Hospital Emergency Department Market Research, 2033

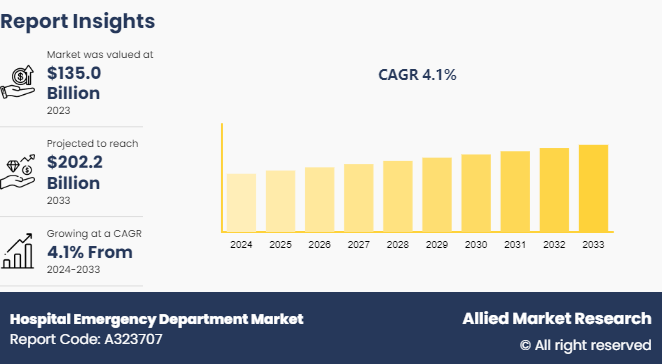

The global hospital emergency department market size was valued at $135.0 billion in 2023, and is projected to reach $202.2 billion by 2033, growing at a CAGR of 4.1% from 2024 to 2033. Rising prevalence of chronic diseases, surge in cases of injuries and accidents, and rise in number of visits to hospital emergency departments are the major factors which drives the market growth.

Market Introduction and Definition

The hospital emergency department (ED) , often referred to as the emergency room (ER) or casualty department (in some regions) , is a specialized medical facility within a hospital that provides immediate care to patients with acute medical conditions or injuries. These conditions typically require urgent attention but may not be severe or life-threatening enough to necessitate admission to the hospital. The primary function of the emergency department is to assess, stabilize, and initiate treatment for patients who arrive without prior appointments, 24 hours a day, 7 days a week.

Key Takeaways

The hospital emergency department market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major hospital emergency department industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The major factors driving the hospital emergency department market size include the increase in incidence of chronic diseases and the rise in prevalence of injuries and accidents which necessitate urgent medical care, thereby boosting demand for emergency department services. In addition, the aging population, which is more susceptible to health complications, significantly contributes to the growing need for emergency care. Advances in medical technology and the availability of more sophisticated diagnostic and therapeutic tools in emergency departments enhance their capability to manage critical conditions efficiently, further propelling growth during the hospital emergency department market forecast.

Furthermore, heightened public awareness about the importance of immediate medical attention for serious health issues and the expanding health insurance coverage, which makes emergency services more accessible, also play crucial roles. Moreover, the ongoing development and expansion of healthcare infrastructure, especially in emerging economies, create more opportunities for the growth of hospital emergency departments. Lastly, governmental and private sector investments in healthcare improvements support the expansion and modernization of emergency care facilities, thereby driving hospital emergency department market growth .

However, the high operational costs associated with maintaining and staffing emergency departments can strain hospital budgets and resources. In addition, emergency departments often face overcrowding issues due to a high patient influx, leading to longer wait times and reduced quality of care, which can deter patients and overburden healthcare professionals. In contrast, increasing demand for emergency medical care, growing emphasis on value-based care and population health management within the healthcare industry, and technological advancements present another significant hospital emergency department market opportunity.

Rising Emergency Department Visits

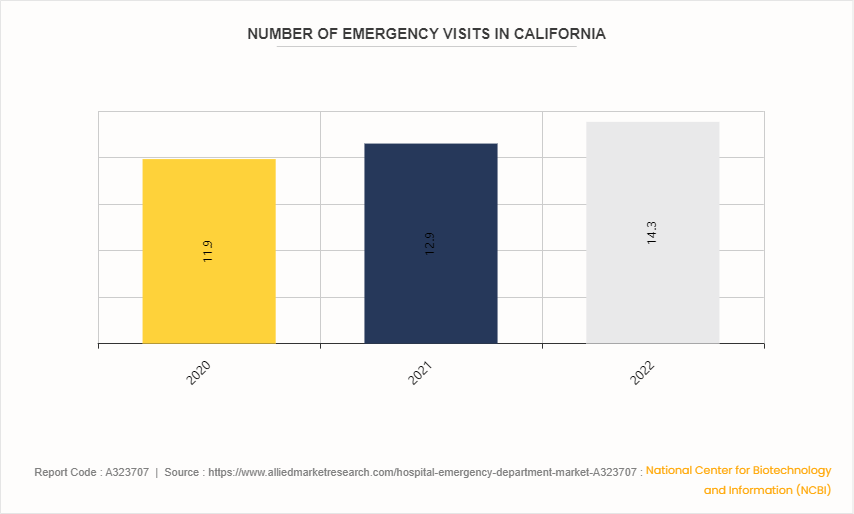

The data from the National Center for Biotechnology Information (NCBI) highlights a rising trend in emergency department (ED) visits in California. In 2020, there were 11.9 million ED visits, which increased to 12.9 million in 2021, and further rise to 14.3 million in 2022. This steady growth indicates an escalating demand for emergency medical services, driven by various factors including population growth, increased prevalence of chronic conditions which strained healthcare systems. This upward trajectory in ED visits directly impacts the hospital emergency department market. Hospitals are compelled to enhance their emergency services to accommodate the increasing patient influx. Additionally, the surge in ED visits drives the need for robust staffing, with more healthcare professionals required to manage the higher patient volumes effectively. Consequently, the market for emergency department services and related equipment is experiencing significant growth, driven by the necessity to address the rising healthcare demands and ensure efficient, high-quality emergency care.

Market Segmentation

The hospital emergency department market is segmented into insurance type, condition, and region. On the basis of insurance type, the market is categorized into medicare & medicaid, and private & others. As per condition, the market is divided into traumatic, infectious, gastrointestinal, psychiatric, cardiac, neurologic, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

In developed regions such as North America and Europe has significant hospital emergency department market share owing to benefit from robust healthcare systems, advanced medical technologies, and higher healthcare spending per capita. Emerging markets in Asia-Pacific and LAMEA present unique opportunities and challenges for the hospital emergency department market. Rapid urbanization, expanding middle-class populations, and increasing access to healthcare services drive demand for emergency care in these regions. Nonetheless, investments in healthcare infrastructure, technology adoption, and public health initiatives offer significant growth potential for hospital emerging department in emerging markets.

Massachusetts General Hospital has been struggling with unprecedented overcrowding in its emergency department for the past 16 months, with patients boarding for a total of 381, 228 hours from October 2022 to September 2023, a 32% increase from the previous 12-month period.

According to the Australian Institute of Health and Welfare, the number of visits to emergency departments (EDs) went up from 8.35 million in 2018–19 to 8.80 million in 2022–23. That means more people are going to the EDs. Also, the rate of visits per 1, 000 people increased from 330 visits per 1, 000 people in 2018–19 to 334 visits in 2022–23. So, more people are seeking emergency care as compared to earlier period.

Industry Trends

Sanjay Gandhi Memorial Hospital (SGMH) introduced several new initiatives during the financial year 2022-23 to enhance services, including mandatory Thalassemia screening for pregnant women, daily OPDs in all departments, strengthening of ICU services, and adjustments in OPD and doctor timings to improve patient care and reduce incidents of violence among doctors and the public.

As per an article published by National Center for Biotechnology and Information in 2023, the annual number of emergency visits resulting in hospital admission increased by 12.0%. The proportion of hospital admissions from nonurgent ED visits decreased from 1.1% in 2012 to 0.5% in 2022.

According to the Health Foundation, in 2022, there were 800, 000 (12%) fewer hospital admissions than in 2019, and emergency admissions by 521, 000 (9%) in England.

In fiscal 2023, Parkland, a public hospital, recorded more than 226, 500 visits to its emergency department and urgent care center and more than 1.1 million visits to the neighborhood and specialty outpatient clinics.

Competitive Landscape

The major players operating in the hospital emergency department market include Parkland Health, Hartford Hospital, Lakeland Regional Health, St. Joseph's Health, HCA, Inc., Siemens, The General Hospital Corporation, Mayo Clinic Hospital, Brigham and Women's Hospital, and Barnes-Jewish Hospital. Other players in hospital emergency department market include Competitive LandscapeSharp HealthCare and so on.

Recent Key Strategy and Development in Hospital Emergency Department Industry

In July 2022, Lakeland Regional Health is continuously expanding to meet the needs of the community. The health system has started planning for an additional location in south Lakeland on a 5.6-acre property Florida Avenue.

Key Sources Referred

National Center for Biotechnology and Information (NCBI)

Centers for Medicare & Medicaid Services (CMS)

National Health Service (NHS)

Australian Government Department of Health and Aged Care

Government of Canada's Health and Wellness

Ministry of Health and Family Welfare (MoHFW)

National Health Mission (NHM)

Ayushman Bharat - Health and Wellness Centres (AB-HWCs)

Centers for Disease Control and Prevention (CDC)

Food and Drug Administration (FDA)

National Institutes of Health (NIH)

World Health Organization (WHO)

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hospital emergency department market analysis from 2024 to 2033 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the hospital emergency department market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global hospital emergency department market trends, key players, market segments, application areas, and market growth strategies.

Hospital Emergency Department Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 202.2 Billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 222 |

| By Insurance Type |

|

| By Condition |

|

| By Region |

|

| Key Market Players | The General Hospital Corporation, Brigham and Women's Hospital, Mayo Clinic Hospital, St. Joseph's Health, Barnes-Jewish Hospital, Lakeland Regional Health, HCA, Inc., Parkland Health, Siemens , Koninklijke Philips N.V. |

Upcoming trends of hospital emergency department market includes integration of advanced telemedicine and digital health solutions to improve patient triage and care, increased focus on patient-centered care models to enhance patient experience and outcomes, and the implementation of AI-driven tools for efficient resource management and predictive analytics in emergency care.

North America is the largest regional market for hospital emergency departments. This dominance is driven by advanced healthcare infrastructure, high healthcare expenditure, and a significant prevalence of chronic diseases and injuries requiring emergency care.

The global hospital emergency department market was valued at $135.0 billion in 2023, and is projected to reach $202.2 Billion by 2033, growing at a CAGR of 4.1% from 2024 to 2033.

The leading application of hospital emergency departments is the treatment of acute medical conditions and injuries. This includes the immediate assessment, stabilization, and management of patients experiencing life-threatening conditions such as heart attacks, strokes, severe trauma, respiratory distress, and other critical health issues.

A hospital emergency department (ED), also known as an emergency room (ER) or casualty department, is a specialized medical facility within a hospital designed to provide immediate and urgent care to patients with acute illnesses, injuries, or medical emergencies.

Loading Table Of Content...