Healthcare Assistive Robot Market Research, 2031

The global healthcare assistive robot market size was valued at $8.3 billion in 2021, and is projected to reach $38.4 billion by 2031, growing at a CAGR of 16.5% from 2022 to 2031. Healthcare assistive robots are the robots used in operating rooms and other clinical settings to support healthcare professionals and improve patient care. Furthermore, healthcare assistive robotics offer value in a variety of areas due to their faster processes and risk reduction.

These robots can clean and prepare patient rooms independently, reducing person-to-person interaction in infectious disease wards. Healthcare assistive robots with AI-enabled medicine identifier software reduced the time to identify, match, and give out medicine to patients in hospitals. Moreover, these robots will become more autonomous as technology evolves, eventually carrying out specific tasks fully on their own. As a result, physicians, nurses, and other healthcare professionals will have more time to spend in directly patient care.

Historical overview

The market was analyzed qualitatively and quantitatively from 2018 to 2020. The healthcare assistive robot market grew at a CAGR of around 14-15% during 2018-2021. Most of the growth during this period was derived from Asia-Pacific, owing to improving health awareness, rising disposable incomes as well as the well-established presence of domestic companies in the region.

Market dynamics

Factors that drive the growth of the healthcare assistive robot market size include increase in geriatric population, rise in sports-related injuries and increase in adoption of assistive robots in rehabilitation therapies. Moreover, the increase in the number of product launches by different key players further propels market growth. For instance, in 2019, Barrett Technology, LLC announced the launch of Burt which is a significant achievement in promoting upper-limb recovery from neurological injuries such as stroke, traumatic brain injury (TBI), spinal cord injury (SBI), Parkinson's, and others.

Furthermore, the presence of a plethora of products in the pipeline and high market potential in untapped emerging economies are anticipated to serve as attractive opportunities for market growth during the forecast period. Moreover, growth in medical tourism in developing economies and rapid implementation of technology in healthcare industry significantly propels the growth of the market. Furthermore, the increase in initiatives taken by various organizations to bridge the gap between academic research and product development in the field of biomedical technology, robotics and advanced manufacturing further accelerate healthcare assistive robot market growth.

COVID-19 Impact Analysis

COVID-19 pandemic outbreak has had a positive impact on the growth of the healthcare assistive robot industry owing to non-contact patient surgeries and treatments. Moreover, several foreign governments, like those of the U.S., China, Korea, and Japan, completely focus on development of healthcare robotics for use in the medical and surgical fields due to priority and necessity in this vital time.

Furthermore, the novel coronavirus has increased interest in robot, drones, and artificial intelligence. These technologies can help deal with massive staffing shortage in healthcare, manufacturing and supply chain, the need for social distancing and diagnosis and treatment. For example, service robotics play a vital role in healthcare, they minimize human intervention at all levels, starting from patient examination to patient care and drug delivery mechanism. The virus has been a great opportunity for companies to display robots for public applications. For instance, socially assistive robots (SARs) have been used to help mitigate the effects of the pandemic including loneliness and isolation, and to alleviate the workload of both formal and informal caregivers. Thus, these factors are anticipated to bring stabilization and drive the growth of the market during the forecast period

Segmental Overview

The healthcare assistive robot market is segmented into product, portability, end user and region. By type, the market is categorized into surgical assistive robot, and care robot. On the basis of portability, the market is segregated into fixed base and mobile. On the basis of end user, the market is divided into hospitals and clinics, rehabilitation centers and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

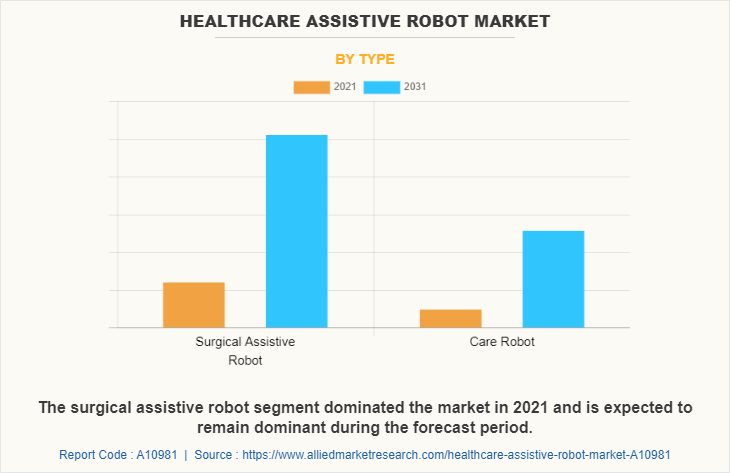

By Type: based on type, the market is segmented into surgical assistive robot, and care robot. The surgical assistive robots segment dominated the global healthcare assistive robot market share in 2021, and is expected to remain dominant throughout the forecast period, owing to the introduction of highly advanced robotic medical equipment and the increase in per-capita healthcare spending along with ongoing technological developments, including robotic catheter control systems (CCS), data recorders, data analytics, remote navigation, motion sensors, 3D-imaging, and HD surgical microscopic cameras drive the market growth.

Furthermore, surgical assistive robots help to reduce the workload of medical staff, allowing them to spend more time directly caring for patients, while also developing important operational procedure that offers effectiveness and low-cost investments in healthcare amenities, which further propel the growth of surgical assistive robot market.

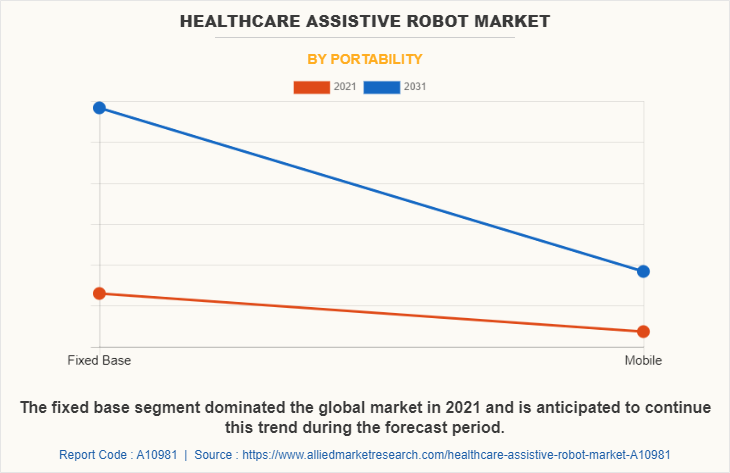

By portability: healthcare assistive robot market is segregated into fixed base and mobile. The fixed base segment dominated the global market in 2021 and is anticipated to continue this trend during the forecast period, owing to increase in use of these robots in the healthcare industry because of their expressive motions, dependable productivity, consistent precision, efficacy in challenging environments, and ability to withstand collisions and stress. In addition, increase in key market players participation for the production of these robots and the expanding use of fixed-based robots in medical setting further boost growth of the market.

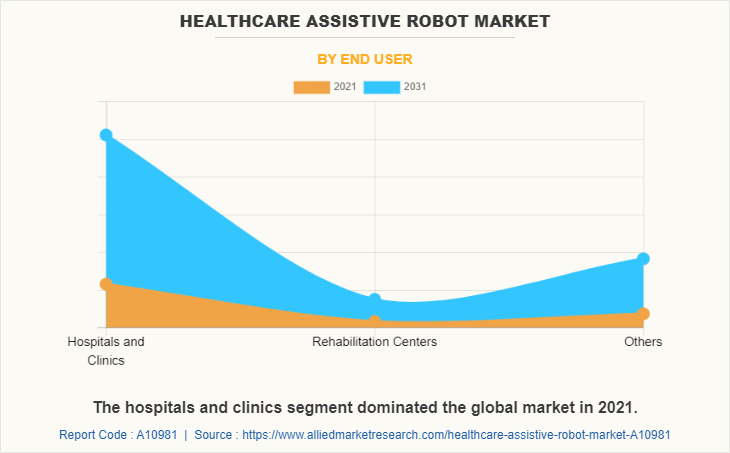

By End User: Healthcare assistive robot market is segregated into hospitals and clinics, rehabilitation centers, and others. The hospitals and clinics segment dominated the global market in 2021 and is anticipated to continue this trend during the forecast period. This is attributed to growing government initiatives to build senior care facilities around the world and rising consumer demand for better senior healthcare facilities in hospitals also contribute to the growth of the market during the forecast period.

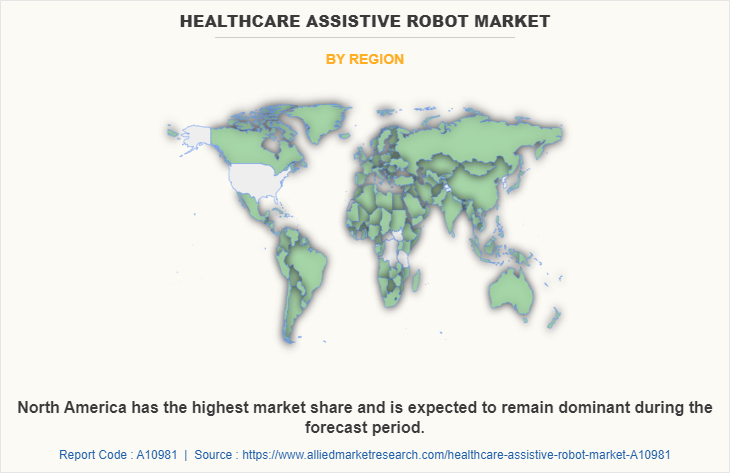

By Region: The healthcare assistive robot market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major healthcare assistive robot market share in 2021 and is expected to maintain its dominance during the forecast period. The rising incidence of bone injuries, increase in investment in healthcare, and growing awareness among the people regarding innovative and advanced use of robotics are the key reasons for the growth of the market.

On the other hand, Asia-Pacific is expected to grow at the highest rate during the healthcare assistive robot market forecast period. The market growth in this region is attributable to the presence of the medical devices industry in the region as well as growth in the purchasing power of populated countries, such as China and India. Moreover, the rise in R&D activities regarding the development of new healthcare assistive products drives the growth of the market.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major players in the healthcare assistive robot, such as Barrett Technology, LLC, Bionik Laboratories, Cyberdyne, Inc., Ekso Bionics Holdings, Inc., Focal Meditech, GaitTronics Inc., Hocoma AG, HONDA Motor Co. Ltd., KUKA AG and ReWalk Robotics Ltd. Intuitive Surgical, Inc. and Medtronic PLC. Major players have adopted product launch, product approval and acquisition as key developmental strategies to improve the product portfolio of the healthcare assistive robot market.

Some examples of product launches in the market

In 2019, Barrett Technology, LLC announced launch of Burt which is a significant achievement in promoting upper-limb recovery from neurological injuries such as stroke, traumatic brain injury (TBI), spinal cord injury (SBI), Parkinson's, and others.

In January 2019, Bionik Inc., a global pioneering healthcare company, headquartered in Canada, announced the launch of its new generation InMotion ARM/HAND robotic system. The system will aid in the clinical rehabilitation of stroke survivors and will also be provided to those who are suffering from mobility impairments due to neurological conditions.

Some examples of corporation in the market

In December 2022, Hocoma and the cybersecurity company Alias Robotics announced a cooperation to improve cybersecurity of medical exoskeletons.

Some examples of acquisition in the market

In December 2022, Ekso Bionics announced acquisition of Human Motion and Control Business unit including Indego product line from Parker Hannifin Corporation.

Some examples of product Approval in the market

In January 2019, Honda announced that it has received Premarket Notification from the U.S. Food and Drug Administration (FDA) for its Walking Assist Device, an externally worn device developed to support people with reduced walking abilities.

In June 2019, ReWalk Robotics, Inc., a developer of wearable robotic exoskeletons, based in the U.S., announced that the Food and Drug Administration (FDA) approved ReStore soft exo-suit system for sale to the rehabilitation centers in the U.S. The system will be used to treat the stroke survivors with mobility challenges.

In October 2022, Medtronic plc, a global healthcare technology leader, announced three significant global market-entrance and indication expansion approvals for its Hugo robotic-assisted surgery (RAS) system.

Some examples of investment in the market

In August 2022, Intuitive Surgical Inc, the U.S.-based robotic surgical system manufacturer, was investing over 700 million yuan ($103.7 million) to build a manufacturing and innovation base in Shanghai to expand access to robotic assisted surgery to more patients in China.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the healthcare assistive robot market analysis from 2021 to 2031 to identify the prevailing healthcare assistive robot market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the healthcare assistive robot market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global healthcare assistive robot market trends, key players, market segments, application areas, and market growth strategies.

Healthcare Assistive Robot Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 38.4 billion |

| Growth Rate | CAGR of 16.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 236 |

| By Type |

|

| By Portability |

|

| By End User |

|

| By Region |

|

| Key Market Players | Bionik Laboratories, Cyberdyne, Inc., Barrett Technology, LLC, Focal Meditech, HONDA Motor Co. Ltd., Intuitive Surgical, Inc., KUKA AG, ReWalk Robotics Ltd., Ekso Bionics Holdings, Inc., GaitTronics Inc., Medtronic plc, hocoma ag |

| Other Players | SoftBank Robotics Corp. |

Analyst Review

Healthcare assistive robots is gaining high traction in the market, owing to increase in prevalence of spinal cord injury, rise in R&D investments in drug discovery & development, and increase in awareness regarding use of robotics.

Furthermore, key players in the market are focusing on adopting strategies to increase accessibility and utilization of healthcare-assistive robot products in developing economies. Moreover, the market gains interest of healthcare companies, owing to its unmet demands in developing economies such as India and China where the population is growing rapidly, which further propel the market growth.

North America is expected to witness the highest growth, in terms of revenue, owing to robust healthcare infrastructure, presence of key players, and rise in healthcare expenditure. However, Asia-Pacific is anticipated to witness notable growth, owing to rise in geriatric population, unmet medical demands and increase in public–private investments in the healthcare sector.

The total market value of healthcare assistive robot marketis $8316.23 million in 2021.

The market value of healthcare assistive robot market in 2031 is $38367.65 million.

The forcast period for healthcare assistive robot is 2022 to 2031

The base year is 2021 in healthcare assistive robot market

Top companies such as Barrett Technology, LLC, Bionik Laboratories, Cyberdyne, Inc., Ekso Bionics Holdings, Inc., Intuitive Surgical, Inc., and Medtronic plc. held a high market position in 2021.

surgical assistive robot segment is the most influencing segment owing to increase in prevalence of neurological, gynecological, and urological diseases, which also increases adoption of surgical assistive robots for surgical purpose

increase in prevalence of spinal cord injury and musculoskeletal disorders,technological advancements, such as the incorporation of artificial intelligence (AI) and machine learning (ML) along with advanced sensors.

Healthcare assistive robots are devices that can sense, analyze sensory data, and carry out activities that help older people and individuals with disabilities to go about their daily lives.

Loading Table Of Content...