Household Cleaners Market Research, 2031

The global household cleaners market size was valued at $34.1 billion in 2021 and is projected to reach $53.3 billion by 2031, growing at a CAGR of 4.6% from 2022 to 2031.Household cleaner is designed to remove dirt, stains, and germs from surfaces such as floors, walls, and countertops, as well as to clean items, including dishes, laundry, and appliances. These cleaners are available in various forms such as liquids, sprays, powders, and wipes. Common ingredients used in household cleaners include surfactants, which help to lift and remove dirt and stains as well as disinfectants and sanitizers, which inhibit the growth of germs and bacteria. Some household cleaners contain fragrances as well as colorants for aesthetic purposes.

Market Dynamics

With the ongoing pandemic, there has been a heightened awareness of the importance of cleanliness and hygiene. Thus, consumers are becoming more hygiene conscious and looking for effective cleaners, which boosted the demand for household cleaners. Furthermore, manufacturers are intensively launching and distributing cleaners in untapped markets.

Hypermarkets and supermarkets serve as the primary distribution channels owing to their high penetration. In addition, other retail channels such as specialty stores and online stores are expected to gain high traction in the market. The key household cleaners market players such as Reckitt Benckiser and Procter & Gamble are investing in improving their digital presence across the U.S. Thus, rapid emergence of modern retail sales channel is expected to propel the growth of the household cleaners industry.

With the increase in the number of households, the demand for household cleaners is expected to rise simultaneously. The requirement of cleaning products in households to maintain a clean and healthy environment acts as a key driver of the global household cleaners industry. Owing to increase in population couple with rapid urbanization, more households are being built, which, in turn, has propelled the need for specialized cleaning products. For example, homes with hardwood floors require different cleaning solutions than those with carpets or tiles. According to the newly released Census Bureau data for 2020, there is an increase in the number of households in the U.S. due to surge in the number of families in the country. As per the same source, households increased by 9.3% from 2010 to 2020 in the U.S.

Furthermore, manufacturers are modifying their marketing and branding approaches for their goods to boost sales in various nations. Thus, they have implemented cutting-edge tactics to boost sales of household cleaners such as surface cleaner, glass cleaner, toilet bowl cleaner, specialty cleaners, and bleaches. A common tactic used by manufacturers to draw in more consumers is the production of cost-efficient and more effective cleaning products. This aids in boosting the revenue of businesses engaged in this sector. Collectively, all these strategies adopted by manufacturers drive the growth of the market.

The consumer demand for organic products is at its peak in the present situation. With the increasing awareness about organic and natural cleaning products, many companies are now offering a wide range of natural cleaning products, making them more accessible to consumers. According to the Organic Trade Association (OTA), organic non-food revenue crossed over $5.5 billion in the U.S. in 2020, the growth rate has increased by 8.5%.

Further, the organic food revenue crossed over $56 billion in the U.S. in 2020, the growth rate has increased by 12.8%. Therefore, increased awareness regarding the benefits of organic products and rise in environmental pollution issues are encouraging consumers to majorly opt for organic and natural products. Hence, increase in demand for organic cleaners is expected to create lucrative opportunities for new entrants in the upcoming years.

Although household cleaners such as degreasers, abrasives, and acids are effective in removing dirt, they are hazardous to the environment. For instance, degreasers are chemicals that are either oil-based or water-based. Oil-based degreasers are harmful to the groundwater as these are toxic chemicals and sometimes can contribute to the formation of smog. Therefore, rise in awareness regarding environmental concerns and global warming issues among consumers are projected to have a negative impact on the sales of chemical-based household cleaners.

Segmental Overview

The global household cleaners market is segmented into type, application, distribution channel, and region. By type, the market is divided into surface cleaner, glass cleaner, toilet bowl cleaner, specialty cleaners, bleaches, and others. Depending on application, it is categorized into kitchen cleaners, bathroom cleaners, fabric care, and floor cleaners. As per distribution channel, it is bifurcated into online and offline. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Italy, Spain, UK, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Thailand, Malaysia, Indonesia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, UAE, Argentina, and rest of LAMEA).

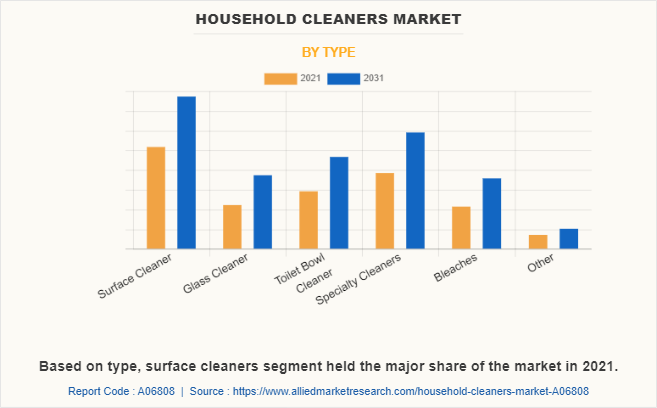

By Type

Depending on type, the surface cleaners segment held the major household cleaners market share in 2021. This is attributed to the fact that consumers are increasingly seeking effective cleaning products that can keep homes and workplaces clean and germ-free owing to rise in awareness of the importance of cleanliness and hygiene. Furthermore, the recent COVID-19 pandemic has heightened consumers’ concerns about the spread of infectious diseases. This has led to an increased demand for surface cleaners that can disinfect and sanitize surfaces, which is expected to propel household cleaners market growth.

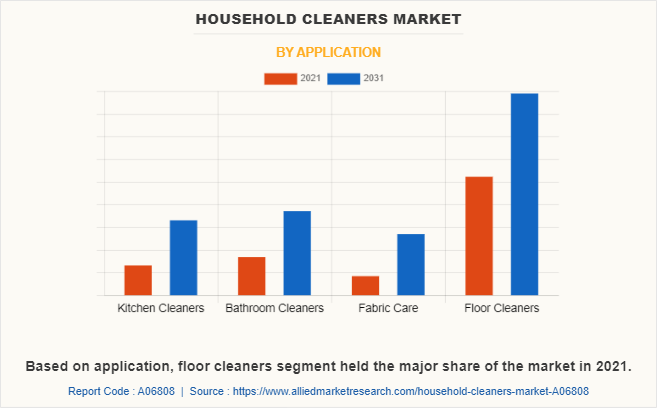

By Application

On the basis of application, the floor cleaners segment was the major shareholder in 2021. Floor cleaners mainly consist of abrasives and cleaners specially used for cleaning various floor types such as hardwood floors, laminate floors, tile floors, and vinyl floors. The wood flooring industry mainly depends on households owing to the increased demand for wood flooring. With the rise in the number of households, consumers are becoming more aware of the importance of maintaining a clean and healthy home environment, which has led to an increase in household cleaners market demand. Manufacturers are focusing on developing products that are specifically designed to disinfect surfaces and eliminate germs and bacteria.

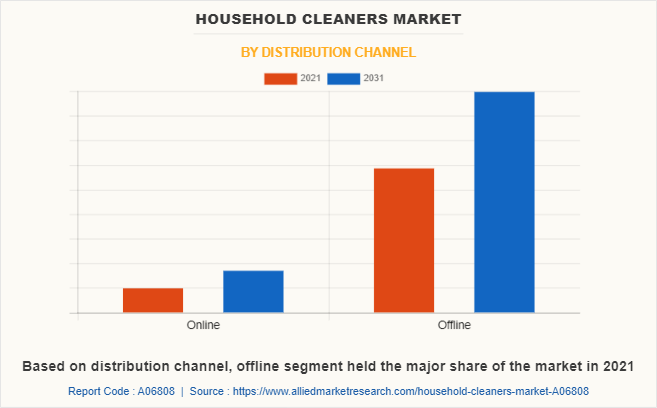

By Distribution Channel

By distribution channel, the offline segment prominent share contributor in 2021 and is expected to maintain its dominance during the forecast period. Hypermarkets & supermarkets, specialty stores, convenience stores and other small retail stores all fall within the offline section. Most localities have a few modest trade lines that house retail establishments, which are often tiny retailers. Such stores are more common in underdeveloped countries with low hypermarket and supermarket penetration rates. Manufacturers consistently work to improve their products' shelf visibility; as a result, they focus mostly on offline sales. As a result, a larger selection of household products, including household cleaning products, is offered offline, which significantly contributes toward the growth of the segment.

By Region

Region wise, Asia-Pacific served as the potential market, garnering maximum share in 2021. , and is projected to grow at the highest CAGR, owing to the constantly expanding infrastructure and real estate sector, where household cleaners are largely demanded. The surge in urbanization and high standard of living of the people, especially in developing countries including India and China, are further driving the growth of the household cleaners market in Asia-Pacific. Moreover, rise in disposable income and high spending on home improvement are some of the major factors positively influencing the product market during the household cleaners market forecast.

Competition Analysis

The players in the household cleaners market have adopted acquisition, business expansion, partnership, collaboration, and product launch as their key development strategies to increase profitability and improve their position in the household cleaners market. Global brands strive among themselves to deliver better value propositions and effective marketing strategies.

Some of the key players profiled in the household cleaners market report include Church & Dwight Co. Inc., Colgate-Palmolive Co., Godrej Consumer Products Ltd., Henkel AG & Co. KGaA, Kao Corp., Reckitt Benckiser Group PLC, S. C. Johnson & Son Inc., and The Procter & Gamble Company.

Recent Partnerships in the Household Cleaners Market

In September 2021, Godrej Consumer Products Limited partnered with InMobi, which is a digital advertising firm. Through this partnership, it will enhance its digital marketing capabilities to strengthen its business presence.

In March 2021, Dettol, brand of Reckitt Benckiser Group PLC, partnered with CleanedUp, brand of theUp.co., which provides sanitizing solutions. Through this partnership, it will provide small businesses with access to hygiene products to raise hygiene standards. This will strengthen its business presence and increase its consumer base.

In December 2020, Dettol partnered with Mirvac, to help increase trust among customers, retailers, staff, and communities across the company's 16 shopping centers, ensuring they continue to shop, dine, and play with increased confidence..

In April 2020, Godrej Conumer Products Limited partnered with Zomato, Shop Kirana and Zoomcar, which are online products and services provider company. This partnership will improve product distribution of direct essential supplies to distributors, consumer, and retailers.

Recent Product Launches in the Household Cleaners Market

In March 2023, The Procter & Gamble Company launched new product under its fabric care product line. This launch includes Spring home & fabric care limited edition range of products for its brands such as Fairy and Lenor. This launch expanded its product portfolio in the fabric care product line.

In November 2022, Reckitt Benckiser Group PLC and Essity AB, manufacturer of consumer goods launched co-branded range of products, which include Antibacterial Multipurpose Cleaner Spray and antimicrobial Foam Soap and a Hand Sanitizer Gel for use in Tork dispensers. This launch expanded its current product offering and strengthened its business presence.

In February 2022, Henkel AG & Co. KGaA launched new sustainable packaging for its Pril brand. This launch includes a refill pouch, which saves 70% percent plastic. This launch expanded its sustainable product offering and expanded its portfolio.

In October 2021, The Procter & Gamble Company launched new Febreze Fabric Antimicrobial. This is infused with a new formula and kills 99% of bacteria. This launch expanded its product offering to its consumer in the fabric care product line.

In August 2021, Godrej Consumer Products Limited launched new products to strengthen its current e-commerce business. This launch includes Godrej Ezee Detergent Pods, and Godrej Protekt All-in-1 Dishwasher Tablets.

In August 2021, Jyothy Labs Limited launched 100% Organic compound-based T-Shine Floor Cleaner. With this launch, it expanded its current product offering the surface cleaners line.

In February 2021, Jyothy Labs Limited launched its product Ujala Liquid Detergent in Tamil Nadu and Kerala. This expanded its product reach and has expanded its consumer base.

Recent Expansions in the Household Cleaners Market

In December 2022, The Procter & Gamble Company invested $501 million dollars to expand its fabric care products manufacturing company in Lima, Ohio, U.S. This expansion will expand its production and manufacturing capabilities.

In February 2022, Kao Corporation opened a new manufacturing plant in Texas, U.S., to meet the growing demands for its sterilizing, cleaning, and industrial products.

In February 2022, Saraya Co. Ltd. opened a new facility in Germany. With this facility, it will strengthen its business presence in the Country and will further its production capabilities.

In February 2020, Henkel Adhesives Technologies India Private Limited, a subsidiary of Henkel AG & Co. KGaA, opened a new manufacturing facility in Pune, India. This new manufacturing plant will expand its production capabilities and will further its presence in the region.

Recent Collaboration in the Household Cleaners Market

In November 2022, Reckitt Benckiser Group PLC collaborated with Essity AB, which is a consumer goods manufacturing company. Through this collaboration, they will incorporate product development expertise to launch new disinfectant products with Dettol, Sagrotan, and Tork.

In February 2022, Reckitt Benchiser Group PLC collaborated with Diversey Holdings, Ltd., which is a hygiene and disinfectant development and delivery company. Through this collaboration, it will expand Reckitt's product presence in business-to-business distribution capabilities across the Middle East and Asia-Pacific.

In April 2021, The Clorox Company and The Golden State Warriors, Chase Center announced collaboration, under which Clorox will officially provide various disinfectant and cleaning products. This will expand its consumer base and its business presence.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the household cleaners market analysis from 2021 to 2031 to identify the prevailing household cleaners market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the household cleaners market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global household cleaners market trends, key players, market segments, application areas, and market growth strategies.

Household Cleaners Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 53.3 billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 290 |

| By Application |

|

| By Distribution Channel |

|

| By Type |

|

| By Region |

|

| Key Market Players | The Clorox Company, Hindustan Unilever Limited, Reckitt Benckiser Group PLC, Formula Corp., S. C. Johnson & Son Inc., McBride plc, The Procter & Gamble Company, Henkel AG & Co. KGaA, Church & Dwight Co., Inc., Kao Corporation, Saraya Co. Ltd., Jyothy Labs Limited, Godrej Consumer Products Limited, Colgate-Palmolive Company, RSPL Group Pvt. Ltd. |

Analyst Review

According to the insights of CXOs of leading companies, household cleaners are expected to gain high traction in the market owing to an increase in awareness about hygiene and cleanliness among consumers. The rise in concerns regarding the ill effects of using chemical-based cleaners on human health and environmental health among consumers is expected to influence the buying decisions of consumers. An increase in popularity and rapid growth in the demand for organic and naturally labeled products are expected to drive the growth of the household cleaner market. People are increasingly using cleaning products for household applications owing to a rise in consumer standards and an increase in purchasing power, particularly in developing nations in Asia-Pacific and the Middle East. This is creating expansion opportunities for the industry. As a result, the market for household cleaners is expected to experience growth during the projected period. Furthermore, manufacturers need to focus on the development of sustainable cleaners that provide effective cleaning of household appliances and surfaces.

The global household cleaners market size was $34,145 million in 2021 and is estimated to reach $53,254.6 million by 2031, registering a CAGR of 4.6% from 2022 to 2031.

According to the market analysis, the global household cleaners market is segmented into type, application, distribution channel, and region. By type, it is divided into surface cleaner, glass cleaner, toilet bowl cleaner, specialty cleaners, bleaches, and others. Depending on application, it is segregated into kitchen cleaners, bathroom cleaners, fabric care, and floor cleaners. As per distribution channel, it is fragmented into online and offline. Region wise, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Italy, Spain, UK, Russia, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, Thailand, Malaysia, Indonesia, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, UAE, Argentina, and rest of LAMEA).

Asia-Pacific is the largest regional market for household cleaners

The major key players profiled in the Household cleaners market analysis include The key players operating in the household cleaners market include Church & Dwight Co. Inc., Colgate-Palmolive Co., Godrej Consumer Products Ltd., Henkel AG & Co. KGaA, Kao Corp., Reckitt Benckiser Group PLC, S. C. Johnson & Son Inc., and The Procter & Gamble Company.

The global household cleaners market report is available on request on the website of Allied Market Research.

Loading Table Of Content...

Loading Research Methodology...