High Voltage Direct Current (HVDC) Transmission Market Research, 2032

The global high voltage direct current transmission market size was valued at $10.6 billion in 2022, and is projected to reach $23.7 billion by 2032, growing at a CAGR of 8.4% from 2023 to 2032.

Report Key Highlighters:

- The high voltage direct current transmission market study covers 20 countries. The research includes a segment analysis of each country in terms of both value ($million)for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The high voltage direct current transmission market share is highly fragmented, with several players including ABB Ltd, General Electric Company, Hitachi Ltd, Mitsubishi Electric Corporation, Nexans S.A., NR Electric Co., Ltd., Prysmian Group, Schneider Electric SE, Siemens, and Toshiba Corporation. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in the HVDC transmission industry.

High voltage direct current transmission is a technology used in the electrical energy industry to transmit large quantities of electricity over lengthy distances with reduced electricity losses. Unlike traditional alternating current (AC) transmission, which periodically reverses the route of electric-powered current, HVDC systems keep a constant go with the flow of electric-powered charge in a single direction.

HVDC transmission entails two converter stations, one at the sending cease and some other at the receiving end. At the sending end, AC energy is converted into high-voltage DC power, which is then transmitted via devoted cables or overhead traces over vast distances. At the receiving end, the DC electricity is transformed back into AC strength for distribution to consumers.

HVDC transmission gives a number of great blessings in the area of electrical strength transmission such as enhanced efficiency, long-distance capability, grid stability, and aid for renewable energy integration. HVDC systems are regarded for their decrease power losses during transmission, which end result from the absence of the skin impact and reduced reactive power losses related with alternating current (AC) transmission. In addition, HVDC transmits electricity over plenty longer distances with minimal power loss, making it perfect for interconnecting remote power generation sources with urban centers.

HVDC is ideal for undersea cable connections between landmasses or countries.

AC transmission encounters greater losses and other technical challenges over long undersea distances due to the capacitance of the cable. HVDC structures can correctly transmit electricity throughout oceans, making global interconnections feasible. HVDC systems can be used to enhance grid steadiness and frequency control. They are successful of shortly regulating energy flow, which is critical in maintaining a steady and reliable electrical grid. HVDC hyperlinks can grant dynamic aid to the grid by means of controlling the strength trade between different regions.

The integration of renewable energy sources, such as wind and photovoltaic power, into the electrical grid can be difficult due to their intermittent nature. HVDC transmission traces facilitate the connection of renewable strength generation facilities, even if they are located in remote areas. This enables the environment-friendly distribution of easy electricity to urban centers. In regions with congested or constrained AC transmission capacity, HVDC transmission can alleviate bottlenecks by using allowing extra power to go with the flow via the existing grid infrastructure. It can serve as a strategic solution to overcome transmission constraints and enhance grid reliability.

Voltage Source Converter (VSC) technology, an integral component in power systems and electrical engineering, transforms electrical strength efficiently.

High voltage direct current transmission industry finds applications in renewable electricity systems, grid stability, and high voltage DC transmission. VSCs excel in controllability and compatibility with renewables, making them quintessential in the transition to cleaner energy. They enable stable grid connections for large-scale wind and solar projects, mitigating the intermittency of renewables. All these factors drive the growth of the VSC technology in the excessive voltage direct present day transmission market in the course of the forecast period.

However, the increase in adoption of distributed and off-grid power generation such as rooftop solar panels and localized wind turbines, poses challenges for the high voltage direct present day transmission market. This trend reduces the demand for large-scale HVDC infrastructure as local energy options come to be extra cost-effective and practical. In addition, regulatory shifts towards distributed electricity systems and technological advancements in local generation further minimize the enchantment of HVDC. All these factors hamper the growth of the market.

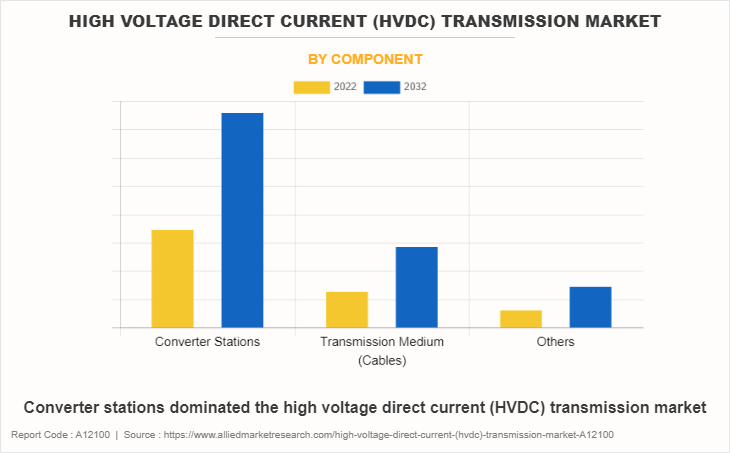

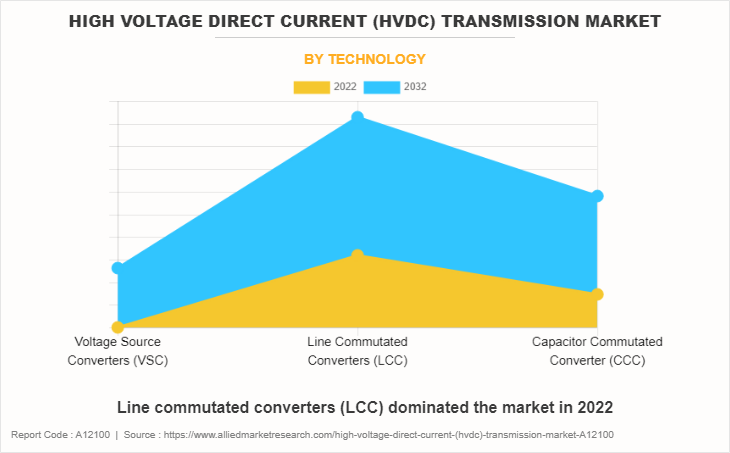

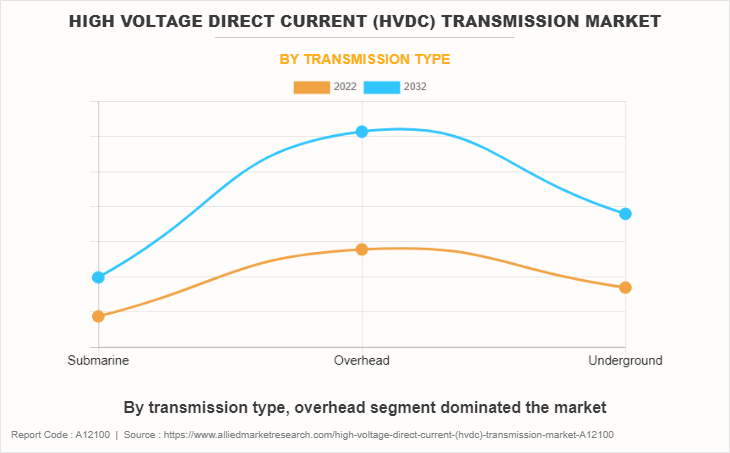

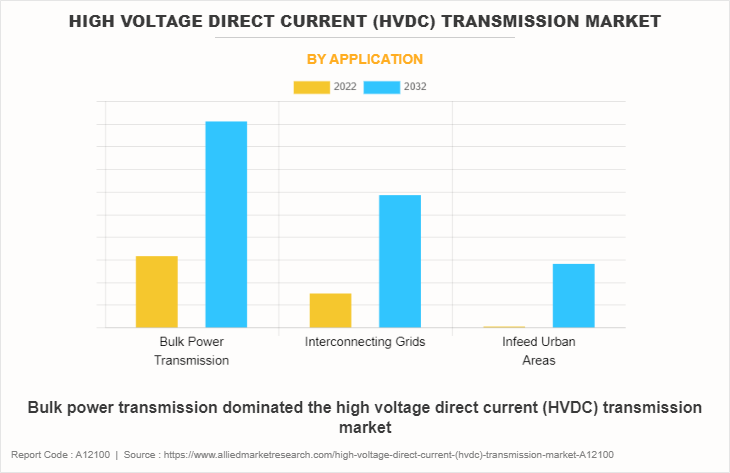

The high voltage direct current transmission market is segmented on the basis of component, technology, transmission type, application, and region. By component, the market is categorized into converter stations, transmission medium (cables), and others. By technology, the market is divided into voltage source converters (VSC), line commutated converters (LCC), and capacitor commutated converters (CCC). By transmission type, the market is classified into submarine, overhead, and underground. By application, the market is segregated into bulk power transmission, interconnecting grids, and infeed urban areas. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

HVDC converter stations are regularly used to interconnect two separate alternative current (AC) power grids. This enables power to flow between areas with exclusive frequencies or incompatibilities, facilitating the transfer of electricity over long distances. HVDC is specifically precious for undersea and underground cable systems. These scenarios frequently involve transmitting power over substantial distances, where power losses in AC traces can be significant. By changing the power to DC at one give up and again to AC at the other, these converter stations limit energy losses, making long-distance transmission greater efficient.

Line commutated converters (LCC) are more cost-effective for high-voltage, high-power applications compared to voltage source converters, making them attractive in budget-constrained HVDC projects, helping to control costs while achieving transmission objectives. They do not inherently support reactive electricity control, which is indispensable for voltage balance in AC grids. As a result, extra tools such as synchronous condensers or static compensators are wanted to manipulate reactive power and make certain the steadiness of the AC grid.

Overhead HVDC transmission lines have lower electricity losses compared to high voltage alternating contemporary (HVAC) lines, mainly for very long distances. This makes HVDC a suitable preference for transmitting electricity from faraway power generation sources like offshore wind farms. HVDC transmission typically includes converter stations at every end of the line, the place where AC electricity is converted to DC for transmission and then returned to AC at the receiving end. These converter stations are frequently located near the overhead transmission lines.

One of the primary reasons for the adoption of HVDC transmission market scope in bulk power transmission is its efficiency. In Alternating Current (AC) transmission systems, power loss happens due to factors such as resistance, inductance, and capacitance in the transmission lines. These losses expand with the length of the transmission lines, making it less environment friendly for long-distance energy transfer. HVDC transmission, on the different hand, operates at high voltage levels, reducing the present day and, consequently, the resistive losses. This efficiency benefit makes HVDC a appropriate choice for transmitting electricity over thousands of kilometers.

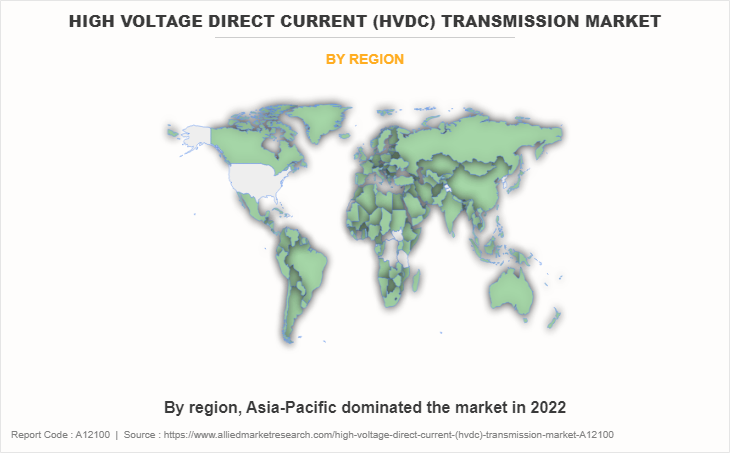

Many countries in the Asia-Pacific region are investing in grid modernization efforts to decorate the effectivity and reliability of their electrical grids. HVDC transmission systems are a key element of these efforts. They allow for higher control of power flow, decreased transmission losses, and accelerated voltage stability, all of which contribute to a greater current and resilient grid infrastructure.

Key players in the high voltage direct current transmission market scope include ABB Ltd, General Electric Company, Hitachi Ltd, Mitsubishi Electric Corporation, Nexans S.A., NR Electric Co., Ltd., Prysmian Group, Schneider Electric SE, Siemens, and Toshiba Corporation.

Apart from the above-listed companies, there are many companies in the high voltage direct current transmission market growth including CG Power and Industrial Solutions Ltd., Elatec Power Distribution GmbH, Viscas Corporation, Schneider Toshiba Inverter Europe, Excel Power, Trans Electric Co., Ltd., Kalpataru Power Transmission Limited, Jiangsu Longzhe Technology and Trade Co., Ltd., TBEA Energy (India) Private Limited, Shandong Electrical Engineering & Equipment Group Co., Ltd., BTW Energy, Isolux Corsán, Alstom Grid India Limited, and others.

Historical trends of high voltage direct current transmission market:

- In the early 1950s, the concept of HVDC transmission emerged. The first commercial HVDC transmission system, the Gotland HVDC link in Sweden, became operational in 1954, showcasing the potential of this technology for long-distance power transmission.

- The 1970s and 1980s marked a period of increased interest and innovation in HVDC technology. Notable projects, such as the Pacific HVDC Intertie in the U.S. and the Inga-Shaba HVDC link in the Democratic Republic of Congo, demonstrated the feasibility of long-distance HVDC transmission for power export and grid interconnection.

- During the 1990s, advancements in semiconductor technology, particularly the use of insulated gate bipolar transistors (IGBTs), improved the efficiency and control of HVDC converter stations. This decade saw a growing interest in HVDC projects for grid stabilization and interconnection in various regions worldwide.

- The early 2000s saw an acceleration of HVDC adoption as countries sought to integrate renewable energy sources into their grids. HVDC became a preferred choice for transmitting power from remote renewable energy generation sites to urban centers. Interconnections between countries, such as the European Union's NorNed and France-Spain interconnectors, expanded.

- The 2010s marked a period of rapid growth in HVDC technology, driven by the need for more efficient, long-distance transmission and the integration of offshore wind farms. Technological advancements, including voltage source converter (VSC) HVDC systems, further improved HVDC's capability to control power flow and stabilize grids.

- In the 2020s, HVDC transmission continued to gain prominence as a vital component of clean energy transition efforts. Projects, like the North Sea offshore grid and the integration of renewable energy sources across continents, demonstrated the potential for HVDC to facilitate large-scale renewable energy integration and cross-border energy trading.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the high voltage direct current transmission market analysis from 2022 to 2032 to identify the prevailing high voltage direct current (HVDC) transmission market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the high voltage direct current transmission market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the high voltage direct current transmission market opportunities.

- The report includes the analysis of the regional as well as global high voltage direct current transmission market trends, key players, market segments, application areas, and market growth strategies.

High Voltage Direct Current (HVDC) Transmission Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 23.7 billion |

| Growth Rate | CAGR of 8.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 325 |

| By Component |

|

| By Technology |

|

| By Transmission Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Toshiba Corporation., Prysmian Group, General Electric Company, Schneider Electric SE., ABB Ltd., Nexans S.A., Siemens AG, NR Electric Co., Ltd., Hitachi Ltd., Mitsubishi Electric Corporation |

Analyst Review

According to the opinions of various CXOs of leading companies, the high voltage direct current transmission market is expected to witness increased demand during the forecast period. The surge in focus toward renewable energy integration, grid modernization, reduced transmission losses, and environmental sustainability increases the demand for high voltage direct current transmission during the forecast period.

High voltage direct current transmission is a technology used in the field of electrical engineering to transmit electricity over long distances with minimal losses. In contrast to conventional alternating current (AC) transmission, which constantly changes the electric current's direction, high voltage direct current keeps the flow of electric charge consistently moving in one direction.

The integration of renewable energy sources drives market growth. HVDC ensures consistent energy supply by efficiently transporting electricity from diverse renewable sources to load centers. In addition, it enhances grid stability, counteracting voltage and frequency fluctuations, and optimizes the utilization of renewable resources by interconnecting energy farms. All these factors are expected to drive the growth of high voltage direct current transmission during the forecast period.

The leading application of high voltage direct current transmission market bulk power transmission, interconnecting grids, and infeed urban areas.

Focus on grid modernization and infrastructure development are the upcoming trends of high voltage direct current transmission market in the world.

Rise in demand for voltage source converter (VSC) technology and the Integration of renewable energy sources are the driving factors of high voltage direct current transmission market.

Rise in share of distributed and off-grid power generation are the restraint factor of high voltage direct current transmission market.

Asia-Pacific is the largest regional market for high voltage direct current transmission market.

Key players in the high voltage direct current transmission market include ABB Ltd, General Electric Company, Hitachi Ltd, Mitsubishi Electric Corporation, Nexans S.A., NR Electric Co., Ltd., Prysmian Group, Schneider Electric SE, Siemens, and Toshiba Corporation.

The global high voltage direct current (HVDC) transmission market was valued at $10.6 billion in 2022, and is projected to reach $23.7 billion by 2032, growing at a CAGR of 8.4% from 2023 to 2032.

Loading Table Of Content...

Loading Research Methodology...