HDPE Pipes Market Size & Insigths:

The global HDPE pipes market size was valued at $21.7 billion in 2022, and is projected to reach $35.4 billion by 2032, growing at a CAGR of 5.1% from 2023 to 2032. Rise in demand for water and wastewater management solutions is a significant factor driving the growth of the global HDPE pipe market. With rise in population growth and urbanization, the need for sustainable and durable infrastructure to manage water resources has increased. HDPE pipes have emerged as a crucial component in addressing these challenges due to their durability, flexibility, and resistance to corrosion, making them ideal for both water distribution and wastewater systems.

Introduction

HDPE pipes, known as high-density polyethylene pipes, are plastic pipes made from a thermoplastic polymer called high-density polyethylene. HDPE pipes are characterized by their high strength, durability, flexibility, and resistance to chemicals, corrosion, and impact. They are widely used in various applications, including water supply systems, wastewater & sewage systems, gas distribution networks, industrial fluid transportation, geothermal heating systems, and marine & subsea projects. HDPE pipes are favored for their lightweight construction, easy installation, long service life, and environmental sustainability. They are manufactured through an extrusion process where molten HDPE material is shaped into continuous pipes and then cooled, sized, and tested for quality assurance.

HDPE pipes are extensively used in sewage and drainage systems due to their chemical resistance, flexibility, and leak-free joints. In sewage systems, they transport wastewater and stormwater without corroding or leaking, even in highly aggressive environments. Their smooth interior walls minimize the buildup of sludge and other debris, reducing maintenance requirements and improving system longevity. HDPE pipes have become the material of choice for gas distribution networks due to their excellent strength, flexibility, and resistance to environmental stress cracking. Natural gas and other gases can be transported through HDPE pipes with high levels of safety and efficiency. Unlike steel or iron pipes, HDPE pipes are non-corrosive and do not require additional protective coatings, reducing long-term maintenance costs.

In industrial applications, HDPE pipes are used to transport chemicals, acids, and other hazardous materials. Their resistance to a wide range of chemicals, including acids, bases, and solvents, makes them ideal for transporting fluids in chemical processing plants, refineries, and other industrial facilities. HDPE pipes also play a critical role in handling slurries and abrasive materials, as they can resist wear and tear, ensuring longer operational life.

Key Takeaways

The report outlines the current HDPE pipes market trends and future scenario of the market from 2022 to 2032 to understand the prevailing opportunities and potential investment pockets.

The global HDPE pipes market has been analyzed in terms of value ($Billion) and volume (Kilotons). The analysis in the report is provided on the basis of type, application, 4 major regions, and more than 15 countries.

The HDPE pipes market report is consolidated in nature with few players such as Lane Enterprises, Inc, JM EAGLE, INC, BLUE DIAMOND INDUSTRIES, LLC, Mexichem S.A.B. de C.V, WL Plastics, POLY PLASTIC Group, Prinsco, Inc., United Poly Systems, and RADIUS System, which hold significant share of the market.

The report provides strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the HDPE pipes manufacturing industry.

Countries such as China, U.S., India, Germany, and Brazil hold a significant share in the global HDPE pipes market.

Market Dynamics

An increase in demand for construction and development of infrastructure is expected to drive the growth of the HDPE pipes market during the forecast period. As urbanization rises and the global population continues to grow, governments and private sectors are placing substantial focus on the expansion of urban infrastructure, water management systems, and utilities, all of which require the durable and reliable properties of HDPE pipes. The importance of HDPE pipes in infrastructure development is further highlighted by their use in irrigation systems, which are critical for agricultural productivity in many developing regions. As governments focus on improving water management and increasing access to clean water, HDPE pipes are being integrated into these systems due to their non-toxic, leak-proof properties that ensure the safe transportation of potable water. Moreover, they are resistant to chemical reactions, which is essential when transporting water in varying pH conditions, particularly in rural and agricultural applications. In April 2024, AmeriTex Pipe & Products (AmeriTex) announced the start of construction on a new facility for High-Density Polyethylene (HDPE) and Polypropylene (PP) corrugated pipes at its Conroe, Texas campus, aiming to enhance service for its Texas customers. Moreover, in June 2025, Prime Minister Narendra Modi inaugurated the 660-MW Panki Thermal Power Extension Project and three 660-MW units of the Ghatampur Thermal Power Project, collectively adding 3,081 MW to the state's power capacity.

However, competition from alternative materials is expected to restrain the growth of the HDPE pipes market during the forecast period. Competition from alternative materials such as PVC, steel, and concrete is a significant factor hampering the HDPE pipe market. Each of these materials has long-standing use in various piping applications, and in many cases, they continue to be preferred due to factors such as cost, familiarity, or local availability. For instance, PVC is often chosen in residential plumbing systems as it is relatively inexpensive and easy to work with, especially in low-pressure applications. Steel, known for its strength and durability, is widely used in industrial and high-pressure environments, while concrete pipes are preferred for large-scale infrastructure projects like drainage systems and culverts due to their strength and longevity.

Segments Overview

The HDPE pipes market is segmented on the basis of type, application, and region. On the basis of type, the market is categorized into HDPE 63, HDPE 83, and HDPE 100. On the basis of application, it is divided into oil & gas pipe, agriculture irrigation pipe, water supply, sewerage system pipe, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

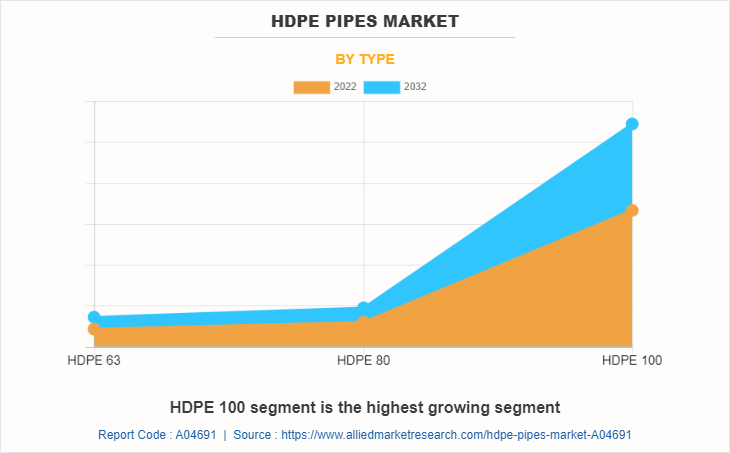

By type, the HDPE 100 segment dominated the global market in 2022, and is anticipated to grow at a CAGR of 5.2% during forecast period. The rise in demand for sustainable water management solutions fuels the market growth for HDPE 100 pipes. This factor is projected to drive the global demand for HDPE pipes for 100 grade segments. Moreover, HDPE 100 pipes offer superior performance compared to other types of pipes. They have high strength, flexibility, and excellent resistance to corrosion, abrasion, and chemical degradation. These properties make them suitable for various applications, including water supply, gas distribution, industrial piping, and mining. The EU's mandate for 100% recyclable water infrastructure by 2030 has accelerated the adoption of PE100-RC grade HDPE pipes, known for their enhanced stress crack resistance. These factors are anticipated to boost the potential demand for HDPE pipes market; thus, creating the most lucrative opportunities during the forecast period.

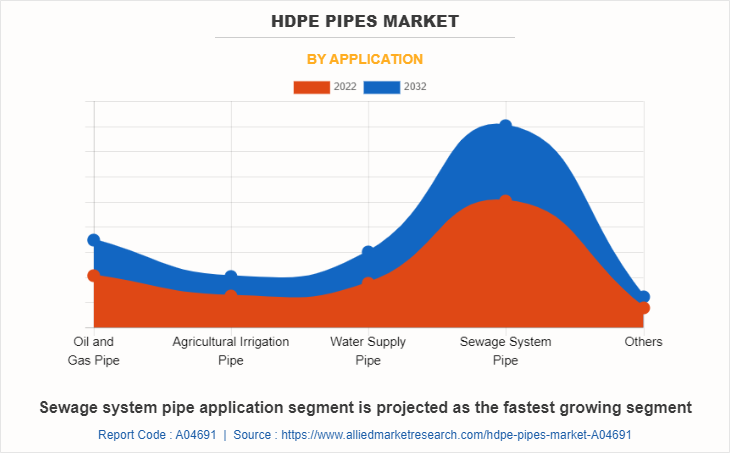

By application, the sewage supply segment was the largest revenue generator in 2022 and is anticipated to grow at a CAGR of 4.9% during the forecast period. HDPE pipes offer excellent chemical resistance, ensuring the safe and efficient conveyance of sludge. furthermore, sewage treatment processes often involve aeration to facilitate the breakdown of organic matter by microorganisms. HDPE pipes are used to distribute air or oxygen into the treatment tanks or basins. In May 2025, KMC approved an approximately $84 million (₹700 crore) project to augment water infrastructure in South Kolkata. This includes laying new pipes, constructing two water treatment plants, and establishing multiple booster pumping stations to ensure consistent water pressure across regions, which is gaining popularity for HDPE pipes. These pipes deliver the air or oxygen to diffusers or aerators placed at the bottom of the tanks, ensuring efficient oxygen transfer, and promoting biological treatment. These factors are offering new avenues for the HDPE pipes market during the forecast period.

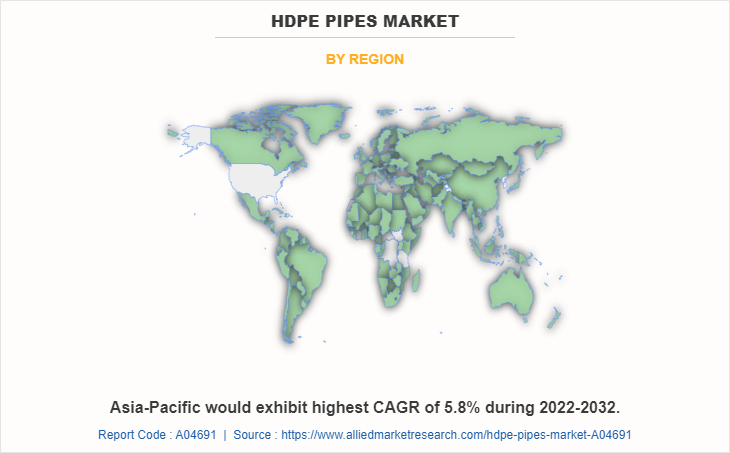

Region-wise, the Asia-Pacific dominated the HDPE pipes market, and is anticipated to grow at the CAGR of 5.8% during the forecast period. In Asia-Pacific region, Japan has aging infrastructure that requires rehabilitation and replacement. HDPE pipes offer a durable and cost-effective solution for infrastructure renewal projects, leading to their increased adoption. In addition, Japan is prone to natural disasters, and HDPE pipes are used in disaster management systems such as drainage, flood control, and sewerage networks. The resilience and flexibility of HDPE pipes make them suitable for such applications. The HDPE pipes market has been experiencing significant growth in South Korea and Australia. Both countries have been investing in infrastructure development, water management projects, and industrial expansion, driving the demand for HDPE pipes. These factors are creating lucrative opportunities for the HDPE pipes in the Asia-Pacific region during the upcoming periods.

Competitive Analysis

The global HDPE pipes market profiles leading players that include Lane Enterprises, Inc, JM EAGLE, INC, BLUE DIAMOND INDUSTRIES, LLC, Mexichem S.A.B. de C.V, WL Plastics, POLY PLASTIC Group, Prinsco, Inc, United Poly Systems, RADIUS System. The key players have adopted strategies such as product launch to increase their market share.The global HDPE pipes market report provides in-depth competitive analysis and profiles of these major players.

Recent Key Developments in the HDPE Pipes Market

On December 6, 2024, WL Plastics acquired the HDPE extrusion pipe business from Charter Plastics. This move aimed to diversify WL Plastics’ product offerings and expand its geographical presence in the HDPE market.

In October 2024, ADS inaugurated a $65 million, 110,000-square-foot Engineering and Technology Center in Hilliard, Ohio. This facility focuses on HDPE pipe innovations, including advanced materials science, manufacturing technologies, and recycled plastics, enhancing the sustainability and performance of HDPE pipes.

In October 2023, Chevron Phillips Chemical Company LLC, a joint venture of Chevron Corp. and Phillips 66, made a $15 billion bid to acquire Nova Chemicals Corp., owned by UAE-based Mubadala. The deal would make the company the third-largest polyethylene producer in North America behind ExxonMobil Chemical Co. and Dow Chemical Co. and the largest producer of high-density polyethylene (HDPE) in North America.

In May 2022 WL Plastics acquired the HDPE extrusion pipe business from Charter Plastics, a move that further diversifies its product offerings and expands its geographical footprint. This strategic acquisition is expected to enhance Charter Plastics portfolio for HDPE pipes.

In February 2021, United Poly, launched new line of HDPOE pipes in the same size as traditional copper tubes and iron pipes for a wide range of application particularly in water supply uses. This strategic product launch is projected to increase the potential sales of the company’s HDPE pipes.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hdpe pipes market analysis from 2022 to 2032 to identify the prevailing hdpe pipes market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hdpe pipes market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hdpe pipes market trends, key players, market segments, application areas, and market growth strategies.

HDPE Pipes Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 35.4 billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 401 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Lane Enterprises, Inc, POLY PLASTIC Group, WL Plastics, United Poly Systems, Prinsco, Inc., Vectus, SCG Chemicals Public Company Limited, Blue Diamond Industries, RADIUS System, JM EAGLE, INC. |

Analyst Review

According to CXOs of leading companies, the global HDPE pipes market is expected to exhibit high growth potential. HDPE (High-Density Polyethylene) pipes are plastic pipes widely used in various industries and applications. HDPE is a thermoplastic material known for its high strength, durability, and resistance to chemicals, corrosion, and abrasion.??

In addition, HDPE pipes are recyclable and have a low carbon footprint, making them an environmentally friendly choice. Their versatility, durability, and cost-effectiveness have made HDPE pipes a popular alternative to traditional piping materials in many industries.??

Moreover, HDPE pipes are widely used for transporting potable water in municipal and industrial water supply systems. Their corrosion resistance, smooth interior surface, and ability to withstand high pressure make them ideal for this application. The CXOs further added that sustained economic growth and the development of the oil and gas sector have surged the popularity of HDPE pipes.?

The HDPE pipes market is segmented by type, application, and region. By type, it is categorized into HDPE 63, HDPE 88, and HDPE 100. By application, it is segregated oil & gas pipe, agricultural irrigation pipe, water supply pipe, sewage system pipe, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Sewage system pipes is the key leading application of HDPE pipes market.

HDPE (High-Density Polyethylene) pipes are a type of plastic pipe commonly used in various industries for fluid and gas transportation. They are known for their durability, flexibility, and resistance to corrosion, chemicals, and abrasion. HDPE pipes are made from high-density polyethylene resin, which is a thermoplastic polymer known for its strength and stiffness.

The global hdpe pipes market was valued at $21.7 billion in 2022, and is projected to reach $35.4 billion by 2032, growing at a CAGR of 5.1% from 2023 to 2032.

Asia-Pacific is the largest regional market for HDPE pipes.

Lane Enterprises, Inc, JM EAGLE, INC, BLUE DIAMOND INDUSTRIES, LLC, Mexichem S.A.B. de C.V, WL Plastics, POLY PLASTIC Group, Prinsco, Inc, United Poly Systems, RADIUS System

The HDPE pipe industry is witnessing continuous technological advancements in manufacturing processes, such as extrusion techniques, improved jointing methods, and enhanced product designs. These advancements are resulting in higher-quality pipes, increased production efficiency, and improved overall performance. Technological developments are driving the market by providing better solutions and expanding the range of applications for HDPE pipes.

Loading Table Of Content...

Loading Research Methodology...