Heat Sink Market Research, 2032

The global heat sink market was valued at $5.5 billion in 2022 and is projected to reach $10.9 billion by 2032, growing at a CAGR of 7.1% from 2023 to 2032. A heat sink functions as a passive cooling mechanism designed to soak up and distribute surplus heat generated by electronic or mechanical components, like computer processors or power semiconductor devices. Its primary goal is to move thermal energy away from the component, preserving the ideal operating temperatures and averting overheating. Usually constructed from thermally conductive materials like aluminum or copper, a heat sink includes fins or other configurations to increase the available surface area for heat dissipation. As the component produces heat during its operation, the heat sink absorbs this thermal energy and aids in its dispersal to the surrounding environment through conduction, convection, and radiation.

The importance of heat sinks in electronic devices cannot be overstated, as excess heat may lead to performance degradation, shortened lifespan, or irreversible damage to components. Efficient heat dissipation is crucial for ensuring the dependability and durability of electronic systems. For example, in computers where CPUs generate substantial heat during processing, a heat sink affixed to the CPU prevents thermal throttling, preserving optimal performance.

The applications of heat sinks extend beyond computers to diverse electronic and mechanical systems. In the automotive industry, heat sinks cool components like power inverters in electric vehicles. In LED lighting, heat sinks disperse the heat generated by light-emitting diodes, preventing degradation and ensuring a prolonged lifespan. Power electronics, such as voltage regulators and motor controllers, also benefit from heat sinks to uphold stable performance.

Furthermore, heat sinks find application in telecommunications equipment, medical devices, and industrial machinery, where efficient thermal management is crucial for reliable and consistent operation in the heat sink industry. The versatility of heat sinks in addressing thermal challenges makes them a fundamental component in various technological fields, ensuring the proper functioning of electronic and mechanical systems.

Segment Overview

The heat sink market is segmented into material, industry vertical, and type.

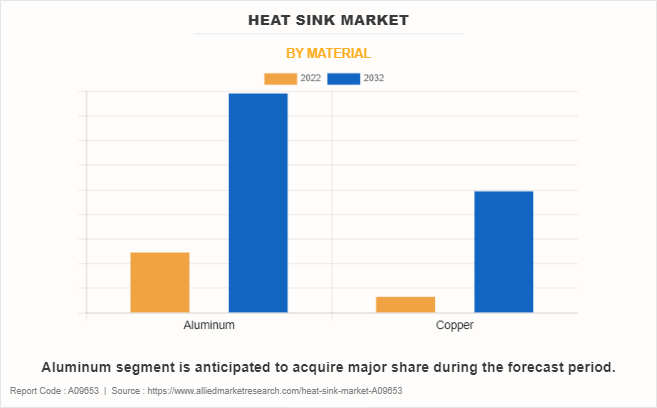

Based on the material, the heat sink market size is divided into aluminum and copper. In 2022, the aluminum segment dominated the market, and it is expected to acquire a major market share by 2032.

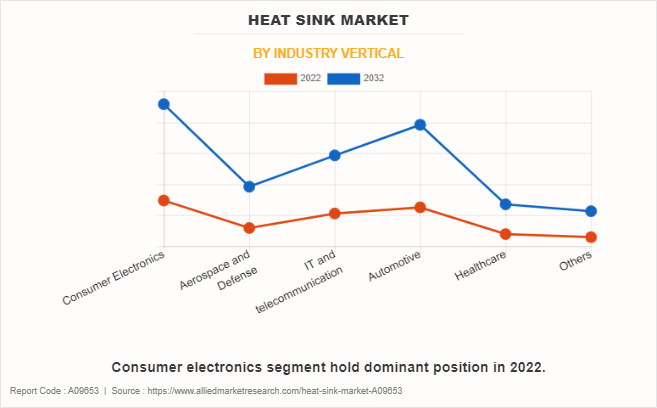

Based on industry vertical, the heat sink market growth is categorized into consumer electronics, aerospace and defense, it and telecommunication, automotive, healthcare, and others. In 2022, the consumer electronics segment dominated the market, and it is expected to acquire a major market share by 2032.

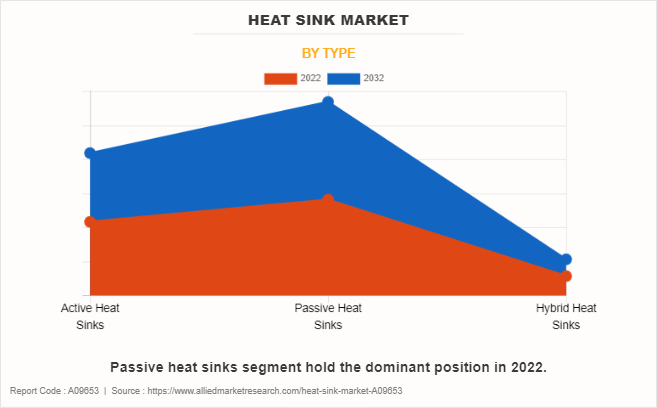

Based on type, the heat sink market is divided into active heat sinks, passive heat sinks, and hybrid heat sinks. In 2022, the passive heat sinks segment dominated the market, and it is expected to acquire a major market share by 2032.

Based on region, the Heat sink market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Country Analysis

Country-wise, the U.S. acquired a prime share in the heat sink market in the North American region, and it is expected to grow at a significant CAGR during the forecast period of 2023-2032.

In Europe, Germany dominated the heat sink market share in terms of revenue in 2022 and is expected to follow the same trend during the forecast period. Germany is expected to emerge as the fastest-growing country in Europe's heat sink market with a CAGR of 8.01%.

In the Asia-Pacific region, China is expected to emerge as a significant market for the Heat sink market industry, owing to a significant rise in investment by prime players due to an increase in the growth of consumer electronics in rural and urban regions.

In the LAMEA region, the Middle East garnered a significant market share in 2022. The LAMEA heat sink market has witnessed an improvement, owing to the growth in the inclination of prime vendors towards utilizing Heat sink across this region in smart TVs and sound systems. Moreover, the Middle East region is expected to grow at a high CAGR of 6.22% from 2023 to 2032.

Competitive Analysis

Competitive analysis and profiles of the major global Heat sink market players that have been provided in the report include ATS, Aavid Thermalloy, LLC, ABL Aluminium Components Ltd, Alpha Novatech, Inc., CTS Corporation, CUI Devices, Ohmite, Sensata Technologies, TE Connectivity, and Wakefield Thermal, Inc.. The key strategy adopted by the major players of the Heat sink market is product launch.

Top Impacting Factors

The heat sink market is expected to witness notable growth owing to a surge in the use of hybrid heat sinks in control systems, an increase in power density and performance requirements, and the miniaturization of electronic devices. Moreover, electric vehicles (EVs), battery thermal management, and high-performance computing and data centers are expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, noise generation limits the growth of the heat sink market forecast.

Historical Data & Information

The global Heat sink market outlook is highly competitive, owing to the strong presence of existing vendors. Vendors of the Heat sink market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

- In October 2023, Advanced Thermal Solutions, Inc. (ATS) announced the launch of new heat sinks developed specifically for cooling NVIDIA Jetson modules, which are widely used in robotics and embedded and edge AI applications. Each straight-fin, black anodized, aluminum heat sink comes with mounting screws or with a steel leaf spring and screws for secure through-hole mounting onto a PCB. Hole pattern guides are included. A high-performance thermal interface material (TIM) is pre-assembled on the attachment side of the heat sink.

- In November 2023, Future Electronics, a leading global distributor of electronic components, is pleased to launch a digital campaign with Boyd Corporation to provide customers with state-of-the-art heat sink solutions for a wide range of applications.

- In March 2023, Alpha Novatech, Inc. announced the launch of the new FSW Heat Sinks. By using this process, standard heat sinks can be joined together to create larger sizes. This allows customers to obtain custom sizes with short lead times and small MOQs. In addition, by combining products with different fin patterns, optimal performance with regard to thermal resistance and pressure drop can be obtained.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the heat sink market segments, current trends, estimations, and dynamics of the heat sink market from 2022 to 2032 to identify the prevailing heat sink market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the heat sink market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global heat sink market trends, key players, market segments, application areas, and market growth strategies.

Heat Sink Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 10.9 billion |

| Growth Rate | CAGR of 7.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 321 |

| By Material |

|

| By Industry Vertical |

|

| By Type |

|

| By Region |

|

| Key Market Players | CTS Corporation, TE Connectivity, CUI Devices, ATS, Aavid Thermalloy, LLC, Wakefield Thermal, Inc., Crydom (Sensata Technologies), Ohmite Mfg Co, ABL Aluminium Components Ltd, Alpha Novatech, Inc. |

Analyst Review

Heat sinks play a pivotal role in managing the thermal conditions of electronic devices, and their importance has significantly increased alongside the widespread adoption of consumer electronics globally. These devices, spanning from laptops and smartphones to smart TVs, generate considerable heat during their operation. In the absence of effective heat dissipation, electronic components may face performance issues, a shortened lifespan, or even permanent damage. Heat sinks offer a solution by proficiently absorbing and dispersing heat, ensuring the optimal functionality of electronic devices.

A key characteristic of heat sinks is their construction using thermally conductive materials like aluminum or copper. These materials possess exceptional thermal conductivity, enabling them to absorb and transfer heat away from electronic components. The design often incorporates fins or other structures to amplify the surface area available for heat dissipation, thereby enhancing cooling efficiency.

Consider, for example, a laptop, a ubiquitous consumer electronic device. Laptops integrate various components such as processors, graphics cards, and memory modules that generate heat during operation. To prevent overheating and ensure peak performance, laptops are equipped with heat sinks. These heat sinks, frequently crafted from aluminum alloy, are strategically positioned near critical components. As the processor produces heat, the heat sink absorbs this thermal energy and expels it into the surrounding air through conduction and convection, preventing the processor from reaching temperatures that could compromise its performance or longevity.

Similarly, for the smartphones, another prevalent category of consumer electronics, heat sinks play a vital role in thermal management. Modern smartphones are equipped with powerful processors capable of generating substantial heat, particularly during resource-intensive tasks like gaming or video streaming. Heat sinks, often integrated into the phone's design, efficiently dissipate this heat, preventing the device from becoming uncomfortably hot and maintaining consistent performance.

In the context of smart TVs, the escalating demand for higher resolution and advanced features has led to the integration of potent processors and graphics units. These components, in turn, generate heat that requires effective management. Heat sinks, sometimes combined with other cooling solutions such as fans, are employed to keep the temperature within acceptable limits, ensuring a reliable and enduring performance of the smart TV.

Numerous companies specialize in the design and manufacturing of heat sinks, contributing to advancements in thermal management technology. Aavid Thermalloy, for instance, is a well-known company celebrated for its expertise in thermal management solutions. Offering a diverse range of heat sinks tailored to specific applications, including those in consumer electronics, Aavid Thermalloy's products showcase innovative designs and materials aimed at optimizing heat dissipation to meet the thermal challenges posed by modern electronic devices.

Another notable player in the thermal management field is Advanced Thermal Solutions (ATS). ATS provides heat sinks, heat pipes, and other cooling solutions designed to address the thermal needs of various electronic applications. Engineered to enhance heat transfer efficiency, ATS's products ensure the reliable and efficient operation of electronic components.

Surge in use of hybrid heat sinks in control systems, increase in power density and performance requirements and miniaturization of electronic devices.

Consumer Electronics

North America

The global heat sink market was valued at $5,525.0 million in 2022.

ATS, Aavid Thermalloy, LLC, ABL Aluminium Components Ltd, Alpha Novatech, Inc., CTS Corporation, CUI Devices, Ohmite, Sensata Technologies, TE Connectivity, and Wakefield Thermal, Inc.

Loading Table Of Content...

Loading Research Methodology...