Halal Food Market Research, 2032

The global halal food market size was valued at $2.3 trillion in 2022, and halal food market forecast to reach $7.5 trillion by 2032, growing at a CAGR of 12.4% from 2023 to 2032.

In terms of Islamic law, halal denotes anything that is acceptable, permitted, and lawful as opposed to haram, which denotes something that is not permitted or approved. What goods and services Muslims are allowed to use, including food, medicine, cosmetics, and other items, is determined by their halal status. In addition, halal makes assumptions on the production process, raw ingredients, and product storage. Since it is difficult for customers to determine if products and services meet halal rules, these requirements are essentially credence. Therefore, Halalness is frequently verified by national or private standards.

Market Dynamics

The rise in the Muslim population has made the Islamic economy well-known and prepared the way for the global sale of halal goods. Furthermore, the halal industry is expanding not just in nations with a majority of Muslims but also in non-Muslim nations like the U.S. Although halal is most commonly linked with food and beverages, a vast range of goods and services are actually provided, including travel, healthcare, medicines, personal care, and cosmetics. One of the most lucrative and significant market segments in the food industry nowadays is the halal food sector.

The global halal market is expanding rapidly in a number of nations that have historically not been supportive of it, and this expansion will continue as the Muslim population grows worldwide. The global halal market's compound annual growth rate (CAGR) is expected to increase in the next years due to the growing demand for halal food and dining alternatives. The halal food market growth in the U.S. is expected to develop significantly in the future and is now expanding at a considerable rate. The estimated value of the U.S. halal food market was $59.4 billion in 2022, and it is expected to reach around $88.9 billion by 2026. The U.S. halal food market is expected to develop further as more businesses want to carry halal food items and as more restaurants seek halal certification to offer halal dining options. The need for halal food items will only increase in tandem with the growth of the Muslim population in the U.S. The global halal food market as well as the American economy will both benefit from increase in demand for halal food items.

Halal cuisine is highly popular in many religions, even though adhering to Islamic dietary laws is imperative. One of the primary causes of the growing demand for halal cuisine is the emphasis on quality. Certification as halal is often associated with strict quality control protocols that ensure food is safe, sanitary, and of the highest standard. Furthermore, halal ethical factors including the humane treatment of animals and ethical sourcing appeal to ethical customers. The epidemic hastened the rise in need for nations to achieve self-sufficiency and to establish local and regional production that addresses issues with supply chains and food security. Additionally, it promoted the expansion and creativity of the regional halal food sector. Then there is the swift digital revolution sparked by Muslim customers seeking convenient, flavorful, and nutritious meal delivery services. Home delivery and groceries e-commerce took off, creating new opportunities for halal food and grocery delivery, such as halal cloud or ghost kitchens. Getir, a Turkish on-demand delivery business, is seizing the opportunity to enter the market. The company's 2021 fundraising totals were $129 million for Series B, $300 million for Series C, and $555 million for Series D. This aided the business's subsequent growth into Paris, Berlin, and the US.

Nations across the globe are modifying their Islamic economic policies to fulfil consumer demands and increase confidence in halal products. For instance, the Halal Product Law was adopted in 2019 in Indonesia, the country with the biggest Muslim population in the world (207 million people), requiring all consumer items and related services to be halal-certified before being entered into or exchanged inside the nation. Certain things are permitted under the law even if they are considered haram, such as alcohol, pig or hog byproducts, blood, and meat that has not been killed in accordance with Islamic law. The government now has more control and management over Indonesia's production and trade owing to the introduction of this mandatory law. One example is the integrated halal product codification and trade data system, which was expected to be operational by the end of 2021 and is intended to enhance consumer trust by streamlining halal logistics and improving traceability. Similarly, in 2019, the kingdom of Saudi Arabia expanded the scope of its necessary halal certification to include imported dairy products, oils and fats, confections, chilled and frozen meals, and items with a long shelf life.

In an effort to break into the global halal market, Pakistan, the nation with the second-largest Muslim population in the world, approved new directives for the Pakistan Halal Authority in October 2021, directing it to promote halal products both, domestically and abroad. The trend is even catching on outside the Organisation of Islamic Cooperation (OIC), as evidenced by agreements put up by Singapore, the Philippines, and South Korea with OIC members to investigate potential collaborations on the import and export of halal goods and related services. M&S Food introduced its own line of halal ready meals including Western cuisine in the UK.

Segmental Overview

The halal food market is segmented into Product Type and Distribution Channel. By product type, the market is categorized into meat and poultry, dairy products, fish and seafood, cereals and confectionery, and others. By distribution channel, it is fragmented into traditional retailers, supermarkets and hypermarkets, online, and others. Region-wise, the halal food market share is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, UK, Italy, Spain, and the rest of Europe), Asia-Pacific (China, India, Indonesia, Australia, Malaysia, Rest of Asia Pacific), and LAMEA (Brazil, UAE, Saudi Arabia, Argentina, Turkey, and the rest of LAMEA).

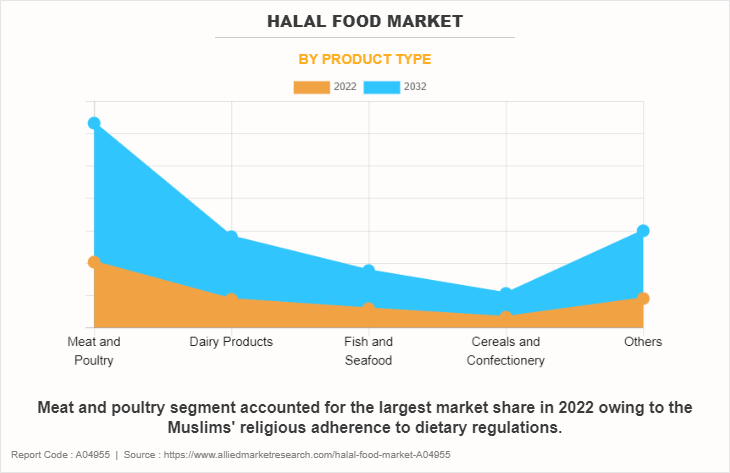

By Product Type

By product type, the meat and poultry segment was the highest revenue contributor in 2022. However,. the dairy products segment is expected to grow at the highest CAGR during the forecast period. Customers are starting to place more importance on food supply chain transparency. Thus, companies are disseminating details on production methods, ingredient source, halal certification, and unambiguous labelling. Made from halal ingredients, halal dairy products are becoming more and more popular in traditional market places where there are sizable Muslim communities as well as non-Muslim majority locations. Increase in demand and consumer awareness for halal products is driving force behind this expansion.

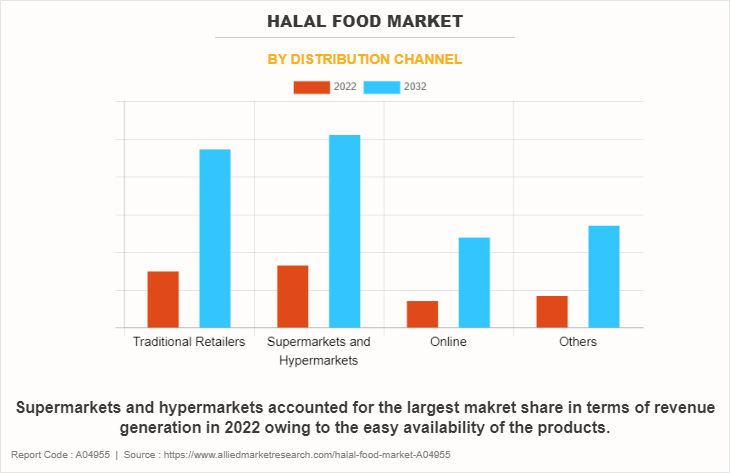

By Distribution Channel

By distribution channel, the supermarkets and hypermarkets segment constituted the largest halal food market share with $822.7 billion revenue in 2022, and is expected to reach $2,546.2 billion by 2032 at a CAGR of 12.03%. A supermarket is a sizable retail complex with a self-service emphasis. However, a hypermarket is a sizable self-service warehouse and convenience store that combines elements of nearly every kind of retail establishment, including grocery stores, supermarkets, retail stores and specialised shops. Hypermarkets are regarded as one-stop stores for all consumer requirements, offering everything a person might possibly need on a daily basis. Thus, the supermarkets and hypermarkets segment is propelling the halal food market demand, which offers strong market growth.

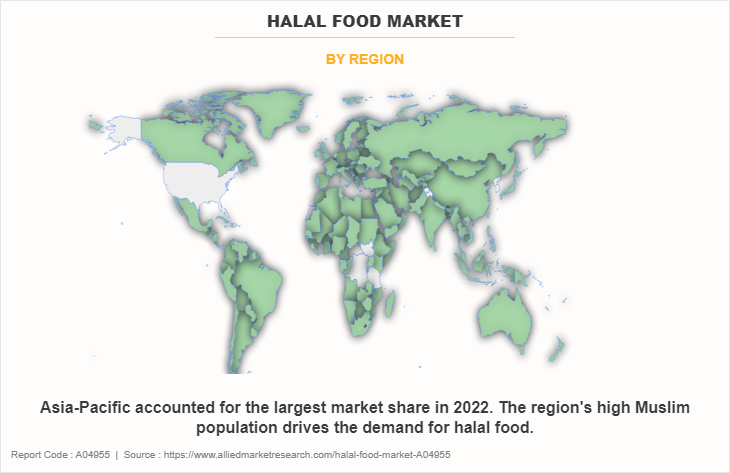

By Region

By region, Asia-Pacific held the largest halal food market size of $1,037.1 billion in 2022, and is estimated to reach $3,323.1 billion by 2032, with a CAGR of 12.42%. Examples of halal food and drink items include meat, bread products, dairy products, confections, food supplements, and a variety of beverage products. Shariah law and the permissible and forbidden things found in religious books define what constitutes a halal diet. In addition, businesses must follow the Halal food guidelines that are outlined by national government agencies in every country. This makes it difficult to ensure halal conformity in food and drink.

Competitive Landscape

The halal food market is being driven by factors such as rapid growth in infrastructural development as well as various advancements in developing countries. The major players operating in the global halal food market are Saffron Road, Kawan Food Manufacturing Sdn Bhd, Al Islami Foods, QL Foods Sdn Bhd, Nestle S.A., American Foods Group, LLC, BRF S.A., Unilever PLC, Cargill, Incorporated, and TAHIRA.

Recent Developments in Halal food Market

Some Examples of Acquisition in the Global Market

In November 2022, Cargill and Owensboro Grain Company, a fifth-generation family-owned soybeanprocessing facility and refinery located in Owensboro, Ky., announced that they have entered into a definitive agreement where Cargill will add Owensboro Grain Company (OGC) to its North America agricultural supply chain business.

Some Examples of Investment in the Global Halal Food Market

- In March 2022, Kawan Food Bhd, announced that it will be taking a 32.5% stake in the young Malaysian startup company, Kejap Food, which is a locally developed fast food chain.

Some Examples of Joint Ventures in the Halal Food Market

In October 2022, BRF S. a subsidiary BRF GmbH signed a joint venture agreement with the Halal Products Development Company (HPDC), a branch of the Public Investment Fund (PIF), a sovereign fund of Saudi Arabia.

Some Examples of Product Launch in the Halal Food Market

- In November 2023, Tahira Foods introduced two sensational additions to its culinary repertoire, the Vegetable Oriental SPRING ROLLS and Vegetable SAMOSAS. This strategic product launch enhances the diverse offerings, captivating palates with irresistible flavors.

- In January 2021, Al Islami Foods announced the launch of vegan burger with an aim to enter into plant-based market.

Some Examples of Expansion in the Global Halal food Industry

- In September 2022, American Foods Group, LLC (AFG) strategically initiated a cutting-edge beef processing facility in Warren County, Missouri near Wright City. This expansion project anticipates creating a substantial $1 billion annual economic impact for the state of Missouri.

- In July 2022, BRF S.A. announced the inauguration of new plant in Dammam, Saudi Arabia, with a production capacity of 1,200 tons of food per month.

- In April 2021, Nestle Malaysia strategically inaugurated its inaugural Plant-Based Meal Solutions production site in ASEAN, marking its second such facility in Asia. With a substantial investment of RM150 million, the Shah Alam Industrial Complex-based site boasts an 8,000-tonne production capacity, focusing on exporting and locally distributing plant-based foods.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the halal food market analysis from 2022 to 2032 to identify the prevailing halal food market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the halal food market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global halal food market trends, key players, market segments, application areas, and market growth strategies.

Halal Food Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 7.5 trillion |

| Growth Rate | CAGR of 12.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 291 |

| By Product Type |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | BRF S.A., Kawan Food Berhad, American Foods Group, LLC, Nestle S.A., QL Resources Berhad, Tahira Foods Ltd., Cargill, Incorporated, Saffron Road, Al Islami Foods, Unilever PLC |

Analyst Review

As per the perspective of top-level CXOs, the global halal food market is expected to unleash attractive business

opportunities in developing economies, however, is dealing with challenges simultaneously. With increase in per

capita income, developing economies are further expected to emerge as major markets for halal food in a decade.

As countries in the Asia-Pacific region are undergoing infrastructural development with better and advanced

connectivity, retail shops are witnessing transition in terms of storage facility and kind of inventory.

The halal food sector is expanding at a phenomenal rate globally. Several well-known food firms are making use of

this invaluable resource to promote more halal products and win over customers. These food firms have made it

simpler to choose halal food by offering processed food from many cuisines and by creating quick and readily

cooked food. Not only are their food products becoming available in supermarkets, hypermarkets, and many online

platforms, but they are also growing their distribution network. Advances in the halal food sector propels the start of

a potentially enormous market, driven by a sizable, rapidly expanding, and youthful Muslim populace in Muslimmajority

nations, who want goods and services consistent with their Islamic lifestyle. According to the study

conducted by Pew Research Centre, 60% of the global Muslim population is under thirty.

Moreover, countries across the globe are modifying their Islamic economic plansto suit market demands and further

increase consumer trust in halal products. For instance, the 207 million-strong Muslim nation of Indonesia enacted

the Halal Product Law in 2019, requiring all consumer goods and associated services to be halal-certified before

being imported or exchanged within the nation. The rule has several limitations, such as the acceptance of haram

goods like alcohol, pig or pork byproducts, blood, and meat that hasn't been killed in accordance with Islamic law.

The global halal food market size was valued at $2.3 trillion in 2022, and halal food market forecast to reach $7.5 trillion by 2032

The global Halal Food market is projected to grow at a compound annual growth rate of 12.4% from 2023 to 2032 $7.5 trillion by 2032

The major players operating in the global halal food market are Saffron Road, Kawan Food Manufacturing Sdn Bhd, Al Islami Foods, QL Foods Sdn Bhd, Nestle S.A., American Foods Group, LLC, BRF S.A., Unilever PLC, Cargill, Incorporated, and TAHIRA.

By region, Asia-Pacific held the largest halal food market size of $1,037.1 billion in 2022, and is estimated to reach $3,323.1 billion by 2032

Growing Muslim population, Increasing demand for halal food products, Increase in Purchasing Power of Consumers

Loading Table Of Content...

Loading Research Methodology...