness, accessibility, and the importance of reproductive health are likely to sustain the dominance of the female sterilization and contraceptive devices segment in the forecast period.

However, the diagnostic imaging systems segment is expected to exhibit the fastest CAGR growth during the forecast period owing to increasing emphasis on early detection and diagnosis of gynecological conditions. Diagnostic imaging systems, including ultrasound, magnetic resonance imaging (MRI), and computed tomography (CT) scanners, play a pivotal role in identifying abnormalities and guiding treatment decisions. The growing awareness of the importance of regular screenings and advancements in imaging technologies contribute to the rising demand for these diagnostic tools.

By End User

Depending on end user, the market is segmented into hospitals, diagnostic centers, and others. The hospitals segment accounted for the largest gynecological devices market share in terms of revenue in 2022 and is expected to maintain its lead during the forecast period owing to the central role of hospitals in providing comprehensive gynecological care. Hospitals serve as primary healthcare institutions where a wide range of gynecological procedures, surgeries, and diagnostic services are conducted. The availability of skilled medical professionals, advanced infrastructure, and the capacity to handle complex cases contribute to the dominance of the hospitals segment in the gynecological devices market.

However, the others segment including ambulatory surgical centers, specialty clinics, and research institutes are expected to exhibit the fastest CAGR growth during the forecast period owing to several factors. Diagnostic centers are gaining popularity due to increased demand for specialized gynecological services, technological advancements, and collaborative research efforts. These healthcare settings offer efficient and specialized care, driving the adoption of advanced gynecology devices, contributing to the segment's rapid growth during the forecast period.

By Region

Region wise, the Gynecological devices market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America had the largest gynecological devices market share in terms of revenue in 2022 and is expected to maintain its lead during the forecast period owing to a well-established healthcare infrastructure and advanced medical facilities. The region's robust economy enables significant investments in healthcare research, development, and technology. Further, a high awareness level regarding women's health, coupled with proactive healthcare policies and early adoption of advanced medical technologies, contributes to the dominance of North America in the gynecological devices market.

However, Asia-Pacific is expected to exhibit the fastest gynecological devices market opportunity during the forecast period, owing to rapid economic development and urbanization, leading to an expansion of healthcare infrastructure and increased accessibility to medical services. In addition, a growing awareness of women's health issues and an evolving cultural shift toward proactive healthcare contribute to increased demand for gynecological devices.

Competition Analysis

Competitive analysis and profiles of the major players in the gynecological devices market that operate in the market, such as Stryker Corporation, Richard Wolf GmbH, MedGyn Product Inc., Medtronic Plc, Boston Scientific Corporation, Karl Storz GmbH and Co. KG, Cooper Surgical, Inc., Olympus Corporation, Hologic, Inc., and Ethicon, Inc. The key players have adopted product launch and product approval as the key strategy to expand their product portfolio.

Recent Developments in the Gynecological Devices Industry

In July 2022, GE Healthcare, a leading global medical technology, pharmaceutical diagnostics, and digital solutions innovator, unveiled its most advanced ultrasound yet, the next-generation Voluson Expert 22. This latest addition to GE Healthcare’s award-winning Women’s Health portfolio utilizes graphic-based beam former technology, which produces higher quality images and offers greater flexibility in imaging functions.

In September 2022, Olympus Corporation, a leading manufacturer of optical and digital precision technology, announced the launch of VISERA ELITE III, its newest surgical visualization platform that addresses the needs of healthcare professionals (HCPs) for endoscopic procedures across multiple medical disciplines including gynecology.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the gynecological devices market analysis from 2022 to 2032 to identify the prevailing gynecological devices market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the gynecological devices market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global gynecological devices market trends, key players, market segments, application areas, and market growth strategies.

Gynecological Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 17.3 billion |

| Growth Rate | CAGR of 7.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Product Type |

|

| By End Users |

|

| By Region |

|

| Key Market Players | Johnson and Johnson, Karl Storz GmbH & Co. KG, Medtronic plc, CONMED Corporation., HOYA Corporation, Boston Scientific Corporation, Stryker Corporation, FUJIFILM Holdings Corporation, Smith and Nephew plc., Olympus Corporation |

Analyst Review

This section provides opinions that the key companies operating in the gynecological devices market. The adoption of gynecological devices is expected to increase due to a rise in the number of self-directed consumers and an upsurge in awareness about the availability of gynecology devices.

In addition, increasing incidence of gynecological disorders, driven by factors such as changing lifestyles and improved healthcare awareness, creates a substantial market demand for diagnostic and treatment devices. In addition, technological advancements, including minimally invasive surgical techniques and advanced imaging technologies, enhance the precision and effectiveness of gynecological procedures, contributing to improved patient outcomes. However, stringent regulatory approval processes are expected to hinder market growth.

Furthermore, North America is expected to remain dominant during the forecast period, due to a surge in the use of gynecological devices. This is attributed to a well-established healthcare infrastructure and high healthcare expenditure. Furthermore, the presence of major market players and academic research institutions fosters innovation and product development. In addition, Asia-Pacific and LAMEA are expected to offer lucrative opportunities to the key players, due to surge in awareness toward preventative healthcare.

The total market value of gynecological devices market is $8,511.97 million in 2022.

The forecast period for gynecological devices market is 2023 to 2032

The market value of gynecological devices market in 2032 is $17,253.34 million

The base year is 2022 in gynecological devices market .

Top companies such as Stryker Corporation, Richard Wolf GmbH, MedGyn Product Inc., Medtronic Plc held a high market position in 2022. These key players held a high market postion owing to the strong geographical foothold in North America, Europe, Asia-Pacific, LA and MEA.

The female sterilization and contraceptive devices segment is the most influencing segment in gynecological devices market owing to increasing awareness, accessibility, and the importance of reproductive health are likely to sustain the dominance of the female sterilization and contraceptive devices segment in the forecast period.

The major factor that fuels the growth of the gynecological devices market are technological advancements, rising incidence of gynecological disorders and conditions and growing aging population drive the growth of the global gynecological devices market.

Gynecological devices are medical instruments, tools, or equipment designed for the diagnosis, treatment, and monitoring of various conditions and diseases related to the female reproductive system

Loading Table Of Content...

Loading Research Methodology...