Histology And Cytology Market Research, 2032

The global histology and cytology market size was valued at $7.2 billion in 2022, and is projected to reach $22.2 billion by 2032, growing at a CAGR of 11.9% from 2023 to 2032. The rising prevalence of chronic diseases, such as cancer, is a significant driver for the histology market. Histology and cytology techniques are crucial in the diagnosis and monitoring of various diseases. For instance, according to an article published in the National Library of Medicine in 2022, 1,918,030 new cancer cases and 609,360 cancer deaths are projected to occur in the United States, including approximately 350 deaths per day from lung cancer, the leading cause of cancer death. In addition, ongoing technological advancements in histology and cytology techniques, including automation, digital pathology, and molecular pathology, contribute to the growth of the market.

Additionally, the aging demographic is frequently linked to a higher prevalence of illnesses necessitating histological and cytological scrutiny. With the aging of the world's population, there's an anticipated surge in demand for diagnostic services. Furthermore, the increased recognition of the significance of early disease identification, combined with the introduction of screening initiatives, amplifies this demand, propelling growth in the histology and cytology market. Early detection not only enhances treatment outcomes but also diminishes healthcare expenses. For instance, as per the World Health Organization, by 2050, 80% of elderly individuals will reside in low- and middle-income nations.

Histology and cytology are vital disciplines that are necessary for closely analyzing tissue and cellular structures in diagnostic pathology. The intricate morphology and structure of biological materials are crucially uncovered by them, and this helps with the accurate detection and classification of many pathological illnesses, including malignant diseases. Histology examines tissues under a microscope to highlight their cellular and architectural characteristics, whereas cytology focuses on the inspection of individual cells and sometimes employs less invasive techniques such as Pap smears or small needle aspiration.

Key Takeaways

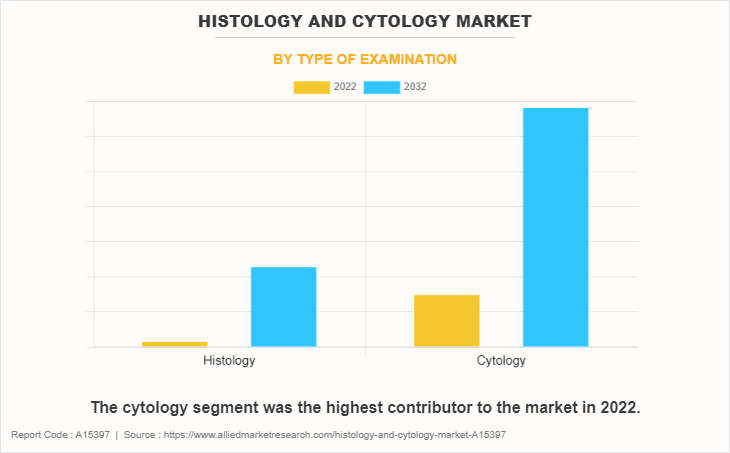

- By type of examination, the cytology segment was the highest contributor to the histology and cytology industry in 2022.

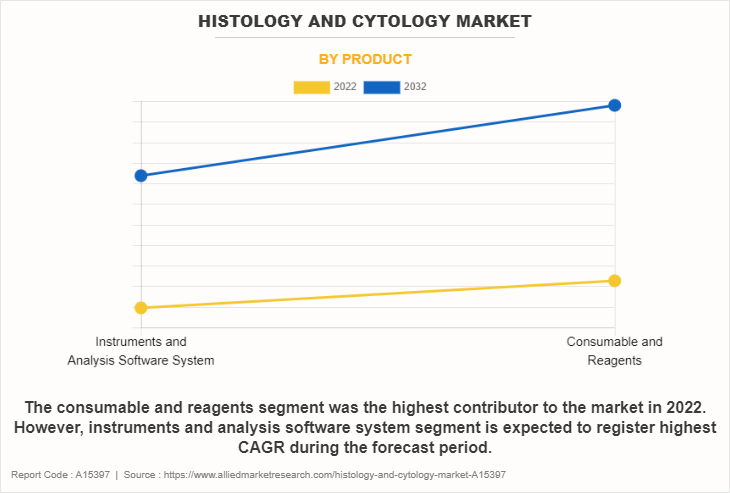

- By product, the consumable and reagents segment was the highest contributor to the market in 2022. However, instruments and analysis software system segment is expected to register highest CAGR during the forecast period.

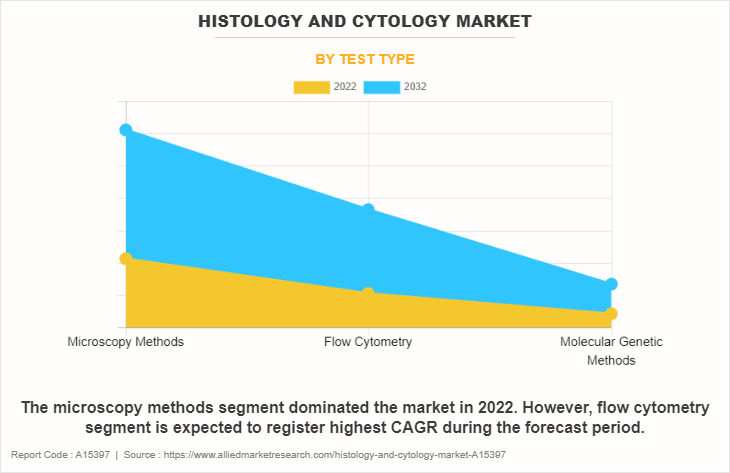

- By test type, the microscopy methods segment dominated the market in 2022. However, flow cytometry segment is expected to register highest CAGR during the forecast period.

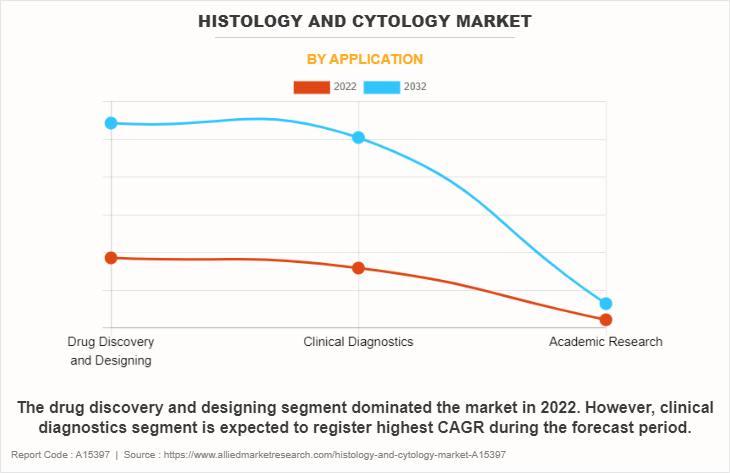

- By application, the drug discovery and designing segment dominated the market in 2022. However, clinical diagnostics segment is expected to register highest CAGR during the forecast period.

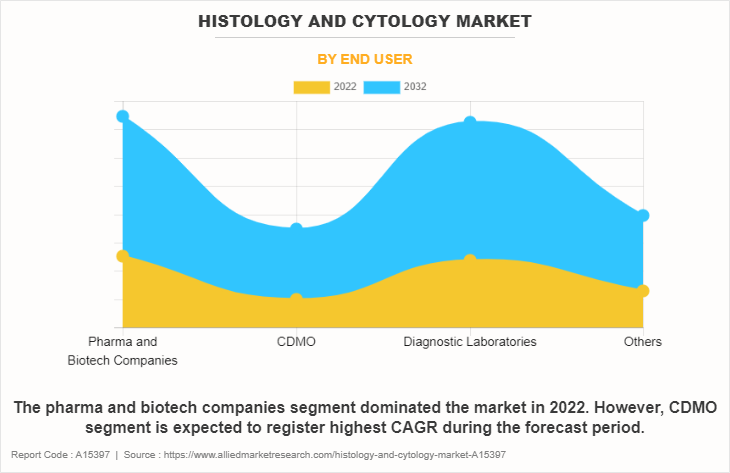

- By end user, the pharma and biotech companies segment dominated the market in 2022. However, CDMO segment is expected to register highest CAGR during the forecast period.

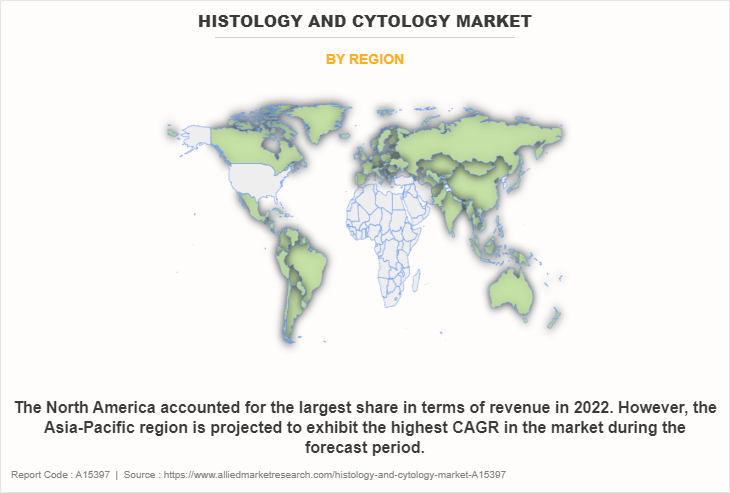

- On the basis of region, North America accounted for the largest histology and cytology market share in terms of revenue in 2022. However, Asia-Pacific is projected to exhibit the highest CAGR in the market during the forecast period.

Market Dynamics

In addition, the heightened focus on precision medicine and targeted therapies has further propelled the adoption of histology and cytology techniques, fostering collaboration between pharmaceutical companies and diagnostic laboratories. For instance, Dr. Lal PathLabs and Ibex Medical Analytics announced the first deployment of an AI platform in India that supports pathologists during routine cancer diagnosis and helps improve the quality and turnaround time of cancer tests. Galen is a clinical-grade, multi-tissue platform that helps pathologists detect & grade breast, prostate, and gastric cancer, along with more than a hundred other clinically relevant features. This collaborative approach aims to enhance the understanding of disease mechanisms, optimize treatment strategies, and ensure the safety and efficacy of pharmaceutical products. In addition, advancements in healthcare infrastructure and technology have created a favorable environment for the growth during histology and cytology market forecast.

In addition, the histology and cytology market size has witnessed a significant surge in adoption, primarily attributed to the widespread use of histological and cytological analysis in clinical diagnosis. Histological analysis involves the examination of tissue specimens under a microscope, providing detailed insights into the cellular architecture and identifying abnormalities that indicate various diseases, including cancer. Similarly, cytological analysis involves the study of individual cells, often obtained through minimally invasive procedures such as fine needle aspiration, enabling the early detection of abnormalities. The high adoption of histological and cytological analysis is attributed to their accuracy in identifying diseases at an early stage, and their ability to guide clinicians in formulating precise treatment plans. According to a 2022 report by the National Library of Medicine, in 2022, there were approximately 4,820,000 new cancer cases in China.

Segments Overview

The histology and cytology industry is segmented based on type of examination, product, test type, application, end user, and region. On the basis of type of examination, the market is bifurcated into histology and cytology. On the basis of product, the market is classified into instruments and analysis software system and consumable and reagents. On the basis of test type, the market is divided into microscopy methods, flow cytometry, and molecular genetic methods. On the basis of application, the market is segregated into drug discovery and designing, clinical diagnostics, and academic research.

On the basis of end user, the market is fragmented into pharma & biotech companies, CDMO, diagnostic laboratories, and others. Others include hospital and academic research. Region-wise, the histology market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

By Type of Examination

On the basis of type of examination, the cytology segment was the largest revenue contributor in 2022 and is expected to remain dominant during histology and cytology market analysis. This is attributed to the widespread adoption of cytological analysis for the diagnosis of various cancer cells in pharma and biotech companies and research and academic institutes. However, the histology market size is expected to register an 11.2% CAGR during the forecast period.

By Product

On the basis of product, the consumable and reagents segment was the largest revenue contributor in 2022, owing to the extensive use of consumables such as staining agents and other reagents in nearly every histological and cytological examination. However, the instruments and analysis software system segment is expected to register the highest CAGR during the histology and cytology market growth. This is attributed to the increase in launches of technologically advanced histology and cytology instruments by key players.

By Test Type

On the basis of test type, the microscopy methods segment was the major revenue contributor in the histology and cytology market in 2022, owing to the prevalent adoption of microscopic examination methods by numerous small and medium-scale laboratories with limited budgets. However, flow cytometry is expected to register the highest CAGR in the forecast. This is attributed to its several advantages in the analysis of individual cells and cellular components.

By Application

On the basis of application, the drug discovery and designing segment was the largest revenue contributor in the histology and cytology market in 2022, due to the pivotal role of histology and cytological analysis in the preclinical trial stage of drug candidates. However, the clinical diagnostics segment is expected to register the highest CAGR in the forecast. This is attributed to the increase in the role of cytological and histological studies in clinical diagnosis as there is a rise in the prevalence of chronic diseases such as cancer and infectious diseases.

By End User

On the basis of end user, the pharma and biotech companies segment was the largest revenue contributor in histology and cytology market 2022, owing to the fact that high adoption of histological and cytological analysis in drug development procedures. However, the CDMO segment is expected to register the highest CAGR in the forecast. This is attributed to the growing trend toward outsourcing clinical trials and drug development procedures.

By Region

On the basis of region, North America accounted for the largest histology and cytology market share in terms of revenue in 2022, owing to the increasing prevalence of chronic diseases, such as cancer, has led to a rising demand for diagnostic procedures like histology and cytology to detect and monitor these conditions. Advances in medical technology and imaging techniques have also propelled the market forward, enhancing the accuracy and efficiency of histological and cytological examinations. Moreover, the aging population in North America has led to a higher incidence of diseases that necessitate histopathological and cytological analysis, further driving market growth.

However, Asia-Pacific is projected to exhibit the highest CAGR in the histology market during the forecast period. This growth is attributed to rise in awareness about the importance of early disease detection and preventive healthcare measures. Furthermore, advancements in healthcare infrastructure, increases in healthcare expenditure, and rise in accessibility to diagnostic services in urban and rural areas contribute to the expanding market. The region's aging population has led to a surge in age-related diseases, necessitating more histopathological and cytological analyses.

In addition, technological advancements, such as digital pathology and automated cytology systems, are gaining traction and providing histology and cytology market opportunity for the key players in the Asia-Pacific region, improving the efficiency and accuracy of diagnostic procedures. Collaborations and partnerships between international and local healthcare organizations are fostering knowledge exchange and technology transfer, further boosting the histology and cytology market. Overall, the Asia-Pacific region's evolving healthcare ecosystem, coupled with the rising burden of diseases, is fueling the market growth.

Competition Analysis

Major players such as Becton, Dickinson, and Company, and F. Hoffmann-La Roche Ltd have adopted product launch, collaboration, agreement, and acquisition as key developmental strategies to improve the product portfolio of the histology market size. For instance, in May 2023, In May 2023, Becton, Dickinson, and Company announced the worldwide commercial launch of new-to-world cell sorting instrument featuring two breakthrough technologies that enable researchers to uncover more detailed information about cells that was previously invisible in traditional flow cytometry experiments.

Recent Developments in the Histology and Cytology Industry

- In November 2023, W&H is expanding its hygiene portfolio with the addition of a new Lexa Plus Class B sterilizer and a new, technologically advanced Assistina One maintenance device bringing added peace of mind to reprocessing and infection prevention for a dental practices workflow.

- In June 2023, Becton, Dickinson, and Company launched a new automated instrument that prepares samples for clinical diagnostics using flow cytometry, enabling a complete "walkaway" workflow solution designed to improve standardization and reproducibility in cellular diagnostics.

- In May 2023, Becton, Dickinson, and Company announced the worldwide commercial launch of new-to-world cell sorting instrument featuring two breakthrough technologies that enable researchers to uncover more detailed information about cells that was previously invisible in traditional flow cytometry experiments. BD FACSDiscover S8 Cell Sorter First to Combine Spectral Flow Cytometry with Real-Time Imaging Technology.

- In August 2022, Becton, Dickinson, and Company announced a collaboration agreement with Labcorp, a leading global life sciences company, creating a framework to develop, manufacture, market and commercialize flow cytometry-based companion diagnostics (CDx) intended to match patients with life-changing treatments for cancer and other diseases.

- In June 2022, F. Hoffmann-La Roche Ltd announced the launch of the BenchMark ULTRA PLUS system, its newest advanced tissue staining platform. The system enables quick and accurate test results, so clinicians make timely decisions regarding a patient's care journey.

- In June 2022, Becton, Dickinson and Company announced that it is expected to introduce new cell sorting technology at the International Society for Advancement of Cytometry (ISAC) CYTO 2022 conference that enables researchers to see and sort cells at speeds never before possible, which creates the potential to transform research and cell-based therapeutic development across a range of fields such as virology and oncology, as well as numerous disease states.

- In February 2022, Becton, Dickinson, and Company announced it has completed the acquisition of Cytognos, specializing in flow cytometry solutions for blood cancer diagnosis, minimal residual disease (MRD) detection and immune monitoring research for blood diseases.

- In December 2021, F. Hoffmann-La Roche Ltd announced the research use only (RUO) launch of three new automated digital pathology algorithms, uPath Ki-67 (30-9), uPath ER (SP1) and uPath PR (1E2) image analysis for breast cancer, which are important biomarkers for breast cancer patients.

- In September 2021, Becton, Dickinson, and Company announced the launch of a spectral-enabled cell analyzer, expanding current cell analyzer capabilities to at least 34 parameters with live spectral unmixing, enabling researchers to precisely analyze selected single cells from complex samples. The new BD FACSymphony A5 SE Cell Analyzer is a fluorescence-activated, spectral-enabled cell analyzer that offers researchers the ability to choose between spectral or compensation-based cell analysis to meet different flow cytometry needs.

- In October 2021, F. Hoffmann-La Roche Ltd announced that it entered into a collaboration with Ibex Medical Analytics. Under the agreement, the companies will jointly develop an embedded image analysis workflow for pathologists to seamlessly access Ibex's AI algorithms, insights, and decision support tools using NAVIFY Digital Pathology, the cloud version of Roche's uPath enterprise software.

- In November 2020, Matachana launched the S1500 sterilization Series. An innovative line of equipment that completes the range of bulk-capacity steam sterilizers, combining productivity and profitability.

- In September 2020, Midmark Corp., a leading dental solutions provider, recently announced the launch of its new Sterilizer Data Logger and the release of the updated Midmark M3 Steam Sterilizer. Both bring speed, simplicity, and compliance to instrument processing.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the histology and cytology market analysis from 2022 to 2032 to identify the prevailing opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global histology and cytology market trends, key players, market segments, application areas, and market growth strategies.

Histology and Cytology Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 298 |

| By Type of Examination |

|

| By Product |

|

| By Test Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Sysmex Corporation, F. Hoffmann-La Roche Ltd., Merck KGaA, Hologic, Inc., Becton, Dickinson, and Company, Trivitron Healthcare Private Limited, Danaher Corporation, Thermo Fisher Scientific, Inc., Koninklijke Philips N.V., Abbott Laboratories |

Analyst Review

The histology and cytology market has witnessed significant growth, primarily driven by the growth in the aging population and the growing pharmaceutical industry. The increasing prevalence of chronic diseases, coupled with advancements in diagnostic technologies, has driven the demand for histology and cytology tools across the region. Countries such as China, Japan, and India are experiencing a surge in healthcare investments, contributing to the expansion of diagnostic infrastructure. Moreover, the rise in awareness about early disease detection and the importance of preventive healthcare measures is fostering a growing demand for histopathology and cytology procedures.

In addition, the growing pharmaceutical industry in the developing region is expected to significantly contribute to the growth of the market. The growth of the pharmaceutical industry has resulted in increased research and development activities leading to a greater demand for histopathology and cytology analytical instruments. As pharmaceutical companies expand their operations and invest in innovative drug development, there is a growing demand for advanced diagnostic techniques to support preclinical and clinical trials.

Furthermore, North America dominated the market in terms of revenue in 2022 owing to an increase in prevalence of chronic disorders, the presence of major key players in the region and an increase in healthcare expenditure. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to availability of domestic market key players, surge in healthcare expenditure and rise in aging population necessitating increased diagnostic scrutiny in this region.

The total market value of the histology and cytology market is $7,190.17 million in 2022.

A. The market value of histology and cytology market in 2032 is $22,154.10 million.

The base year is 2022 in histology and cytology market.

The forecast period for histology and cytology market is 2023 to 2032.

The cytology segment is the most influencing segment in histology and cytology market owing to high adoption of the cytological analysis for of various cancer cells in cancer diagnosis.

The Hologic, Inc., F. Hoffmann-La Roche Ltd., Abbott Laboratories, Becton, Dickinson and Company, Danaher Corporation, Merck KGaA, Thermo Fisher Scientific, Inc., and Koninklijke Philips N.V. held a high market position in 2022.

The growth of the histology and cytology market is primarily driven by surge in adoption, primarily attributed to the widespread use of histological and cytological analysis in clinical diagnosis.

Histology and cytology represent pivotal disciplines within the realm of diagnostic pathology, playing integral roles in the comprehensive analysis of tissue and cellular structures.

Loading Table Of Content...

Loading Research Methodology...