High Temperature Polyamides Market Research, 2030

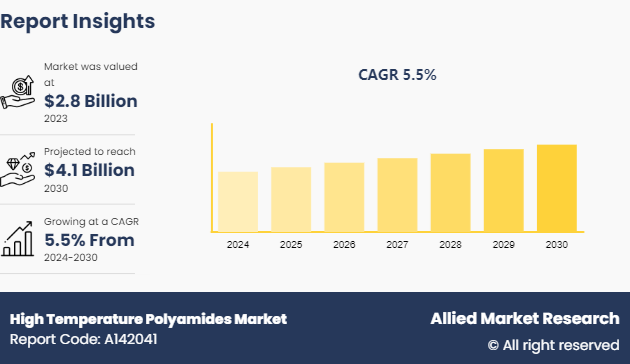

The global high temperature polyamides market was valued at $2.8 billion in 2023, and is projected to reach $4.1 billion by 2030, growing at a CAGR of 5.5% from 2024 to 2030.

Introduction

Polyamide is a versatile polymer with strong demand in a variety of end-user industries, including automotive, textiles, electronics, equipment, packaging, and coatings. Polyamides can be found in nature in the form of wool and silk, among other things. However high high-temperature polyamides are manufactured artificially. The artificially manufactured polyamides include nylon, polyamide 6, and aramid. Wear resistance, strong mechanical qualities, low gas permeability, and chemical resistance are the characteristics of artificial polyamides. Polyamide 6 is the most popular polyamide type in terms of revenue and usage attributed to its low cost-to-performance ratio.

Key Takeaways

- The high temperature polyamides market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

- More than 1, 500 product literature, industry releases, annual reports, and other documents of major high temperature polyamides industry participants, authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve the most ambitious growth objectives.

Market Dynamics

The high-temperature polyamide market is expected to witness significant growth, driven by increasing demand in the electrical and electronics sector. This fast-growing segment benefits greatly from the excellent electrical and mechanical properties of polyamide-6 (PA-6) , and polyamide-66 (PA-66) compounds, which include toughness, good dielectric strength, flame-retardant properties, and insulation resistance. These attributes make PA-6 ideal for use in a variety of components such as mobile phone connectors, computer motherboards, terminal blocks, and power tool housings. Furthermore, the cost-effectiveness and reliability of PA-6 have solidified its position in the market, particularly in emerging economies where the demand for advanced electrical and electronic devices continues to rise. This surge in demand is expected to propel the growth of the high-temperature polyamide market during the forecast period. For instance, according to the International Data Corporation (IDC) , the worldwide market for IoT solutions including intelligent systems, connectivity services, infrastructure, applications, security, analytics, and professional services has observed an annual growth rate of 20% CAGR”. IoT solution development largely depends on the electrical and electronics market.

The automotive industry, particularly the electric vehicle (EV) sector, plays a crucial role in the market dynamics of high-temperature polyamides. The trend towards lightweight vehicles for improved fuel efficiency and reduced CO2 emissions has led to a shift from traditional metal components to new materials and thermoplastics like PA-6, and PA-66. High-temperature polyamides offer significant advantages in terms of weight reduction and cost-effectiveness, making them an attractive alternative to metals in vehicle manufacturing. As the demand for electric vehicles increases globally, driven by environmental regulations and consumer preferences for eco-friendly transportation, the high-temperature polyamide market is expected to experience robust growth. The material's ability to be easily molded and mass-produced further enhances its appeal in the automotive industry. According to the International Energy Agency (IEA) , “14 million new electric cars were registered globally in 2023, bringing the total number of electric vehicles on the roads to 40 million. This represents a significant increase, with electric car sales in 2023 being 3.5 million higher than in 2022, marking a 35% year-on-year growth. Electric cars accounted for around 18% of all cars sold in 2023, with over 250, 000 new registrations each week throughout the year. Battery electric cars constituted 70% of the electric car stock in 2023”.

However, the market faces challenges due to fluctuating crude oil prices, which impact the production costs of key raw materials such as hexamethylene diamine, adipic acid, and caprolactam. These price volatilities hinder the growth of the high-temperature polyamide market by making raw material procurement unpredictable and costly. In addition, stringent government regulations and competition from elastomer-based alternatives pose further restraints. Despite these challenges, opportunities include favorable government policies promoting electric vehicles and ongoing R&D in specialty polyamides. Companies are investing in the development of advanced polyamides for various applications, including automotive and medical, which are expected to drive market growth. Innovations such as high-temperature polyamides, supported by regulatory incentives and increasing health consciousness, present significant growth prospects for the high-temperature polyamide market in the forecast period.

Patent Analysis

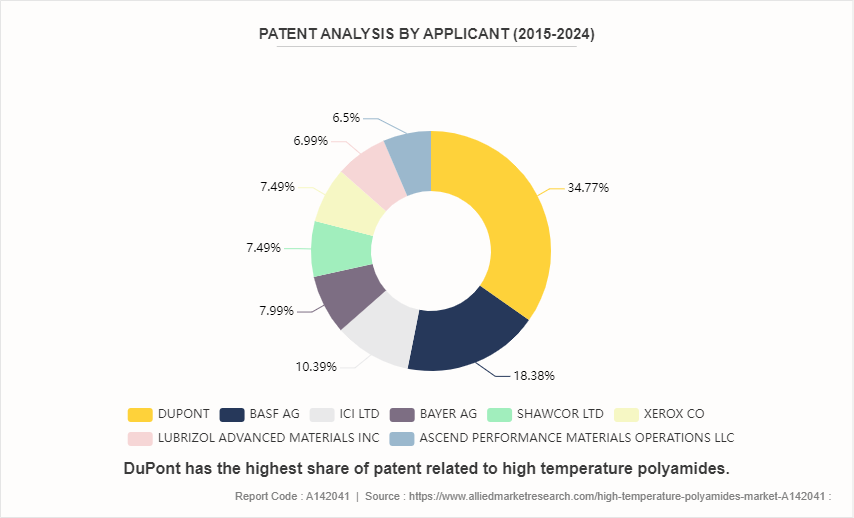

The patent analysis from 2015 to 2024 shows a robust interest and significant R&D investment in polyamides by leading global companies. DuPont leads the innovation race, followed by BASF AG, with other notable contributions from ICI Ltd., Bayer AG, Shawcor Ltd., Xerox Co, Lubrizol Advanced Materials Inc., and Ascend Performance Materials Operations LLC. This patent activity reflects the ongoing advancements and competitive dynamics within the polyamide market, driving the development of new materials and applications across various industries.

Segment Overview

The high temperature polyamides market is segmented into type, application, end-use industry, and region. By type, the market is divided into polyamide 6, polyamide 6-6, and others. By application, the market is classified into fiber and films, engineering plastics, and others. As per the end-use industry, the market is categorized into automotive, textile, consumer goods, electrical and electronics, construction, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Analysis

Key market players in the high temperature polyamides market include Koninklijke DSM N.V., Asahi Kasei Corporation, Evonik Industries AG, Dupont, BASF SE, Honeywell International Inc., Celanese Corporation, Lanxess AG, Invista Company, Huafon Group, Lealea Enterprises Co., Gujarat State Fertilizers & Chemicals Limited, Mitsubishi Chemical Holdings, Radici Group, and others.

Recent Key Developments in High Temperature Polyamides Market

- On 22 April 2024, BASF's sustainable polyamide PA6 and PA6.6 product range are certified as Recycled Claim Standard for textile applications. This label enables manufacturers to market certified textiles produced using recycled raw materials.

- On 26 September 2023, Asahi Kasei Group will showcase diversified material solutions for safe and compact EV batteries, improved connectivity and lightweight, as well as circular economy at Fakuma. The presence of diverse material solutions for EV batteries, a growing industry, has a positive impact on the high temperature polyamides market.

- On 16 October 2023, Celanese Launches announced the global commercial launch of two new polyamide solutions for Electric Vehicle (EV) powertrain components manufacturers and EV battery applications.

Industry Trends

- The demand for portable energy solutions has led to investment in energy harvesting textiles, driven by increasing research and interest in piezo/tribo and photovoltaic technologies. The increase in the investment towards the energy harvesting textile is expected to drive the demand for high temperature polyamide materials.

- In terms of the consumer goods industry, polyamide is widely used in power tools and garden equipment, ranging from handles, housings, and switches to motor parts, fuel tanks, and water pumps. Such exterior applications require superior esthetic properties and comfortable grip, for which polyamides with improved surface finish are particularly well-suited. The presence of an aging population in the major developed countries across the globe has led to an increase in outdoor activities related to gardening or other activities that require power tools. The demand for power tools is expected to have a positive impact on the demand of the high temperature polyamide market.

- Saudi Arabia's Vision 2030 aims to diversify the economy and reduce oil dependence. It includes significant infrastructure development, transforming the Public Investment Fund into a global sovereign wealth fund, and boosting real estate and construction. The National Investment Strategy will establish comprehensive investment plans for various sectors. This vision is expected to transform Saudi Arabia into a global hub. The transformation towards a global hub requires a high demand for high temperature polyamides which are widely used in various construction industries, especially in the high climatic countries such as Saudi Arabia.

Impact of High Temperature Polyamides on Textile Industry

High temperature polyamides (HTPAs) , commonly known as nylons, have revolutionized the textile industry with their unique combination of durability, strength, and thermal stability. These advanced materials are integral to various applications, ranging from everyday apparel to high-performance industrial textiles. Polyamides are extensively used in the textile industry to manufacture apparel, lingerie, hosiery, and activewear. HTPAs' excellent durability, strength, and abrasion resistance make them ideal for high-performance fabrics. Common applications include clothing items such as stockings, swimwear, sportswear, and lingerie, which benefit from the tensile strength and elasticity of polyamide fibers. In addition, home textiles like carpeting and upholstery utilize polyamides for long-lasting properties and resistance to wear and tear, while industrial applications, such as tire cords, ropes, and conveyor belts, leverage polyamide fibers for robustness and resistance to mechanical stress.

The properties of HTPAs that drive adoption in the textile industry include thermal stability, tensile strength, durability, abrasion resistance, and chemical resistance. HTPAs, such as nylon 6 and nylon 66, maintain properties at elevated temperatures, making them suitable for applications where heat resistance is crucial. HTPAs’ excellent tensile strength and durability ensure the longevity and reliability of the textiles, while high resistance to abrasion makes them perfect for high-wear applications, enhancing the lifespan of the products. Moreover, HTPAs’ resistance to chemicals and solvents allows polyamide textiles to withstand various cleaning processes without degrading.

The future of high temperature polyamides in the textile industry looks promising, driven by several key trends. Companies like BASF are expanding their polyamide portfolio with sustainable solutions for the textile industry that offer RCS-certified PA6 and PA6-6 recycled products that incorporate recycled materials to save fossil raw materials and reduce carbon footprints. Advancements in polyamide synthesis and fiber engineering are leading to enhanced performance characteristics, including improved heat resistance, greater elasticity, and better moisture management, which are crucial for high-performance textiles.

The move towards sustainable polyamides is driven by the need to reduce the textile industry's environmental footprint. Sustainable practices include the use of recycled polyamides in textile manufacturing, supporting a circular economy, reducing waste, and conserving resources. By incorporating recycled materials and optimizing production processes, the carbon footprint of polyamide textiles is significantly reduced. High temperature polyamides (HTPAs) have a profound impact on the textile industry, offering unmatched performance and versatility. HTPAs unique properties make them essential for a wide range of applications. With the ongoing shift towards sustainability and the development of bio-based polyamides, the future of HTPAs in the textile industry is set to grow, contributing to both high-performance textiles and environmental sustainability.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the high temperature polyamides market analysis from 2024 to 2030 to identify the prevailing high temperature polyamides market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the high temperature polyamides market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global high temperature polyamides market trends, key players, market segments, application areas, and market growth strategies.

High Temperature Polyamides Market Report Highlights

| Aspects | Details |

| Market Size By 2030 | USD 4.1 Billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2024 - 2030 |

| Report Pages | 300 |

| By Type |

|

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Koninklijke DSM N.V., Celanese Corporation, Gujarat State Fertilizers & Chemicals Limited, DuPont, LANXESS, Asahi Kasei Corporation, Evonik Industries AG, BASF SE, Mitsubishi Chemical Holdings, Honeywell International, Inc. |

Loading Table Of Content...