HealthTech Market Research, 2033

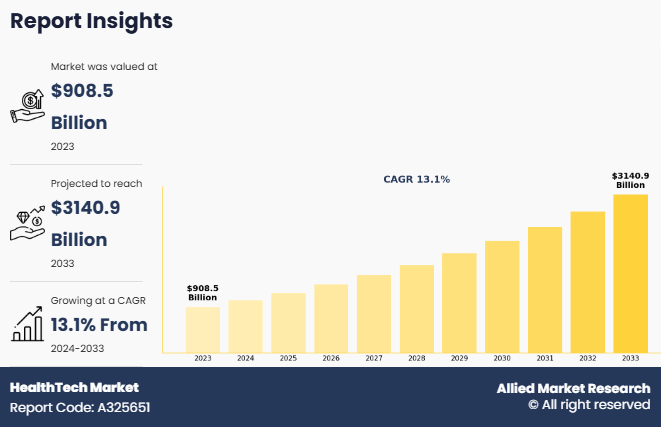

The global healthtech market size was valued at $908.5 billion in 2023, and is projected to reach $3,140.9 billion by 2033, growing at a CAGR of 13.1% from 2024 to 2033. HealthTech is also known as digital health, which uses technology to enhance the delivery of health services and provide better care for patients. The HealthTech industry encompasses a broad range of innovative technologies, such as electronic health records, telemedicine, wearable fitness trackers, and health apps. The primary goal of HealthTech is to utilize healthcare technology to improve access and efficiency of health services, as well as to improve patient outcomes.

Key Takeaways

By Component, the hardware segment held the largest share in the healthtech market for 2023.

By End Users, the healthcare institution held the largest share in the healthtech market for 2023

By Technology, the healthcare E-commerce segment held the largest share in the healthtech market for 2023.

Region-wise, North America held largest market share in 2023. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Factors such as rise in health awareness and preventive care and the increase in the ageing population positively impacted the growth of the market. In addition, the surge in the government initiatives and policy support and the growing demand for smartphones, tablets, and other mobile platforms, are expected to fuel the growth of the market during the forecast period. Furthermore, the adoption of digital health technologies in remote patient monitoring, telemedicine, and health data analytics is expected to provide lucrative growth opportunities for the market in the upcoming years. Moreover, the healthtech market insights highlights the development of advanced artificial intelligence (AI) and machine learning (ML) algorithms to enable personalized treatment plans, predictive analytics, and improved diagnostic accuracy, is also expected to create remunerative opportunities for the healthtech market growth.

Segment Review

The healthtech market is segmented into component, end users, technology, and region. By component, the market is categorized into hardware, software, and services. The software segment is further sub-segmented in deployment mode that is on-premise and cloud. As per end users, the market is divided into healthcare institutions and consumers. Depending on technology, the market is classified into healthcare e-commerce, healthcare IT, wearable, mHealth, telemedicine, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the global healthtech market share was dominated by the hardware segment in 2023 and is expected to maintain its dominance in the upcoming years, owing to the increase in the need for remote monitoring tools that assist patients and physicians in effectively managing medical conditions and rising incidence of chronic diseases like diabetes, cardiovascular diseases, and respiratory disorders. However, the software segment is expected to experience the highest growth during the healthtech market forecast period. This segment is experiencing surge in the use of remote patient monitoring (RPM) apps, AI-powered diagnostics, telemedicine platforms, electronic health records (EHRs), and health analytics.

Region wise, North America dominated the market share in 2023 for the healthtech market. This is due to favorable government policies in promoting the adoption of digital health solutions, including telehealth and electronic health records (EHRs), contributing significantly to the regions market growth. However, Asia-Pacific is expected to experience the fastest growth during the forecast period. The region is increasingly integrating AI into existing healthcare infrastructures, enabling more accurate diagnoses, personalized treatment plans, and improved operational efficiency, which is expected to provide lucrative growth opportunities for the market in this region.

Competition Analysis

The report analyzes the profiles of key players operating in the healthtech market are Tebra Technologies, Inc., Siemens Healthineers AG, Koninklijke Philips N.V, OMRON Healthcare, Inc., Medtronic, EPIC Systems Corporation, Stryker, Intuitive Surgical, Stratasys, Materialise, Novo Nordisk A/S, GRAIL, Inc., Tempus AI, Inc., ZS Associates, Inc., Apple, and Alphabet. These players have adopted various strategies to increase their market penetration and strengthen their position in the healthtech industry.

Recent Developments in the HealthTech Market

In December 2024, Reliance Industries, through its subsidiary Reliance Strategic Business Ventures Limited (RSBVL), infused $24.26 million to settle Karkinos Healthcare's debts, following NCLT's approval of its resolution plan. Additionally, Reliance provided $18 million for Karkinos' operational revival. The resolution plan allocated $4.51 million to secured creditors, $7.81 million to unsecured creditors, and $11.93 million to operational creditors.

In July 2024, Samsung Electronics launched the Galaxy Watch7 and Galaxy Watch Ultra, expanding Galaxy AI's capabilities to enhance digital wellness. These wearables offer personalized insights and tailored wellness experiences, leveraging advanced sensor innovations. The Galaxy Watch7 focuses on everyday wellness with personalized workouts, while the Galaxy Watch Ultra is designed for next-level achievements. TM Roh highlighted that these devices integrate Samsung's latest technologies to provide preventative healthcare solutions and meaningful health insights. This is expected to accelerate wearable health device adoption, enhance digital health integration, and empower proactive health management, further driving growth of the healthcare sector.

In October 2024, sehatUP launched India's first integrated digital health clinic, combining modern medicine, Ayurveda, and Homeopathy for personalized healthcare. This supports the Government of India's vision to integrate traditional and modern medical practices, offering personalized healthcare plans, free doctor consultations, and affordable, clinically approved medicines and supplements, focusing on sexual wellness and weight management. This initiative is expected to improve healthcare access, outcomes, and the adoption of integrated digital health solutions, accelerating the growth of the market.

Top Impacting Factors

Driver

Rising health awareness and preventive care

The rise in health awareness and focus on preventive care is a significant driver in the healthtech market. With the increase in health consciousness, there is a rise in demand for digital health technologies like fitness trackers, health apps, and wearables that enable proactive health monitoring and management. In addition, digital platforms, telemedicine, and mobile apps provide enhanced health awareness and preventive care, making healthcare more accessible to remote and underserved populations. Furthermore, the increase in the adoption of healthtech solutions for the early detection and management of chronic diseases like diabetes, heart disease, and hypertension improves patient outcomes, reduces the burden on traditional healthcare systems, and promotes long-term well-being. These factors are expected to contribute to the growth of the healthtech market.

Furthermore, the growing demand for preventive health solutions has led healthtech companies to develop products focused on wellness and lifestyle management, offering personalized health tools and improving overall patient care. In addition, mental health screenings during routine check-ups help in early detection of mental issues, leading to access counseling and support services, preventing severe issues. Moreover, preventive healthcare provides better quality and stress-free life and is cost-effective by investing in affordable health insurance and accessible diagnostic devices for early disease detection.

Restraints

High cost of deployment of digital health solutions

The major challenge for the growth of the healthtech market size is the substantial investment associated with the deployment of digital health solutions. Integrating new digital health solutions with existing systems requires extra time and money for customization and troubleshooting. In addition, smaller healthcare organizations may hesitate to adopt digital health technologies due to the significant upfront costs associated with infrastructure, software, and training. Furthermore, skilled expertise required to effectively manage and utilize the new digital health tools, add to the overall expenses. Continuous maintenance, upgrades and the need to ensure compatibility with other digital health tools and legacy systems also contribute to the total costs involved. Moreover, high deployment costs can divert funds from essential healthcare areas like staffing, facility maintenance, and patient care, potentially causing resource imbalances. In addition, the long return of investment (ROI) timeline often deters adoption, as healthcare providers struggle to justify upfront costs for solutions like telemedicine and AI-driven tools that take years to show full value. Despite these challenges, the investment in digital health solutions is essential for improving healthcare efficiency, patient outcomes, and the long-term sustainability of the healthcare system.

Opportunity

Adoption of digital health technologies

The increase in the adoption of digital health technologies presents a significant opportunity for healthtech market to improve patient care, reduce costs, and drive innovation. Electronic Health Records (EHR) allows secure, efficient data storage and sharing, reducing administrative workload and improving communication among healthcare providers. In addition, AI algorithms analyze health data to diagnose conditions faster, predict outcomes, and personalize treatment plans. Machine learning improves decision-making and detects unnoticed patterns. Furthermore, telemedicine offers remote clinical healthcare services, where patients consult with doctors through video calls, phone calls, or online messaging for diagnosis, treatment, and follow-up care. In addition, telehealth, including remote monitoring, health education, and wellness support via mobile apps and wearables, aims to improve access to care, increase patient convenience, and reduce costs by reducing in-person visits. These advanced technologies enhance healthcare efficiency, improve patient outcomes, and make healthcare more accessible and cost-effective.

Furthermore, robotics is increasingly integrated into healthcare to streamline operations, improve efficiency, and reduce human error by assisting with surgical assistance, lab automation, and patient rehabilitation. In addition, digital health solutions automate billing processes, reducing errors and ensure timely payments. This leads to better cash flow and financial stability for healthcare providers. Furthermore, wearables like smartwatches and fitness trackers monitor heart rate, sleep, activity, blood pressure, and glucose levels, by providing continuous health data for early issue detection, personalized care, and proactive chronic condition management. Moreover, the integration of digital health and genomics enable personalized medicine by tailoring treatments to patients' genetic profiles. This precision minimizes side effects and enhances effectiveness, especially in oncology. For instance, in February 2025, GOQii and Acrannolife Genomics partnered and launched GrafCare, a program that revolutionizes post-transplant care. By combining genomic diagnostics, AI, and personalized health monitoring, GrafCare offers early complication detection, real-time health insights, and tailored support, enhancing patient outcomes and quality of life. This partnership is expected to improve post-transplant care, reduce complications, and enhance patient outcomes using genomic diagnostics and AI.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the healthtech market analysis from 2023 to 2033 to identify the prevailing healthtech market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the healthtech market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global healthtech market trends, key players, market segments, application areas, and market growth strategies.

HealthTech Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.1 trillion |

| Growth Rate | CAGR of 13.1% |

| Forecast period | 2023 - 2033 |

| Report Pages | 250 |

| By Component |

|

| By End User |

|

| By Technology |

|

| By Region |

|

| Key Market Players | EPIC Systems Corporation, Alphabet, Tempus AI, Inc., GRAIL, Inc., OMRON Healthcare, Inc., Koninklijke Philips N.V., Novo Nordisk A/S, Siemens Healthineers AG, Tebra Technologies, Inc., Medtronic, Intuitive Surgical, Stratasys, Materialise, Apple, ZS Associates, Inc., Stryker |

Analyst Review

The Healthtech market has experienced rapid growth in response to the increasing adoption of digital health solutions and the need for data-driven decision-making. CXOs are considering the benefits that AI, IoT, and big data can offer in healthcare, such as enabling personalized treatment plans, improving diagnostic accuracy, and optimizing patient care through real-time data analysis. In addition, these technologies may help healthcare organizations streamline operations, reduce costs, and enhance the overall patient experience by automating routine tasks and improving healthcare delivery. Such factors are expected to drive lucrative growth opportunities in the Healthtech market during the forecast period.

Furthermore, AI in healthtech can transform patient care by analyzing healthcare data for diagnostics and monitoring, while also enabling collaboration among developers and medical professionals to create tailored applications. However, CXOs also recognize the challenges associated with healthtech solutions. One significant challenge is the industry's fragmentation, is the data and privacy concerns requiring stringent security protocols and compliance with regulations. In addition, healthtech solutions require significant investment in advanced technologies, infrastructure, and skilled professionals which can be a barrier to entry for smaller healthcare providers and startups.

Moreover, ethical and regulatory concerns regarding patient data privacy and security must be addressed, ensuring compliance with healthcare regulations and privacy laws. There is also a need for a strong ecosystem of healthcare providers, technology partners, and developers to build and integrate innovative healthtech solutions. CXOs in the healthtech sector must evaluate technologies based on their specific needs and requirements, such as improving patient outcomes, enhancing diagnostic accuracy, and optimizing healthcare workflows.

The Healthtech Market is expected to witness notable growth due to a rise in health awareness and preventive care and the increase in the ageing population.

The Healthtech Market is projected to reach $3,140.9 billion by 2033.

The Healthtech market is estimated to grow at a CAGR of 13.1% from 2024 to 2033.

The key players profiled in the report include Tebra Technologies, Inc., Siemens Healthineers AG, Koninklijke Philips N.V, OMRON Healthcare, Inc., Medtronic, EPIC Systems Corporation, Stryker, Intuitive Surgical, Stratasys, Materialise, Novo Nordisk A/S, GRAIL, Inc., Tempus AI, Inc., ZS Associates, Inc., Apple, and Alphabet.

The key growth strategies of healthtech market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...