HIV Injection Market Research, 2033

The global HIV injection market was valued at $1 billion in 2023, and is projected to reach $5.5 billion by 2033, growing at a CAGR of 17.9% from 2024 to 2033. Further, according to the Centers for Disease Control and Prevention, the U.S. had an estimated 1.2 million HIV-positive individuals at the end of 2021, and among them, over 87% were aware of their HIV status. Moreover, according to U.S. Department of Health and Human Services number of HIV positive individuals in 2022, were about 39 million worldwide. According to the Joint United Nations Programme on HIV/AIDS (UNAIDS) about 29.8 million people were accessing antiretroviral therapy in 2022. Thus, rise in cases of HIV led to increase in demand for HIV injections, which drives the market growth.

Key Takeaways of HIV Injection Market Report

Key Takeaways of HIV Injection Market Report

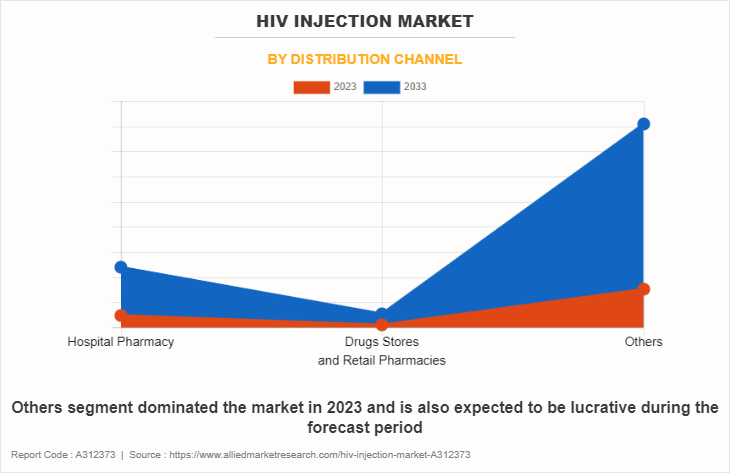

• By distribution channel, the others segment dominated the HIV injection market share in terms of revenue in 2022.

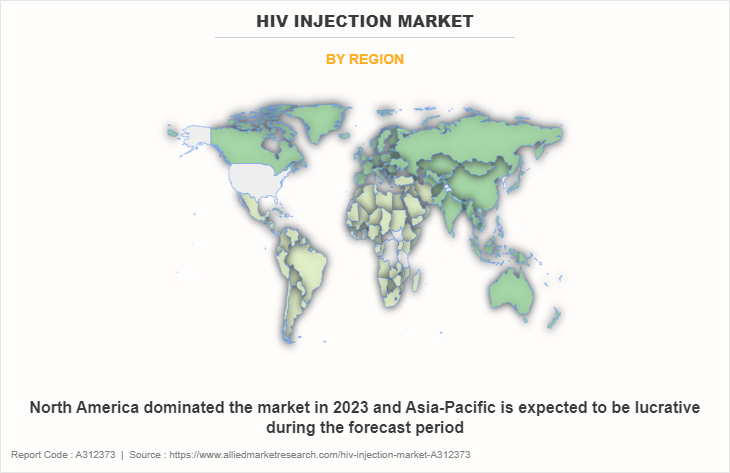

• By region, North America dominated the HIV injection market size in terms of revenue in 2022. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Human Immunodeficiency Virus (HIV) is a virus that attacks the immune system, specifically the CD4 cells (T cells), which help the immune system fight off infections. HIV is primarily transmitted through unprotected sexual intercourse, sharing of contaminated needles or syringes, and from an infected mother to her child during childbirth or breastfeeding. People at risk of contracting HIV may use pre-exposure prophylaxis (PrEP), which involves taking medication regularly to reduce the risk of HIV infection. In addition, antiretroviral therapy (ART) is a common treatment for those living with HIV to manage the virus and maintain a healthy immune system.

Market Dynamics

The HIV injection market trends include rise in global awareness to combat HIV, which has resulted in increased demand for HIV injections for treatment. As more individuals are identified as HIV positive, it led to rise in the demand for antiretroviral therapies such as injectable treatments. In addition, convenience and potential advantages of injectable formulations over traditional oral medications contribute to their growing popularity. Injectable treatments, in some cases, offer prolonged release mechanisms, reducing the frequency of administration and improving patient adherence to the prescribed regimens. This can lead to better disease management and a reduction in the risk of drug resistance. Thus, benefits offered by injectable formulations supports the HIV injection market growth.

Furthermore, government initiatives, non-profit organizations, and pharmaceutical companies working collaboratively to address the global HIV cases play a pivotal role in boosting the HIV injection market opportunity. Subsidized programs, increased funding for R and D, and partnerships aimed at improving access to these injections in resource-limited settings have all contributed to the market expansion. For instance, in February 2021, Gilead Sciences, Inc. announced a new partnership with the Wake Forest University School of Divinity, one of the leading academic and faith-based institutions in the U.S., as part of the company’s ongoing COMPASS Initiative. Through COMPASS, Gilead works with non-profit and academic institutions, which serve as coordinating centers that direct support to local community organizations through grants, training and collaborative learning opportunities to help mitigate the HIV epidemic in the Southern U.S.

Moreover, the pharmaceutical industry's commitment to HIV R and D has been a driving force in shaping the HIV injection market. Significant investments in clinical trials, exploring new drug formulations and delivery mechanisms, have yielded groundbreaking results. The pursuit of more effective and convenient treatment options has propelled the HIV injection market forecast. Funding for research and development, as well as support for access to treatment, has accelerated the introduction of innovative injectable therapies.

Further, collaboration between governments, non-profit organizations, and pharmaceutical companies has facilitated the development and distribution of these critical interventions which is expected to drive the market growth. However, the regulatory process for approving medical treatments, including HIV injections, involves rigorous evaluations to ensure safety, efficacy, and quality standards which may limit the adoption of HIV injections and restrain the market growth.

During economic downturns, individuals and governments may face financial constraints, leading to reduced healthcare spending. This could potentially affect the accessibility and affordability of HIV injections, especially in regions where healthcare resources are already limited. People may delay or forgo seeking medical treatment, including preventive measures like vaccinations, due to financial concerns. Despite these challenges, the HIV injection market continues to experience moderate revenue growth owing to the urgency and critical nature of HIV, and is projected to drive increased attention and investment in R and D. Thus, the HIV injection market is moderately impacted by recession.

Segmental Overview

The HIV injection market analysis is segmented into distribution channel and region. By distribution channel, the market is classified into hospital pharmacy, drug stores and retail pharmacies, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Distribution Channel

The others segment held the largest HIV injection market size in 2022 and is expected to register the highest CAGR during the forecast period, owing to their ability to provide convenient, accessible, and specialized services that align with evolving patient needs and preferences. In addition, the convenience and accessibility offered by online platforms align with the growing trend of digital healthcare services further drive the segment growth.

By Region

The HIV injection market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major HIV injection market share of the HIV injection market in 2022 and is expected to maintain its dominance during the forecast period. The presence of several major players, such as GlaxoSmithKline plc, Johnson and Johnson, Gilead Sciences, Inc., and F. Hoffmann-La Roche Ltd, in the region drives the growth of the market. In addition, high healthcare expenditure, government initiatives and policies in supporting R and D activities for innovative treatment options for HIV, are driving the demand for HIV injection.

Asia-Pacific offers profitable opportunities for key players operating in the HIV injection market, thereby registering the fastest growth rate during the forecast period, owing to growth in awareness of HIV and increase in healthcare expenditure are creating a demand for advanced drug therapies. In addition, government support, coupled with collaborations and funding, facilitates the availability and accessibility of HIV injection therapies, fostering market growth in this region.

Competition Analysis

Competitive analysis and profiles of the major players in the HIV injection industry, such as GlaxoSmithKline plc, Johnson and Johnson, Gilead Sciences, Inc., ImmunityBio, Inc., F. Hoffmann-La Roche Ltd, Theratechnologies Inc., Viriom, Inc., Shionogi & Co., Ltd., AbbVie Inc., and Brii Biosciences are provided in this report. Major key players have adopted product approvals, partnership, expansion, agreement, and clinical trial as key developmental strategies to improve the product portfolio of the HIV injection market.

Recent Developments in the HIV Injection Industry

In October 2023, ViiV Healthcare, the global specialist HIV company with majority owned by GSK announced that the National Medical Products Administration (NMPA) of China approved Vocabria (cabotegravir injection) used in combination with the Janssen Pharmaceutical Companies of Johnson & Johnson's Rekambys (rilpivirine long-acting injection) for the treatment of HIV-1 infection.

In September 2023, ViiV Healthcare, the global specialist HIV company with majority owned by GSK, announced that the European Commission has authorised Apretude (cabotegravir long-acting (LA) injectable and tablets) for HIV prevention.

In May 2022, ViiV Healthcare, the global specialist HIV company with majority-owned by GSK announced that it has received approval for Vocabria (cabotegravir injection and tablets) used in combination with Janssen Pharmaceutical Companies of Johnson & Johnson’s Rekambys (rilpivirine long-acting injectable suspension) and Edurant (rilpivirine tablets), the first and only complete long-acting treatment for HIV, from the Ministry of Health, Labour and Welfare (MHLW) in Japan.

In March 2022, the Janssen Pharmaceutical Companies of Johnson & Johnson announced the U.S. Food and Drug Administration (FDA) has approved CABENUVA (cabotegravir and rilpivirine) for the treatment of HIV-1 in virologically suppressed adolescents who are 12 years of age or older, weigh at least 35 kg and are on a stable antiretroviral regimen, with no history of treatment failure, nor known or suspected resistance to either cabotegravir or rilpivirine

In February 2021, Gilead Sciences, Inc. announced a new partnership with the Wake Forest University School of Divinity, one of the leading academic and faith-based institutions in the U.S., as part of the company’s ongoing COMPASS Initiative. Through COMPASS, Gilead works with non-profit and academic institutions, which serve as coordinating centers that direct support to local community organizations through grants, training and collaborative learning opportunities to help mitigate the HIV epidemic in the Southern U.S.

In February 2023, Gilead Sciences, Inc. announced data evaluating lenacapavir in combination with broadly neutralizing antibodies (bNAbs) teropavimab and zinlirvimab as a potential long-acting treatment regimen with twice-yearly dosing.Results fromthe Phase 1b clinical trial demonstrated the investigational combination was generally well tolerated with high efficacy in select virologically suppressed participants living with HIV.

In January 2022, ImmunityBio, Inc., a clinical-stage immunotherapy company announced promising study results that demonstrate the activation of CD4+ and CD8+ T cells and natural killer (NK) cells in people living with HIV by ImmunityBio’s IL-15 superagonist Anktiva (N-803). Anktiva stimulates latent HIV replication (the “kick”) in CD4 memory cells allowing the previously hidden infected cells to be revealed and eliminated (the “kill”) by CD8 and NK cells.

In October 2021, Theratechnologies Inc., a biopharmaceutical company focused on the development and commercialization of innovative therapies, is pleased to announced that it has reached an agreement with the Italian Medicines Agency, AIFA, for the reimbursement of Trogarzo for eligible people aged 18 and older living with multi-drug resistant (MDR) HIV-1.

In March 2021, Gilead Sciences, Inc. and Merck, known as MSD outside the United States and Canada announced that they have entered into an agreement to co-develop and co-commercialize long-acting treatments in HIV that combine Gilead’s investigational capsid inhibitor, lenacapavir, and Merck’s investigational nucleoside reverse transcriptase translocation inhibitor, islatravir,into a two-drug regimen with the potential to provide new, meaningful treatment options for people living with HIV.

In September 2021, Shionogi & Co., Ltd. announced that it entered into an out-licensing agreement with ViiV Healthcare, the global specialist HIV company with majority owned by GlaxoSmithKline to develop third-generation HIV integrase inhibitor with potential for use in ultra long-acting HIV regimens.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hiv injection market analysis from 2023 to 2033 to identify the prevailing hiv injection market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the hiv injection market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global hiv injection market trends, key players, market segments, application areas, and market growth strategies.

HIV Injection Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 5.5 billion |

| Growth Rate | CAGR of 17.9% |

| Forecast period | 2023 - 2033 |

| Report Pages | 197 |

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Brii Biosciences, AbbVie Inc., GlaxoSmithKline plc, Gilead Sciences, Inc., ImmunityBio, Inc., F. Hoffmann-La Roche Ltd., Johnson & Johnson, Viriom, Inc., Theratechnologies Inc., Shionogi & Co., Ltd. |

Analyst Review

This section provides various opinions of top-level CXOs in the global HIV injection market. According to the insights of CXOs, the global HIV injection market is expected to exhibit high growth potential due to rise in investments for R&D activities, increase in demand for sophisticated healthcare facilities, and rise in healthcare expenditure. However, stringent regulatory process for drugs and delay approval limits the growth of the HIV injection market??

CXOs further added that rise in adoption of HIV injections, increase in awareness, and rise in diagnosis rate of HIV drive the demand for HIV injections. In addition, emerging markets gain importance for the majority of the HIV drugs manufacturers and distributors, as they focus on unmet demand for treating diseases. Thus, many companies have started introducing advanced products and growing healthcare infrastructure, especially in developing economies which further supports market growth.?

Furthermore, North America dominated the market share in 2023, in terms of revenue, owing to surge in cases of cancer, easy availability of drugs, availability of robust healthcare infrastructure, strong presence of key players, and high healthcare expenditure in this region. However, Asia-Pacific is anticipated to witness notable growth owing to surge in use of HIV injections, high unmet medical demands, presence of high population base, and increase in public–private investments in the healthcare sector.?

The HIV injection market refers to the pharmaceutical sector focused on the development, manufacturing, and distribution of injectable treatments for individuals living with HIV. These injections often include antiretroviral therapies (ART) and other medications designed to manage and control the progression of the virus.

The others segment holds the largest market share in 2023. This is attributed to the convenience, accessibility, and personalized support offered by online platforms, aligning with the evolving trend of digital healthcare services.

Key driving factors include the rise in prevalence of HIV, advancements in treatment modalities, patient preference for injectable therapies, government initiatives and funding, evolving healthcare policies, substantial research and development investments, awareness campaigns, and collaborations within the pharmaceutical industry.

Top companies such as GlaxoSmithKline plc, Gilead Sciences, Inc., Johnson & Johnson, F. Hoffmann-La Roche Ltd., and Theratechnologies Inc. held a high market position in 2023. These key players held a high market position owing to the strong geographical foothold in North America, Europe, Asia-Pacific, and LAMEA.

The base year is 2023 in HIV injection market .

The market value of HIV injection market in 2033 is $5.5 billion

The forecast period for HIV injection market is 2024 to 2033.

The total market value of HIV injection market is $1.0 billion in 2023.

Loading Table Of Content...

Loading Research Methodology...