Healthcare Finance Solutions Market Research, 2032

The global healthcare finance solutions market was valued at $115.9 billion in 2022, and is projected to reach $276 billion by 2032, growing at a CAGR of 9.3% from 2023 to 2032.

Healthcare finance solutions are tools and strategies used by healthcare organizations, such as hospitals and clinics, to manage their financial processes effectively. These solutions help streamline billing and payment procedures, ensuring that patients and insurance companies are accurately billed for services. They also assist in navigating complex insurance reimbursement models, ensuring fair and timely payments.

Moreover, healthcare finance solutions offer financial analysis and reporting, providing insights into the organization's financial performance. Some solutions even incorporate advanced technologies, such as Artificial Intelligence, to make data-driven financial decisions. Thus, these solutions enable healthcare providers to maintain financial stability, optimize revenue cycles, and deliver quality care to patients while meeting regulatory requirements.

The healthcare finance solutions market trends are driven by continuous technological advancements that streamline financial processes, enhance data accuracy, and improve cost efficiency for healthcare providers and payers. These innovations enable better financial management, leading to increased adoption of these solutions. Moreover, the aging population's increasing demands create a need for managing the complex financial aspects of providing care to elderly patients, ensuring efficient reimbursement processes and cost containment. Regulatory changes in the healthcare industry encourage the adoption of finance solutions to meet compliance requirements, manage billing complexities, and accurately handle healthcare claims.

However, data security and privacy concerns pose significant challenges, as healthcare organizations must ensure the protection of sensitive patient data. These concerns can limit the widespread adoption of finance solutions if not adequately addressed. In addition, the complexity of reimbursement models in healthcare, including value-based care and bundled payments, creates challenges for adopting finance solutions. Healthcare providers must navigate various payment models, which may require customized finance solutions to ensure accurate and efficient reimbursement processes. On the contrary, the integration of Artificial Intelligence (AI) presents a significant opportunity for the healthcare finance solutions market. AI-powered analytics and automation can enhance financial decision-making, optimize revenue cycles, and detect fraudulent activities, improving overall financial performance for healthcare providers and payers. By leveraging AI capabilities, healthcare organizations can achieve higher levels of efficiency, accuracy, and financial success.

The report focuses on growth prospects, restraints, and trends of the healthcare finance solution market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the healthcare finance solutions market size.

Segment Review

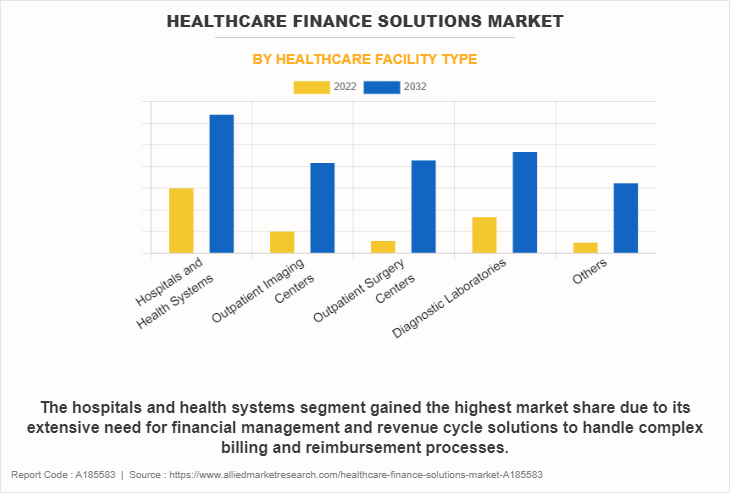

The healthcare finance solutions market analysis is segmented on the basis of equipment type, healthcare facility type, services and region. On the basis of equipment type, the market is bifurcated into imaging equipment, specialist beds, surgical instruments, decontamination equipment, and IT equipment. Based on healthcare facility type, the market is segmented into hospitals and health systems, outpatient imaging centers, outpatient surgery centers, diagnostic laboratories, and others. By services, it is bifurcated into equipment and technology finance, working capital finance, project finance solution, and corporate lending. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By healthcare facility type, the hospitals and health systems segment held the highest healthcare finance solutions market share. This was attributed to the fact that hospitals are major healthcare providers with extensive patient volumes, requiring robust financial management to handle billing, insurance reimbursements, and compliance with complex regulatory requirements. The need to manage a diverse range of financial processes makes healthcare finance solutions indispensable for hospitals and health systems, leading to their dominant market position. On the other hand, the outpatient surgery centers is forecasted to be the fastest-growing segment. This is attributed to the rising popularity of outpatient procedures, driven by cost-effectiveness and advancements in medical technology, has significantly increased the demand for finance solutions in these centers. As more patients opt for outpatient procedures, the need for streamlined financial management to handle billing, reimbursements, and revenue cycles in these centers is projected to grow rapidly during the forecast period, propelling the segment's accelerated expansion.

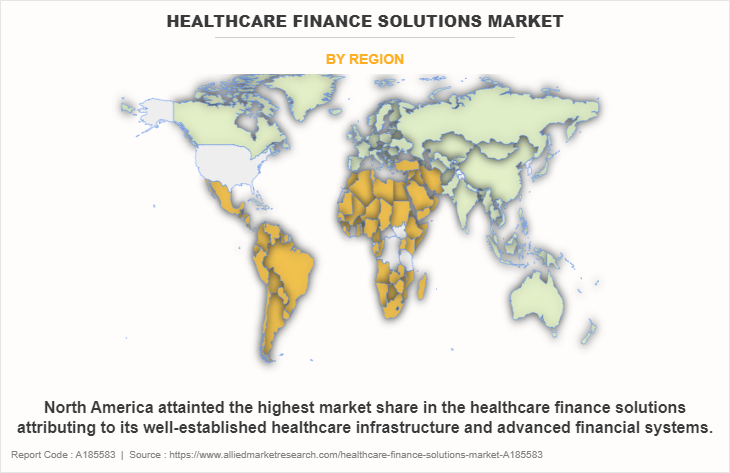

By region, North America attained the highest market share in the healthcare finance solution market. This is due to the region's well-established healthcare infrastructure, including a strong focus on technological advancements and financial management practices. The presence of mature healthcare providers, insurance companies, and robust regulatory frameworks in North America drives the adoption of finance solutions to efficiently handle complex financial processes. On the other hand, Asia-Pacific is expected to be the fastest-growing segment in the healthcare finance solution market. This is due to its rapid economic growth and increasing investments in the healthcare sector.

Moreover, as countries in the region experience rising healthcare demands and expanding access to quality medical services, there is a rising need for efficient financial management to support this growth. Furthermore, the increasing number of healthcare providers and insurers in the region are expected to drive the adoption of healthcare finance solutions market demand.

The report analyzes the profiles of key players operating in the healthcare finance solution market such as B.C. Ziegler and Company, Commerce Bancshares, Inc., eCapital, Inc., First-Citizens Bank & Trust Company, FORVIS, LLP, GE HealthCare, Johnson & Johnson Medical Ltd, Koninklijke Philips N.V., Siemens Healthcare Private Limited, and Siena Healthcare Finance. These players have adopted various strategies to increase their market penetration and strengthen their position in the healthcare finance solutions industry.

Market Landscape and Trends

The major market landscape in the healthcare finance solution market includes the dominance of North America due to its well-established healthcare infrastructure and a focus on advanced financial management practices. In addition, the Asia-Pacific region is emerging as the fastest-growing segment, driven by rapid economic growth, increasing investments in healthcare, and a growing demand for efficient financial management solutions to support the expanding healthcare sector. In terms of trends, there is a significant adoption of technology, such as Artificial Intelligence (AI) and automation, to improve financial decision-making, optimize revenue cycles, and enhance overall financial performance for healthcare providers and payers. Moreover, there is a rising emphasis on data security and privacy measures to address concerns related to safeguarding sensitive patient information. Healthcare finance solutions continue to evolve to meet the ever-changing regulatory landscape and complexities of reimbursement models, ensuring healthcare organizations can effectively manage their finances while delivering quality care to patients.

Top Impacting Factors

Technological Advancements

Technology advancement has become a driving force in the growth of the healthcare finance solutions market. With continuous innovation and digital transformation, technology is revolutionizing the way financial processes are managed in the healthcare industry. The surge in integration of advanced analytics and data-driven decision-making tools has enabled healthcare providers to optimize revenue cycles and reduce financial inefficiencies. Real-time data analysis helps in identifying billing errors, streamlining claims processing, and enhancing revenue collection, thus improving overall financial performance. In addition, the emergence of telehealth and remote monitoring solutions has expanded access to healthcare services, leading to increased patient volume and revenue streams. These technologies allow healthcare providers to extend their reach beyond traditional brick-and-mortar facilities, opening up new revenue opportunities during the forecast period.

Furthermore, the adoption of electronic health records (EHRs) and blockchain technology has enhanced data security and interoperability, enabling seamless information exchange between stakeholders. This helps improve operational efficiency, prevent fraud, and reduce compliance risks, ultimately contributing to financial stability. Moreover, the proliferation of mobile payment solutions and patient financial portals has improved billing transparency and patient engagement. Patients easily access and manage their financial information, leading to better collections and reduced bad debts for healthcare providers. As technology continues to evolve, its impact on healthcare finance is expected to be even more profound. Such factors are expected to create a more efficient and sustainable healthcare ecosystem and eventually strengthen market growth opportunities.

Aging Population

As societies around the world experience a demographic shift toward higher proportions of elderly individuals, the demand for healthcare services and related financing options has surged which creates a demand for healthcare finance solutions. With an aging population, there is an increased prevalence of chronic diseases and age-related conditions, leading to greater healthcare utilization and costs. This puts a significant strain on healthcare systems and requires innovative financial solutions to ensure sustainability and accessibility of care.

Furthermore, healthcare finance solutions encompass various strategies and technologies that aim to optimize payment models, enhance cost-effectiveness, and improve financial management in the healthcare sector. These solutions include value-based payment arrangements, health savings accounts, insurance products tailored for older adults, and telemedicine platforms. Moreover, as older individuals typically rely on retirement savings and pensions, financial products catering to their unique needs become essential. This opens up opportunities for insurance companies, investment firms, and financial technology providers to develop specialized offerings for the aging population. As a result, the market for healthcare finance solutions is expected to continue expanding in response to the evolving healthcare landscape.

Regulatory Changes

Regulatory changes play a pivotal role and are often aimed at addressing challenges within the healthcare industry, such as rising costs, inefficient payment systems, and patient access to care. As governments and regulatory bodies implement reforms, various opportunities and challenges emerge, shaping the financial landscape of healthcare that is expected to aid healthcare finance solution market growth. The growing emphasis on value-based care models is also acting as the driving factor for the market. Regulatory shifts toward rewarding healthcare providers based on patient outcomes rather than the volume of services rendered encourage the adoption of innovative financial solutions. This drives the demand for healthcare finance tools that enable providers to measure, track, and optimize patient outcomes while managing costs effectively.

In addition, regulations related to reimbursement policies and payment methods drive the market's growth. Reforms in insurance policies, such as the expansion of Medicaid or Medicare, increase the number of insured patients and boost demand for financial solutions that streamline billing and claims processes. In conclusion, regulatory changes in the healthcare sector significantly impact the finance solutions market by promoting value-based care, influencing reimbursement policies, and driving the need for secure and compliant financial tools. Providers and organizations that embrace these changes and adapt their financial strategies are better positioned to thrive in the evolving healthcare landscape.

Data Security and Privacy Concerns

Data security and privacy concerns have emerged as significant restraints on the growth of the healthcare finance solutions market. With the increasing adoption of digital technologies and electronic health records, vast amounts of sensitive patient data are generated, stored, and transmitted across various healthcare systems and platforms. The potential risk of data breaches and cyberattacks raises concerns among patients, healthcare providers, and financial institutions involved in the healthcare finance ecosystem. A single breach lead to unauthorized access to personal and financial information, resulting in identity theft and financial fraud, causing significant reputational damage to healthcare organizations.

Furthermore, compliance with data protection regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. or the General Data Protection Regulation (GDPR) in Europe, adds complexity and cost to implementing healthcare finance solutions. Non-compliance lead to severe penalties, further deterring market growth.

Moreover, the lack of standardization in data security practices across healthcare systems poses interoperability challenges. This hinder seamless data exchange between different entities, limiting the efficiency and effectiveness of financial processes. In response to these concerns, collaborations with cybersecurity experts and regulatory bodies are vital to stay ahead of evolving threats and ensure compliance.

Complex Reimbursement Models

The healthcare finance solutions market growth is being restrained by complex reimbursement models due to several reasons. These reimbursement models, often imposed by government policies and insurance companies, create a web of intricate procedures and requirements for healthcare providers to receive payment for their services. The complexity of these models leads to an increased administrative burden on healthcare facilities. The need to navigate through a labyrinth of billing codes, documentation, and compliance guidelines results in additional overhead costs and slows down the payment process. As a result, healthcare providers experience delayed or reduced reimbursements, impacting their financial stability.

In addition, the unpredictability of reimbursement rates and changing regulations create uncertainty for healthcare organizations. Adapting to constant changes in reimbursement policies is challenging, requiring them to invest in expensive resources, such as updated billing systems and staff training. Moreover, the complexity of reimbursement models hinders the adoption of innovative healthcare finance solutions. Startups and smaller companies struggle to enter the market, as the high entry barrier and compliance costs discourage potential investors and entrepreneurs. Such complexity of reimbursement models in the healthcare finance solutions market holds back growth and innovation, hampers efficiency, and poses financial challenges for providers.

Artificial Intelligence (AI) Integration

AI integration is revolutionizing the healthcare finance solutions market, presenting significant opportunities for growth. By leveraging AI technologies, healthcare providers streamline financial processes, enhance efficiency, and improve patient care. AI-powered algorithms analyze vast amounts of patient data, accurately predicting patient payment behaviors and optimizing billing processes. This results in reduced claim denials, quicker reimbursements, and improved cash flow for healthcare institutions.

In addition, advanced algorithms help to monitor transactions in real time, flagging suspicious activities and potentially fraudulent claims. This protects healthcare organizations from financial losses and ensures compliance with regulations and safeguards patient data. Moreover, AI enables personalized financial assistance for patients. Machine learning models assess individual financial situations and recommend suitable payment plans or financial aid options. This fosters better patient satisfaction and increases the likelihood of timely payments. In conclusion, the integration of AI in healthcare finance solutions presents a transformative opportunity for industry. Through enhanced efficiency, fraud detection, personalized assistance, and data-driven decision-making, healthcare providers achieve improved financial stability, better patient experiences, and sustained market growth.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the healthcare finance solutions market forecast from 2022 to 2032 to identify the prevailing healthcare finance solutions market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the healthcare finance solutions market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global healthcare finance solution market trends, key players, market segments, application areas, and market growth strategies.

Healthcare Finance Solutions Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 276 billion |

| Growth Rate | CAGR of 9.3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 427 |

| By Equipment Type |

|

| By Healthcare Facility Type |

|

| By Services |

|

| By Region |

|

| Key Market Players | FORVIS, LLP, Koninklijke Philips N.V., Johnson & Johnson Medical Ltd, First-Citizens Bank & Trust Company, Siena Healthcare Finance, GE Healthcare, Commerce Bancshares, Inc., Siemens Healthcare Private Limited, B.C. Ziegler and Company, eCapital, Inc. |

Analyst Review

The healthcare finance solutions market has experienced steady growth. It has become increasingly essential for healthcare organizations to manage their financial processes efficiently. The market has adapted to the challenges posed by the COVID-19 pandemic and has witnessed a rise in demand as healthcare providers continue to prioritize cost optimization and revenue management. Looking into the future, the healthcare finance solutions market is expected to further expand as healthcare systems worldwide continue to face financial pressures and seek ways to enhance their financial sustainability. The integration of advanced technologies, such as AI and data analytics, into these solutions is anticipated to drive innovation and efficiency, meeting the evolving needs of the healthcare industry. As a result, the market is likely to witness sustained growth, offering vital financial support for healthcare organizations in their quest to deliver high-quality patient care.

Furthermore, market players have adopted various strategies for enhancing their services in the market and improving customer satisfaction. For instance, Proparco is contributing to finance the health sector in South and Southeast Asia via a $35 million equity investment in Quadria Capital. Proparco is supporting a player with recognized expertise in the healthcare sector, which is projected to develop quality, affordable healthcare in the Indo-Pacific region. This new partnership between Proparco and Quadria was signed under the auspices of Chrysoula Zacharopoulou, French Minister of State for Development, the Francophonie and International Partnerships. Therefore, these strategies by the market players operating at a global and regional level are expected to help the market to grow significantly during the forecast period.

Some of the key players profiled in the report include B.C. Ziegler and Company, Commerce Bancshares, Inc., eCapital, Inc., First-Citizens Bank & Trust Company, FORVIS, LLP, GE HealthCare, Johnson & Johnson Medical Ltd, Koninklijke Philips N.V., Siemens Healthcare Private Limited, and Siena Healthcare Finance. These players have adopted various strategies to increase their market penetration and strengthen their position in the healthcare finance solution market.

The major market landscape in the healthcare finance solution market includes the dominance of North America due to its well-established healthcare infrastructure and a focus on advanced financial management practices. In addition, the Asia-Pacific region is emerging as the fastest-growing segment, driven by rapid economic growth, increasing investments in healthcare, and a growing demand for efficient financial management solutions to support the expanding healthcare sector.

North America is the largest regional market for Healthcare Finance Solutions

The global healthcare finance solution market was valued at $115.94 million in 2022 and is projected to reach $276.04 million by 2032, growing at a CAGR of 9.3% from 2023 to 2032.

B.C. Ziegler and Company, Commerce Bancshares, Inc., eCapital, Inc., First-Citizens Bank & Trust Company, FORVIS, LLP, GE HealthCare, Johnson & Johnson Medical Ltd, Koninklijke Philips N.V., Siemens Healthcare Private Limited, and Siena Healthcare Finance

Loading Table Of Content...

Loading Research Methodology...