Heart Attack Diagnostics Market Overview

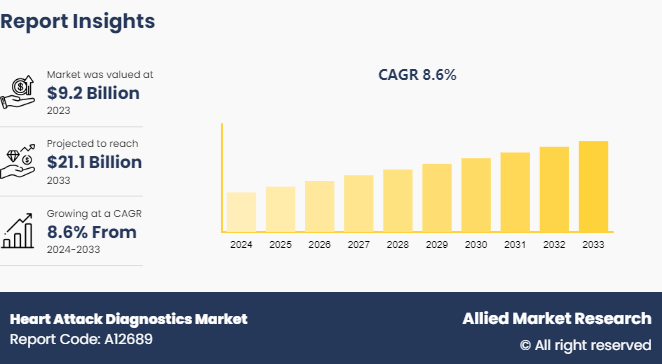

The global heart attack diagnostics market size was valued at $9.2 billion in 2023, and is projected to reach $21.1 billion by 2033, growing at a CAGR of 8.6% from 2024 to 2033. Rising global prevalence of cardiovascular disease fueled by aging populations, unhealthy lifestyles, and chronic risk factors; and rapid technological innovation are major drivers of the market.

Market Size & Future Outlook

- 2023 Market Size: $9.2 Billion

- 2033 Projected Market Size: $21.1 Billion

- CAGR (2024-2033): 8.6%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The global heart attack diagnostics market is experiencing growth due to several factors such as increase in prevalence of cardiovascular diseases, technological advancement in diagnostic techniques, and growing awareness among both healthcare providers and patients about the importance of early detection and intervention in preventing adverse outcomes from heart attacks.

Market Introduction and Definition

Heart attack diagnostics involve a series of tests and evaluations aimed at determining whether an individual has experienced a myocardial infarction, commonly known as a heart attack. These diagnostics typically include an assessment of symptoms such as chest pain, shortness of breath, and nausea, along with the patient's medical history and risk factors such as smoking, hypertension, and diabetes. Diagnostic tests may include an electrocardiogram (ECG/EKG) to measure the heart's electrical activity, blood tests to check for cardiac enzymes such as troponin, which are released into the bloodstream when the heart muscle is damaged, and imaging tests such as echocardiography or coronary angiography to visualize the heart and its blood vessels.

Key Takeaways

- The heart attack diagnostics market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period, 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major heart attack diagnostics industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The heart attack diagnostics market size is experiencing a surge driven by numerous factors. One of the primary drivers is the rising incidence of cardiovascular diseases globally. As sedentary lifestyles become more prevalent and dietary habits shift towards processed food, the prevalence of risk factors such as obesity, diabetes, and hypertension increase, consequently driving the demand for heart attack diagnostics. For instance, about 695, 000 people in the U.S. died from heart disease in 2021. In addition, the adoption of unhealthy lifestyles in emerging economies such as India and China, has led to a surge in cardiovascular disease cases, creating a substantial market opportunity for diagnostic companies to cater to this growing patient pool.

However, regulatory bodies impose rigorous approval processes for diagnostic devices to ensure safety and efficacy, leading to prolonged time-to-market and increased development costs for manufacturers. For instance, the stringent regulatory framework in regions such as North America and Europe necessitates extensive clinical trials and documentation, which can hinder the introduction of innovative diagnostics technologies into these markets.

On the other hand, technological advancements offer promising opportunities for market players to innovate and differentiate their offerings. The advent of novel diagnostic modalities, such as high-sensitivity troponin assays and point-of-care testing devices, enables faster and more accurate detection of myocardial infarction, thereby enhancing patient outcomes and driving market growth.

global heart attack diagnostics market is experiencing growth due to several factors such as increase in prevalence of cardiovascular diseases, technological advancement in diagnostic techniques, and growing awareness among both healthcare providers and patients about the importance of early detection and intervention in preventing adverse outcomes from heart attacks.

Heart Attack Diagnostics Market Segmentation

The heart attack diagnostics industry is segmented into test type, end-user, and region. On the basis of test type, the market is divided into electrocardiogram, blood tests, angiogram, computerized cardiac tomography, and others. By end user, the market is divided into hospitals, diagnostics centers and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America has largest heart attack diagnostics market share which experiencing significant growth driven by several key factors such as advancements in medical technology have led to the development of more accurate and efficient diagnostic tools for detecting heart attacks, such as high-sensitivity cardiac troponin assays and advanced imaging techniques such as cardiac MRI and CT angiography. These innovations have improved the speed and accuracy of diagnosis, allowing for quicker initiation of life-saving treatments.

In addition, rise in prevalence of cardiovascular diseases and risk factors such as hypertension, diabetes, and obesity have increased the demand for heart attack diagnostics. As the population ages and lifestyles become increasingly sedentary, the incidence of heart attacks is expected to continue rising, driving further demand for diagnostic tests and services which further drive the growth of heart attack diagnostics market share.

Furthermore, there is growing awareness among both healthcare providers and patients about the importance of early detection and intervention in preventing adverse outcomes from heart attacks. This awareness has led to increased screening and testing for cardiovascular risk factors, as well as greater emphasis on preventive care and lifestyle modifications.

Moreover, in both China and India, the market is witnessing significant heart attack diagnostics market opportunity, propelled by several key drivers including rapid urbanization and changing lifestyles in both countries have led to an increase in cardiovascular risk factors such as obesity, sedentary lifestyle, and poor dietary habits. This has resulted in a higher prevalence of heart attacks and other cardiovascular diseases, thereby driving the demand for advanced diagnostic technologies and services.

Secondly, the aging population in China and India is contributing to the rising burden of cardiovascular diseases which further drive the heart attack diagnostics market growth. As the population ages, the incidence of heart attacks and related complications is expected to increase, fueling demand for early and accurate diagnostic tests to enable timely intervention and management.

Furthermore, increasing healthcare expenditure and infrastructure development are expanding access to healthcare services, including diagnostic facilities, in urban as well as rural areas. Government initiatives aimed at improving healthcare infrastructure, enhancing access to healthcare services, and raising awareness about cardiovascular diseases are also driving growth during heart attack diagnostics market forecast.

- In November 2023, a late-breaking science study conducted in a Taiwanese hospital and presented at the American Heart Association's Scientific Sessions 2023 revealed that the time it took to diagnose and send patients for treatment was reduced by nearly ten minutes by using technology incorporating artificial intelligence (AI) and electrocardiogram (EKG) testing for patients experiencing a heart attack.

- In September 2023, the UK was awarded the Innovative Cardiovascular Health Program to improve heart health in Kentucky.

Industry Trends

- In December 2022, Dr. Hans Henri P. Kluge, the Regional Director of WHO for Europe, introduced a new Signature Initiative that will be especially relevant to the nations in the Region with the highest rates of CVDs, the highest prevalence of hypertension, inadequate control of hypertension, and high salt consumption.

- Million Hearts 2022 is a national initiative co-led by CDC and the Centers for Medicare & Medicaid Services to prevent 1 million heart attacks and strokes in 5 years. The initiative focuses partner actions on a small set of priorities selected for their impact on heart disease, stroke, and related conditions.

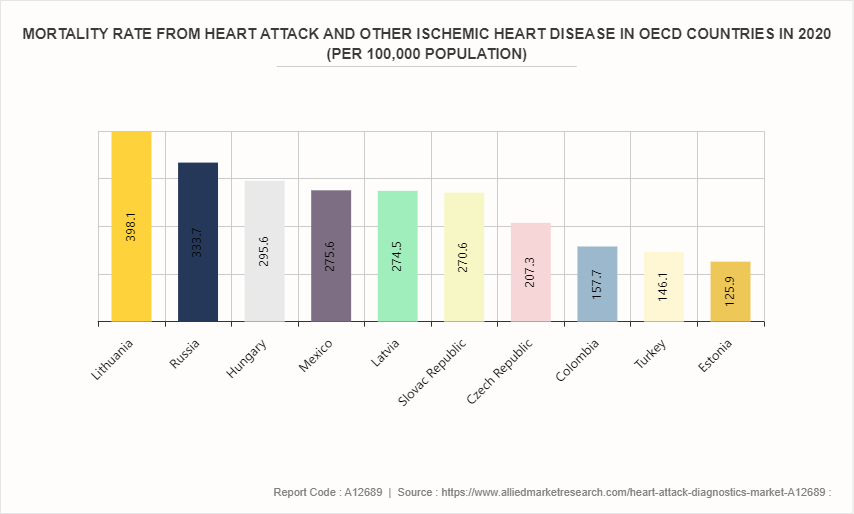

What are the Top 10 Countries with Mortality Rate from Heart Attack & other Ischemic Heart Disease

In 2020, Lithuania had the highest rate of death from ischemic heart disease among OECD countries at around 398.1 deaths per 100, 000 inhabitants followed by Russia and Hungary with 333.7 and 295.6 deaths per 100, 000 inhabitants respectively.

Competitive Landscape

The major players operating in the heart attack diagnostics industry include Bionet Co., Ltd., Toshiba Corporation, Bio-Rad Laboratories Inc., Life Sign LLC, Schiller AG, Beckman Coulter, GE Healthcare, Hitachi Medical Systems, F. Hoffmann-La Roche Ltd., Abbott Laboratories. Other players in heart attack diagnostics market include Koninklijke Philips N.V., Welch Allyn, Inc., Midmark Corporation, Siemens Healthcare Diagnostics and so on.

Recent Key Strategies and Developments

- In February 2023, Cardio Diagnostics Holdings launched PrecisionCHD, an integrated epigenetic-genetic blood test for the early detection of coronary heart disease.

- In April 2021, Roche launched a series of five new intended uses for two key cardiac biomarkers using the Elecsys technology: high sensitive cardiac troponin T (cTnThs) and N-terminal pro-brain natriuretic peptide test (NT-proBNP) . These gold standard biomarkers have proven to be successful in supporting cardiovascular disease management and can help clinicians diagnose heart attacks (cTnT-hs) and better manage heart failure (NT-proBNP) .

- In March 2021, the European Union approved the artificial intelligence-based CaRi-Heart Technology to detect and predict the risk of severe heart attack years before it happens. The CaRi-Heart Technology was developed by the British Heart Foundation and Caristo Diagnostics.

- In July 2021, Canon Medical Systems, U.S. joined forces with Cleerly in a strategic partnership to support simple and streamlined adoption of cardiac CT and create a new standard of care in heart disease.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the heart attack diagnostics market analysis to identify the market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the heart attack diagnostics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global heart attack diagnostics market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the heart attack diagnostics market players.

- The report includes the analysis of the regional as well as global heart attack diagnostics market trends, key players, market segments, application areas, and market growth strategies.

Key Sources Referred

- World Health Organization

- Center for Disease Control and Prevention

- National Center for Biotechnology Information

- British Heart Foundation

- Australian Institute of Health and Welfare

- Pan American Health Organization

- European Society of Cardiology

- Australian Bureau of Statistics

- National Health Service

- American Heart Association

- British Heart Foundation

- The Heart Foundation

- Cardiovascular Research Foundation

Heart Attack Diagnostics Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 21.1 Billion |

| Growth Rate | CAGR of 8.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 260 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Beckman Coulter,Inc., TOSHIBA CORPORATION, Bionet Co., Ltd, Abbott Laboratories, Bio-Rad Laboratories Inc, Hitachi Medical Systems, Schiller AG, GE Healthcare, Life Sign LLC, F. Hoffmann-La Roche Ltd. |

Loading Table Of Content...