Healthcare RCM Outsourcing Market Research, 2033

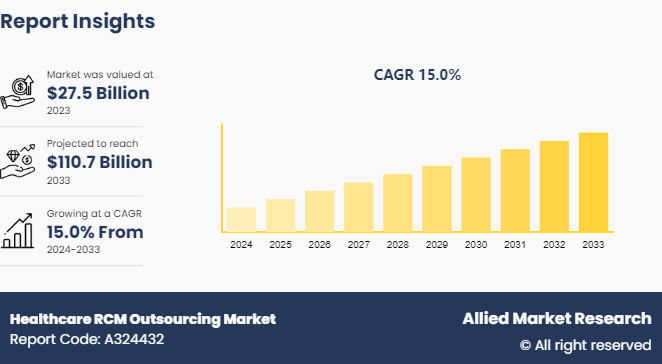

The global healthcare RCM outsourcing market size was valued at $27.5 billion in 2023, and is projected to reach $110.7 billion by 2033, growing at a CAGR of 15% from 2024 to 2033. The healthcare RCM (Revenue Cycle Management) outsourcing market is driven by the increasing complexity of healthcare billing and coding processes, regulatory changes, and the need for cost-efficient solutions. Additionally, the growing focus on minimizing billing errors and improving cash flow management further boosts the demand for outsourcing services.

Market Introduction and Definition

Healthcare Revenue Cycle Management (RCM) outsourcing refers to the practice of delegating the financial and administrative tasks related to the revenue cycle to external service providers. This process encompasses various stages, from patient registration and eligibility verification to coding, billing, and collections. By outsourcing these functions, healthcare organizations aim to enhance operational efficiency, reduce costs, and improve financial outcomes.

The revenue cycle in healthcare involves managing the full range of services provided to patients, ensuring accurate billing and timely reimbursement from insurance companies. Outsourcing allows healthcare providers to leverage specialized expertise and advanced technology without the need to invest heavily in internal resources. This approach helps in addressing challenges such as complex billing regulations, frequent changes in coding standards, and the need for continuous monitoring of accounts receivable. Overall, RCM outsourcing supports healthcare organizations in focusing on their core mission of delivering high-quality patient care while optimizing their financial processes.

Key Takeaways

- The healthcare RCM outsourcing industry study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major healthcare RCM outsourcing industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The healthcare RCM outsourcing market size is driven by several key factors, including the growing complexity of healthcare billing and reimbursement processes, driven by evolving regulatory requirements and coding systems such as ICD-10. The rising need to reduce operational costs and administrative burdens, especially in the wake of shrinking healthcare margins, is encouraging healthcare providers to outsource RCM functions. Additionally, the increasing adoption of advanced technologies such as artificial intelligence, machine learning, and robotic process automation (RPA) has made RCM outsourcing more attractive due to enhanced accuracy, speed, and efficiency in billing and claims management.

However, the market faces certain restraints during healthcare RCM outsourcing market forecast, such as concerns over data privacy and security, particularly in light of stringent regulations such as HIPAA. The potential risks of patient data breaches and non-compliance with local regulations can deter healthcare providers from outsourcing to external vendors. Moreover, high initial implementation costs and reluctance among small healthcare providers to relinquish control of core financial processes may also limit the healthcare RCM outsourcing market growth.

On the other hand, significant healthcare RCM outsourcing market opportunity exist in the form of emerging markets where healthcare infrastructure is rapidly expanding. Countries in Asia-Pacific and Latin America are increasingly adopting RCM outsourcing to address their healthcare system inefficiencies. Additionally, the growing shift toward value-based care models is creating demand for specialized RCM services that can manage alternative payment methods and bundled payments, offering further growth prospects for the market. The continued expansion of telehealth and virtual care services is also presenting new avenues for RCM outsourcing providers to adapt to the evolving healthcare landscape.

Market Segmentation

The healthcare RCM outsourcing industry is segmented into type, service, end user and region. On the basis of type, the market is classified into patient access, patient encounter, and patient billing. Based on service, the market is divided into back-end services, middle-end services and front-end services. Depending on end user, the market is divided into hospitals & clinics, ambulatory surgical centers, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America holds largest healthcare RCM outsourcing market share and is characterized by a robust and dynamic landscape, driven by several key factors. One of the primary drivers is the increasing complexity of the U.S. healthcare system, including intricate billing processes and frequent changes in healthcare regulations. Healthcare providers are seeking to streamline their operations and ensure compliance, leading to a heightened demand for specialized RCM outsourcing services. Additionally, the rise in the volume of patient data and the need for accurate coding and billing further contribute to the healthcare RCM outsourcing market growth.

Technological advancements also play a crucial role in driving the North American RCM outsourcing market. The adoption of advanced analytics, artificial intelligence, and automation tools enhances the efficiency and accuracy of revenue cycle processes. Outsourcing partners in the region are leveraging these technologies to offer sophisticated solutions that improve financial outcomes for healthcare organizations.

Opportunities in this market are significant due to the growing emphasis on cost reduction and operational efficiency. Healthcare providers are increasingly recognizing the value of outsourcing as a strategy to manage financial workflows more effectively and focus on patient care. Moreover, there is a burgeoning demand for outsourcing services from smaller healthcare providers and physician practices, which were previously underserved. The expanding healthcare landscape, coupled with a focus on improving revenue management practices, creates a fertile ground for growth and innovation in the North American healthcare RCM outsourcing market.

Industry Trends

- With growing regulatory requirements and coding complexities (e.g., ICD-10) , healthcare providers are increasingly outsourcing RCM services to ensure compliance and accuracy in claims processing.

- The rise of telehealth and virtual care during the COVID-19 pandemic has increased the need for RCM outsourcing to handle complex billing structures and reimbursement models associated with these services.

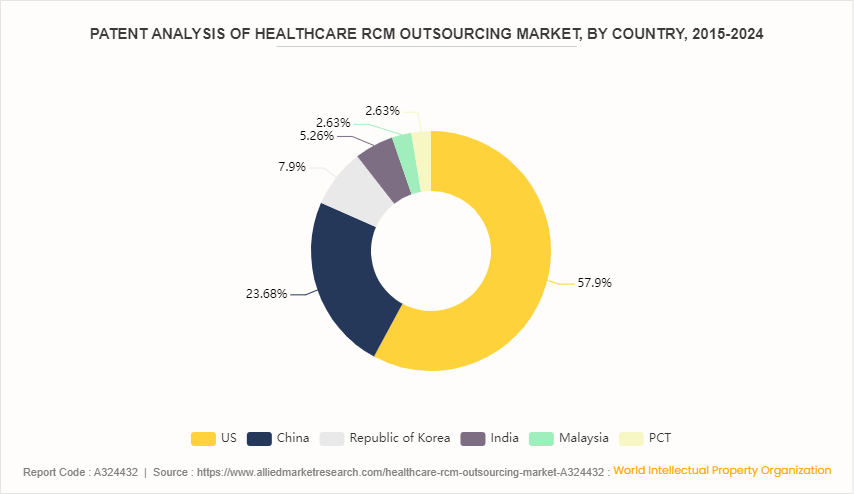

Patent Analysis, By Country, 2015-2024

U.S. witnessed the highest number of patent approvals and applications, due to favorable government policies, new technological advancement and new product launches in the country. China has 23.68% of the total number of patents, followed by Republic of Korea at 7.9% and India at 5.26%.

Competitive Landscape

The major healthcare RCM outsourcing market share players operating in the market include Cerner Corporation, McKesson Corporation, Optum360, Conifer Health Solutions, MedData, R1 RCM Inc., Parallon, Kareo, eCatalyst Healthcare Solutions and Visionary RCM. Other players in the Healthcare RCM outsourcing market include Medusind, Dell Technologies, GeBBS Healthcare Solutions, iMarque Solutions, and so on.

Recent Key Strategies and Developments

- In March 2022, Omega Healthcare acquired Reventics, an RCM solution developer that provides solutions for provider engagement to improve compliance and physician reimbursement.

- In May 2023, Aspirion, a leading RCM provider announced the acquisition of FIRM Revenue Cycle Management Services, Inc.

- In 2022, PrecisionBI Lite, a condensed business intelligence platform, was announced by CareCloud, Inc. This platform will help to expand the company's addressable market and provide powerful financial analytics and business insights to small, independent practices.

- In 2020, R1 RCM, Inc. entered into a strategic partnership with Rush University System for Health (RUSH) to achieve revenue cycle performance excellence and boost healthcare innovation.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the healthcare RCM outsourcing market segments, current trends, estimations, and dynamics of the healthcare RCM outsourcing market analysis from 2023 to 2033 to identify the prevailing healthcare RCM outsourcing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the healthcare RCM outsourcing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global healthcare RCM outsourcing market statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global healthcare RCM outsourcing market trends, key players, market segments, application areas, and market growth strategies.

Key Sources Referred

- Centers for Disease Control and Prevention

- World Health Organization

- National Center for Biotechnology Information

- The Lancet

- GOV.UK

- Science Direct

- Health Resources and Services Administration (HRSA)

- Department of Health and Human Services (HHS)

- National Institutes of Health (NIH)

- Government of India

Healthcare RCM Outsourcing Market , by Type Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 110.7 Billion |

| Growth Rate | CAGR of 15% |

| Forecast period | 2024 - 2033 |

| Report Pages | 260 |

| By Type |

|

| By Services |

|

| By End User |

|

| By Region |

|

| Key Market Players | Visionary RCM, R1 RCM Inc., Optum360, Cerner Corporation, Kareo, eCatalyst Healthcare Solutions, parallon, MedData, Conifer Health Solutions, LLC, McKesson Corporation. |

The Cerner Corporation, McKesson Corporation, Optum360, Conifer Health Solutions held a high market position in 2023.

The base year is 2023 in healthcare RCM outsourcing market.

The forecast period for healthcare RCM outsourcing market is 2024 to 2033.

The market value of healthcare RCM outsourcing market is projected to reach $110.7 billion by 2033.

The total market value of healthcare RCM outsourcing market was $27.45 billion in 2023.

Loading Table Of Content...