Health Insurance Market Research, 2032

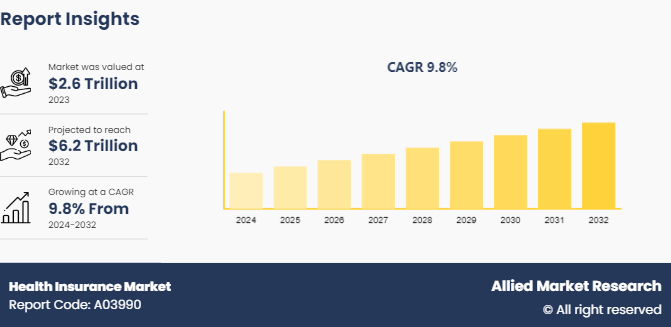

The global health insurance market was valued at $2.6 trillion in 2023, and is projected to reach $6.2 trillion by 2032, growing at a CAGR of 9.8% from 2024 to 2032.

The health insurance market is experiencing significant growth due to increasing healthcare costs and heightened awareness of health and wellness. This expansion is further driven by government initiatives to enhance healthcare accessibility and the rising demand for comprehensive coverage plans.

Market Introduction and Definition

Health insurance is an agreement that is made between a person and an insurance company. In return for regular premium payments, the insurer offers to pay for a percentage of the insured's medical costs. Preventive care, prescription drugs, hospital stays, surgeries, and doctor visits are all covered by this insurance. Insurance for health can be obtained through employer-sponsored plans, government programs, or private businesses. It seeks to shield people from excessive, unforeseen healthcare expenses and guarantee that they can obtain essential medical care without suffering severe financial hardship.

Key Findings

The health insurance market size study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2032.

Several product literatures, industry releases, annual reports, and other such documents of major health insurance industry participants along with authentic industry journals, associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global health insurance market forecast and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

Numerous factors influence the need for health insurance. One of the primary causes is rise in expense of healthcare, and health insurance market, which necessitates purchasing an insurance coverage to cover potential costs for hospital stays, medical treatments, and prescription medication costs. Adequate income levels can enable families and people to subscribe to better insurance packages, even though income levels are a direct correlation with obtaining health insurance market share and financial position is a determinant. As mandates and subsidies are increased, certain policies and laws may be beneficial in promoting broader coverage. Changes in the population, such as an aging population, result in a greater need for health services, which may in turn fuel the demand for insurance.

Parent Market Analysis

The global health insurance market is a mature and fast-growing sector with considerable significance for global business security. It can be divided into categories such as life insurance, medical insurance, and other insurance. According to Allied Market Research, the life insurance segment dominates the market share with a share around 45%. The factors influencing the growth of this segment are propelled by the financial security and long-term savings offered by the policies. Health insurance comprises nearly 25%; the increased costs of healthcare and the issue of insurance coverage have been primary drivers. General insurance, which includes property, casualty, and liability insurance occupies 30%. It covers a variety of risks that are of concern to both the business and the individual including natural catastrophes and technology-related risks. This general insurance segment represents the diversity of the insurance industry and shows how the firm meets the different demands for and offers crucial services for growth in global economies and personal development. The relative dominance of these segments changes with the changing global milieu; trends in the population structure, regulations governing industry and the state of the economy all having a bearing on the operations of the different segments.

Market Segmentation

The global health insurance market is segmented into type, coverage, end user, age group, distribution channel, and region. By type, the market is bifurcated into diseases insurance and medical insurance. The medical insurance segmented accounted for a higher share in 2023. By coverage, the health insurance market is segmented into preferred provider organizations (PPOS) , point of service (POS) , health maintenance organization (HMOS) , and exclusive provider organizations (EPOS) . The PPOS segmented for the largest share in the market in 2923. By end user, the market is classified into groups and individuals. The group healthcare insurance segmented accounted for a larger share in the market in 2023. By age group, the market is categorized into senior citizens, adults, and minors. The adult segment accounted for the largest share in 2023. By distribution channel, the market is classified into direct sales, brokers/agents, banks, and others. The broker/agent segment accounted for the largest share in the global healthcare insurance market in 2023. Based on region, the market is segmented into North America, Europe, Asia-Pacific, and LAMEA. North America accounted for the highest share in 2023.

Regional/Country Health Insurance Market Outlook

The North America health insurance market growth accounted for the largest share in the global market in 2023. Some of the key factors driving the expansion of the health insurance market in the region includes rise in overall health expenditure, which includes both private and public spending on the programs and increase in demand for health insurance among those with employer-sponsored health coverage as well as individual health insurance portfolio. Furthermore, the majority of people in the U.S. and Canada have health insurance policies since they provide a host of advantages, including paying for pre-hospitalization costs, covering medical expenses, and protection against serious illnesses. For example, 92% of Americans have health insurance to safeguard against financial loss from medical disease, according to a 2019 survey by the American Community Survey and the Current Population Survey Annual Social & Economic Supplement. This is seen to be a major factor supporting the growth of the health insurance industry in North America.

Also, due to the high rate of private insurance acceptance, rise in the number of people with chronic illnesses, and increase in disposable money, this demand for health insurance in the region. The top three health insurance providers and health insurance specialist in the U.S. are UnitedHealth, Kaiser Foundation, and Anthem, Inc. Through their affiliates and subsidiaries, they provide a broad range of health insurance market products and related services, which is offering lucrative health insurance market opportunity across North America.

Industry Trends

In April 2024, Insurance Regulatory and Development Authority of India (RDAI) announced new regulations focusing on increased coverage for AYUSH treatments, which includes ayurveda, yoga and naturopathy, unani, siddha, and homeopathy. As per the new regulations announced by RDAI, it is now mandatory for insurers to provide Board-approved plans that treat AYUSH procedures similarly to other medical treatments.

The global health insurance insurance market report 2023 published by Alliance group, indicates increase of 4.9% average in insurance premiums across the globe including health, life, and property & casualty insurance. Also, according to the same report, the health insurance market outlook recorded a growth of 4.9% alone in 2022.

Competitive Landscape

The major players operating in the health insurance market include UnitedHealth Group, Aviva, Cigna, Allianz, and Aetna Inc. Other players in the health insurance market include AIA Group Limited, Ping An Insurance (Group) Company of China, Ltd, Assicurazioni Generali S.P.A, AXA, ZURICH, and others.

Report Coverage & Deliverables

The health insurance market report provides a comprehensive analysis of key market dynamics, including the trends, growth factors, and challenges shaping the industry. It covers various insurance types, target demographics, and geographical regions, offering in-depth insights into the competitive landscape and market opportunities. The report includes detailed data on health insurance coverage, policy types, and service providers, as well as market projections and growth forecasts.

Insurance Type Insights

The health insurance market includes various types of insurance coverage:

Private Health Insurance: This covers a range of services offered by private insurers, focusing on individual or employer-sponsored plans.

Public Health Insurance: Government-sponsored plans like Medicare and Medicaid, which cater to specific populations, such as the elderly and low-income individuals.

Supplementary Insurance: Additional plans that cover gaps in standard health insurance, such as dental, vision, or long-term care. Each type is growing as governments emphasize universal coverage and private players expand customized plans.

Coverage Insights

Health insurance coverage varies based on policy types and geographical regions. The health insurance market share is driven by comprehensive plans offering a broad range of services, including hospitalization, outpatient services, and specialized treatments. Growth in policy coverage is attributed to increased awareness about preventive healthcare, rising medical costs, and government mandates for broader coverage. The share of public insurance programs has also increased, particularly in regions focusing on healthcare accessibility and affordability.

End User Insights

Health insurance end users include:

Individuals: Rising healthcare awareness, lifestyle diseases, and government incentives drive individual health insurance purchases.

Corporates/Businesses: Employers increasingly offer health insurance as part of employee benefits packages, with comprehensive plans being a key attraction for talent retention. The end-user growth is also fueled by factors such as the aging population, increasing chronic illness rates, and the global pandemic's effects, which highlighted the importance of healthcare accessibility increase health insurance growth.

Regional Insights

North America holds the largest market share, driven by advanced healthcare infrastructure, high insurance penetration, and government programs like Medicare.

Asia-Pacific is experiencing the fastest growth, thanks to rising disposable income, increased health awareness, and government initiatives aimed at expanding healthcare access.

Key Companies & Market Share Insights

Major players in the health insurance market include: UnitedHealth Group, Aviva, Cigna, Allianz, and Aetna Inc. Other players in the health insurance market include AIA Group Limited, Ping An Insurance (Group) Company of China, Ltd, Assicurazioni Generali S.P.A, AXA, ZURICH, and others

Recent Key Strategies and Developments

In April 2024, AIA announced the launch of new health plans in the Great Bay region. The new plans launched by the company are expected to cover compensation, home visits, and outpatient coverage.

In November 2020, Aetna Inc. entered a strategic partnership with McLaren Physician Partners, which is a physician organization. The partnership extended coverage in Michigan and provided access to in-network care for around 40, 000 individual and group Medicare Advantage plan members.

Key Sources Referred

The Health Insurance Association of America (HIAA)

The National Association of Health Underwriters (NAHU)

The Patient Advocate Foundation

General Insurance Council (GIC)

Insurance Brokers Association of India (IBAI)

Association of Healthcare Providers (India) (AHPI)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the health insurance market analysis from 2024 to 2032 to identify the prevailing health insurance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the health insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global health insurance market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the health insurance market players.

- The report includes the analysis of the regional as well as global health insurance market trends, key players, market segments, application areas, and market growth strategies.

Health Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 6.2 Trillion |

| Growth Rate | CAGR of 9.8% |

| Forecast period | 2024 - 2032 |

| Report Pages | 250 |

| By Insurance Type |

|

| By Coverage |

|

| By End User |

|

| By Age Group |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Aviva Inc., Ping An Insurance (Group) Company Of China, Ltd, Aetna Inc, UnitedHealth Group, Cigna Corp., Allianz, AIA Group Limited, The Zurich Insurance Group Ltd, Assicurazioni Generali S.P.A, AXA |

Technological integration and the digital transformation across the health insurance industry is the major notable trend in the market.

The Preferred Provider Organizations (PPOS) is the leading coverage type in the health insurance market in 2023.

North America is the largest regional market in the health insurance market as of 2023.

The health insurance market is expected to reach US$ 6.2 trillion by 2032.

The top players covered in the market include Unitedhealth Group, Aviva, Cigna, Allianz, Aetna Inc, AIA Group Limited, Ping An Insurance (Group) Company Of China, Ltd, Assicurazioni Generali S.P.A, AXA, and ZURICH.

Loading Table Of Content...