High Speed Steels Market Overview

The global high speed steels market size was valued at USD 5.3 billion in 2022, and is projected to reach USD 9.4 billion by 2032, growing at a CAGR of 6.2% from 2023 to 2032.

High-speed steels are the cutting tool materials used to make power saw blades and drill bits. Cutting tools are used in the manufacturing process to drill, cut, grind, mill, bore, tap, and perform a range of other tasks. High-speed steels can withstand greater temperatures without losing their toughness. It outperforms standard high-carbon steel tools in terms of performance. It is widely used in a variety of end-user industries, including aerospace, automotive, and others.

Increasing need for high-speed steel in the aerospace and energy sectors is expected drive the market growth. The aerospace industry requires high-performance materials that can withstand intense temperatures, pressures, and mechanical strains. High-speed steel is appropriate for aerospace applications due to its high hardness, heat resistance, and exceptional wear resistance. High-speed steel is used to produce crucial components such as turbine blades, drill bits, cutting tools, and engine parts. As the aircraft industry expands and modernizes, demand for high-speed steel is likely to rise, driving market expansion. The energy sector is divided into several segments, including electricity generating, oil & gas exploration, and renewable energy. Cutting tools and machining components that can survive harsh conditions during drilling, machining, and processing operations are required in these industries. High-speed steel is used in drilling tools, cutting tools, turbine components, and other vital parts in the energy sector due to its outstanding heat resistance, hardness, and wear resistance. Growing global energy consumption and a greater emphasis on renewable energy projects is predicted to boost the high speed steels market growth.

Lack of investment in R&D activities in the high-speed steel field, as well as the increasing usage of carbide-cutting tools in various end-use industries, are expected to restrict the growth of the high speed steels industry during the forecast years. Furthermore, the increased use of carbide-based cutting tools in various end-use industries and low high speed steel production capacity are likely to act as serious restraints to high speed steels market development rate during the forecast period. Whereas economic sluggishness in the manufacturing sector could obstruct the development of the high speed steels market in the upcoming years.

Increasing awareness about technological advancements and the benefits of high-speed steel (HSS) is expected to drive market growth in the future. New and improved high-speed steel products have been created as a result of ongoing developments in production techniques, metallurgy, and tool design. The performance properties of HSS have been improved by the use of cutting-edge coatings, nanostructured materials, and alloying components. Higher adoption rates and market expansion may result from increased knowledge of these technological developments among companies and users. High-speed steel has several advantages that make it an excellent choice for a variety of cutting and machining applications. These advantages include high hardness, wear resistance, toughness, and thermal stability. High-speed steel tools can resist high cutting speeds, keep their sharpness for longer periods of time, and manage difficult machining circumstances. As the importance of high-speed steel is recognized by industries, the market players are expected to witness several growth opportunities.

Key Market Players

The key players profiled in this report include Sandvik AB, NIPPON KOSHUHA STEEL CO., LTD., Proterial, Ltd., ArcelorMittal, Amada Co., Ltd, OSG corporation, Kennametal, Kyocera, Walter AG, and RUKO GmbH. Investment and agreement are common strategies followed by major market players. In October 2021, ArcelorMittal and Nippon Steel Corp.'s joint venture steel firm in India announced a proposal to invest $13.34 billion (INR 1 trillion) over ten years to expand its activities in the nation. This expansion will provide the market with several growth opportunities.

Segment Overview

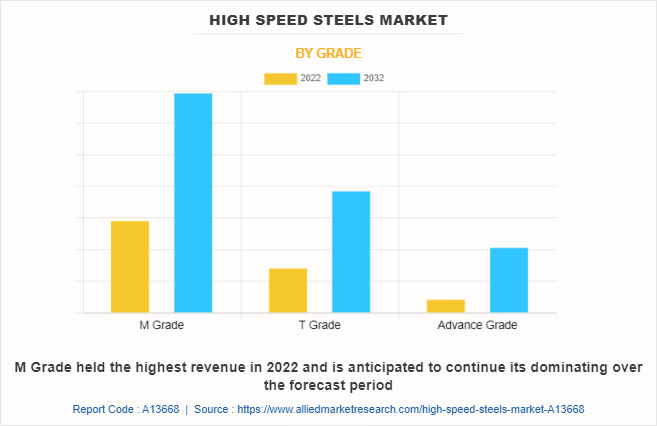

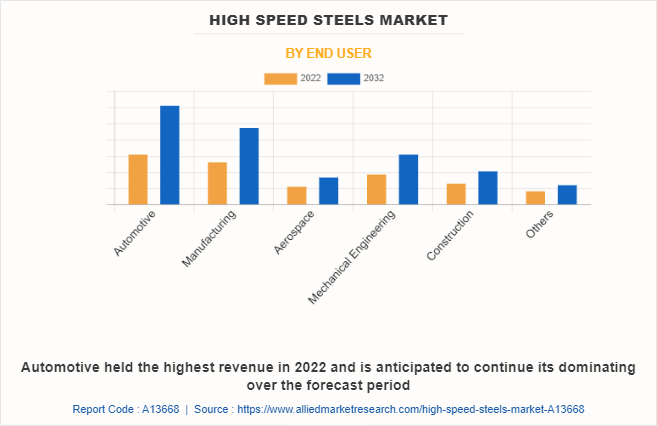

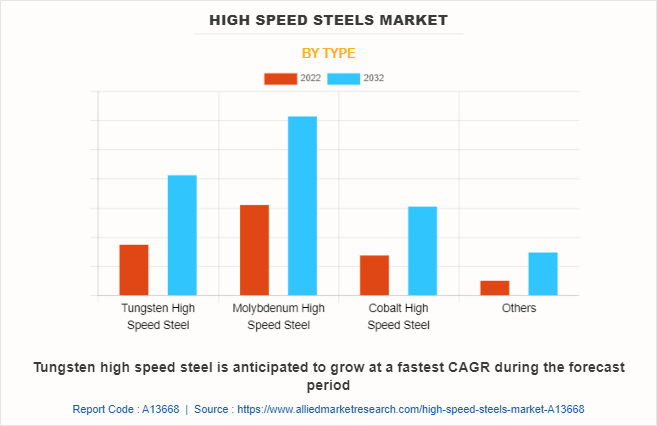

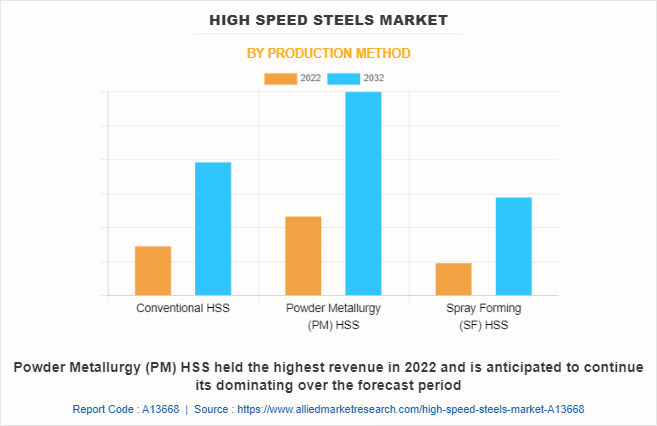

The highspeed steels market is segmented on the basis of type, production method, grade, end user, and region. By type, the market is divided into tungsten high speed steel, molybdenum high speed steel, cobalt high-speed steel, and others. By production method, the market is classified into conventional HSS, powder metallurgy (PM) HSS, and spray Forming (SF) HSS. By grade, the market is classified into M grade, T grade, and advance grade. By end user, the market is classified into automotive, plastic, aerospace, energy, manufacturing, mechanical engineering, construction, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The high speed steels market is segmented into Grade, End User, Type and Production Method.

By grade, the M grade sub-segment dominated the global high speed steels market share in 2022. The M series alloys have a lower tungsten concentration (between 1.25% and 10%).. This element, with a lower atomic weight, provides several similar benefits as tungsten. It has less hot hardness because of its lower melting point. The M series is widely considered as the go-to for the majority of tooling applications. Among these steels are M2, M3, M4, M7, and M42. All these factors are projected to drive the sub-segment growth in the upcoming years.

By end user, the automotive sub-segment dominated the global high-speed steels in 2022. The usage of high speed steels cutting tools in the production of automotive components has increased significantly. Drilling and fastening tools are the most commonly used tools for tightening fasteners, engine mounting, and other joint repairs. The car parts and chassis are smoothed and polished using sanders and angle grinders. With the global electric car industry developing at a rate of about 60% per year, additional production facilities and expansion are likely to drive up demand for cutting tools. This may be more noticeable in nations such as China, Japan, the U.S., and Western European nation, where EV manufacturing is expected to accelerate during the forecast period.

By type, the molybdenum high speed steel sub-segment dominated the market in 2022. Molybdenum high-speed steel (HSS) is a form of high-speed steel in which molybdenum is used as an alloying element. Molybdenum contributes to the steel's high-temperature strength and hardness. This allows molybdenum HSS to retain its performance and hardness even at high temperatures, making it suited for high-speed machining, cutting, and drilling applications. Molybdenum high-speed steel has excellent wear resistance, which is crucial for tools subjected to high-speed cutting or machining operations. The combination of high hardness, red hardness, and wear resistance allows molybdenum HSS to retain its sharpness and cutting performance for a longer time, resulting in improved tool life and productivity. All these factors are anticipated to drive the molybdenum high speed steel sub-segment growth.

By production method, the powder metallurgy (PM) HSS sub-segment dominated the global high speed steels market share in 2022. When compared to steels generated by conventional procedures, the powder manufactured steel formation process produces a homogeneous microstructure with a finer, more uniform carbide distribution, resulting in greater dimensional stability, grind ability, and toughness. This technology also enables the creation of more highly alloyed grades that would be impossible to make using traditional steelmaking methods.. It has grown in popularity as a tooling material for mechanical and CNC applications. It is suited for a wide range of users who grind, with the exception of procedures involving high-temperature alloys and exotics.

By region, North America dominated the global market in 2022. The region's strong economic progress, as well as increased investments in high-speed steels by various governments and major industrial players are factors projected to drive the regional market growth. Furthermore, rising middle-class earnings in the region are stimulating demand for a variety of commodities, which is driving the development of various sectors in North America. Therefore, industrialization in the region continues, supporting expansion of the North America high-speed steels industry. The rise in fabrication and construction projects in the U.S., is also a driving factor for the regional market growth.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the high speed steels market analysis from 2022 to 2032 to identify the prevailing high speed steels market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the high speed steels market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global high speed steels market trends, key players, market segments, application areas, and market growth strategies.

High Speed Steels Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 9.4 billion |

| Growth Rate | CAGR of 6.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 370 |

| By Grade |

|

| By End User |

|

| By Type |

|

| By Production Method |

|

| By Region |

|

| Key Market Players | ArcelorMittal, RUKO GmbH, Kennametal, NIPPON KOSHUHA STEEL CO., LTD., Sandvik AB, Amada Co., Ltd, Walter AG, OSG corporation, Proterial, Ltd., Kyocera |

| | Others |

The increasing use of high-speed steel in various industrial applications, as well as the growing demand from the aerospace industry, are the primary growth factors for the market. One of the primary drivers of the industry is the demand for high-speed steel in the shipbuilding and energy sectors. The growing usage of high-speed steel in the production of cutting tools is driving its demand in high speed steel in automotive industry.

The major growth strategies adopted by high-speed steels market players are investment and agreement.

North America will provide more business opportunities for the global high speed steels market in the future.

Sandvik AB, NIPPON KOSHUHA STEEL CO., LTD., Proterial, Ltd., ArcelorMittal, Amada Co., Ltd, OSG corporation, Kennametal, Kyocera, Walter AG, and RUKO GmbH Limited are the major players in the high-speed steels market.

The molybdenum high speed steel sub-segment of the type acquired the maximum share of the global high speed steels market in 2022.

Automotive, manufacturing, aerospace, and mechanical engineering industries are the major customers in the global high-speed steels market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global high-speed steels market from 2022 to 2032 to determine the prevailing opportunities.

Loading Table Of Content...

Loading Research Methodology...