Hemostats Market Research, 2031

The global hemostats market size was valued at $2.8 billion in 2021, and is projected to reach $4.7 billion by 2031, growing at a CAGR of 5.3% from 2022 to 2031. The growth of the global hemostats market share is majorly driven by increase in number of surgeries such as orthopedic surgery, gynecological surgery, reconstructive surgery, and cardiac surgery; rise in in various cancer types that require surgical procedures; and development of new hemostasis product market by large number of key players. Moreover, rise in flowable hemostats usage boosts the flowable hemostats market. According to the International Osteoporosis Foundation, in 2019, approximately 200 million people were affected by osteoporosis-related fractures across the globe.

Market Introduction and Definition

Hemostat is referred to a surgical agent that regulates and controls the bleeding process during surgical procedures. Hemostats help to shorten surgery time and reduces the need for blood transfusion. Hemostatic agents are essential in establishing hemostasis in pre-hospital conditions and preventing death associated with hemorrhage. Hemostats are used to compress blood vessels and prevent the flow of blood or other fluids. They are generally used in adjunct to surgical procedures to manage bleeding. Hemostatic agents offer different benefits, which include decreased wound healing & operative time, better management of anti-coagulated patients, and reduction in the patient recovery period boosting the hemostasis market.

Key market dynamics

Thus, rise in burden of orthopedic disorders increases the demand for hemostats to reduce surgical injuries, which is anticipated to foster the growth of the hemostats market size. Furthermore, rise in geriatric population notably contributes toward the growth of the market. This is attributed to the fact that aged individuals are highly susceptible to various types of diseases, which increases the need for surgeries, thus boosting the hemostats market share. Furthermore, increase in number of road accidents has led to surge in surgical procedures, which augmented the growth of the hemostats market.

According to the World Health Organization, in 2019, approximately 235 million major surgical procedures were performed across the globe. According to the National Cancer Statistics, in 2020, there were 1,806,590 new cases of cancer in the U.S. Therefore, surge in number of surgeries is anticipated to boost the growth of the market. According to the American Society of Plastic Surgeons, 15.6 million cosmetic surgeries were performed in 2020. Furthermore, increase in number of product approvals is expected to provide lucrative hemostats market opportunity for the expansion during the hemostats market forecast period. Thus, rise in hemostats utilization in surgeries is bound to increase hemostasis market potential.

The COVID-19 outbreak is anticipated to have a positive impact on the growth of the global hemostats industry. According to the National Library of Medicine, in 2020, there were 1,307 cases of bariatric surgeries reported in India. Out of which 78% were performed before March 31, 2020 and 276 were performed after April 1, 2020. There were 87 patients found to be positive who underwent bariatric surgery. Thus, rise in number of bariatric surgeries has increased the usage of hemostats during surgical procedures, which drives the hemostats market growth.

Moreover, new innovations by key players and rise in number of product approvals propel the growth of the market. However, stringent government regulations associated with the approval of hemostats restrict the hemostats industry growth.

Market Segmentation

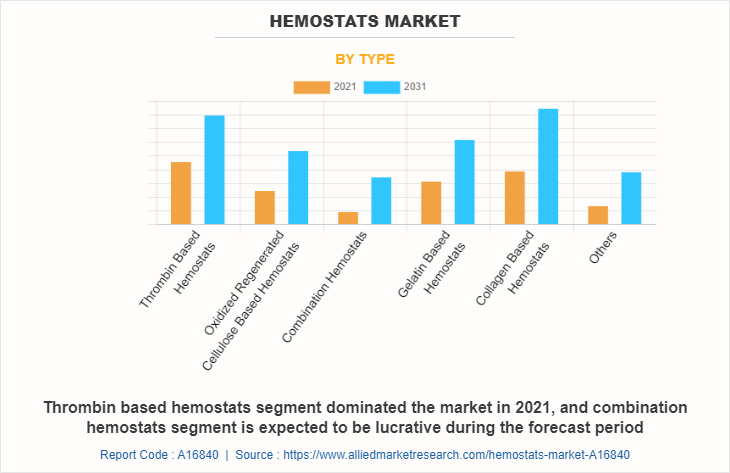

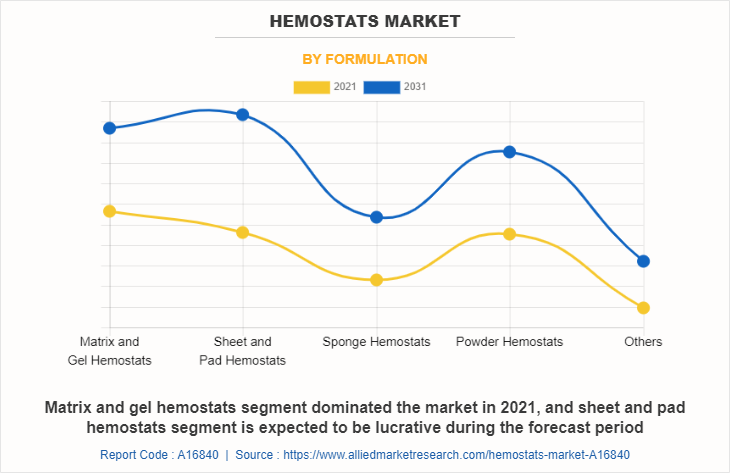

The hemostats market analysis is segmented into type, formulation, application, and region. By type, the market is categorized into thrombin-based hemostats, oxidized regenerated cellulose-based hemostats, combination hemostats, gelatin-based hemostats, collagen-based hemostats, and others. Depending on formulation, it is fragmented into matrix & gel hemostats, sheet & pad hemostats, sponge hemostats, powder hemostats, and others.

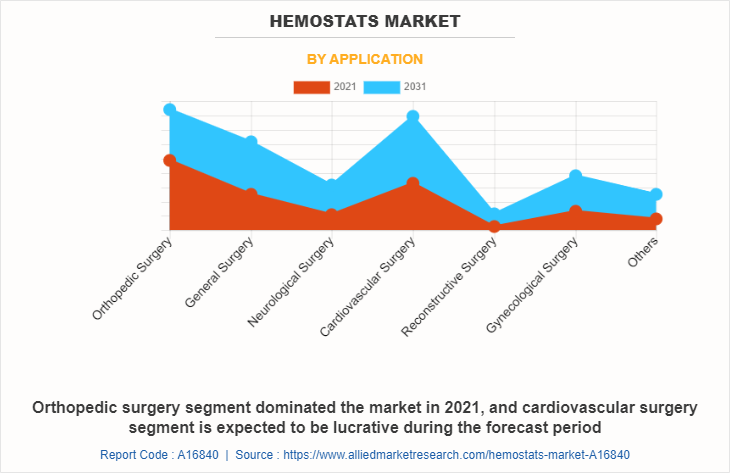

On the basis of application, it is segregated into orthopedic surgery, general surgery, neurological surgery, cardiovascular surgery, reconstructive surgery, gynecological surgery, and other surgeries.

Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and rest of LAMEA).

Segment Review

Depending on the type, the thrombin-based hemostats segment dominated the global market in 2021, and is anticipated to continue this trend during the forecast period, owing to surge in adoption of thrombin-based hemostats due to their rapid effect as they quickly facilitate the clotting process. In addition, the combination hemostats segment is expected segment is expected to witness the highest growth in the market during forecast period, owing to increase in investments in the development of new hemostat products and the advantages associated with the use of combination hemostats, as they offer enhanced efficacy by combining the advantages of different hemostatic agents

By formulation, the matrix & gel hemostats acquired the largest share in 2021, and is expected to remain dominant throughout the forecast period. This is attributed to the advantages associated with matrix & gel hemostats, such as easy application, biocompatibility, and cost-effectiveness. On the other hand, sheet and pad hemostats segment is expected to witness the highest growth in the market during forecast period, owing to availability of wide number of products and effective management of bleeding over a large surface.

By application, the orthopedic surgery segment dominated the market in 2021, and is anticipated to continue this trend during the forecast period, owing to higher prevalence of orthopedic conditions & sports injuries requiring surgical interventions, leading to rise in the number of procedures thus increasing the uptake of hemostats. Moreover, the cardiovascular segment is expected to witness the highest growth in the market during the forecast period, owing to rise in the geriatric population, sedentary lifestyle leading to an increase in number of cardiovascular diseases, which, in turn, has led to rise the number of cardiac surgeries.

Regional/Country Market Outlook

Region wise, North America accounted for a majority of the global hemostats market share in 2021, and is anticipated to remain dominant during the forecast period. This is attributed advanced healthcare infrastructure, and presence of key players offering hemostats. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in number of surgical procedures and upsurge in healthcare expenditure in the emerging economies which is anticipated to offer lucrative opportunities for the market expansion and is expected to drive the growth of the market during the forecast period.

By Region

North America, dominated the global market in 2021, whereas, Asia-Pacific in anticipated to witness the most notable growth

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hemostats market analysis from 2021 to 2031 to identify the prevailing hemostats market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hemostats market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hemostats market trends, key players, market segments, application areas, and market growth strategies.

Hemostats Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 4.7 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 237 |

| By Type |

|

| By Formulation |

|

| By Application |

|

| By Region |

|

| Key Market Players | Stryker Corporation, Hemostatis LLC, Becton Dickinson and Company, B.Braun Melsungen AG, Pfizer Inc., Johnson and Johnson, Integra Life Sciences Holding Corporation, Teleflex Incorporated, Medtronic Plc, Baxter International Inc. |

Analyst Review

This section provides the opinions of the top level CXOs in the hemostats market. According to the CXOs, rise in R&D activities in pharmaceutical industry is more likely to drive growth of the market during forecast period. In addition, increase in healthcare expenditure followed by strategic collaborations between key players play crucial role in the growth of the market.

The CXOs further added that according to WHO estimates (2019), approximately 235 million surgical procedures are undertaken worldwide every year, which fuels the market growth. In addition, rise in number of product approvals propels the market growth. For instance, in 2020, Baxter received an FDA approval for PeriStrips Dry with Veritas Collagen Matrix product with Secure Grip. This product helps in mitigating bleeding during bariatric surgeries. However, Asia-Pacific registering the fastest growth rate during the forecast period, according to article published in January 2020, China announced to invest $4.6 billion for construction of hospitals in Wuhan. Therefore, significant growth in number of hospitals and surgical centers is expected to support the growth of the hemostats market.

The base year of the market is 2021.

The global hemostats market was valued at $2,805.93 million in 2021 and is projected to reach $4,712.2 million by 2031 registering a CAGR of 5.3% from 2021 to 2031.

Surge in number of surgical procedures, availability of medical specialties for the treatment & management of several diseases are the upcoming trends of hemostats market in the world.

Orthopedic surgeries is the leading application of hemostats market.

North America is the largest regional market for hemostats.

Pfizer Inc., Teleflex Incorporated, Baxter International Inc., and Johnson & Johnson held a high market position.

Loading Table Of Content...

Loading Research Methodology...