Hematology Diagnostics Market Research, 2032

The global hematology diagnostics market size was valued at $10.9 billion in 2022, and is projected to reach $16.9 billion by 2032, growing at a CAGR of 4.4% from 2023 to 2032. The growth of the hematology diagnostics market is attributed to growing prevalence of chronic conditions, growing awareness of health and screening programs and surge in adoption of point of care testing. According to the World Health Organization (WHO) in May 2023, it is estimated that 40% of all children aged 6–59 months, 37% of pregnant women and 30% of women 15–49 years of age are affected by anemia globally.

Blood-related disorders, such as anemia, leukemia, hemophilia, thrombocytopenia, and various other hematological conditions, affect millions of individuals globally. This heightened prevalence is driven by a combination of factors, including an aging population, lifestyle changes, genetic predispositions, and environmental factors. Thus, the high prevalence of blood-related disorders in the population is significantly increasing the demand for hematological testing within healthcare systems.

Key Takeaways:

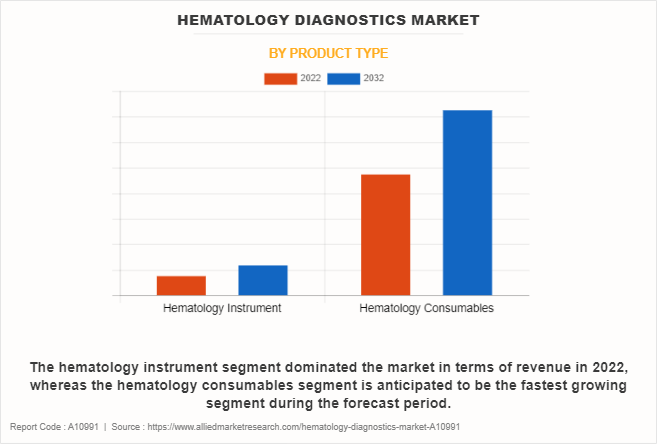

The hematology consumables segment dominated the global hematology diagnostics market size in 2022.

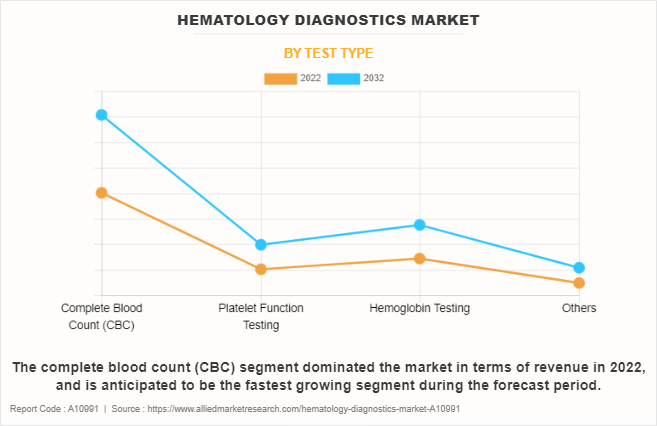

The complete blood count (CBC) segment dominated the global market in 2022 and is anticipated to be the fastest-growing segment.

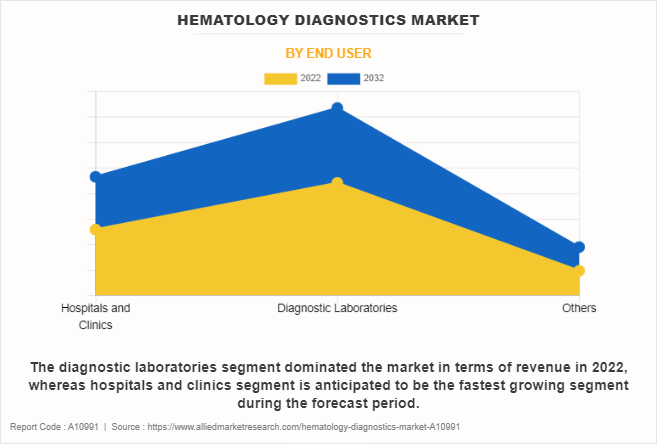

The diagnostic laboratories segment held the largest hematology diagnostics market share in terms of revenue in 2022.

The hospitals & clinics segment is anticipated to be the fastest growing segment during the forecast period.

The North America region dominated the market in terms of revenue in 2022.

Hematological diagnostics is a field of medical diagnostics that examines and analyzes blood and its components to diagnose and track various blood disorders, including anemia, leukemia, clotting disorders and immune system disorders. It includes a broad spectrum of laboratory tests and processes to evaluate the composition and function of blood, such as red blood cells (RBCs), white blood cells (WBCs), platelets (PHLs), hemoglobin, and other parameters, to guide treatment decisions, track disease progression, and ensure overall patient well-being. Hematological diagnostics are critical in providing important insights into a patient’s hematologic health and play an important role in clinical and research settings.

Market Dynamics

The hematology diagnostics market trends includes the rising prevalence of blood disorders, driven by aging populations, genetic predisposition, and lifestyle changes. The increased emphasis on preventive health care and early detection of disease drives the need for routine health checks and hematology tests. In addition, the growing healthcare infrastructure makes it easier for more people to access comprehensive blood testing in both diagnostic labs and healthcare settings.

Also, recent technological advancements in the field of cell counters and hematology analyzers, coupled with the increased automation of critical analysis steps, have brought about significant changes that have greatly improved laboratory work. These advancements have not only enhanced the precision of cellular analysis but have also revolutionized the way lab technicians operate in the lab. This is anticipated to boost the market growth during hematology diagnostics market forecast period.

However, lack of skilled professionals may hinder the hematology diagnostics market growth to some extent. in underdeveloped countries, skilled labor shortages are a major obstacle to economic growth and social progress. In the health sector, a lack of qualified doctors, lab technicians and other healthcare professionals can lead to a lack of access to high-quality medical care, which can result in increased mortality rates, poor treatment outcomes, and a shortage of essential health services.

The current global recession has had a significant impact on many industries, including pharmaceuticals, medical technology, and biotechnology. As with any other industry, the impact of the recession has been moderate on hematology diagnostics sectors. As healthcare spending continues to decline, individuals and institutions may reduce their healthcare spending. This can lead to a decrease in the demand for medical tests, including hematology diagnostics. Non-essential tests and screenings may also be temporarily postponed, leading to a decrease in demand for hematology services.

The recession has also had a negative impact on innovation in the hematology diagnostic industry. Job loss and reduced healthcare access during an economic downturn can lead to patients delaying necessary medical procedures such as hematology tests due to affordability concerns and insurance coverage issues.

However, in response to economic pressure, healthcare providers are expected to turn to cost-saving solutions and streamlining processes, which could lead to increased automation and standardization of hematology procedures in the near future.

Segmental Overview

The market for hematology diagnostics is segmented on the basis of product type, test type, end user, and region. On the basis of product type, the market is segmented into hematology instrument and hematology consumables. The hematology instrument segment is further segmented into hematology analyzers, flow cytometers and others. The hematology analyzers segment is further segmented into fully automated hematology analyzers and semi-automated hematology analyzers, whereas flow cytometry segment is further segmented into cell-based flow cytometry and bead-based flow cytometry.

On the basis of test type, the market is segmented into complete blood count (CBC), platelet function test, hemoglobin test and others. Based on end user, the market is segmented into hospitals and clinics, diagnostic laboratories and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Product Type

Based on product type, the hematology consumables segment dominated the market in terms of revenue in 2022 and is anticipated to maintain its dominance during the forecast period. Consumables play an essential role in the day-to-day operations of diagnostic labs and healthcare facilities. They are used in almost all hematology tests and procedures. Hence, hematology diagnostic consumables are in constant demand due to the need for continuous testing and care for patients.

In addition, the growth of the hematology diagnostic consumables segment is also driven by the constant development of medical technologies that often need specialized consumables to operate.

On the other hand, the hematology instrument segment is anticipated to be the fastest growing segment during the forecast period. This growth is attributed to advancements in hematology diagnostic technologies that have led to the development of more sophisticated and efficient equipment, such as hematology analyzers, coagulation analyzers, and flow cytometers. These state-of-the-art machines offer higher accuracy, quicker test results, and increased automation, making them attractive to healthcare providers seeking improved diagnostic capabilities.

By Test Type

Based on test type, the complete blood count (CBC) segment dominated the market in 2022 and is anticipated to be the fastest growing segment during the forecast period. CBC is one of the most widely used and important blood tests in healthcare, as it provides detailed information about a patient’s blood type including red blood cells (RBCs), white blood cells (WBCs), platelets (PHLs), hemoglobin, and hematocrit. The continued need for CBC testing is due to the fact that it is used in many different fields of medicine, from regular medical check-ups to diagnosing and monitoring blood disorders.

By End User

By end user, the diagnostic laboratories segment held a largest hematology diagnostics market share in terms of revenue in 2022. These laboratories play a vital role in the blood testing process, providing high-quality results that are essential for diagnosing and treating a wide range of blood disorders and conditions. These laboratories often operate under stringent quality control and regulatory standards, building trust with the healthcare industry and patients.

On the other hand, the hospitals & clinics segment is anticipated to be the fastest growing segment during the forecast period. Hospitals & Clinics are the primary health care providers that meet the needs of all patients, including diagnostics. As hospitals & clinics grow and modernize, they increasingly incorporate full hematology diagnostics to improve patient care, which will boost the market in coming years.

By Region

The hematology diagnostics market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The hematology diagnostics market in North America is growing due to several factors, such as the increasing prevalence of blood disorders due to aging, lifestyle, and genetic predisposition. The region also has a well-established healthcare system, access to cutting-edge diagnostic technologies, and strict regulatory standards that promote innovation and accessibility in hematology diagnostics.

Furthermore, the increasing cost of healthcare, the emphasis on early detection and prevention of diseases, and the use of digital health solutions are also driving the growth of the market. Furthermore, the demand for comprehensive hematology testing services in diagnostic labs and hospitals, and the increase in research and development in the field of hematology, are driving the market growth in North America.

On the other hand, the Asia-Pacific region is anticipated to be the fastest growing segment during the forecast period. Asia-Pacific hematology diagnostics industry is driven by a number of factors such as large and ageing population, which increases the risk of blood related disorders. In addition, the region’s rapidly expanding healthcare infrastructure, especially in developing countries, is increasing the demand for hematological diagnostics.

Also, technological advances in diagnostic equipment are increasing the focus on early detection of diseases, particularly in developing countries. Asia-Pacific’s strong economic growth and investment in R&D are driving innovation and increasing the availability of hematological testing in the region.

Competitive Analysis

Competitive analysis and profiles of the major players in the hematology diagnostics industry, such as Cardinal Health Inc., Danaher Corporation, Siemens AG, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., F. Hoffmann-La Roche Ltd., Sysmex Corporation, Abbott Laboratories, EKF Diagnostics Holdings plc, Nihon Kohden Corporation and Erba Group. Other key players in the market include Bio-Rad Laboratories, Boule Diagnostics, Cellavision, Drucker Diagnostics and others. Major players have adopted product launch, product approval, geographical expansion and agreement as a key developmental strategy to improve the product portfolio and gain a strong foothold in the hematology diagnostics market.

Recent Product Launches in the Hematology Diagnostics Market

In December 2020, Nihon Kohden launched MEK-1305 Celltac α+, an Automated Hematology and ESR Analyzer, in overseas market. Meyk1305 is a revolutionary hematological analyzer that is capable of measuring a complete blood count, including a 3-part differential of white blood cells, as well as ESR.

In July 2022, HORIBA Medical announced the launch of new products in its Yumizen H500 & H550 hematology product family. Yumizen H500 and H550 are designed to provide a fast and detailed hematology report with 60 test cycles per hour, 40 tube autonomy with continuous load, urgent manual mode, and for multi analysis mode and sampling.

In March 2021, Sysmex Corporation announced the launch of its XR-Series Automatic Hematology Analyzer, the industry’s first all-in-one automated hematology analyzer, and its XQ-Series 3-part WBC differential model.

Recent Agreement in the Hematology Diagnostics Market

In August 2023, Roche and Sysmex Corporation announced the renewal of the Global Business Partnership Agreement (GPA) that has been in place for 25 years. The renewed framework strengthens the long-standing partnership between the two companies. Under the renewed terms and conditions, Sysmex will continue to provide Roche with its hematology products as part of its overall lab solutions portfolio.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hematology diagnostics market analysis from 2022 to 2032 to identify the prevailing hematology diagnostics market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hematology diagnostics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hematology diagnostics market trends, key players, market segments, application areas, and market growth strategies.

Hematology Diagnostics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 16.9 billion |

| Growth Rate | CAGR of 4.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 272 |

| By Product Type |

|

| By Test Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Nihon Kohden Corporation, Sysmex Corporation, Erba Mannheim, Abbott Laboratories, F. Hoffmann-La Roche Ltd., Danaher Corporation, Siemens AG, EKF Diagnostics Holdings plc, Cardinal Health Inc. |

| Other Players | Agilent Technologies |

Analyst Review

The advancements in technology, global health awareness and rising prevalence of chronic conditions are the major factors driving the growth of the hematology diagnostics market. There have been several innovations in the field of hematology diagnostics. These innovations have made blood testing more efficient, more accurate, and more accessible. Some of the most notable innovations in hematology have been the introduction of automated hematology analyzers (AHAs), flow cytometers (FCs), and molecular diagnostics (MDSs). All these innovations offer significant opportunities for growth as they allow for faster and more complete diagnostics.

In addition, the North America region dominated the market in terms of revenue in 2022, whereas the Asia-Pacific region is anticipated to be the fastest growing region during the forecast period. Asia and LAMEA are developing regions where access to healthcare is growing rapidly. As they invest in healthcare systems, the need for hematological diagnostics is expected to increase significantly, which will boost market growth in coming years.

The forecast period for hematology diagnostics market is 2023 to 2032.

The base year is 2022 in hematology diagnostics market.

The total market value of hematology diagnostics market is $10.9 billion in 2022.

The market value of hematology diagnostics market in 2032 is $16.9 billion.

Major players profiled in this report are Cardinal Health Inc., Danaher Corporation, Siemens AG, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., F. Hoffmann-La Roche Ltd., Sysmex Corporation, Abbott Laboratories, EKF Diagnostics Holdings plc, Nihon Kohden Corporation, and Erba Group.

The hematology consumables segment is the most influencing segment in the market as consumables such as lancets, slides, blood collection tubes, cotton rolls and others are required on a daily basis for hematology diagnosis and hence, there is a high demand for these consumables in the market.

Key factors driving the growth of the hematology diagnostics market includes growth in awareness of health and screening programs, surge in adoption of point of care testing and growth in prevalence of chronic conditions.

Asia-Pacific has the highest growth rate in the market owing to the high prevalence of blood related disorders, high population base, rising healthcare expenditure and rising awareness among the population for early disease diagnosis and treatment

Loading Table Of Content...

Loading Research Methodology...