Household Appliances Market Overview, 2035

The global household appliances market was valued at $490,452.88 million in 2023, and is projected to reach $983,193.41 million by 2035, growing at a CAGR of 6.03% from 2024 to 2035. The demand for household appliances is driven by increase in technological advancements, rapid urbanization, growth of the housing sector, rise in per capita income, improvement in living standard, changes in consumer lifestyle, and escalation in number of smaller households. In addition, inclination of consumers toward eco-friendly & energy-efficient appliances further boosts the household appliances market growth. Moreover, factors such as government initiatives for energy-efficient appliances undertaken across various countries such as the U.S. and many EU countries are expected to facilitate the adoption of energy efficient appliances in the recent years for household appliances market.

Household appliances are electrical/mechanical devices designed to perform various domestic tasks and make daily life more convenient and efficient in residential settings. These appliances are primarily used for cooking, cleaning, entertainment, food preservation, laundry, and temperature control within households. Household appliances market is categorized into major appliances or white goods, small appliances, and consumer electronics. Major appliances are large home appliances used for regular housekeeping tasks such as cooking, washing laundry, food preservation, and others. These are generally equipped with special connections such as electrical, gas, plumbing, and ventilation arrangements, and thus, limit the mobility of the appliances around the house. Small appliances are semi-portable or portable machines and are generally used on platforms such as counter-tops and tabletops. Some of the small appliances are air purifiers, humidifiers & de-humidifiers, blenders, clothes steamers & iron, electric kettle & coffee machines, and others. Consumer electronics include devices used for entertainment, communications, and home-office activities, such as TV, music system, and other.

Key Takeaways of the Household Appliances Market Report

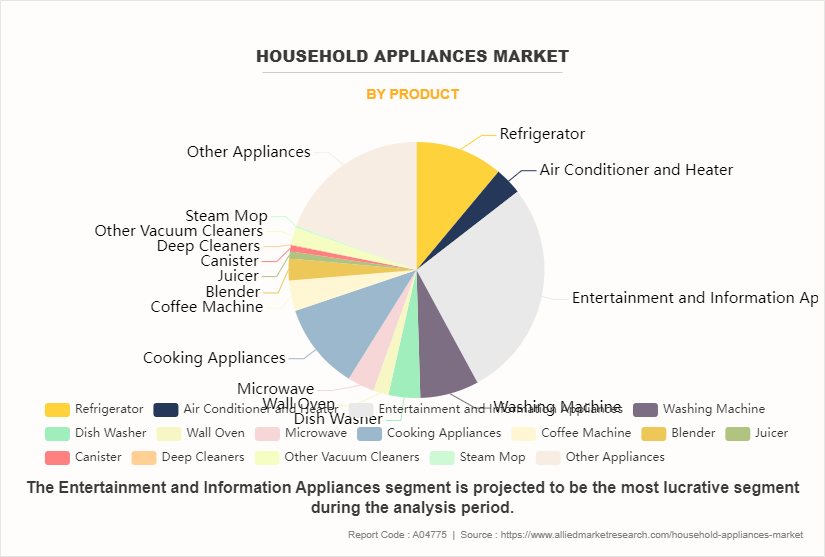

- By Product, the entertainment & information appliances segment was the highest revenue contributor to the market in 2023.

- As per Distribution channel, the specialty store segment was the largest segment in the global household appliances market during the forecast period.

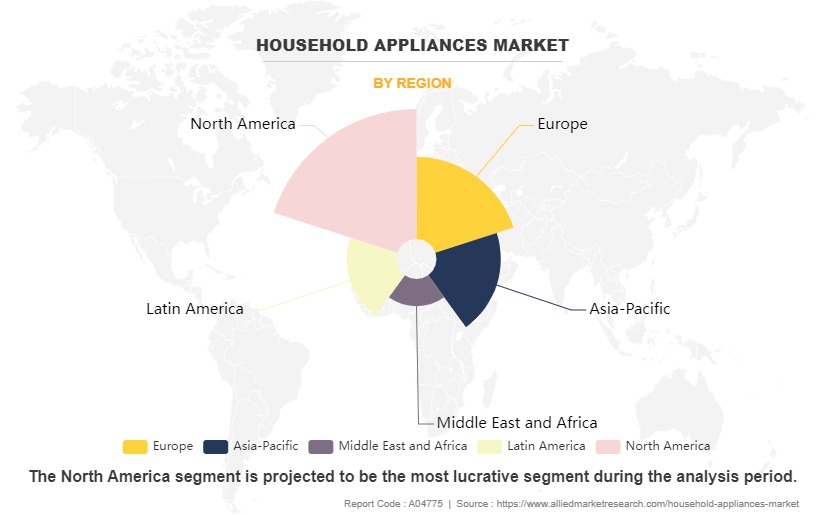

- Region-wise, North America was the highest revenue contributor in 2023 owing to the growing trend of smart homes and connected appliances.

Market Dynamics

The household appliances market has experienced significant growth, largely driven by the increase in disposable income among consumers. With more financial resources at their disposal, individuals are increasingly inclined to invest in modern and sophisticated household appliances that offer convenience, energy efficiency, and enhanced functionality. These appliances have become essential components of daily life, simplifying tasks, and improving overall quality of living. The surge in disposable income has particularly driven demand for premium household appliances, including smart refrigerators, high-end washing machines, and advanced cooking appliances.

Moreover, factors such as increasing urbanization and the rise of nuclear families have further boosted the demand for compact and multifunctional appliances. Urban households, in particular, seek appliances that save time, streamline tasks, and enhance comfort levels. As a result, the overall demand for household appliances has witnessed a notable increase, with consumers increasingly recognizing their role in easing daily chores and improving efficiency. This trend is expected to continue as standards of living improve, the need for convenience grows, and disposable incomes continue to rise, ultimately driving further household appliances market growth in the household appliances sector.

However, counterfeit products often fail to meet quality and safety standards, posing potential risks to consumers. These products use substandard materials, lack proper safety features, and have shorter lifespans compared to genuine appliances. Consequently, consumers who unknowingly purchase counterfeit products may experience dissatisfaction, leading to mistrust and hesitation toward future purchases from legitimate brands. According to a report by the International Trademark Association, counterfeit goods cost the global economy over $1 trillion annually.

Moreover, the prevalence of counterfeit brands defames the reputation of genuine manufacturers, eroding consumer confidence in the household appliances market. Reputable appliance brands invest heavily in research, development, and quality assurance, which drives up costs. When counterfeit products flood the market at significantly lower prices, it creates an uneven playing field, discouraging legitimate manufacturers from innovating and introducing new products. This ultimately leads to stagnation in the industry, limiting consumer choice and access to advanced appliances. A study by the European Union Intellectual Property Office in 2018 revealed that household appliances market statistics counterfeiting and piracy result in the loss of over 670,000 jobs annually in the EU alone, with a significant portion of these losses affecting the household appliances sector (Source: European Union Intellectual Property Office).

In addition, online retail platforms are the major driver for the household appliances industry. Presently, numerous retailers are associating or have their own web-based retail stores where consumers can gain information about the organization and their products. Moreover, the integration of augmented reality (AR) and virtual reality (VR) technologies in e-commerce platforms has revolutionized the way consumers interact with and visualize household appliances before making a purchase. This immersive experience has further enhanced the online shopping experience, potentially leading to increased sales and customer satisfaction. There is an increase in the number of online shoppers, owing to availability of varied product options and price comparison on online shopping sites. This is useful for retailers due to zero expenditure on physical outlets or stores. One of the major reasons behind consumers preferring online shopping online is that consumers can read reviews provided by other users, and compare various stores, products as well as the price by different sellers.

Furthermore, according to the World Bank, as of 2020, household appliances market forecast approximately 92.5% of the population in North America are internet users, followed by Europe and Central Asia, accounting for around 89.2% of the population as internet users. In addition, access to the internet and online household appliance supplies have provided consumers a platform where they can easily compare assorted products and prices, and shop with comfort. Some of the popular online retailers in the household appliances market are Amazon.com, and Walmart.com among others.

Segmental Overview

The household appliances market analysis is classified into product, distribution channel, and region. By product, the household appliances market is categorized into refrigerator, air conditioner & heater, entertainment & information appliances, washing machine, dish washer, wall oven, microwave, cooking appliances, coffee machine, blender, juicer, canister, deep cleaners, other vacuum cleaners, steam mop, and other appliances. By distribution channel, the market is classified into supermarket & hypermarket, specialty store, e-commerce, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa.

By Product

By Product, the entertainment & information appliances segment dominated the global household appliances market demand in 2023 and is expected to register the highest CAGR of 6.14% during the forecast period, owing to the advancements in technology have led to the integration of entertainment and information functionalities into household appliances, making them increasingly versatile and appealing to consumers. Furthermore, the rise of smart home ecosystems has fueled the demand for interconnected appliances, with entertainment and information appliances playing a central role. Consumers are increasingly seeking seamless integration between their devices, enabling them to control and manage their entertainment experience from a single platform.

By Distribution Channel

By Distribution channel, the specialty store dominated the global household appliances market in 2023 and is anticipated to maintain its dominance during the forecast period with the highest CAGR of 6.09% during the forecast period. Specialty stores are often strategically located in high-traffic areas, shopping malls, or standalone outlets, enhancing their visibility and accessibility to consumers. This physical presence allows customers to interact directly with the products, compare different models, and seek hands-on demonstrations, which can be particularly important for appliances such as refrigerators, ovens, and washing machines, where functionality and design play crucial roles in the purchasing decision. Moreover, specialty stores often invest in creating immersive and interactive retail environments, utilizing engaging displays, demonstrations, and knowledgeable staff to enhance the shopping experience household appliances market share.

By Region

Region-wise, North America is anticipated to dominate the household appliances market with the largest share during the forecast period. North America has a sizable population with relatively high disposable incomes, which translates into a robust demand for household appliances. Consumers in this region often prioritize convenience and efficiency, driving the adoption of advanced and innovative appliances. In addition, North America is home to several leading manufacturers and brands in the household appliances sector, contributing to the region's dominance in the household appliances market size. These companies have established strong distribution networks and brand recognition, further strengthening their market presence and sales. Moreover, the growing trend of smart homes and connected appliances is particularly prevalent in North America, further driving market growth. Consumers in this region are increasingly embracing technologically advanced appliances that offer features such as remote monitoring, energy efficiency, and integration with smart home ecosystems.

Competitive Analysis

Several well-known and upcoming brands are competing for market dominance in the expanding household appliances industry. Smaller, niche firms have become more well-known for catering to consumer demands and tastes. Large conglomerates, however, still control the majority of the market and frequently buy creative start-ups to broaden their product lines.

Private label brands created by merchants and e-commerce platforms are another aspect of the competitive market. While they provide more affordable options, they might have different recognition or range of products than well-known companies. An important competition component is innovation in formulations, ingredient sourcing, and sustainability policies. Companies that can influence the preferences of their considered audience and coordinate with their ethical and environmental principles hold a competitive edge against competitors.

Recent Developments in Household Appliances Market

- In April 2022, LG Electronics, leading Consumer Durable brand, launched the new lineup of 2022 Home Appliances which includes a range of Smart Home Appliances. The 2022 lineup consists of new Stunningly Stylish Refrigerators - InstaView Door-in-Door™ and Frost-Free Refrigerators, AI Direct Drive Washing Machines, Puricare™ Wearable Air Purifier, VIRAAT Air Conditioners, UV+UF Water Purifiers and a new range of Charcoal Microwaves.

- In April 2024, Samsung Electronics announced the launch of a range of AI-powered home appliances enabled with bespoke AI (artificial intelligence) that ensures smarter living for homes and reduces energy consumption, contributing to a greener planet.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the household appliances market analysis from 2023 to 2035 to identify the prevailing household appliances market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the household appliances market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global household appliances market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global household appliances market trends, key players, market segments, application areas, and market growth strategies.

Household Appliances Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 294 |

| By Product |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Robert Bosch GmbH, Whirlpool Corporation, Panasonic Corporation, Sharp Corporation., Haier Group Corporation., AB Electrolux, Midea Group Co., Ltd., Hitachi, Ltd., Samsung Electronics, LG Electronics |

Analyst Review

The global household appliances market is emerging at a considerable pace due to several factors such as increase in compatibility of the appliances, enhanced internet penetration, changes in lifestyle patterns, and growth in concerns about energy prices. Over the past few years, there has been an increase in the women workforce; and therefore, families rely on different appliances for comfort. These appliances also help ease the chores and save time.

Moreover, Asia-Pacific and LAMEA are projected to register a significant growth as compared to the saturated markets of Europe and North America due to rapid urbanization, increase in penetration of technology even in small cities, growth in disposable income, and improvement in standard of living.

In line with increase in environmental concerns, consumers also prefer to buy appliances that are eco-friendly and energy efficient. Therefore, manufacturers take steps to improve the product efficiency and reduce e-waste.

The global household appliances market was valued at $490,452.88 million in 2022 and is projected to reach $983,193.41million by 2032, registering a CAGR of 6.03% from 2023 to 2032.

The forecast period in the household appliances market report is 2024 to 2035.

The base year calculated in the household appliances market report is 2023.

The top companies analyzed for global household appliances market report are Haier Group Corporation, Robert Bosch GmbH, Samsung Electronics, Whirlpool Corporation, LG Electronics, Hitachi, Ltd., Midea Group Co., Ltd., Panasonic Corporation, Sharp Corporation, and AB Electrolux.

Entertainment & information appliances segment is the most influential segment in the household appliances market report.

North America holds the maximum market share of the household appliances market.

The company profile has been selected on the basis of revenue, product offerings, and market penetration.

The market value of the household appliances market in 2023 was $490,452.88 million.

Loading Table Of Content...

Loading Research Methodology...