Heat Pump Market Research, 2032

The global heat pump market size was valued at $71.2 billion in 2022, and is projected to reach $201.5 billion by 2032, growing at a CAGR of 11.1% from 2023 to 2032. The integration of smart building systems and the adoption of building automation drives the growth of market. Smart building systems optimize energy usage by intelligently controlling heating, ventilation, and air conditioning (HVAC) systems, including heat pumps. This optimization leads to improved energy efficiency, reduced energy consumption, and lower operational costs. However, high space requirements of heat pump hinder the market growth. Heat pumps require outdoor units, which need sufficient space for installation. In urban areas with limited outdoor space, finding suitable locations for heat pump units can be difficult. Moreover, integrating heat pumps with thermal energy storage offers remunerative opportunities for the expansion of the heat pump market.

Introduction

Heat pumps operate based on the principle of heat transfer, which involves the movement of heat from a source to a sink. This process occurs continuously, driven by temperature differences between the heat source and the heat sink. Heat pumps use a refrigerant, a substance with a low boiling point, to facilitate the transfer of heat. The refrigerant undergoes phase changes from liquid to vapor and back again, absorbing heat from the surroundings in its evaporator coil and releasing it in its condenser coil.

One of the primary advantages of heat pumps is their high energy efficiency. By transferring heat rather than generating it, heat pumps can deliver more heating or cooling capacity per unit of energy input compared to traditional systems, resulting in lower energy bills and reduced carbon emissions. Heat pumps can provide both heating and cooling functions, making them versatile solutions for year-round comfort. In heating mode, they extract heat from the outdoor air, ground, or water source and deliver it indoors. In cooling mode, they remove heat from indoor spaces and release it outdoors.

Key Takeaways

- The heat pump industry covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global heat pump markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the heat pump market report.

- The heat pump market share is highly fragmented, with several players including DAIKIN INDUSTRIES, Ltd., Mitsubishi Electric Corporation, Carrier, Panasonic Corporation, Trane Technologies plc, Lennox International Inc., Bosch Thermotechnology Corp, NIBE GROUP, FUJITSU GENERAL., and SAMSUNG. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in the heat pump market growth.

Market Dynamics

Smart building systems monitor and analyze energy usage patterns in real-time, allowing for optimized operation of heat pumps based on building occupancy, weather conditions, and other factors. This dynamic control helps maximize energy efficiency and reduce overall operating costs. Smart buildings equipped with integrated heat pumps have the capability to engage in demand response initiatives, allowing for flexible adjustments in electricity consumption based on grid conditions or pricing signals. This flexibility helps utilities manage peak demand and grid stability while providing financial incentives to building owners.

Smart building technologies enable predictive maintenance of heat pump systems by continuously monitoring equipment performance and detecting early signs of potential issues. This proactive approach helps prevent unexpected downtime and reduces maintenance costs. Thus, the integration of smart building systems drives the growth of heat pump market.

Heat pumps typically require an outdoor unit for air-source or ground-source heat exchange. In urban areas with limited outdoor space, finding suitable locations for outdoor units can be challenging. Restrictions on outdoor unit placement due to zoning regulations, building codes, or aesthetic considerations may further complicate installation.

Heat pump systems often face challenges in finding suitable installation locations due to competing demands for space from various building infrastructures such as rooftop equipment, ventilation systems, and utility meters. Limited rooftop or ground space restricts the installation of heat pump units, particularly in multi-story buildings or structures with complex layouts. Adequate airflow around outdoor heat pump units is essential for efficient operation and heat dissipation. Space constraints limit ventilation options, leading to potential overheating or performance degradation.

Heat pumps operate based on the principle of heat transfer, which involves the movement of heat from a source to a sink. This process occurs continuously, driven by temperature differences between the heat source and the heat sink. Heat pumps use a refrigerant, a substance with a low boiling point, to facilitate the transfer of heat. The refrigerant undergoes phase changes from liquid to vapor and back again, absorbing heat from the surroundings in its evaporator coil and releasing it in its condenser coil.

Segments Overview

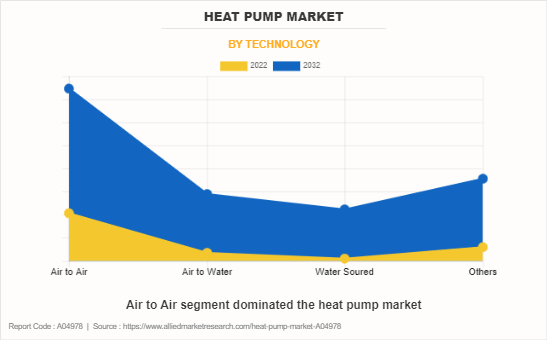

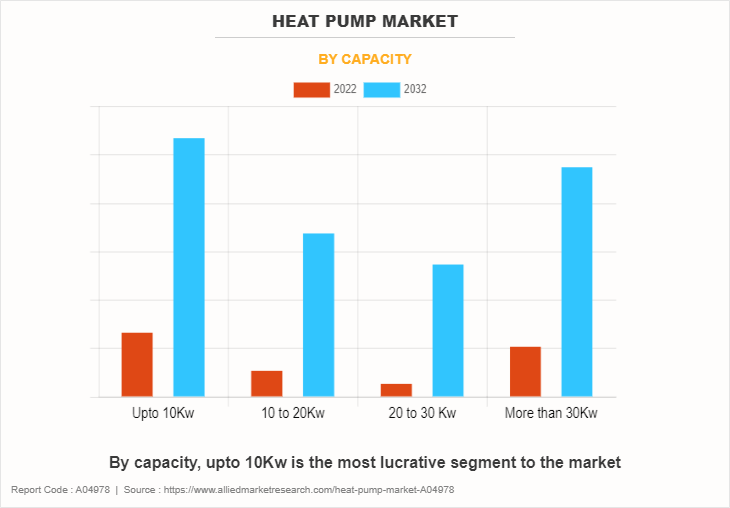

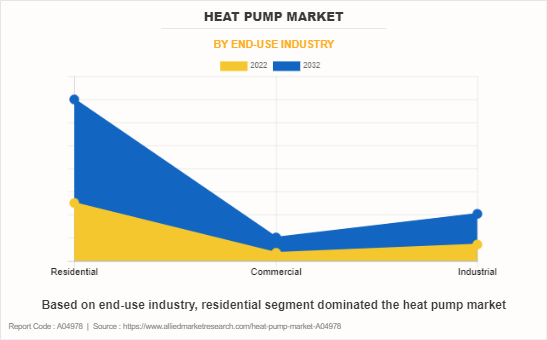

The heat pump market is segmented into technology, capacity, end-use industry, and region. On the basis of type, the market is classified into air to air, air to water, water soured, and others. On the basis of the capacity, the market is divided into upto 10Kw, 10 to 30Kw, 20 to 30 Kw, and more than 30Kw. On the basis of the end-use industry, the market is divided into residential, commercial, and industrial. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Global Market By Technology

Air to air heat pumps can be integrated into heating, ventilation, and air conditioning (HVAC) systems for industrial facilities to provide both heating and cooling as part of a centralized system. This helps in efficiently managing indoor air quality and temperature throughout the facility. Industrial facilities can benefit from the energy efficiency of air-to-air heat pumps, especially in comparison to traditional heating and cooling systems. By utilizing heat transfer from the ambient air, these systems can reduce energy consumption and operating costs for industrial operations.

The U.S. Department of Energy reports significant energy and cost savings in the Northeast and Mid-Atlantic regions when switching to air-source heat pumps. According to the Northeast Energy Efficiency Partnerships, replacing entire heating units results in annual savings of approximately 3,000 kWh ($459) compared to electric resistance heaters and 6,200 kWh ($948) compared to oil systems. Even when used alongside existing oil systems, the average annual savings are still substantial, nearing 3,000 kWh (approximately $300). These findings are expected to drive further market growth for air-source heat pumps.

Global Market By Capacity

Industries engaged in small-scale manufacturing processes, such as boutique production facilities, artisanal workshops, or laboratories, can benefit from heat pumps up to 10 kW. These heat pumps can provide precise temperature control for various production needs, including curing, drying, and testing processes. Small-scale greenhouse operations, such as those found in urban agriculture initiatives or community gardens, benefit from heat pumps up to 10 kW. These systems can provide heating during colder months, extending the growing season and ensuring optimal conditions for plant growth.

Global Market By End Use

Residential heat pumps have found applications in various industries due to their energy efficiency and versatility in providing both heating and cooling solutions. One prominent sector where heat pumps are extensively utilized is the food industry. In food processing facilities, maintaining specific temperature conditions is crucial for preserving food quality and safety. Heat pumps offer precise temperature control, allowing these facilities to optimize their processes while reducing energy consumption compared to traditional heating and cooling systems.

- As per the U.S. Energy Information Administration’s (EIA) households using central air conditioners or heat pumps will collectively save $2.5 billion to $12.2 billion on energy bills during the 30-year period following implementation of the standards.

- In 2023, new residential central air-conditioning and air-source heat pump systems sold in the U.S. required to meet new efficiency requirements. The new standards require a seasonal energy efficiency ratio (SEER) of 15.0 and heating seasonal performance factor (HSPF) of 8.8 for air-source heat pumps.

Global Market By Region

China, as one of the largest industrial economies in the world, has also been investing heavily in heat pump technology across various sectors. With the country's commitment to transitioning towards a greener economy, Chinese industries are increasingly turning to heat pumps to improve energy efficiency and reduce greenhouse gas emissions. Moreover, initiatives such as the Belt and Road Initiative (BRI) have facilitated the transfer of heat pump technology to other countries in the Asia Pacific region, further promoting its adoption.

Competitive Analysis

The major players operating in the heat pump market include DAIKIN INDUSTRIES, Ltd., Mitsubishi Electric Corporation, Carrier, Panasonic Corporation, Trane Technologies plc, Lennox International Inc., Bosch Thermotechnology Corp, NIBE GROUP, FUJITSU GENERAL., and SAMSUNG. In November 2022, Mitsubishi introduced a new cascaded air source heat pump, capable of producing heat within the range of 7.8 kW to 640 kW. This innovative system can efficiently provide hot water at temperatures of up to 70°C without the need for boost heaters. Primarily designed for commercial settings such as schools and hospitals, Mitsubishi Electric aims to offer reliable heating solutions tailored to the unique demands of these environments.

Recent Key Developments in Heat Pump Industry

In October 2022, Midea Group initiated the construction in Feltre, northern Italy, dedicated to the production, research, and development of heat pumps. This strategic move aims to boost Midea's global market presence. The new base represents a significant investment of $58.75 million (EUR 60 million) and is situated within the production hub of Clivet, a prominent European firm specializing in cooling, heating, ventilation, and air purification solutions for residential, commercial, and industrial sectors.

In September 2022, Panasonic Corporation announced that it would invest about 20 billion yen approx. $157.16 million in its Czech Plant by the Fiscal Year ending in March 2026 to strengthen the production of air-to-water heat pumps (A2W), which have been experiencing growing demand in Europe.

- In April 2022, Daikin pledged its backing for REPowerEU, an initiative aiming to triple the deployment of heat pumps from 10 million units by 2027 to 30 million units by 2030. This initiative aligns with the broader push toward smart building technologies, offering a pathway for the European Union to meet its ambitious decarbonization targets for the residential sector by 2050.

In February 2022, the U.S. Environmental Protection Agency introduced the ENERGY STAR Home Upgrade program, designed to help families save approximately $500 annually on utility expenses. This initiative offers access to new technology such as ENERGY STAR-certified air source heat pumps for eco-friendly heating and cooling, as well as ENERGY STAR-certified heat pump water heaters for highly efficient hot water systems.

According to the International Energy Agency, heat pumps have the potential to cut global carbon dioxide (CO2) emissions by a minimum of 500 million tons by 2030, equivalent to the annual emissions from all cars in Europe. Financial incentives for heat pumps are accessible in over 30 countries, addressing over 70% of heating needs, aimed at assisting consumers in overcoming the initial higher costs compared to alternative heating solutions.

In September 2023, Johnson Controls-Hitachi Air Conditioning unveiled the Hitachi air365 Hybrid dual fuel system. This system incorporates an electric Hitachi Mini VRF heat pump as its main heating and cooling component. Notably, it integrates a dual fuel module designed to minimize carbon emissions effectively.

Historic Trends of the Heat Pump Market

- In 1859 Ferdinand Carré, a French engineer, built the first successful mechanical ice-making machine based on the heat pump principle. This marks one of the earliest practical applications of heat pump market outlook.

- In 1922 the first heat pump for residential heating is developed by Robert C. Webber. This system, known as the "New Englander," used ammonia as a refrigerant and was designed to provide both heating and cooling to homes.

- In 1948 the first air-source heat pump for residential heating and cooling is introduced by Robertshaw-Fulton Controls Co. This marks a significant milestone in making heat pump technology more accessible to homeowners.

- In the 1970s the oil crisis prompted an increased interest in energy-efficient heating and cooling technologies, leading to further advancements in heat pump technology.

- In 2000, manufacturers introduced more efficient heat pump models with advanced features such as variable-speed compressors, improved heat exchangers, and smart controls. These innovations helped improve performance and energy savings.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the heat pump market analysis from 2022 to 2032 to identify the prevailing heat pump market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the heat pump market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the heat pump market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global heat pump market trends, key players, market segments, application areas, and market growth strategies.

Heat Pump Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 201.5 billion |

| Growth Rate | CAGR of 11.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Capacity |

|

| By End-Use Industry |

|

| By Technology |

|

| By Region |

|

| Key Market Players | FUJITSU GENERAL., Panasonic Corporation, Lennox International Inc., Mitsubishi Electric Corporation, Samsung, Trane Technologies plc, Bosch Thermotechnology Corp, Daikin Industries, Ltd., NIBE GROUP, Carrier |

Analyst Review

According to the opinions of various CXOs of leading companies, the global heat pumps market was dominated by the residential segment in 2022.

Increase in demand for smart home technologies drives the growth of the heat pump market. Smart thermostats and home automation systems allow users to monitor and control their heat pumps remotely using mobile apps or web interfaces. This capability enables homeowners to adjust temperature settings, schedule heating and cooling cycles, and receive alerts for maintenance or system malfunctions from anywhere, improving convenience and comfort. Smart heat pump systems can collect and analyze data related to energy consumption, temperature profiles, and system performance. By providing users with insights into their energy usage patterns and efficiency metrics, these systems empower homeowners to make informed decisions about energy conservation measures, equipment upgrades, and maintenance scheduling.

High initial costs restrain the growth of the heat pump market. The upfront investment required for a heat pump system may exceed their budgetary constraints. Compared to traditional heating and cooling systems, such as furnaces or air conditioners, which may have lower initial costs, the price of purchasing and installing a heat pump can be prohibitive for some homeowners. Despite the long-term energy savings potential of heat pumps, some consumers may perceive the upfront cost as a barrier, especially if they are uncertain about the expected return on investment. The payback period for a heat pump system, during which energy savings offset the initial investment, can vary depending on factors such as energy prices, climate conditions, and system efficiency.

The Asia-Pacific region is projected to register robust growth during the forecast period.

The heat pump market is primarily driven by the adoption of building automation and the integration of smart building systems.

The residential sector is the largest end-use industry in the heat pump market.

Key companies in the heat pump market include DAIKIN INDUSTRIES, Ltd., Mitsubishi Electric Corporation, Carrier, Panasonic Corporation, Trane Technologies plc, Lennox International Inc., Bosch Thermotechnology Corp, NIBE GROUP, FUJITSU GENERAL, and SAMSUNG.

Integrating heat pumps with thermal energy storage is an emerging trend shaping the global heat pump market.

The Asia-Pacific region leads as the largest market for heat pumps.

The global heat pump market was valued at $71.2 billion in 2022 and is expected to grow to $201.5 billion by 2032, registering a CAGR of 11.1% between 2023 and 2032.

Loading Table Of Content...

Loading Research Methodology...