Home Healthcare Market Research, 2033

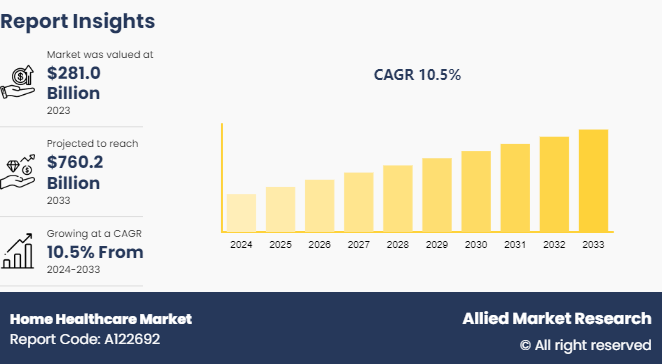

The global home healthcare market size was valued at $281.0 billion in 2023, and is projected to reach $760.2 billion by 2033, growing at a CAGR of 10.5% from 2024 to 2033. The global home healthcare market is experiencing growth due to several factors such as increase in prevalence of chronic diseases aging population, technological advancements, and the growth in demand for convenient, personalized care.

Market Introduction and Definition

Home healthcare refers to medical and non-medical services provided to individuals in the comfort of their own homes. It encompasses a broad range of care, including nursing, physical therapy, assistance with daily activities, and even companionship for those in need. This personalized approach to healthcare allows individuals to receive the attention and support they require while maintaining their independence and familiar surroundings. Home healthcare services are often tailored to meet the unique needs of each individual, promoting both physical and emotional well-being.

Key Takeaways

- The home healthcare market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2024-2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major home healthcare industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The home healthcare market size is expected to witness significant growth, driven by various factors that propel its expansion while encountering certain constraints. One of the key drivers is the increase in the geriatric population worldwide, particularly in developed nations such as the U.S., Japan, and several European countries. As the elderly population increases, there is a growing demand for healthcare services that can be provided in the comfort of one's home. This trend is further accelerated by advancements in technology, which have enabled the development of sophisticated medical devices and telemedicine solutions. For instance, wearable health monitoring devices allow patients to track their vital signs and share real-time data with healthcare providers, facilitating remote monitoring and timely interventions.

However, the home healthcare market faces several restraints for home healthcare market growth, including regulatory challenges and reimbursement limitations. Regulations vary across different regions, posing barriers to the adoption of certain home healthcare services and technologies. Reimbursement policies may also deter healthcare providers from offering home-based care, as they may not receive adequate compensation for services rendered outside traditional clinical settings. Additionally, concerns related to data privacy and security present challenges for the widespread adoption of telehealth solutions, as patients and healthcare providers alike prioritize the protection of sensitive medical information.

Nevertheless, amidst these challenges lie significant home healthcare market opportunity for growth and innovation in market. The COVID-19 pandemic highlighted the importance of remote healthcare delivery, thus driving accelerated adoption of telemedicine and other virtual care solutions. This shift towards telehealth is expected to persist beyond the pandemic, offering opportunities for companies to expand their offerings and reach new patient populations. Moreover, advancements in artificial intelligence and machine learning hold promise for improving the efficiency and effectiveness of home healthcare services, from personalized treatment plans to predictive analytics that anticipate patients' needs and prevent adverse health events.

Market Segmentation

The home healthcare industry is segmented into product and service, indication, and region. On the basis of product & service, the market is bifurcated into equipment, software and services. On the basis of indication, the market is divided into cancer, neurological disorders, mobility disorders, cardiovascular disorders and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America has largest home healthcare market share in the market is being driven by several key factors, paving the way for transformative innovations and advancements in the healthcare industry. One significant driver is the increase in adoption of digital health technologies, such as telemedicine platforms, remote patient monitoring devices, and wearable health trackers. In addition, rise in focus on data analytics and AI in healthcare further drives the growth during home healthcare market forecast.

The home healthcare market share in developing countries such as China and India is being driven by several factors, ushering in a new era of advanced medical technology and services. One primary driver is the increasing adoption of digital health solutions to address the challenges of accessibility and affordability in these populous nations.

In China, the government's initiatives such as "Healthy China 2030" is promoting the integration of technology into healthcare to enhance efficiency and quality. For instance, Tencent's WeDoctor platform offers telemedicine services, enabling patients in remote areas to consult with doctors online, thus reducing the burden on traditional healthcare infrastructure.

Similarly, in India, the government's emphasis on digitalization through programs such as National Health Stack and Ayushman Bharat is fostering the growth of smart healthcare solutions. Startups like mfine and Practo provide mobile-based consultations and health monitoring, empowering individuals to manage their health proactively.

- In March 2020, the Quebec government in collaboration with the Canadian Medical Association (CMA) decided to expand the access to telehealth services across different provinces of Canada such as Alberta, New Brunswick, British Columbia, Manitoba, Ontario, Newfoundland, and others. Such attempts are expected to boost digital patient-oriented healthcare services globally.

- In March 2020, the NHS UK encouraged first-tier medical institutions to use telemedicine to reduce the COVID-19 spread. The UK recorded nearly 340 million files of annual medical consultations and only 1% of them were made through video calls. However, the NHS is planning to implement telemedicine services by reducing face-to-face consultation.

- In March 2020, the All India Institute of Medical Sciences (AIIMS) launched a 24/7 Telemedicine Hub, CoNTeC. It is a real-time telemedicine hub aimed to assist physicians to treat patients.

Industry Trends

- In April 2024, the U.S. Food and Drug Administration announced the launch of a new initiative, Home as a Health Care Hub, to help reimagine the home environment as an integral part of the health care system, with the goal of advancing health equity for all people in the U.S.

- In November 2021, Biden Harris administration improved home health services for older adults and people with disabilities.

- In March 2020, the American Hospital Association (AMA) stated that nearly 76% of hospitals in the U.S. use telehealth to connect with consulting practitioners and patients owing to its affordability and elevated healthcare value.

- In April 2020, Huawei commended the provision of wireless networks, conferencing, and smartphones across Thailand, Bangladesh, and Malaysia. This is intended to increase the adoption of telemedicine practices to combat the COVID-19 pandemic in the region.

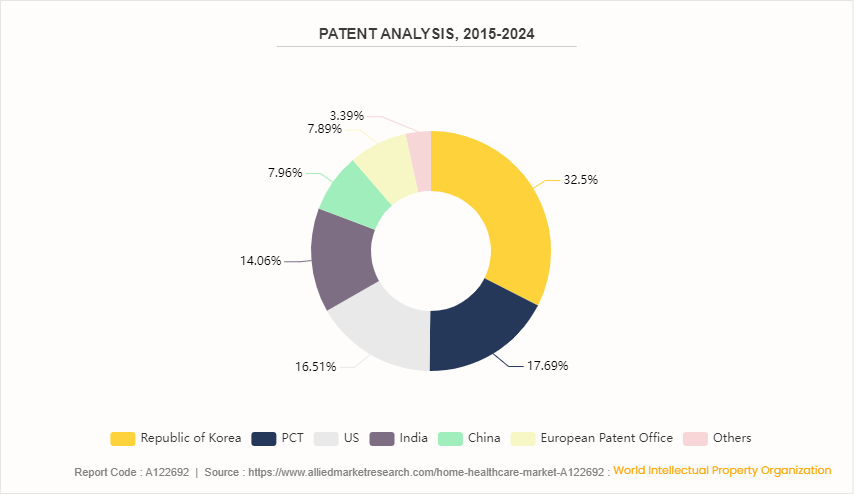

Patent Analysis, By Country, 2015-2024

The Republic of Korea witnessed the highest number of patent approvals and applications, due to favorable government policies, new technological advancement, and new product launches in the country. PCT has 17.7% of the total number of patents, followed by the U.S. at 16.5% and India at 14.1%.

Competitive Landscape

The major players operating in the home healthcare industry include B. Braun Melsungen AG, Abbott, Sunrise Medical, 3M Healthcare, Baxter International Inc., Medtronic PLC, Cardinal Health Inc., F. Hoffmann-La Roche AG, Air Liquide, Amedisys, Inc. Other players in home healthcare market includes NxStage Medical, Inc. (Fresenius Medical Care) , Arkray, Inc., BD, Omron Healthcare, Inc., Drive DeVilbiss Healthcare, GE Healthcare and so on.

Recent Key Strategies and Developments

- In August 2023, Extendicare Inc. acquired Revera and its affiliates and gained 15% managed stakes in 25 LTC homes operated by Revera and oversaw an extra 31 LTC homes owned by Revera.

- In April 2020, Proxxi, a Canadian firm launched a wearable device, Halo. This device is designed to ensure compliance with social distancing at a workplace during the ongoing global COVID-19 pandemic. This device would constantly notify of separation to ensure proper social distancing.

- In September 2021, MSF introduced free telemedicine helpline for COVID-19 patients in India.

- In April 2020, IBM released AI-powered technologies to assist the research and health community in hastening the discovery of medical insights and treatments for COVID-19 by launching the COVID-19 High-Performance Computing Consortium in the collaboration with the U.S. Department of Energy and the White House Office of Science and Technology.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the home healthcare market analysis to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the home healthcare market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global home healthcare market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the home healthcare market players.

- The report includes the analysis of the regional as well as global home healthcare market trends, key players, market segments, application areas, and market growth strategies.

Key Sources Referred

- HealthIT.gov

- EO Intelligence

- WIPO - World Intellectual Property Organization

- Centers for Disease Control and Prevention

- World Health Organization

- American Medical Informatics Association (AMIA)

- Becker's Health IT & CIO Report

Home Healthcare Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 760.2 Billion |

| Growth Rate | CAGR of 10.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 260 |

| By Product And Service |

|

| By Indication |

|

| By Region |

|

| Key Market Players | Baxter International Inc.,, Medtronic PLC, Cardinal Health Inc., B. Braun Melsungen AG, 3M Healthcare, Abbott Laboratories, Sunrise Medical, Amedisys, Inc., Air Liquide, F. Hoffmann-La Roche AG |

Loading Table Of Content...