Hormonal Contraceptive Market Research, 2035

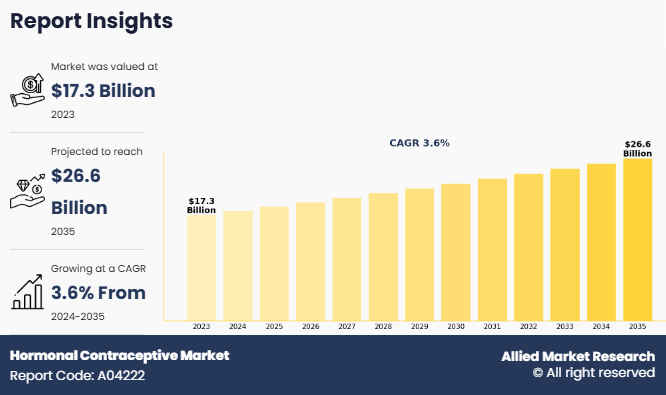

The global hormonal contraceptive market was valued at $17.3 billion in 2023, and is projected to reach $26.6 billion by 2035, growing at a CAGR of 3.6% from 2024 to 2035. According to the National Library of Medicine, about 80% of sexually active young women in the U.S. use hormonal contraceptives during their reproductive years. Thus, such high adoption drives the market growth.

Hormonal contraceptives are birth control methods that use synthetic hormones to prevent pregnancy by inhibiting ovulation, thickening cervical mucus, and altering the uterine lining. They come in various forms, including oral contraceptive pills, patches, injections, vaginal rings, and implants. Combination pills contain estrogen and progestin, while progestin-only pills (mini-pills) are suitable for individuals who cannot take estrogen. Long-acting reversible contraceptives like implants and injections provide extended protection without daily adherence.

The hormonal contraceptive market growth is driven by rise in awareness of family planning, increase in government initiatives for birth control, rise in number of working women, and advancements in hormonal contraceptive. Some of the family planning initiatives in different countries are National Family Planning Program (India), Two-Child Policy (China), Family Planning 2020 (Global Initiative), National Reproductive Health Program (Indonesia), and Title X Family Planning Program (U.S.).

Key Takeaways

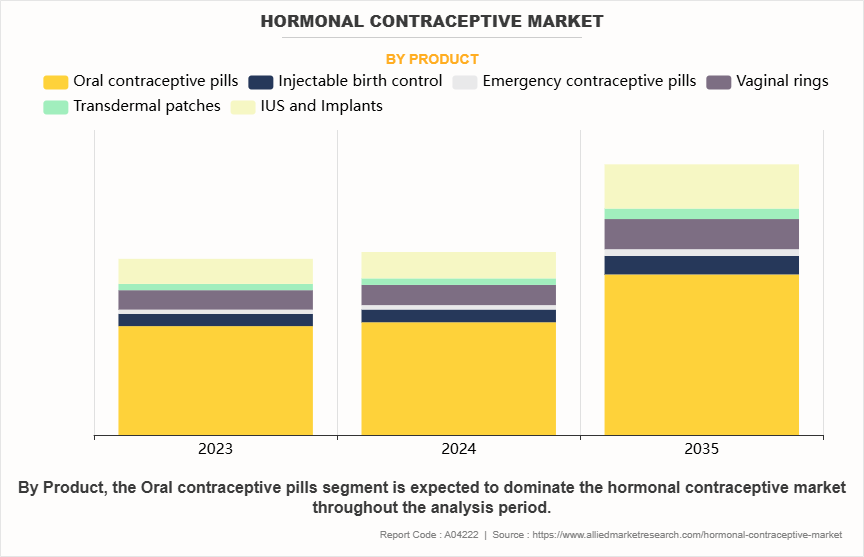

- By product, the oral contraceptive pills segment was the highest contributor to the hormonal contraceptive market share in 2023. However, the IUS and implant segment is expected to register the highest CAGR during the forecast period.

- By hormone, the combined hormonal contraceptive segment was the highest contributor to the market in 2023. However, the progestin only contraceptive segment is expected to register the highest CAGR during the forecast period.

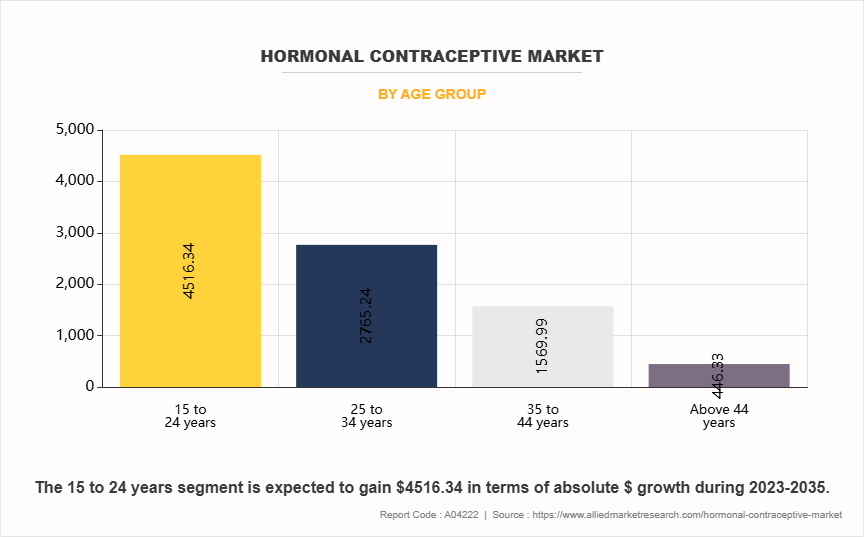

- By age group, the 15-24 years segment was the highest contributor to the market in 2023 and is also expected to register highest CAGR during the forecast period.

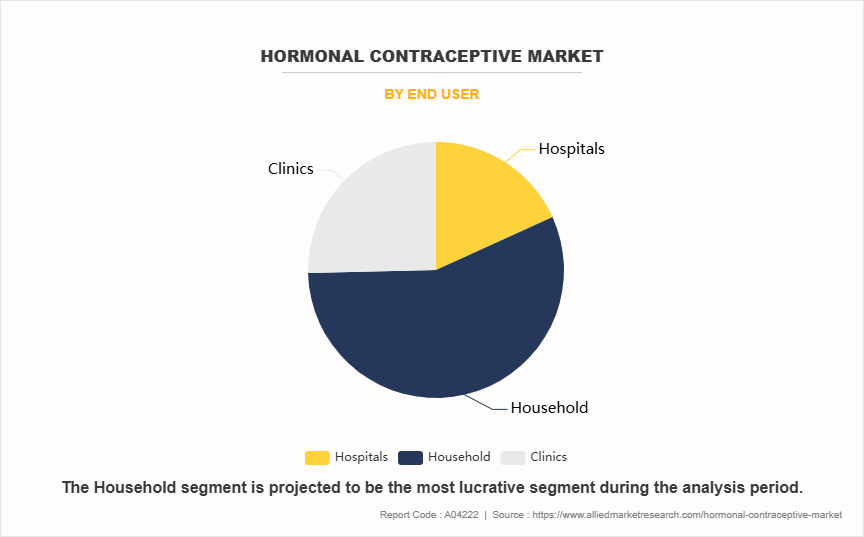

- By end user, the household segment dominated the market in 2023 and is expected to continue this trend during the forecast period.

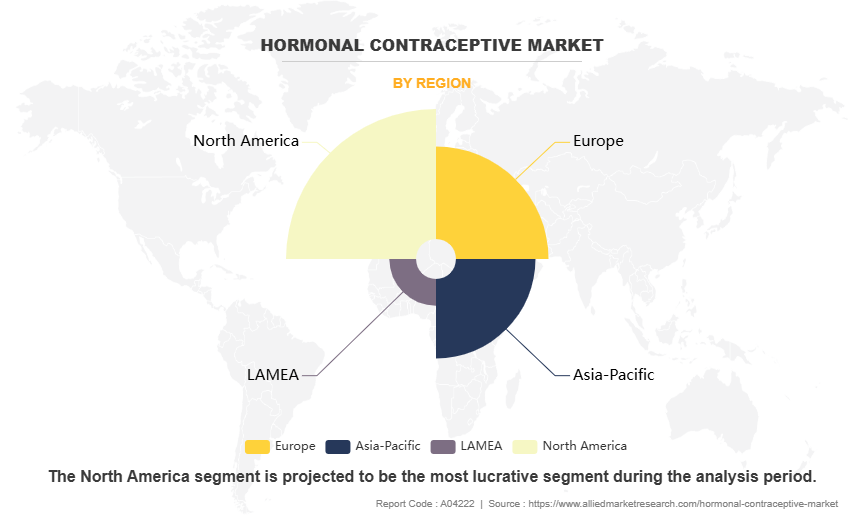

- By region, North America garnered the largest revenue hormonal contraceptive market share in 2023. However, Asia-Pacific is expected to grow at the fastest rate during the forecast period.

Market Dynamics

The hormonal contraceptives market growth is driven by factors such as the rise in prevalence of unintended pregnancies, increase in awareness about family planning, and rise in adoption of modern contraceptive methods. Government initiatives and programs promoting birth control and reproductive health also contribute to hormonal contraceptives market growth. Rise in prevalence of unintended pregnancies is a significant factor driving the growth of the hormonal contraceptives market. Unintended pregnancies pose substantial social, economic, and health challenges, increasing the demand for effective contraceptive methods. According to a 2024 article by National Library of Medicine, the national rate of unintended pregnancy in India is approximately 9.1%. Factors such as lack of awareness and inconsistent use of contraceptives contribute to the high rate of unintended pregnancies.

Increasing awareness about family planning and the growing adoption of modern contraceptive methods are driving the growth of the hormonal contraceptives market. Governments and healthcare organizations globally are actively promoting family planning initiatives to reduce unintended pregnancies and improve maternal and child health outcomes. For instance, Family Planning 2030 (FP2030) is a global partnership dedicated exclusively to family planning. FP2030 (Family Planning 2030) is a global partnership dedicated to advancing universal access to voluntary, rights-based family planning. It builds upon the foundation of FP2020, a previous initiative launched in 2012 and aims to accelerate progress in improving reproductive health and gender equality worldwide.

FP2030 operates through a decentralized structure, encouraging regional leadership and country-led commitments to ensure sustainable impact. It focuses on expanding contraceptive access, strengthening health systems, and promoting policies that support women's and adolescent girls' reproductive rights. By fostering collaboration among governments, civil society, and private sector stakeholders, FP2030 seeks to empower individuals with the knowledge and resources necessary to make informed family planning choices. Thus, the aforementioned factors drive the hormonal contraceptive market opportunity.

Educational campaigns, increased access to reproductive healthcare services, and social awareness programs have led to a higher acceptance of hormonal contraceptives, including pills, patches, injectables and implants. In addition, advancements in contraceptive formulations that offer improved efficacy, fewer side effects, and longer durations of action have contributed to their widespread adoption. The availability of hormonal contraceptives through pharmacies, online platforms, and family planning clinics has further enhanced accessibility, particularly in developing regions where reproductive health services are expanding, thereby driving the hormonal contraceptive market forecast.

Segmental Overview

The hormonal contraceptive market analysis is segmented on the basis of product, hormones, end user, age group, and region. On the basis of product, the market is divided into oral contraceptive pills, injectable birth control, emergency contraceptive pills, and vaginal rings, transdermal patches, and IUS & implants. On the basis of hormones, the market is divided into progestin only contraceptive, and combined hormonal contraceptive.

On the basis of age group, the market is categorized into 15 to 24 years, 25 to 34 years, 35 to 44 years, and above 44 years. On the basis of end user, the market is segmented into hospitals, household, and clinics. On the basis of region, the market is analyzed across North America (U.S., Canada, and Mexico), Europe (France, Germany, Italy, Spain, UK, Rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and Rest of Asia-Pacific), and LAMEA (Brazil, Saudi Arabia, South Africa, and Rest of LAMEA).

By Product

On the basis of product, the market is divided into oral contraceptive pills, injectable birth control, emergency contraceptive pills, and vaginal rings, transdermal patches, and IUS & implants. The oral contraceptive pills segment was the major revenue contributor to the hormonal contraceptive market share in 2023. This is attributed to widespread adoption of oral pills, high efficacy, and ease of use. Oral pills offer a non-invasive, convenient, and reversible method of contraception, making them a preferred choice among women globally. vailability of different formulations, including combination pills and progestin-only pills, allows for customization based on individual health needs, further increasing their appeal.

However, the IUS and implants segment is expected to register the highest CAGR during the hormonal contraceptive market forecast period. This is attributed to rise in adoption of IUS and implants due to their long-acting nature, high efficacy. IUS and implants offer prolonged protection, reducing the need for frequent user intervention as compared to oral contraceptives or injectables, which enhances compliance and effectiveness. Rise in awareness about long-acting reversible contraceptives (LARCs), driven by initiatives from healthcare organizations and government programs, has further boosted their adoption. In addition, rise in demand for discreet and hassle-free contraceptive solutions, particularly among younger women and working professionals, has contributed to the increase in preference for IUS and implants.

By Hormone

On the basis of hormones, the market is divided into progestin only contraceptive, and combined hormonal contraceptive. The combined hormonal contraceptive segment was the major revenue contributor to the hormonal contraceptive market size in 2023, owing to its widespread adoption, high efficacy, and diverse formulation options. The availability of multiple delivery forms, including oral pills, patches, and vaginal rings, enhances user convenience and compliance, further driving the demand of combined hormonal contraceptive. In addition, growing awareness about family planning, increased government initiatives promoting contraceptive use, and rise in number of working women seeking effective birth control solutions contribute to growing adoption of combined hormonal contraceptive. However, the progestin only contraceptive segment is expected to register highest CAGR during the forecast period, owing to growing acceptance of progestin only contraceptive among women who cannot tolerate estrogen-based contraceptives.

By Age Group

On the basis of age group, the market is segmented on the basis of 15 to 24 years, 25 to 34 years, 35 to 44 years, and above 44 years. The 15 to 24 years segment was the major revenue contributor to hormonal contraceptive market size in 2023 and is expected to register the highest CAGR during the forecast period. This is attributed to high contraceptive usage among sexually active young individuals, increase in awareness of family planning, and improved access to reproductive healthcare services. This age group is particularly targeted by government initiatives and non-profit organizations promoting sexual health education and contraceptive access, leading to higher adoption rates.

By End User

On the basis of end user, the market is segmented into hospitals, household, and clinics. The household segment was the highest revenue contributor to hormonal contraceptive market growth in 2023 and is expected to register highest CAGR during the forecast period. This is attributed to increasing preference for self-administered contraceptive methods, such as oral pills, and patches. Rise in awareness about family planning and reproductive health, driven by government initiatives and non-profit organizations, has further encouraged the adoption of hormonal contraceptives at the household level.

By Region

North America dominated the hormonal contraceptives market share in 2023 owing to high awareness and widespread adoption of contraceptive methods, supported by favorable government policies and healthcare initiatives. The region benefits from a well-established healthcare infrastructure, ensuring easy access to a variety of hormonal contraceptives, including oral pills, injectables, patches, and intrauterine systems. High disposable income and significant healthcare spending further contribute to market growth, as consumers are more likely to afford prescription-based contraceptive options.

However, Asia-Pacific hormonal contraceptive industry is expected to register highest CAGR during the forecast period, owing to increase in awareness about family planning, rise in government initiatives to promote contraceptive use, and a growing population of reproductive-age women. Countries such as India and China are implementing extensive family planning programs and subsidizing contraceptive methods to control population growth, thereby driving market expansion.

Competition Analysis

Competitive analysis and profiles of the major players in the hormonal contraceptive industry include Teva Pharmaceutical Industries Ltd., Bayer AG, Pfizer Inc, Johnson and Johnson, AbbVie Inc., Lupin Pharmaceuticals, Inc., Organon & Co, Afaxys, Inc., Pregna International Limited, and Mayne Pharma Group Limited. The key players have adopted clinical trials, collaboration, partnership, strategic alliance, investment, product launch, product approval, and agreement as the key strategies for expansion of their product portfolio.

Recent Developments in Hormonal Contraceptives Industry

- In January 2021, Teva Pharmaceuticals USA, Inc. announced the availability of generic version of NuvaRing (etonogestrel and ethinyl estradiol vaginal ring), 0.120 mg/0.015 mg per day, in the U.S. Teva's AB-rated and bioequivalent etonogestrel and ethinyl estradiol vaginal ring, is an estrogen/progestin combination hormonal contraceptive (CHC) indicated for use by women to prevent pregnancy.

- In October 2022, Bayer, a leader in women's healthcare, announced that Mirena has been approved in Europe for an extended duration of use as a contraceptive. This regulatory approval in Europe is based on the results of the Mirena Extension Trial evaluating the efficacy and safety of Mirena, which demonstrated that contraceptive efficacy remains high with greater than 99% during years six to eight of use.

- In August 2023, The Bill and Melinda Gates Foundation, Children's Investment Fund Foundation (CIFF), Pfizer, and Becton, Dickinson and Company (BD) announced the expansion of their nearly decade-long collaboration. Under this expanded partnership, more than 320 million doses of Pfizer's injectable contraceptive (Sayana Press) will be supplied through 2030. These doses will be administered using BD's Uniject Auto-Disable Prefillable Injection System, enhancing accessibility and ease of use.

- In February 2022, Organon and Co. announced that it acquired the rights from Bayer AG to Marvelon and Mercilon, combined oral hormonal daily contraceptive pills, in the People's Republic of China, including Hong Kong and Macau, and entered into an agreement to acquire the rights to these products in Vietnam.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hormonal contraceptive market analysis from 2023 to 2035 to identify the prevailing hormonal contraceptive market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hormonal contraceptive market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hormonal contraceptive market trends, key players, market segments, application areas, and market growth strategies.

Hormonal Contraceptive Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 26.6 billion |

| Growth Rate | CAGR of 3.6% |

| Forecast period | 2023 - 2035 |

| Report Pages | 348 |

| By Product |

|

| By Hormone |

|

| By Age Group |

|

| By End User |

|

| By Region |

|

| Key Market Players | Afaxys, Inc., Bayer AG, Lupin Pharmaceuticals, Inc., AbbVie Inc., Organon & Co., Pfizer Inc., Teva Pharmaceutical Industries Ltd., Pregna International Limited, Mayne Pharma Group Limited, Johnson & Johnson |

Analyst Review

The growth of the hormonal contraceptive market is primarily driven by increase in awareness of family planning, rise in demand for effective birth control methods, and growing focus on women's health. In addition, the development of new, more convenient, and less invasive hormonal contraceptive products is attracting more users. The expansion of healthcare access, particularly in developing regions, and greater social acceptance of contraception further fuel the market growth. Moreover, increase in government initiatives promoting reproductive health and rise in healthcare spending also play a significant role in the market's expansion, as they make contraceptives more accessible and affordable to diverse populations.

Another major factor fueling the market growth is rise in focus on women’s health and empowerment. As women become more active in the workforce and pursue higher education, they seek methods to manage their fertility in ways that align with their personal and professional goals. Rise in adoption of hormonal contraceptives among working women owing to its convenience and effective solution for women looking to delay pregnancy is a key factor driving the market growth.

2023 is the base year of hormonal contraceptive market in the globe.

Oral contraceptive pills is the leading product of hormonal contraceptive market

North America is the largest regional market for hormonal contraceptive market.

The hormonal contraceptive market in 2023 is valued at $17.3 billion.

Major key players that operate in the global hormonal contraceptive market are Teva Pharmaceutical Industries Ltd., Bayer AG, Pfizer Inc,?Johnson and Johnson, AbbVie Inc., Lupin Pharmaceuticals, Inc., Organon & Co, Afaxys, Inc., Pregna International Limited, and Mayne Pharma Group Limited.

2024 to 2035 is the forecast year of hormonal contraceptive market in the globe

Household is the leading end user of hormonal contraceptive market.

Loading Table Of Content...

Loading Research Methodology...