HOA Property Management Software Market Research, 2032

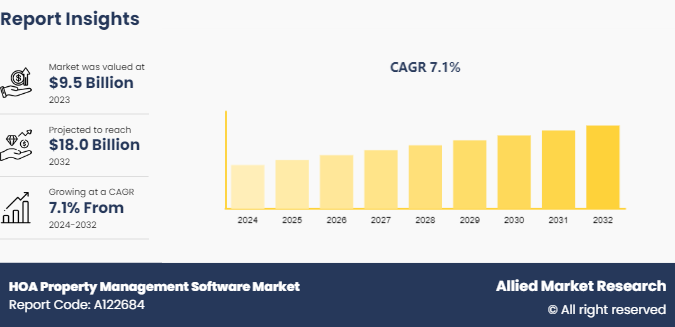

The global hoa property management software market was valued at $9.5 billion in 2023, and is projected to reach $18.0 billion by 2032, growing at a CAGR of 7.1% from 2024 to 2032. Within the larger property management software market, the segment that primarily serves the requirements of homeowners associations and community management businesses is known as the HOA (Homeowners Association) Property Management Software Market.

Market Introduction and Definition

The purpose of this specialized software is to manage residential communities by automating and streamlining a variety of duties and processes, including monitoring community amenities, keeping track of dues and payments, interacting with residents, and managing repair requests. The capacity of HOA property management software to compile and arrange vital data about property owners, occupants, vendors, and community assets is a crucial feature. The program makes it possible to save and retrieve this data on a consolidated platform, which streamlines community operations administration and improves stakeholder communication. The financial management features of HOA property management software are another crucial aspect. Typically, the program comes with features for creating financial reports, tracking spending, fees, and due dates, as well as for enabling online payments. Informed budgetary decisions are made possible, timely dues collection is ensured, and correct financial records are maintained by HOAs and community management businesses. Furthermore, communication options that facilitate smooth communication between property managers, board members, residents, and vendors are frequently included in HOA property management software. Automated alerts, message boards, and community forums are among the few of the features that increase resident satisfaction, encourage community involvement, and improve transparency.

Key Takeaways

The HOA property management software market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected HOA property management software market forecast period 2024-2032.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major HOA property management software industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights and HOA property management software market size.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The HOA Property Management Software Market is being primarily driven by the increasing adoption of technology in the real estate sector. Property management software offers HOAs and community management companies the ability to streamline operations, improve communication, and enhance overall efficiency. This technological advancement is a key driver for the market as it enables property managers to automate tasks, reduce manual errors, and provide better services to residents. Additionally, the growing trend towards smart homes and connected communities is creating a demand for software solutions that can integrate with IoT devices and provide data-driven insights for better decision-making. However, there are certain restraints that may impact the growth of the HOA Property Management Software Market. One of the main challenges is the resistance to change from traditional methods of property management. Some HOAs may be hesitant to invest in new software solutions due to concerns about implementation costs, training requirements, and data security. Moreover, the complexity of transitioning from legacy systems to modern software platforms can pose a barrier for adoption, especially for smaller HOAs with limited resources. Moreover, there are significant opportunities for growth in the HOA property management software market. The increasing focus on sustainability and energy efficiency in residential communities presents an opportunity for software vendors to develop solutions that help HOAs monitor and optimize resource consumption. Additionally, the rise of remote work and virtual communication in the wake of the COVID-19 pandemic has highlighted the need for digital tools that enable remote management of properties. This shift towards remote operations opens up new possibilities for software providers to offer cloud-based solutions that support flexible and efficient property management practices.

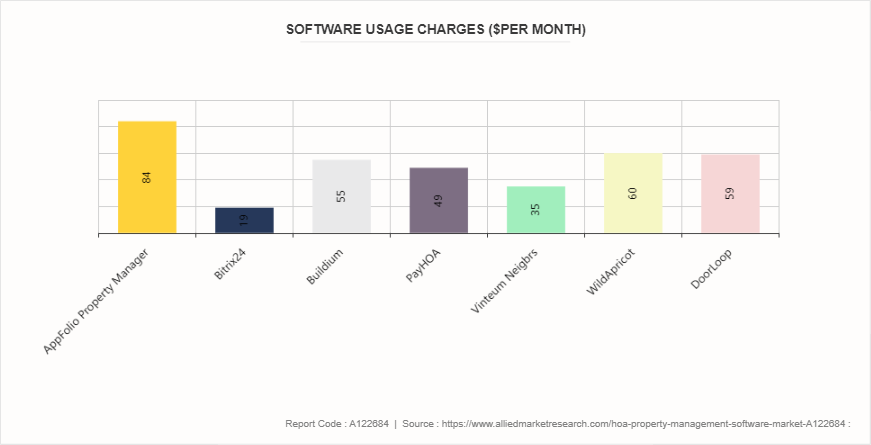

Software Usage Charge of Global HOA Property Management

Buildium and AppFolio Property Manager are two of the most popular platforms in the HOA property management market, out of all the possibilities for software. Property managers are well-served by AppFolio Property Manager's extensive feature set, which includes tools for accounting, maintenance, leasing, and communication. For homeowners associations and community management businesses searching for an all-in-one solution, its powerful features and easy-to-use interface make it a popular option. Another strong competitor in the industry is Buildium, which provides a number of tools for managing residential properties, taking care of money, and interacting with tenants. Property managers that want flexibility and efficiency in their operations will find that its mobile-friendly interface and configurable reporting capabilities make it their go-to choice. Although AppFolio Property Manager and Buildium are the top options for HOA property management software, there are other platforms that offer special features and functionalities that address particular needs in the industry, such as Bitrix24, ONR App, PayHOA, Vinteum Neighbors, WildApricot, and DoorLoop.”

Market Segmentation

The HOA property management software market is segmented into deployment mode, type and region. On the basis of type, the market is divided into rental properties and homeowners associations. As per deployment mode, the market is divided into cloud and on-premise. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

In the U.S., the HOA property management software market is well-established and competitive, with a focus on features like accounting and maintenance tracking for homeowner associations. The market is driven by a large number of HOAs looking for efficient solutions to manage their properties effectively. In the UK, the market is growing quickly due to more residential developments and a move towards digital property management practices. Software providers in the UK are concentrating on user-friendly interfaces and compliance with local regulations. In China, the market is rapidly expanding due to urbanization and a growing real estate sector. Chinese software providers are using advanced technologies like AI and data analytics to offer innovative solutions for property management. The market in China is also influenced by government initiatives promoting smart cities and sustainable urban development, leading to increased adoption of technology-driven property management solutions.

In July 2023, MRI Software, a global leader in real estate solutions, announced that it has expanded its offerings to the Canadian market through the launch of its first cloud instance in Canada. MRI clients in Canada can now easily access the latest solutions from MRI and host their data in country, ensuring compliance with privacy and security regulations.

In November 2023, MRI software launched new residential and commercial solutions for APAC as it announces record ascend users conference. Ascend APAC was the company’s first ever virtual users conference, drawing more than 900 registrants and marking its largest event in the region to date. Attendees watched keynotes, presentations and panels by MRI and its technology partners. The users conference marked the APAC launch of MRI Living and MRI @Work, which encompass the company’s comprehensive solutions for residential and commercial property management.

In March 2024, MRI Software, a global leader in real estate software, sets the stage for a seismic shift in property management technology, announced its next-generation Property Management XTM (PMX) solution. Embarking on a mission to redefine the very essence of property management, MRI’s enhancements to its flagship product will represent not just an evolution, but a revolution in user experience and data access. The result of a comprehensive, multi-year initiative to rethink critical property management functions and workflows, PMX redesigned from the ground up for improved usability, efficiency and intelligence.

Industry Trends:

In May 2023, SAP SE and Google Cloud announced an extensive expansion of their partnership, introducing a comprehensive open data offering designed to simplify data landscapes and unleash the power of business data. The offering enables customers to build an end-to-end data cloud that brings data from across the enterprise landscape using the SAP Datasphere solution together with Google’s data cloud, so businesses can view their entire data estates in real time and maximize value from their Google Cloud and SAP software investments.

In March 2023, SAP SE announced key data innovations and partnerships that give customers access to mission-critical data, enabling faster time to insights and better business decision-making. SAP announced the SAP® Datasphere solution, the next generation of its data management portfolio, which gives customers easy access to business-ready data across the data landscape. SAP also introduced strategic partnerships with industry-leading data and AI companies – Collibra NV, Confluent Inc., Databricks Inc. and DataRobot Inc. – to enrich SAP Datasphere and allow organizations to create a unified data architecture that securely combines SAP software data and non-SAP data.

For instance, in May 2021, ON24 launched its ON24 Big data analysis would also be available in the Japanese language, starting with ON24 Webcast Elite. This demonstrates the company’s efforts to strengthen its market position in Asia-Pacific. This functionality is expected to empower ON24 Webcast Elite to provide a more user-friendly user interface to Japanese consumers for easily creating on-demand and live digital experiences with analytics and reporting.

Competitive Landscape

The major players operating in the HOA property management software industry include Infor, ResMan, MRI Software, Chetu, TOPS Software Corporation, Entrata, CoreLogic, PropertyBoss Solutions, AppFolio, Buildium and so on.

Recent Key Strategies and Developments

In June 2023, CINC Systems launched TresRE, a treasury management solution that brings banking, software, and payments together for real estate managers who have long been forced to shift between legacy accounting and banking solutions that aren't connected by middleware. CINC clients are able to conduct their online banking – such as making transfers, pulling statements, examining check images and reconciling their books – inside CINC's accounting software. Effectively, CINC customers never need to log into bank portals that aren't designed for real estate.

In December 2023, CINC Systems (“CINC”), a leading cloud-based software company serving the community association management sector, announced it has secured a strategic growth investment from Hg, a leading investor in European and North American software and services businesses. On completion of the transaction, Hg became a strategic shareholder in the business, investing alongside CINC’s founder, Bill Blanton, and its management team, as well as current investors Spectrum Equity. CINC is a leading provider of accounting, homeowner management, bank integrations and payments software for the association management industry, comprised of homeowner association (“HOA”) and condominium associations.

Key Sources Referred

- devtechnosys.com

- stratoflow.com

- matellio.com

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hoa property management software market analysis from 2024 to 2032 to identify the prevailing hoa property management software market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities and HOA property management software market share.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hoa property management software market segmentation assists to determine the prevailing market opportunities and HOA property management software market forecast.

- Major countries in each region are mapped according to their revenue contribution to the global HOA property management software market size.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hoa property management software market trends, key players, market segments, application areas, and market HOA property management software market growth strategies.

HOA Property Management Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 18.0 Billion |

| Growth Rate | CAGR of 7.1% |

| Forecast period | 2024 - 2032 |

| Report Pages | 220 |

| By Type |

|

| By Deployment Mode |

|

| By Region |

|

| Key Market Players | AppFolio, Inc., ResMan, Infor, Buildium A RealPage Company, tops software corporation, MRI Software, Chetu Inc., PropertyBoss Solutions, Entrata, Inc. |

The HOA property management software market was valued at $9.5 billion in 2023 and is estimated to reach $18.0 billion by 2032, exhibiting a CAGR of 7.1% from 2024 to 2032.

Increasing demand for efficient and automated property management solutions in Homeowners Associations (HOAs) and growing adoption of cloud-based software solutions for better accessibility and scalability in property management. are the upcoming trends of HOA Property Management Software Market in the globe.

Integration of advanced technologies like AI and IoT to enhance the functionality and efficiency of property management software is the leading application of HOA Property Management Software Market.

North America is the largest regional market for HOA Property Management Software.

Infor, ResMan, MRI Software, Chetu, TOPS Software Corporation, Entrata, CoreLogic, PropertyBoss Solutions, AppFolio, Buildium are the top companies to hold the market share in HOA Property Management Software.

Loading Table Of Content...