High Purity Alumina Market Research, 2033

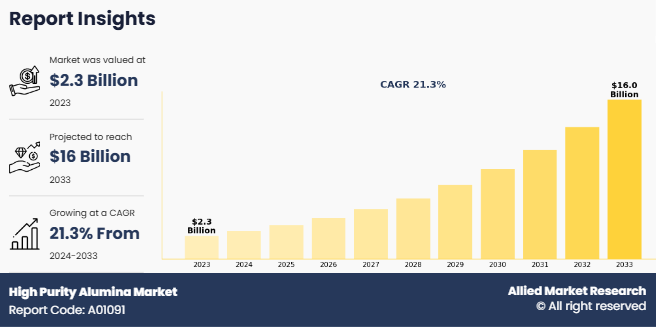

The global high purity alumina market size was valued at $2.3 billion in 2023, and is projected to reach $16 billion by 2033, growing at a CAGR of 21.3% from 2024 to 2033.Increase in demand for electric vehicle (EV) batteries and increased investments in LED manufacturing drive the growth of the high purity alumina (HPA) market. High purity alumina is a critical component in the production of lithium-ion batteries used in EVs owing to its excellent conductivity and stability, supporting the growth of the electric mobility sector.

Introduction

High purity alumina is a premium-grade form of aluminum oxide (Al₂O₃) characterized by its exceptional purity levels, typically ranging from 99.99% (4N) to 99.9999% (6N). High purity alumina is synthesized through advanced chemical processes such as hydrolysis of aluminum alkoxide or modified Bayer processes, ensuring the removal of impurities such as sodium, iron, and silicon. The high level of purity imparts superior properties such as excellent thermal stability, high corrosion resistance, and remarkable hardness that makes it a critical material for various high-technology applications. High purity alumina is widely used in the manufacturing of synthetic sapphire, which serves as a substrate in light-emitting diodes (LEDs), a protective layer in smartphone screens, and optical windows in specialized instruments. Its role in the LED industry is particularly vital, as it enhances energy efficiency and durability.

Key Takeaways

The global high purity alumina market forecast has been analyzed in terms of value. The analysis in the report is provided on the basis of type, application, 4 major regions, and more than 15 countries.

The global high purity alumina market report includes a detailed study covering underlying factors influencing industry opportunities and trends.

The high purity alumina industry is fragmented in nature with few players such as Altech Chemicals Limited, Alpha HPA Limited, Baikowski SAS, FYI Resources Ltd, Nippon Light Metal Holdings Co., Ltd., Xuancheng Jingrui New Materials Co., Ltd., Sasol Limited, Sumitomo Chemical Co., Ltd., Honghe Chemical Co., Ltd., and Polar Sapphire Ltd.

The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the industry.

Countries such as China, the U.S., India, Germany, and Brazil, hold a significant share in the global high purity alumina market.

Market Dynamics

Increase in demand for electric vehicle (EV) batteries has significantly boosted the need for high-purity alumina (HPA). According to the International Energy Agency (IEA), electric car markets are seeing robust growth as sales neared 14 million in 2023. The share of electric cars in total sales has increased from around 4% in 2020 to 18% in 2023. As EV adoption accelerates, manufacturers are focusing on developing advanced lithium-ion batteries that ensure greater energy density, longevity, and safety. High purity alumina (HPA) plays a crucial role in this process as it is a key material for producing separator coatings that improve battery performance and thermal stability. Moreover, increased investments in LED manufacturing drives the demand for high purity alumina. The LED market is experiencing rapid growth, owing to surge in global efforts to transition toward energy-efficient lighting solutions and meet sustainability goals. HPA ensures superior optical clarity and thermal conductivity in LEDs that makes it a critical material for high-quality production. All these factors are expected to drive the demand for the high purity alumina market during the forecast period.

However, growth of the high purity alumina market is significantly hampered by the fluctuating prices of aluminum and related raw materials, which are critical to HPA production. These price variations, driven by factors such as supply-demand imbalances, geopolitical tensions, and changes in mining and refining costs, increase the overall production costs and affect high purity alumina market stability. Moreover, high purity alumina is a costly material that faces pricing fluctuations due to market volatility, which hinders its competitiveness against alternative materials and limit its adoption in price-sensitive applications such as LEDs and battery separators. All these factors hamper the high purity alumina market growth.

Moreover, innovations such as advanced hydrolysis processes, plasma-based purification techniques, and energy-efficient methods enable manufacturers to achieve higher purity levels with lower environmental impact. These advancements also open avenues for scaling production to meet rise in demand from industries such as LEDs, lithium-ion batteries, and semiconductors. Furthermore, development of alternative, sustainable raw materials and automation in production processes is driving the accessibility of HPA that makes it more competitive in price-sensitive markets and expanding its applications across emerging sectors. All these factors are anticipated to offer new growth opportunities for the high purity alumina market during the forecast period.

Segments Overview

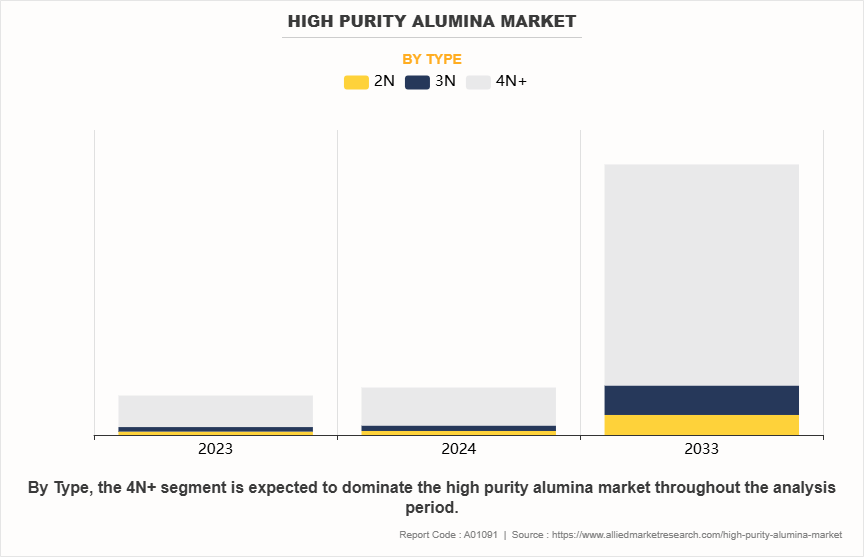

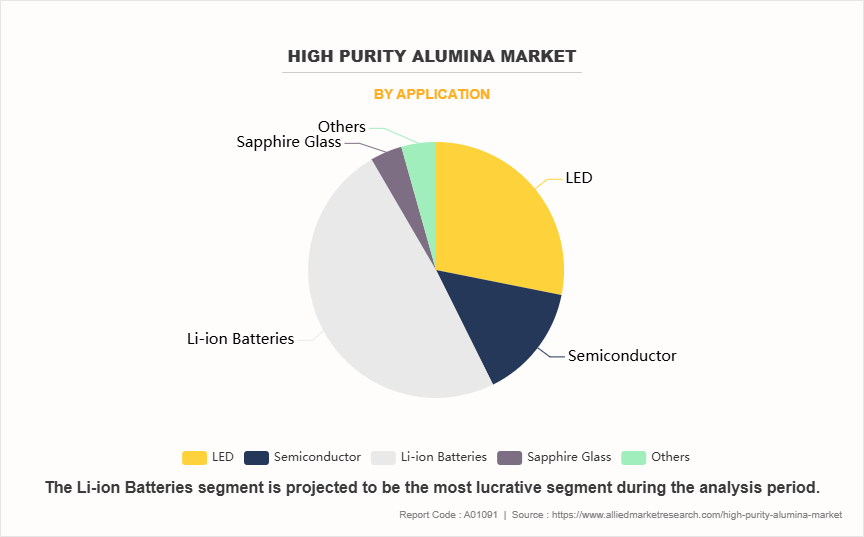

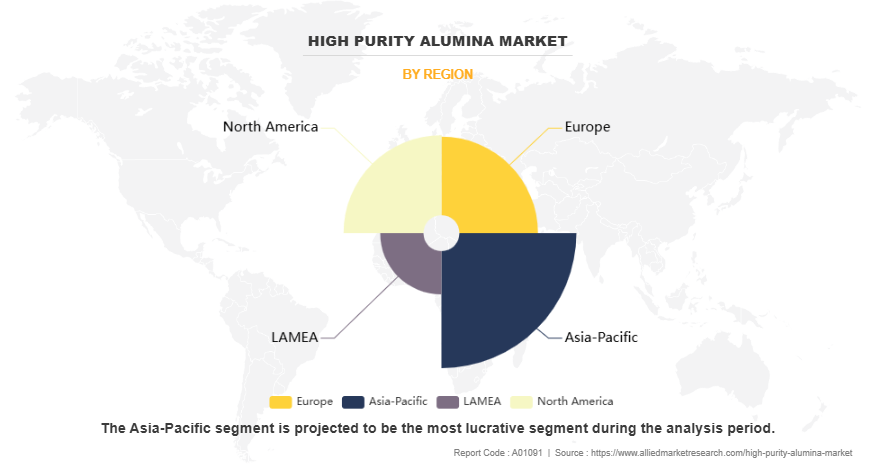

The high purity alumina market is segmented on the basis of type, application, and region. On the basis of type, the market is segmented into 2N, 3N, and 4N+. On the basis of application, the market is classified into LED, semiconductor, li-ion batteries, sapphire glass, others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the market is segmented into 2N, 3N, and 4N+. The 4N+ segment accounted for four-fifths of global high purity alumina market share in 2023 and is expected to maintain its dominance during the forecast period. This dominance is attributed to its exceptional purity level of 99.99% or higher, making it indispensable for critical applications such as LED production, lithium-ion battery separators, and high-performance ceramics. The superior properties of 4N+ alumina, including its high thermal conductivity, chemical stability, and electrical insulation, have driven its widespread adoption across industries requiring stringent material standards.

On the basis of application, the market is classified into LED, semiconductor, li-ion batteries, sapphire glass, others. The li-ion batteries segment accounted for around less than half of the global high purity alumina market share in 2023 and is expected to maintain its dominance during the forecast period. This dominance is driven by the critical role of HPA in enhancing the performance and safety of lithium-ion battery separators, where its high thermal stability and chemical resistance are essential. The increasing adoption of electric vehicles (EVs) and the growing demand for efficient energy storage systems have further fueled the demand for HPA in this segment.

Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific accounted for more than one-third of the global high purity alumina market share in 2023 and is expected to maintain its dominance during the forecast period. This dominance is driven by the region's rapidly growing industrial base, significant investments in electronics manufacturing, and the expanding electric vehicle (EV) industry. Countries such as China, Japan, and South Korea have become major hubs for high purity alumina consumption due to their leadership in LED production, lithium-ion battery manufacturing, and advanced ceramics. In addition, the region's favorable policies promoting renewable energy and clean technologies further boost the high purity alumina demand.

Competitive Analysis

Key players in the high purity alumina industry include Altech Chemicals Limited, Alpha HPA Limited, Baikowski SAS, FYI Resources Ltd., Nippon Light Metal Holdings Co., Ltd., Xuancheng Jingrui New Materials Co., Ltd., Sasol Limited, Sumitomo Chemical Co., Ltd., Honghe Chemical Co., Ltd., and Polar Sapphire Ltd.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the high purity alumina market analysis from 2023 to 2033 to identify the prevailing high purity alumina market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the high purity alumina market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global high purity alumina market trends, key players, market segments, application areas, and market growth strategies.

High Purity Alumina Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 16 billion |

| Growth Rate | CAGR of 21.3% |

| Forecast period | 2023 - 2033 |

| Report Pages | 420 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Baikowski SAS, Alpha HPA Limited, Altech Chemicals Limited, Honghe Chemical Co., Ltd, Nippon Light Metal Holdings Co., Ltd, Polar Sapphire Ltd, Sumitomo Chemical Co., Ltd, Sasol Limited, FYI Resources Ltd, Xuancheng Jingrui New Materials Co., Ltd |

Analyst Review

According to the opinions of various CXOs of leading companies, the high purity alumina market is expected to witness growth during the forecast period owing to surge in demand from end-user industries such as electronics, healthcare, and automotive. Furthermore, rise in adoption of energy-efficient lighting, such as LED bulbs, and government encouragement to the consumers toward usage of LED bulbs against incandescent bulbs to save the energy consumption are some of prominent factors that drive the growth of the global high purity alumina market. In addition, increase in demand for electric vehicles across the globe to curb the carbon emission has led to increase in demand for Li-Ion batteries to power these electric vehicles and to reduce the dependency on the conventional fuels such as diesel and petrol. This factor is expected to surge the demand for high purity alumina during the forecast period.

Surge in demand for electric vehicle (EV) batteries, increased investments in led manufacturing are the upcoming trends of High Purity Alumina Market in the world.

li-ion batteries is the leading application of High Purity Alumina Market

Asia-Pacific is the largest regional market for High Purity Alumina

$16 billion is the estimated industry size of High Purity Alumina by 2033.

Altech Chemicals Limited, Alpha HPA Limited, Baikowski SAS, FYI Resources Ltd., Nippon Light Metal Holdings Co., Ltd., Xuancheng Jingrui New Materials Co., Ltd., Sasol Limited, Sumitomo Chemical Co., Ltd., Honghe Chemical Co., Ltd., and Polar Sapphire Ltd are the top companies to hold the market share in High Purity Alumina

Loading Table Of Content...

Loading Research Methodology...