HbA1c Testing Device Market Research, 2033

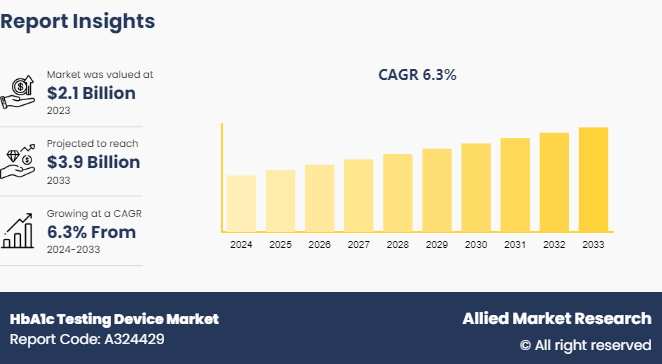

The global HbA1c testing device market size was valued at $2.1 billion in 2023, and is projected to reach $3.9 billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033. The HbA1c testing device market is driven by the increasing prevalence of diabetes, which necessitates regular monitoring to manage the condition effectively. Advances in technology and the growing demand for non-invasive and user-friendly testing solutions also contribute to market growth.

Market Introduction and Definition

HbA1c testing devices are specialized instruments designed to measure glycated hemoglobin (HbA1c) levels in the blood, an essential marker for managing diabetes. HbA1c testing is crucial for assessing long-term glucose control in patients with diabetes, as it reflects average blood glucose levels over the past two to three months. These devices provide healthcare professionals with valuable information for tailoring treatment plans and monitoring patient progress.

The testing devices vary in complexity, ranging from point-of-care systems used in clinics and hospitals to more advanced, laboratory-based analyzers. They offer various features such as rapid results, ease of use, and integration with electronic health records, enhancing their utility in both clinical and home settings. By providing accurate and timely HbA1c measurements, these devices play a vital role in improving diabetes management and patient outcomes.

Key Takeaways

- The HbA1c testing device industry study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major HbA1c testing device market industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The HbA1c testing device market size is primarily driven by the increasing prevalence of diabetes globally. As the incidence of diabetes rises, there is a growing demand for effective and accurate monitoring tools to manage and control blood glucose levels. Technological advancements have led to the development of more sophisticated and user-friendly HbA1c testing devices, enhancing their appeal to both healthcare providers and patients. For instance, the integration of digital technologies and cloud-based data management systems into these devices allows for real-time monitoring and more efficient diabetes management. Furthermore, government initiatives and healthcare policies aimed at improving diabetes care and promoting preventive measures are also fueling HbA1c testing device market growth.

Despite the positive growth trajectory, the market faces several challenges during HbA1c testing device market forecast. High costs associated with advanced testing devices can be a significant barrier, particularly in low-income regions or among underserved populations. Additionally, the accuracy and reliability of some HbA1c testing devices can be impacted by factors such as sample handling and device calibration, leading to potential discrepancies in results. Regulatory hurdles and the need for frequent updates and maintenance can also pose challenges for manufacturers and healthcare providers.

There are numerous HbA1c testing device market opportunity. The development of portable and home-use HbA1c testing devices presents a significant opportunity to enhance patient convenience and adherence to monitoring routines. Innovations such as non-invasive testing methods and integration with mobile health applications could further revolutionize diabetes management. Moreover, expanding into emerging markets with increasing diabetes prevalence offers growth potential for companies in the HbA1c testing sector. Collaborative efforts between technology developers and healthcare providers to create more personalized and accessible diabetes care solutions also represent a promising avenue for market expansion.

Market Segmentation

The HbA1c testing device market is segmented into type of device, end-user and region. On the basis of type of device, the market is bifurcated into laboratory-based testing devices, and point-of-care (POC) testing devices. As per technology, the market is bifurcated into immunoassays, chromatography, enzymatic assays, boronate affinity chromatography, high-performance liquid chromatography, and others. Based on end user, the market is divided into hospitals & clinics, diagnostic laboratories, and homecare settings. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The North America has largest HbA1c testing device market share and is primarily driven by several key factors. Firstly, the rising prevalence of diabetes in the region creates a heightened demand for accurate and reliable HbA1c testing to manage and monitor long-term glucose control. The increasing awareness of the importance of regular HbA1c testing for diabetes management further fuels market growth.

Additionally, advancements in technology have led to the development of more efficient and user-friendly testing devices, driving adoption among healthcare providers and patients. Government initiatives and healthcare policies aimed at improving diabetes care also contribute to the market expansion. Moreover, the growing emphasis on preventive healthcare and early diagnosis is prompting more frequent HbA1c testing, supporting market growth.

Industry Trends

- The market is witnessing advancements in HbA1c testing technology, with innovations focusing on improving accuracy, speed, and ease of use. Modern devices are increasingly integrating with digital health platforms, enabling real-time data sharing and remote monitoring.

- There is a rising preference for point-of-care HbA1c testing devices due to their convenience and ability to provide rapid results. These devices are increasingly used in clinics and primary care settings, allowing for immediate treatment adjustments.

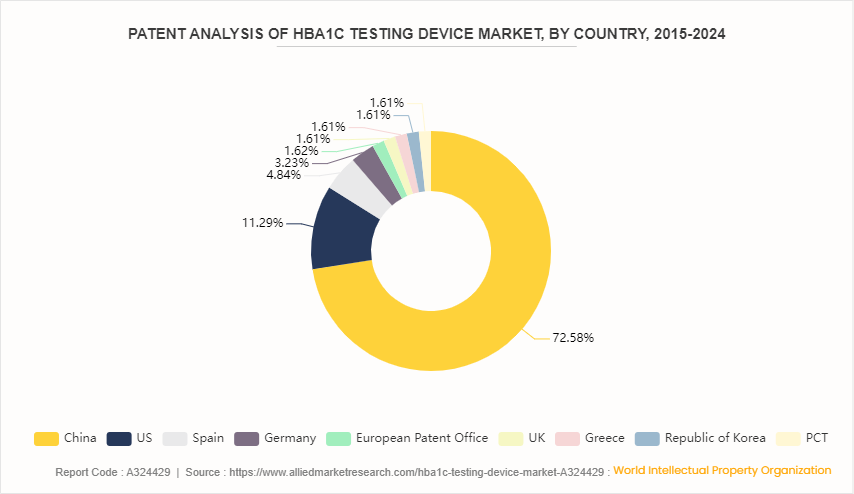

Patent Analysis, By Country, 2015-2024

U.S. witnessed the highest number of patent approvals and applications, due to favorable government policies, new technological advancement and new product launches in the country. U.S. has 11.29% of the total number of patents, followed by Spain at 4.84%.

Competitive Landscape

The major HbA1c testing device market share players operating in the HbA1c testing device market include F.hoffmann LA. Roche, Abbott Laboratories, Siemens Healthineers, Danaher Corporation, Becton, Dickinson and Company, Thermo Fisher Scientific, Mylan N.V., Sysmex Corporation, A. Menarini Diagnostics, Bio-Rad Laboratories. Other players in HbA1c testing device market include Hemosense, Inc., Trinity Biotech, Jant Pharmacal Corporation, Mediwise, DCAVantage, and so on.

Recent Key Strategies and Developments

- In April 2023, FIND partnered with Abbott, i-SENS Inc, and Siemens Healthineers to offer discounted point-of-care HbA1c test kits for low- and middle-income countries, aiming to improve diabetes diagnosis and management in underserved regions.

- In February 2024, HemoCue collaborated with Novo Nordisk to enhance point-of-care diagnostic testing for children with type 1 diabetes in low- and middle-income countries. HemoCue HbA1c 501 Systems will be deployed across 30 countries to improve diabetes management and reach 100, 000 children by 2030.

- In January 2024, Roche announced a contract to acquire LumiraDx's point-of-care testing technology for USD 295 million, with an additional up to USD 55 million allocated to support Lumira's point-of-care technology platform until the completion of the acquisition.

- In November 2022, LumiraDx expanded its HbA1c test's commercial reach, addressing diabetes management needs in various care settings. The test, run on the LumiraDx Platform, offers rapid results, aiding in screening and monitoring, with potential benefits for patient outcomes.

- In May 2022, Labcorp introduced an at-home collection kit for diabetes risk testing, utilizing a new device from Weavr Health. This innovative approach offers convenience and accessibility, aiming to empower individuals to monitor their health status from home.

- In May 2022, LumiraDx received CE Marking for its HbA1c test, enhancing diabetes screening and monitoring on its point-of-care LumiraDx Platform. The rapid microfluidic assay provides results in under seven minutes, aiding patient risk identification.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the HbA1c testing device market segments, current trends, estimations, and dynamics of the HbA1c testing device market analysis from 2023 to 2033 to identify the prevailing HbA1c testing device market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the HbA1c testing device market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global HbA1c testing device market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global HbA1c testing device market trends, key players, market segments, application areas, and market growth strategies.

Key Sources Referred

- Centers for Disease Control and Prevention

- World Health Organization

- National Center for Biotechnology Information

- The Lancet

- The Scottish Government

- Science Direct

- Health Resources and Services Administration (HRSA)

- Department of Health and Human Services (HHS)

- National Institutes of Health (NIH)

- GOV.UK

HbA1c Testing Device Market , by Type of Device Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.9 Billion |

| Growth Rate | CAGR of 6.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 260 |

| By Type Of Device |

|

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | Danaher Corporation (Beckman Coulter), Roche Diagnostics, Sysmex Corporation, Becton, Dickinson and Company (BD), Siemens Healthineers AG, Bio-Rad Laboratories, Menarini Diagnostics, Thermo Fisher, Mylan N.V, Abbott Laboratories |

The Roche Diagnostics, Abbott Laboratories, Siemens Healthineers, Danaher Corporation, Becton, Dickinson and Company (BD), Thermo Fisher Scientific, Mylan N.V., held a high market position in 2023.

The base year is 2023 in HbA1c testing device market.

The forecast period for HbA1c testing device market is 2024 to 2033.

The market value of HbA1c testing device market is projected to reach $3.9 billion.

The total market value of HbA1c testing device market was $2.10 billion in 2023.

Loading Table Of Content...