Hovercraft Market Insights, 2031

The global hovercraft market was valued at USD 224 million in 2021, and is projected to reach USD 331.5 million by 2031, growing at a CAGR of 4.1% from 2022 to 2031. The global hovercraft market is growing due to rise in investment in defense sector, increase in the demand for commercial application, and its growing adoption for recreational purposes. However, high initial cost of hovercraft, operational limitations, and high maintenance costs are the factors hampering the growth of the market. Furthermore, technological advancements and growing demand from emerging countries are the factors expected to offer growth opportunities during the forecast period.

Key Market Trends

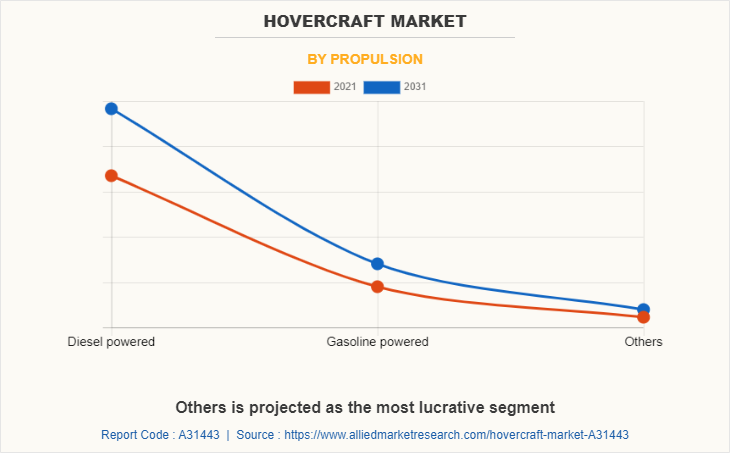

- Propulsion Trend: The Others segment is expected to witness notable growth in the coming years.

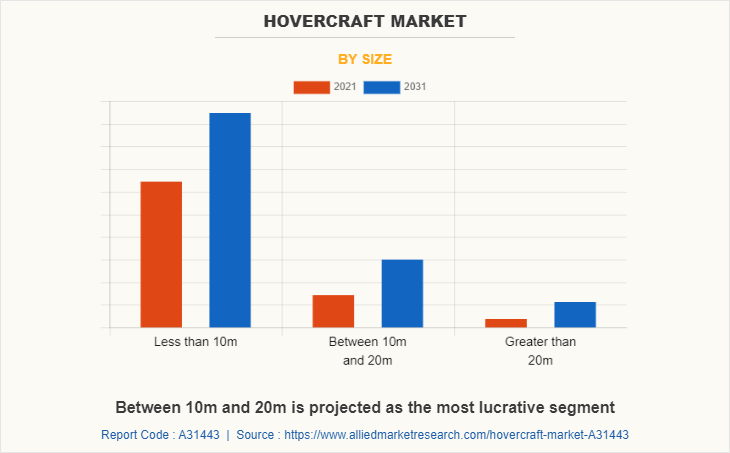

- Size Trend: Vehicles sized between 10m and 20m are projected to experience significant expansion.

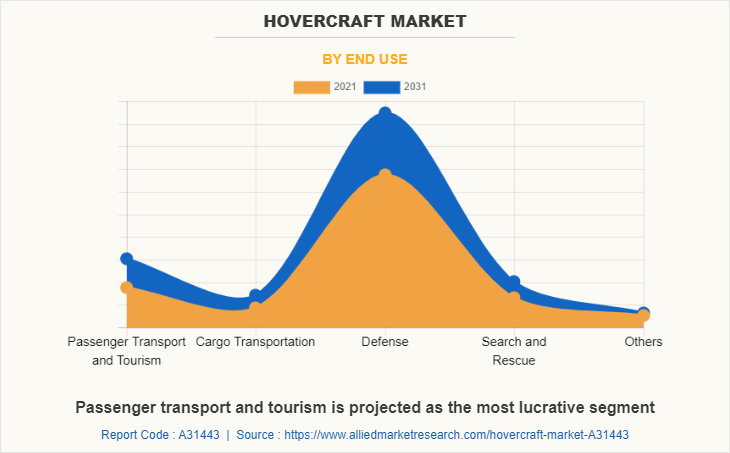

- End-use Trend: Passenger transport and tourism are set to drive strong market demand.

- Regional Trend: Asia-Pacific is forecasted to record the highest CAGR during the study period.

Market Size & Forecast

- 2031 Projected Market Size: USD 331.5 million

- 2022 Market Size: USD 224 million

- Compound Annual Growth Rate (CAGR) (2022-2031): 4.1%

Introduction

Hovercraft is a vehicle, which has the ability to travel over mud, water, land, and ice. It is also referred as an air-cushion vehicle. A hovercraft supports its weight on a high-pressure air cushion that is maintained with the aid of one or more horizontal fans. In addition, hovercrafts are available in different variants ranging from small rescue hovercraft to giant passenger ferries.

At present, hovercraft manufacturers are focusing on developing technologically advanced and lightweight hovercrafts. Hovercraft manufacturers are focusing on reducing noise from the hovercrafts and increasing their payload capacity. In addition, hovercraft manufacturers are launching new technologically advanced hovercrafts in the market. For instance, in 2021, British Hovercraft company in a collaboration with Keith Smallwood of Vortex Hovercraft Services, launched a new BHC700/750D hovercraft to extend its product portfolio. The new hovercraft has payload capacity of up to 750 kg and seating capacity of up to 9 persons. Such advancements in hovercraft are expected to provide growth opportunities for market player in near future.

Market Segmentation

The hovercraft market is segmented on the basis of propulsion, size, end use, and region. By propulsion, it is classified into diesel powered, gasoline powered, and others. By size, it is fragmented into less than 10m, between 10m & 20m, and greater than 20m. By end use, it is categorized into passenger transport & tourism, cargo transportation, defense, search & rescue, and others. By region, the report is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The hovercraft market in Europe is analyzed across the UK, Germany, France, Italy, and rest of Europe. The rest of Europe includes countries such as Sweden the Netherlands, Belgium, and others. The increased adoption of hovercraft in military application in the European region has driven the growth of market. Furthermore, the military logistics through heavy hovercraft have increased in this region. In addition, various adventure hovercraft ride activities and usage of hovercraft in military operations have propelled the growth of hovercraft market.

British companies have lunched a range of new hovercraft in recent years to fulfil the growing demand for hovercraft in the region. For example, in September 2019, The British Hovercraft Company announced the release of their latest hovercraft model, the TIDAL-PRO. This dynamic craft is largely an upgrade to its predecessor craft, the Coastal-Pro XL, with a wider front duct to compensate the bigger, more powerful Briggs & Stratton Vanguard 627cc lift engine, as well as a convenient flip-front bonnet for easy access to the greater lift engine for maintenance. This new bonnet also features a revised air intake system for improved induction.

France based companies have organized various adventure programs to promote usage of hovercraft. For instance, in August 2022, the president of the Rhône association Powerboat Alps, Jean-Claude Delorme, organized a hovercraft raid from Saint-Étienne-des-Sorts to Seyssel, near Annecy in Haute-Savoie. In Saint-Étienne-des-Sorts, enthusiasts from all across Europe gathered. This was the 31st edition of this event, which is the only one of its kind in France. The hovercraft is powered by a motor system that drives the device using a propeller on the back. While some can travel much faster, they are restricted to 40 km/h in this area.

The rest of Europe includes Sweden, Spain, Switzerland, Denmark and other countries across which the hovercraft market report has been studied. Companies operating in this region are continuously introducing new hovercrafts to cater to the growing demand in the region. Sweden military has adopted advanced hovercraft in military operations. For instance, on June 11, 2022, a Swedish navy military hovercraft travelled across the Stockholm archipelago during the Baltic Operations NATO military drills (Baltops 22). With more than 45 ships, 75 planes, and 7,500 soldiers, 14 NATO allies and two NATO partner nations, Finland and Sweden, took part in the exercise.

Which are the Top Hovercraft companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the hovercraft industry.

- Griffon Hoverwork Ltd

- The British Hovercraft Company

- Vanair Hovercraft

- Universal Hovercraft of America Inc.

- Neoteic Hovercraft

- Hovertechnics

- Textron Inc.

- AirLift Hovercraft

- Garden Reach Shipbuilders and Engineers

- Aerohod Ltd

What are the Recent Developments in the Hovercraft Market

In August 2022, Hammacher Schlemmer, an Illinois-based company has launched a new hovercraft namely, ‘The Flying Hovercraft’. The new hovercraft can glide over the land as well as water. It has a 130-hp twin cylinder, liquid cooled engine which can travel up to 155 miles at a speed of 70 mph and 20 feet above the ground

In 2019, Griffon Hoverwork, a part of Gibraltar’s Bland Group, received contracts to deliver two hovercrafts to two separate buyers. The one hovercraft was supplied to a private customer and second hovercraft was destined to serve as a tender for an as-yet-unidentified superyacht. The hovercraft was 8.6 m and has a Ford Tiger Diesel engine, linked to an integrated lift fan & electric generator.

What are the Top Impacting Factors

Key Market Driver

Rise in investment from defense sector

Leading countries such as the U.S., Russia, China, Saudi Arabia, and India are strengthening the defense sectors by investing huge amounts in the procurement and development of advanced military systems. In addition, due to the rise in concern for border security and terrorism, the emerging economies across the globe are modernizing their conventional defense equipment and systems to tackle the enemy. For instance, according to Stockholm International Peace Research Institute (SIPRI), military spending by the U.S amounted to a total of $801 billion in 2021 and the U.S. military burden decreased from 3.7% of GDP in 2020 to 3.5% in 2021. Moreover, military spending of China was $293 billion in 2021, a 4.7% increase compared with 2020.

Furthermore, hovercrafts are primarily employed in defense to provide combat support to forces during amphibious military operations. This provides military troops with efficient monitoring and inspection of land and water borders. In addition, it is used as landing crafts in military applications. It is also used for the transportation of military troops and defense arms such as tanks, weapons, missile launchers, infantry equipment, small aircraft, artillery systems, and others. Thus, countries across the globe are procuring hovercrafts for their robust defense system. This in turn, fuels the demand for hovercrafts.

Growth in demand for hovercraft from commercial applications

Increase in water transportation activities have led the commercial hovercraft manufacturers to develop technologically advanced hovercrafts to fulfill the surge in demand from the commercial sectors. In addition, increase in usage of hovercrafts in various commercial activities such as ferrying passengers, waterway constructions, survey & research, and others further boost the demand for hovercrafts. This factor positively impacts the growth of the hovercraft market.

Moreover, several countries are also awarding contracts to hovercraft manufacturers to develop and deliver hovercrafts for passenger transport services, which also supplements the growth of the market. For instance, in November 2021, Japan awarded a $33.69 million contract to Griffin Hoverwork to develop and deliver three 12000TD hovercraft to Japan. The new hovercraft is expected to provide a passenger service connecting Oita Airport in Kunisaki with Oita City. Thus, rise in demand for commercial application is the factor that is expected to drive the growth of the market during the forecast period.

Greater use of hovercrafts for recreational purposes

Leisure and recreational activities have been gaining traction in recent years across the globe, as individuals are focusing on positive lifestyle for stress management. In recent years, increase in the adoption of hovercrafts for recreational purposes has been observed. Hovercraft is being utilized for several recreational activities such as racing and others. In addition, small commercially manufactured kit or plan-built hovercrafts are increasingly being used for inland racing and cruising. Moreover, small personal hovercrafts are being used for leisure use, which can carry up to 4 persons. Such extensive use of hovercrafts for recreational purposes results in increase in demand for new hovercrafts, which in turn contributes in the growth of the market.

Restraints

High initial cost of hovercraft

The adoption of advanced technology-based systems and equipment in the hovercrafts increases the initial cost of the hovercrafts. The design of the hovercrafts can be customized as per the applications. Thus, the systems used in the hovercrafts must be compatible with both land as well as water, leading to high expenditure.

In addition, the engine used in these vehicles is different from the engine used in the land operated vehicles and has to be specially designed to operate on land as well as water. Such factors increase the initial cost of hovercrafts and thus are expected to hamper the growth of the market.

Operational Limitations

Hovercrafts are utilized for several purposes such as passenger transport, search & rescue, surveying, and others. However, hovercrafts have some operational limitations. Hovercrafts have limited capacity as they carry a certain payload depending on their size to ensure effective hover. In addition, during bad weather conditions, high winds and heavy sea states can affect the performance of hovercrafts. Moreover, hovercrafts cannot operate on steep slopes. Thus, such operational limitations hamper the growth of the hovercraft market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hovercraft market analysis from 2021 to 2031 to identify the prevailing hovercraft market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hovercraft market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hovercraft market trends, key players, market segments, application areas, and market growth strategies.

Hovercraft Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 331.5 million |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 239 |

| By Size |

|

| By Propulsion |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Vanair Hovercraft, Hovertechnics, Garden Reach Shipbuilders And Engineers, Aerohod Ltd., Universal Hovercraft Of America Inc., Textron Inc., Griffon Hoverwork Ltd, The British Hovercraft Company Limited, Airlift Hovercraft Pty Ltd, Neoteric Hovercraft, Inc. |

Analyst Review

The global hovercraft market is expected to witness growth due to rise in investment in defense sector, surge in demand for commercial applications, and growing adoption for recreational purposes.

There has been increasing focus on developing technologically advanced hovercrafts, which have the capability to carry more payload and high speed. Hovercraft manufacturers are launching new hovercrafts with enhanced payload capabilities in the market. For instance, in 2021, British Hovercraft company in a collaboration with Keith Smallwood of Vortex Hovercraft Services, launched a new BHC700/750D hovercraft to extend its product portfolio. The new hovercraft has payload capacity of up to 750 kg and seating capacity of up to 9 persons.

However, high initial cost of hovercraft, operational limitations, and high maintenance costs are the factors that hampers the growth of the market. Furthermore, technological advancements, and growing demand from emerging countries are the factors expected to offer growth opportunities during the forecast period.

The top companies in the market include Griffon Hoverwork Ltd, The British Hovercraft Company, Vanair Hovercraft, Universal Hovercraft of America Inc., Neoteic Hovercraft, Hovertechnics, Textron Inc., AirLift Hovercraft, Garden Reach Shipbuilders and Engineers, and Aerohod Ltd.

The global hovercraft market was valued at $224.0 million in 2021, and is projected to reach $331.5 million by 2031, registering a CAGR of 4.1% from 2022 to 2031.

The largest regional market for hovercraft is North America.

The leading application of hovercraft is defense.

The upcoming trends include greater use of hovercrafts in passenger transport and tourism and the development of electric-powered hovercrafts.

Loading Table Of Content...