HIV Drugs Market Research, 2032

The global HIV drugs market size was valued at $32.8 billion in 2022, and is projected to reach $51.1 billion by 2032, growing at a CAGR of 4.5% from 2023 to 2032. The growth of the HIV drugs market share is driven by the rise in demand of HIV drugs, increase in initiatives taken by various government associations to raise awareness about diagnosis and management of HIV and rise in cases of HIV. For instance, according to the Joint United Nations Program on HIV and AIDS (UNAIDS), 39 million [33.1 million–45.7 million] people globally were living with HIV in 2022. As per the same source, 1.3 million [1 million–1.7 million] people became newly infected with HIV in 2022. And 630,000 [480 000–880 000] people died from AIDS-related illnesses in 2022.

Key Takeaways:

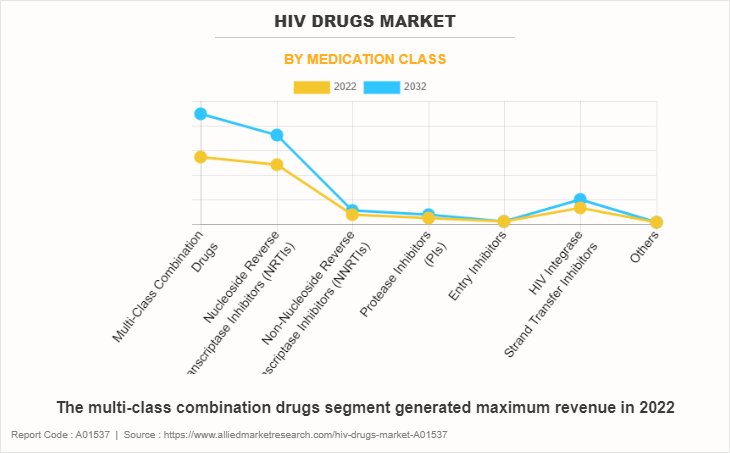

- The multi-class combination drugs segment held the largest share in the HIV drugs market in 2022.

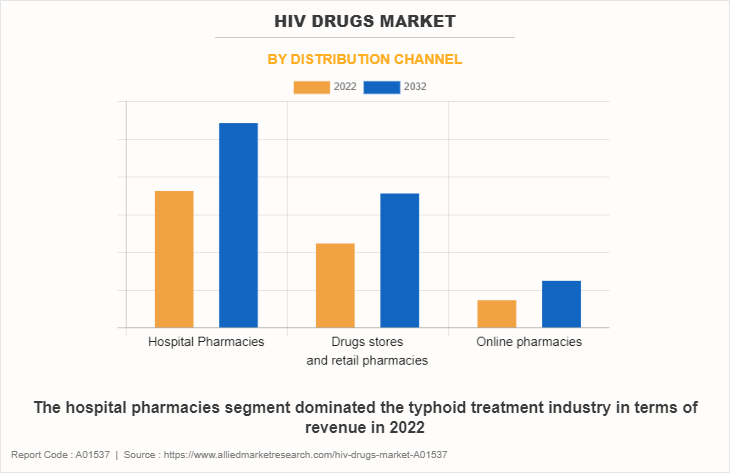

- The hospital pharmacies dominated the HIV drugs market in 2022.

- North America was the major shareholder in 2022. However, Asia-Pacific is expected to witness the highest CAGR during the forecast period.

Human immunodeficiency virus (HIV) is a chronic and life-threatening disease, which can be transferred from one person to another through blood-to-blood and sexual contact. It is a virus, which attacks immune cells known as CD-4 cells, making the body susceptible to infections and other diseases. Over the years, the rise in prevalence of HIV disease worldwide has positively influenced the demand for HIV drugs. HIV drugs help to prevent the multiplication of HIV virus, thereby reducing the risk of its transmission.

Market Dynamics

The pharmaceutical industry continues to invest in research and development efforts to better understand the underlying mechanisms of HIV and develop innovative therapies. This includes exploring new drug targets, conducting clinical trials, and investigating combination therapies. Therefore, the rise in research and development in drug discovery drives the growth of HIV drugs market size during the forecast period. For instance, in February 2023, Merck & Co., Inc., known as MSD, outside of the U.S. and Canada, announced that the company has opened enrollment in its new Phase 3 clinical program with investigational once-daily islatravir 0.25 mg in combination with doravirine 100 mg (DOR/ISL) for the treatment of HIV-1 infection.

Furthermore, the rise in awareness about HIV leads to more individuals seeking testing and diagnosis. This results in the identification of previously undiagnosed cases, subsequently increasing the demand for HIV drugs to initiate treatment. Thus, the rise in awareness about HIV can significantly drive the growth of the HIV drugs market. For instance, the U.S. Agency for International Development and various associations across the globe have introduced many initiatives and education campaigns for community awareness to address HIV prevention, treatment, and care.

The rise in funding for raising awareness and reducing the burden of HIV by various international programs and organizations drives the growth of HIV drugs market. Hence, such factors drive the growth of the HIV drugs therapeutics market.

Recession 2023 impact analysis on HIV Drugs Market

The recession can present challenges for the HIV drugs market, particularly for pharmaceutical companies engaged in R&D efforts. During economic downturns, funding constraints and reduced return on investment in pharma R&D may impede the progress of introducing new and innovative HIV drugs to the market. For instance, Deloitte's report in January 2023 showed that the projected return on investment in pharma R&D fell to 1.2%, the lowest in 13 years. In addition, the average cost of developing a new drug rose significantly, reaching $2.3 billion in 2022. This financial pressure may lead to slower development timelines and reduced focus on researching new drug for HIV and drug resistant HIV.

Despite these challenges, the overall demand for therapeutic drugs, including HIV drugs, remains relatively stable during economic downturns due to their essential role in treating health conditions. Moreover, the prevalence of HIV infections contributes to sustained demand for therapeutic drugs, in the face of a recession and is expected to drive the HIV drugs market growth.

Segmental Overview

The HIV drugs market is segmented on the basis of medication class, distribution channel, and region. On the basis of medication class, the HIV drugs market is categorized into multi-class combination drugs, nucleoside reverse transcriptase inhibitors (NRTIs), non-nucleoside reverse transcriptase inhibitors (NNRTIs), protease inhibitors (PIs), entry inhibitors, HIV integrase strand transfer inhibitors and others.

The multi-class combination drugs segment is further categorized into Atripla, Complera, Prezcobix, Stribild, Genvoya, Odefsey, Symtuza, Triumeq, descovy, dovato and others. The nucleoside reverse transcriptase inhibitors (NRTIs) segment is further categorized into Emtriva, Epivir, Epzicom, Truvada, biktavry and others. The non-nucleoside reverse transcriptase inhibitors (NNRTIs) segment is further categorized into Edurant and others. The protease inhibitors (PIs) segment is further categorized into Aptivus, Kaletra, Lexiva/ Telzir, Norvir, Viracept and others. The entry inhibitors segment is further categorized into Selzentry, Fuzeon and Rukobia. The HIV integrase strand transfer inhibitors segment is further categorized into Isentress, Tivicay, Apretude and Juluca.

On the basis of distribution channel, it is segregated into hospital pharmacies, drugs stores and retail pharmacies, and online pharmacies. On the basis of region, the HIV drugs market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and Rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and Rest of LAMEA).

By Medication Class

On the basis of medication class, the HIV drugs market is categorized into multi-class combination drugs, nucleoside reverse transcriptase inhibitors (NRTIs), non-nucleoside reverse transcriptase inhibitors (NNRTIs), protease inhibitors (PIs), entry inhibitors, and HIV integrase strand transfer inhibitors. The multi-class combination drugs segment generated maximum revenue in 2022, owing to high adoption of multi-class combination drugs for the treatment of HIV and the effectiveness of multi-class combination drugs against HIV. The same segment is expected to witness the highest CAGR during the forecast period, owing to an availability of various multi-class combination drugs product in pipeline and rise in preference of healthcare professional for multi-class combination drugs against HIV.

By Distribution Channel

The hospital pharmacies segment dominated the HIV drugs market in 2022, owing to high sales of drugs from hospital pharmacies and high number of HIV patient hospital for treatment. The online pharmacies segment is expected to witness the highest CAGR during the forecast period, owing to convenience in shopping, increase in e-commerce sales, improvements in logistics services, and ease in payment options. In addition, the easy accessibility and heavy discounts & offer provided by these online platforms drives the growth of online pharmacies during forecast period.

By Region

North America accounted for a major HIV drugs market share in 2022 and is expected to maintain its dominance during the forecast period. The presence of several major players, such as AbbVie Inc.; Bristol-Myers Squibb Company; Gilead Sciences, Inc.; Johnson & Johnson; and Merck & Co., Inc. and others; rise in number of clinical trials of HIV drugs; availability of advanced healthcare facilities; and high healthcare expenditure from the government organizations in the region drive the growth of the HIV drugs market.

Furthermore, the existence of a sophisticated reimbursement structure that aims to reduce expenditure levels fosters the growth of the HIV drugs market. In addition, the U.S. is anticipated to contribute to a major share of the regional market and is expected to drive the growth of the HIV drugs therapeutics market throughout the forecast period. The presence of key players, high purchasing power, rise in research and development activities regarding HIV drugs, and significant increase in capital income in developed countries.

Asia-Pacific is expected to grow at the highest rate during the forecast period. This is attributable to a rise in cases of HIV drugs as well as increase in purchasing power of populated countries, such as China and India. The countries in Asia-Pacific possess a huge population base, with China being the first having 1,411,778,724 population in 2020 and India being the second most populated country with 1,380,004,385 population in 2020. A rise in population along with longer life expectancy is thus expected to drive the growth of the market in Asia-Pacific during the HIV drugs market forecast period.

Competition Analysis

Competitive analysis and profiles of the major players in the HIV drugs therapeutics market, such as AbbVie Inc., Boehringer Ingelheim International GmbH, Bristol-Myers Squibb Company, Cipla, F. Hoffmann-La Roche Ltd., Gilead Sciences, Inc., GSK plc (ViiV Healthcare), Johnson & Johnson, Merck & Co., Inc., and Teva Pharmaceutical Industries Ltd. are provided in the report. There are some important players in the HIV drugs market such as AbbVie Inc., Bristol-Myers Squibb Company, Gilead Sciences, Inc., Johnson & Johnson, Merck & Co., Inc., and Teva Pharmaceutical Industries Ltd. These players have adopted product launch, product approval, clinical trials, and partnership as their key developmental strategies to improve their product portfolio.

Recent Product Launch in the HIV Drugs Market

In October 2020, Teva Pharmaceuticals USA, Inc., a U.S. affiliate of Teva Pharmaceutical Industries Ltd., announced the launch of the first Food and Drug Administration (FDA)-approved generic versions of TRUVADA (emtricitabine 200 mg/tenofovir disoproxil fumarate 300 mg) and ATRIPLA (efavirenz 600 mg/emtricitabine 200 mg/tenofovir disoproxil fumarate 300 mg) tablets in the U.S. Both the tablets are used for the treatment of HIV-1 infection.

In March 2022, Janssen Pharmaceutical a wholly owned subsidiary of Johnson & Johnson announced the U.S. Food and Drug Administration (FDA) has approved CABENUVA (cabotegravir and rilpivirine) for the treatment of HIV-1 in virologically suppressed adolescents' patients. Co-developed as part of a collaboration with ViiV Healthcare, CABENUVA is the first and only complete long-acting HIV-1 treatment regimen.

Recent Product Approval in the HIV Drugs Industry

In February 2023, ViiV Healthcare, a subsidiary of GlaxoSmithKline plc., announced the European Commission has granted Marketing Authorization for Triumeq, a dispersible tablet formulation of the fixed-dose combination of abacavir, dolutegravir, and lamivudine for the treatment of pediatric patients weighing 14 kg to 25 kg with human immunodeficiency virus type 1 (HIV-1).

In December 2022, Gilead Sciences, Inc. announced that Sunlenca (lenacapavir), in combination with other antiretroviral(s) (ARV), has been granted approval by the U.S. Food and Drug Administration (FDA) for the treatment of HIV-1 infection in heavily treatment-experienced (HTE) adults with multi-drug resistant (MDR) HIV-1 infection. Sunlenca has a multi-stage mechanism of action distinguishable from other currently approved classes of antiviral agents and no known cross resistance exhibited in vitro to other existing drug classes. Sunlenca offers a new, twice-yearly treatment option for adults with HIV that is not adequately controlled by their current treatment regimen.

In November 2022, Gilead Sciences, Inc. announced that the European Commission (EC) has authorized a new low-dose tablet dosage form of Biktarvy (bictegravir 30 mg/emtricitabine 120 mg/tenofovir alafenamide 15 mg tablets) and an extension of the indication for Biktarvy to treat HIV infection in virologically suppressed children who are at least two years of age and weigh at least 14 kg.

In May 2022, ViiV Healthcare, a subsidiary of GlaxoSmithKline plc., announced it obtained approval for Vocabria (cabotegravir injection and tablets) used in combination with Janssen Pharmaceutical Companies of Johnson and Johnson’s Rekambys and Edurant, the first and only complete long-acting treatment for HIV, from the Ministry of Health, Labor and Welfare (MHLW) in Japan.

In March 2022, Janssen Pharmaceutical Companies of Johnson & Johnson announced the U.S. Food and Drug Administration (FDA) has approved CABENUVA (cabotegravir and rilpivirine) for the treatment of HIV-1 in virologically suppressed adolescents (HIV-1 RNA less than 50 copies per milliliter [c/mL]) who are 12 years of age or older, weigh at least 35 kg and are on a stable antiretroviral regimen, with no history of treatment failure, nor known or suspected resistance to either cabotegravir or rilpivirine.

In October 2021, ViiV Healthcare, a subsidiary of GlaxoSmithKline plc., announced the U.S. Food and Drug Administration (FDA) approved a new low-dose tablet dosage form of Biktarvy for pediatric patients weighing at least 14 kg to less than 25 kg who are virologically suppressed or new to antiretroviral therapy.

Recent Partnership in the HIV Drugs Industry

In March 2020, AbbVie announced the collaboration with select health authorities and institutions globally to determine antiviral activity as well as efficacy and safety of lopinavir/ritonavir against COVID-19. AbbVie is supporting clinical studies and basic research with lopinavir/ritonavir, working closely with European health authorities and the U.S. Food and Drug Administration, Centers for Disease Control and Prevention, National Institutes of Health and Biomedical Advanced Research and Development Authority to coordinate on these efforts.

In July 2023, Gilead Sciences, Inc. announced that the two public-private partnerships. The first will accelerate the development of an investigational dispersible pediatric formulation containing emtricitabine and tenofovir alafenamide (F/TAF) for HIV treatment. The second aims to develop investigational pediatric formulations of TAF and sofosbuvir (SOF) designed to eliminate bitterness.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the HIV drugs market analysis from 2022 to 2032 to identify the prevailing HIV drugs market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the HIV drugs market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global HIV drugs market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global HIV drugs market trends, key players, market segments, application areas, and HIV drugs market growth strategies.

HIV Drugs Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 51.1 billion |

| Growth Rate | CAGR of 4.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 35 |

| By Medication Class |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | GlaxoSmithKline plc, Bristol-Myers Squibb Company, Johnson & Johnson, Teva Pharmaceutical Industries Ltd., Gilead Sciences, Inc., Cipla Ltd., Merck & Co., Inc., AbbVie Inc., Boehringer Ingelheim International GmbH, F. Hoffmann-La Roche Ltd. |

Analyst Review

This section provides opinions of top level CXOs in the HIV drugs market. According to the insights of the CXOs, the HIV drugs market is projected to grow at a notable pace due to surge in cases of HIV.

As per the perspectives of CXOs, advancements in HIV drugs, increase in awareness and diagnosis rate of HIV drive the demand for HIV drugs. The CXOs further added that the demand for new HIV drugs options is on continuous rise due to research and development of HIV drugs, increase in healthcare expenditure and rise in patient advocacy and support. Moreover, emerging markets gain importance for the majority of the HIV drugs manufacturers and distributors, as they focus on unmet demand for treating diseases. Hence, many companies have started introducing advanced products to cater to the needs of a growth in population, especially in developing economies.

North America garnered the highest market share in 2022 and is expected to maintain its lead during the forecast period, in terms of revenue, owing to availability of robust healthcare infrastructure, strong presence of key players, and rise in healthcare expenditure. However, Asia-Pacific is anticipated to witness notable growth owing to increase in use of HIV drugs, high unmet medical demands, presence of high population base, and increase in public–private investments in the healthcare sector.

The base year is 2022 in HIV drugs market report.

The estimated industry size of HIV Drugs is $32.80 billion in 2022

The key trends of HIV Drugs Market are rise in number of research regarding HIV drugs, increase in number of patients suffering from HIV and rise in diagnosis rate of HIV.

The forecast period for HIV drugs market is 2023 to 2032.

The estimated industry size of HIV Drugs is $51.1 billion in 2032

The medication class is the leading segment of HIV Drugs Market

North America is the largest regional market for HIV Drugs

The Gilead Sciences, Inc., GSK plc (ViiV Healthcare), Johnson & Johnson, Merck & Co., Inc., and Teva Pharmaceutical Industries Ltd are the top companies to hold the market share in HIV Drugs

Yes, competitive analysis included in HIV drugs market report.

Loading Table Of Content...

Loading Research Methodology...