Hollow Metal Doors Market Size &, Forecast 2031

The global hollow metal doors market size was valued at USD 15.7 billion in 2021, and is projected to reach USD 26.1 billion by 2031, growing at a CAGR of 5.2% from 2022 to 2031.

Hollow metal doors are one of the most common types of doors used in commercial and industrial environments. A hollow metal door is composed of a steel frame that has steel panels laminated to both sides. The door is typically equipped with mounts for hinges and a pocket for a mortise lock.

The demand for hollow metal doors is largely driven by increase in multifamily housing trends, rise in adoption of automated doors in commercial sector, and development of energy efficient doors. Modern automated doors are used in various commercial sectors such as airports, malls, corporate offices, and others. The other significant factor driving the market for hollow metal doors is the rise in government spending on residential and commercial buildings development. Moreover, escalation in industrialization and urbanization in economies which include India and Africa, is expected to cater to the development of the hollow metal doors market. Further, a surge in consumer expenditure on home renovation & enhancement activities and improvement in new construction activities are expected to provide remunerative growth opportunities for the market players.

Increase in population in developing economies such as China, India, and the U.S., has resulted in rapid urbanization, which is expected to boost development of the industrial sector and is expected to increase the demand for hollow metal doors. However, fluctuating raw material prices such as metal, are expected to hinder the hollow metal doors market growth.

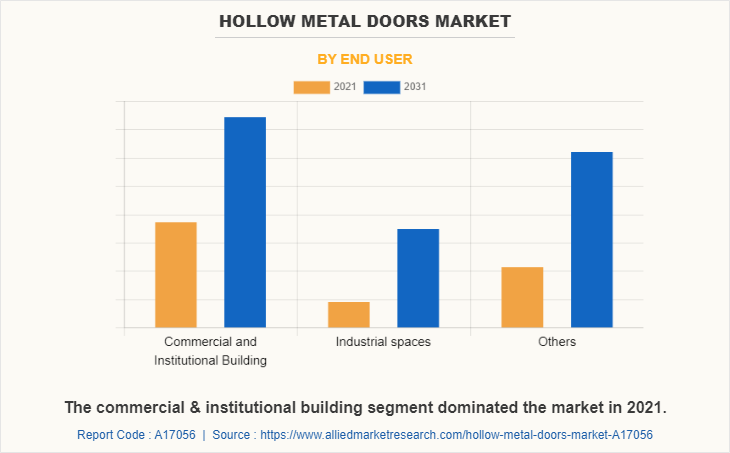

On the basis of end user, the commercial and institutional building segment generated the highest revenue in 2021. This is attributed to rise in government investment in institutional and commercial buildings. Similarly, governments across the globe are helping in development of commercial infrastructure. For instance, in August 2020, Tokyo International Conference on African Development (TICAD) planned to invest $20 billion in Africa in the next three years. This is expected to boost the growth of the hollow metal doors market during the forecast period.

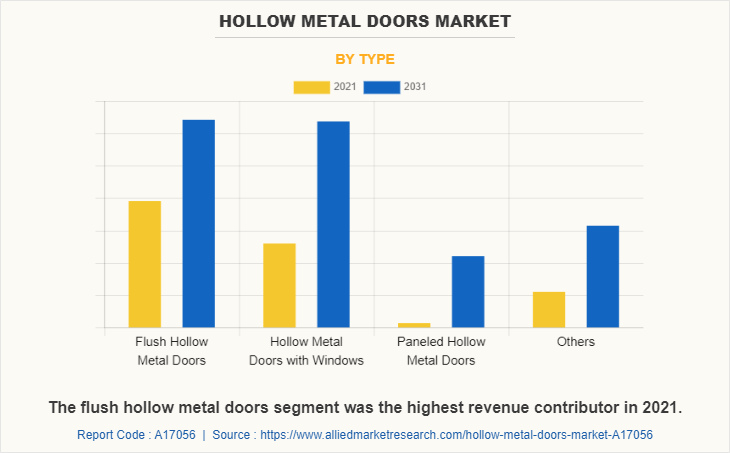

On the basis of type, the flush hollow metal doors segment is expected to register the highest hollow metal doors market share in 2021. Flush style hollow metal doors are the most popular design of hollow metal doors. The flush hollow metal door designs can be found on the majority of hollow metal door installations including door applications for fire exit doors, rear building doors, storage room doors, entrance doors, and more.

The novel coronavirus (COVID-19) rapidly spread across various countries and regions in 2019, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and has now become a significant threat to global trade, the economy, and finance. The COVID-19 pandemic halted production of many products in the hollow metal doors market, owing to lockdowns. Furthermore, the number of COVID-19 cases is expected to reduce in the future with the introduction of a vaccine for COVID-19 in the market. This has led to reopening of hollow metal doors companies at their full-scale capacities. This is expected to help the market recover by the end of 2022. After COVID-19 infection cases begin to decline, equipment & machinery producers must focus on protecting their staff, operations, and supply networks to respond to urgent emergencies and establish new methods of working.

Asia-Pacific dominated the market in 2021, accounting for the highest share, and is anticipated to maintain this trend throughout the hollow metal doors market forecast period. This is attributed to increase in population, urbanization, and industry. In addition, China’s 14th Five-Year Plan, covering the years 2021 to 2025, includes government-driven efforts to apply digital technology to the construction and building process. Thus, all such factors are expected to drive the hollow metal doors market growth in Asia-Pacific.

The hollow metal doors market is segmented into Type, Application and End User. By type, the market is categorized into flush hollow metal doors, hollow metal doors with windows, paneled hollow metal doors and others. Depending on application, it is fragmented into new construction and renovation. On the basis of end user, it is categorized into commercial and institutional building, industrial spaces and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competition Analysis

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hollow metal doors market analysis from 2021 to 2031 to identify the prevailing hollow metal doors market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hollow metal doors market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hollow metal doors market trends, key players, market segments, application areas, and market growth strategies.

Hollow Metal Doors Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | AccessSMT Holdings Ltd., Fleming, EightynineA LLC, DCI Hollow Metal, Quality Engineered Products Co., ALLEGION, Deansteel Manufacturing Company, Inc, Plyler Entry Systems, DKS Steel Doors & Frames, Inc, CECO DOOR, TRUDOOR, Curries, Concept Frames, Beacon Commercial Door & Lock, Houston-Starr Company, Baron Metal Industries, Inc, GH Hollow Metal Doors & Frames Industries Corp |

Analyst Review

The hollow metal doors market has witnessed substantial growth over the past few years, due to rise in new construction activities and surge in home remodeling expenditures. In 2021, the flush hollow metal doors segment dominated the market and paneled hollow metal doors is expected to continue this trend in the future. Hollow metal doors are manufactured using various materials such as honeycomb, polystyrene and others. Rise in construction activities in emerging nations such as India, China and the U.S., are creating demand for hollow metal doors and thus, driving the market growth.

Moreover, key players are implementing strategic moves to sustain its market position. For instance, in January 2022, Allegion acquired Stanley Access Technologies LLC and assets related to automatic entrance solutions business from Stanley Black & Decker, Inc. Access Technologies offers doors, frames and automatic doors in North America. Such factors are providing lucrative growth in the hollow metal doors market.

The global hollow metal doors market size was valued at $15.7 billion in 2021.

The global hollow metal doors market size is projected to reach $26.1 billion by 2031.

Asia-Pacific is the largest regional market for Hollow Metal Doors.

New construction segment is the leading application of Hollow Metal Doors Market.

Rapid urbanization & industrialization and surge in residential & non-residential construction are the upcoming trends of Hollow Metal Doors Market in the world.

High initial costs and predictive maintenance for automatic doors and fluctuation on raw material prices are the affecting factors in the hollow metal doors market.

The product launch is key growth strategy of smart bathroom industry players.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...