Healthcare Waste Treatment Market Research, 2035

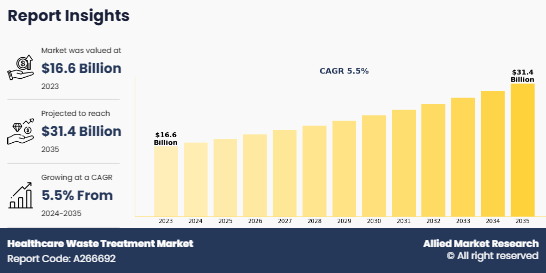

The global healthcare waste treatment market size was valued at $16.6 billion in 2023, and is projected to reach $31.4 billion by 2035, growing at a CAGR of 5.5% from 2024 to 2035. Key factors driving the growth of the market are rise in awareness about the importance of biohazardous and infectious medical waste management and growing volume of healthcare waste. According to a 2023 article by the National Library of Medicine, it was reported that high-income countries produce up to almost 11 kg of hazardous waste per hospital bed per day.

Healthcare waste treatment involves the treatment of waste generated in medical facilities, including hospitals, clinics, laboratories, and research centers. This waste encompasses a variety of materials, such as infectious waste (e.g., sharps, contaminated dressings), hazardous chemicals, pharmaceuticals, and general non-hazardous waste. Effective treatment is crucial to prevent the spread of infections, protect the environment, and comply with regulatory standards.

Key Takeaways

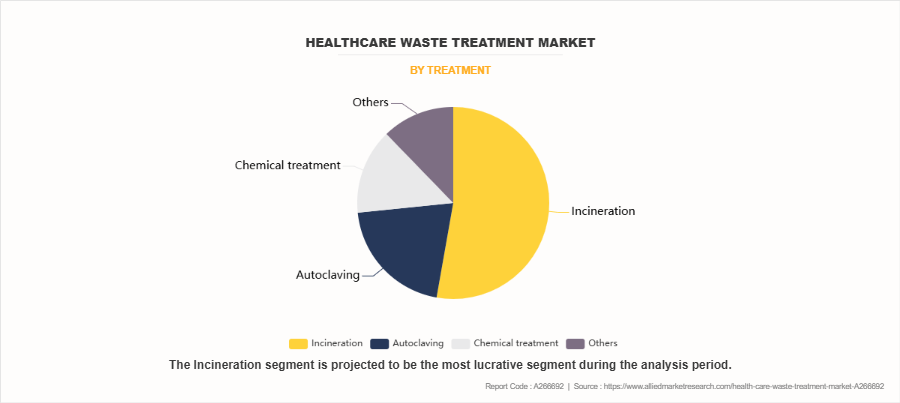

- By treatment, the incineration segment was the highest contributor to the market in 2023.

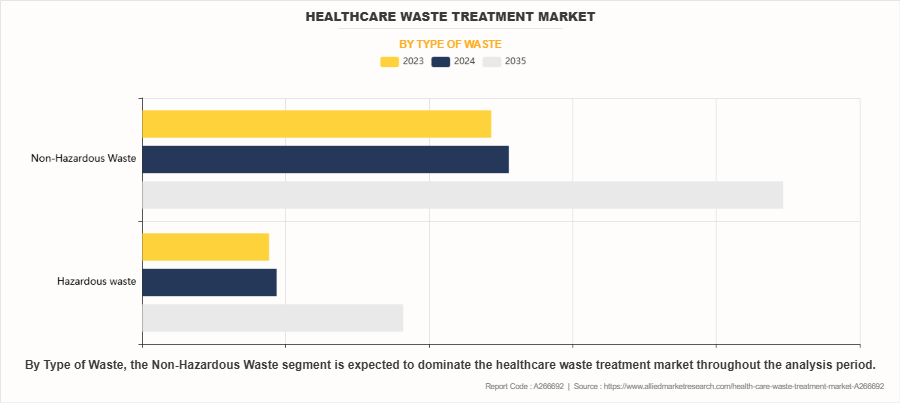

- By type of waste, the non-hazardous waste segment was the highest contributor to the market in 2023.

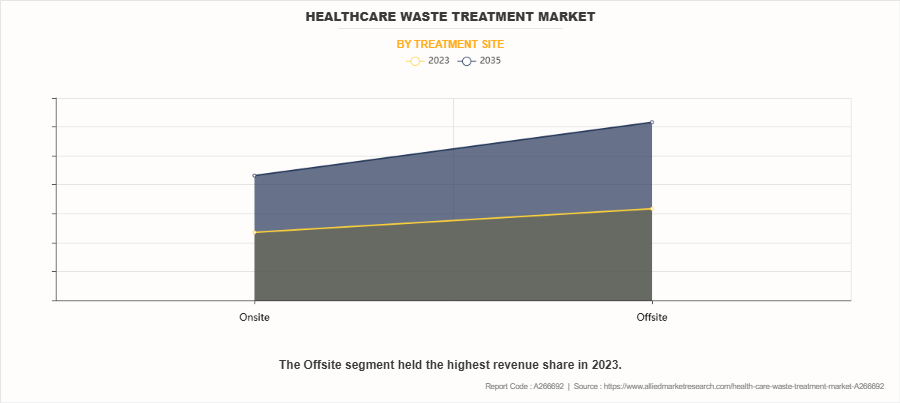

- By treatment site, the offsite segment was the highest contributor to the market in 2023.

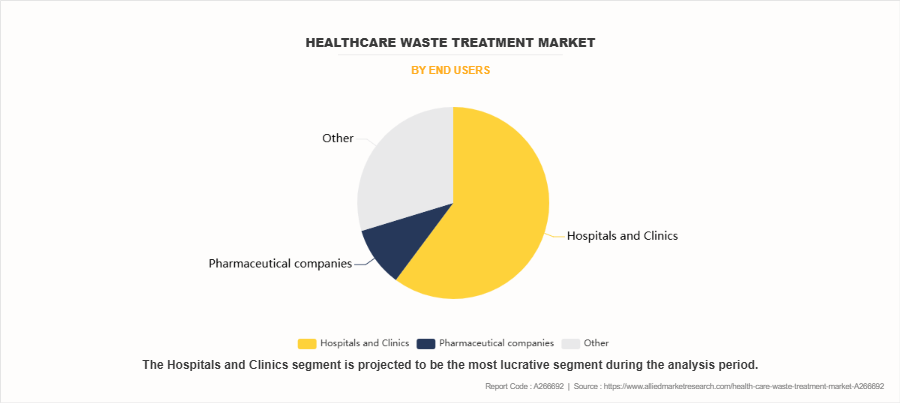

- By end user, the hospitals and clinics segment dominated the market in 2023, and is expected to continue this trend during the forecast period.

- By region, North America garnered the largest revenue share in 2023. However, Asia-Pacific is expected to grow at the fastest rate during the forecast period.

Market Dynamics

According to healthcare waste treatment market forecast analysis the growth of the healthcare waste treatment market is primarily driven by the increasing volume of healthcare waste generated due to the growing healthcare industry, especially in developing regions. The rising number of healthcare facilities, hospitals, and diagnostic centers significantly contributes to the volume of waste produced, which includes infectious, chemical, and radioactive materials. As healthcare services expand and medical procedures become more advanced, the amount of waste generated in hospitals, clinics, and other healthcare facilities increases. This includes not only general waste but also hazardous materials like infectious waste, sharps, and pharmaceutical residues, which require special handling and treatment.

According to a 2023 article by the National Library of Medicine, it was reported that healthcare waste constitutes approximately 1–2% of total produced urban waste. The rise in healthcare activities, including surgeries, diagnostics, and immunizations, has led to an escalation in the volume of both biomedical and non-biomedical waste. Additionally, the increase in hospital admissions, the number of outpatient visits, and the global expansion of healthcare infrastructure, particularly in emerging markets, further drives the generation of medical waste. Thus, growing volumes of healthcare waste is expected to drive the healthcare waste treatment market growth.

In addition, the rise in the incidence of infections due to improperly managed medical waste is a major driver for the healthcare waste treatment market. Improper disposal of medical waste, particularly infectious materials such as contaminated sharps, dressings, syringes, and body fluids, poses a significant risk to public health. These materials can contain harmful pathogens such as bacteria, viruses, and fungi, which, if not properly disposed of, can spread infections within healthcare facilities, to waste handlers, and even to the general public.

According to 2024 article by National Library of Medicine, for healthcare workers worldwide, the attributable fractions for work-related infections exposed to HBV, HCV, and HIV are 37%, 39%, and 4.4%, respectively. The increasing global focus on infection control has highlighted the dangers of inadequate medical waste management. Thus, the rise in incedence of infection due to improper disposal and treatment of medical waste is expected to drive the growth of healthcare waste treatment market growth.

Furthermore, growing awareness about the importance of medical waste management is a significant driver for the healthcare waste treatment market size. As healthcare facilities worldwide generate large volumes of waste, including hazardous and infectious materials, there is an increasing recognition of the need for proper disposal and treatment to mitigate environmental and public health risks. Awareness campaigns, regulations, and initiatives aimed at educating healthcare professionals, patients, and the general public about the dangers of improperly managed medical waste have led to higher demand for advanced waste treatment solutions.

This includes the adoption of efficient methods like incineration, autoclaving, and advanced chemical treatments that ensure safe disposal and recycling of medical waste. Additionally, regulatory frameworks imposed by government agencies, alongside growing concerns about sustainability, are pushing healthcare organizations to invest in compliant and eco-friendly waste management practices.

Segmental Overview

The healthcare waste treatment industry is segmented on the basis of treatment, type of waste, treatment site, end user, and region. On the basis of treatment, the market is divided into incineration, autoclaving, chemical treatment, and others. On the basis of type of waste, the market is divided into hazardous waste and non-hazardous waste. On the basis of treatment site, the market is segmented into onsite, and offsite. On the basis of end user, the market is segmented into hospitals and clinics, pharmaceutical companies, and others. On the basis of region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and Rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and Rest of LAMEA).

By Treatment

The incineration segment held the largest healthcare waste treatment market share in 2023 and is expected to register the highest CAGR during the forecast period. This is attributed to its effectiveness in managing hazardous and infectious waste. Incineration provides a safe and efficient way to dispose of medical waste, especially those that cannot be recycled or treated by other methods. It ensures the destruction of pathogens, toxins, and harmful chemicals, significantly reducing the risk of disease transmission. Additionally, the incineration process helps in volume reduction, turning large quantities of medical waste into ash, which is easier to manage and dispose of. The growing volume of healthcare waste, driven by increased healthcare services, medical procedures, and rising health concerns globally, has made incineration an essential waste treatment method.

By Type of Waste

The non-hazardous waste segment held the largest healthcare waste treatment market share in 2023. This is attributed to high volume of non-hazardous waste generated in healthcare facilities, such as hospitals, clinics, and nursing homes.

By Treatment Site

The offsite segment held the largest healthcare waste treatment market share in 2023. This is attributed to increasing volume of healthcare waste generated across hospitals, clinics, and other healthcare facilities has led to a rising demand for offsite treatment services, as healthcare providers prefer to outsource waste disposal to specialized third-party service providers. Additionally, offsite treatment allows for economies of scale, as waste treatment facilities are often equipped with larger, more efficient systems that can handle a higher volume of waste compared to onsite solutions.

By End User

The hospitals and clinics segment held the largest share of the healthcare waste treatment market in 2023. This was attributed to significant volume of medical waste generated in these healthcare settings. Hospitals and clinics produce a wide range of waste, including infectious materials, pharmaceuticals, and sharps, which require specialized treatment to prevent contamination and the spread of disease. The increasing number of hospitals and healthcare facilities worldwide, along with growing healthcare needs, has led to a surge in medical waste production.

By Region

North America region dominated the healthcare waste treatment market share in 2023 owing to well developed healthcare infrastructure, high volume of surgeries performed each year and high adoption of waste management services. However, according to healthcare waste treatment market opportunity analysis Asia-Pacific region is expected to register highest CAGR in the forecasted period owing to rise in awareness about proper waste management and growing number of healthcare facilities. In addition favorable government initiatives for waste management also contribute significantly in the growth of the market in Asia-Pacific region.

Competition Analysis

Major key players that operate in the global healthcare waste treatment market are EcoMed Services, Biosan Disposal, Biomedical Waste Solutions, LLC, Clean Harbors, Inc., Biotic Waste Limited, Stericycle, Inc., Remondis Medison, Veolia Environmental services, Cleanaway, and Daniels Health Inc. Key players such as Stericycle, Inc have adopted expansion as key developmental strategies to drive market growth.

Recent Developments in Healthcare Waste Treatment Industry

- In October 2024, Stericycle, Inc. unveiled its latest state-of-the-art Hospital, Medical, and Infectious Waste Incinerator (HMIWI) facility located at the Tahoe Reno Industrial Center in McCarran, Nevada.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the healthcare waste treatment market analysis from 2023 to 2035 to identify the prevailing healthcare waste treatment market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the healthcare waste treatment market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global healthcare waste treatment market trends, key players, market segments, application areas, and market growth strategies.

Healthcare Waste Treatment Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 31.4 billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2023 - 2035 |

| Report Pages | 499 |

| By Treatment |

|

| By Type of Waste |

|

| By Treatment Site |

|

| By End Users |

|

| By Region |

|

| Key Market Players | Clean Harbors, Inc., Biotic Waste Limited, Biosan Disposal, Daniels Health Inc., EcoMed Services, Stericycle, Inc., BioMedical Waste Solutions, LLC, Cleanaway Waste Management Limited, Remondis Medison GmbH, Veolia Environmental Services |

Analyst Review

Healthcare Waste treatment involves the treatment of waste generated by healthcare facilities such as hospitals, clinics, laboratories, and research centers. This waste includes a variety of materials, such as infectious waste, hazardous chemicals, pharmaceuticals, sharps, and non-hazardous general waste. Proper treatment is essential to mitigate environmental and public health risks, as untreated healthcare waste can contribute to pollution, the spread of diseases, and exposure to toxic substances. Factors driving the growth of the market are rise in volume of medical waste, technological advancements, expansion of healthcare services, and public health concerns

The total market value of Healthcare waste treatment market is $16.5 billion in 2023.

The forecast period for Healthcare waste treatment market is 2024-2033.

The base year is 2023 in Healthcare waste treatment market

The market value of Healthcare waste treatment market in 2035 is $ 31.4 billion.

Major key players that operate in the Healthcare waste treatment market are EcoMed Services, Biosan Disposal, Biomedical Waste Solutions, LLC, Clean Harbors, Inc

Loading Table Of Content...

Loading Research Methodology...