Human Insulin Market Research, 2033

The global human insulin market size was valued at $17.1 billion in 2023, and is projected to reach $24.0 billion by 2033, growing at a CAGR of 3.4% from 2024 to 2033. The human insulin market is primarily driven by increasing prevalence of diabetes globally, rising awareness about diabetes management, advancements in insulin delivery devices, government initiatives for diabetes awareness and treatment, and growing geriatric population susceptible to diabetes.

Market Introduction and Definition

Human insulin is a synthetic form of the hormone insulin that is structurally identical to the insulin produced by the human pancreas. Human insulin is used to regulate blood sugar levels in people with diabetes, helping to manage their condition by facilitating the uptake of glucose into cells, thereby lowering blood glucose levels. This synthetic insulin mimics the natural hormone's effects, ensuring that diabetic patients can maintain more stable and healthy blood sugar levels.

Key Takeaways

The human insulin market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major human insulin industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The major factors for the growth of the human insulin market size include the rise in prevalence of diabetes which led to a growing demand for insulin, especially human insulin, which is bioidentical to the insulin produced by the human body. In addition, increase in geriatric population, who are more prone to diabetes, along with changing lifestyles characterized by sedentary behavior and unhealthy dietary habits, contribute to the escalating demand for human insulin. Furthermore, ongoing research and development activities focused on enhancing the efficacy and safety profile of human insulin formulations, as well as the introduction of novel delivery methods, drive innovation during the human insulin market forecast.

However, the cost of insulin remains a significant barrier for many patients, particularly in low- and middle-income countries, limiting access and adherence to treatment which may hamper the market growth. In contrast, ongoing advancements in insulin formulations, delivery devices, and monitoring systems enhance treatment efficacy, convenience, and patient adherence which provide lucrative opportunity to the human insulin market growth.

In addition, heightened awareness campaigns and educational initiatives about diabetes management promote early diagnosis and treatment, leading to greater acceptance and utilization of insulin therapy thereby driving the market growth. Patient education programs also empower individuals to make informed decisions about their diabetes care, driving market growth. Supportive government policies, subsidies, and healthcare reforms aimed at improving diabetes care and access to insulin therapy provides human insulin market opportunity. Reimbursement policies that cover insulin expenses and promote affordability also drive market demand.

Market Segmentation

The human insulin market is segmented into product type, indication, type of insulin, distribution channel, and region. On the basis of product type, the market is categorized into pens, syringes, and others. As per indication, the market is divided into type 1 diabetes, type 2 diabetes, and gestational diabetes. On the basis of type of insulin, the market is classified into rapid-acting insulin, short-acting insulin, intermediate-acting insulin, and others. Depending on distribution channel, the market is classified into hospital pharmacies, drug stores & retail pharmacies, and online providers. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America and Europe have significant major human insulin market share owing to availability of advanced insulin therapies, well-established healthcare systems, and high levels of diabetes awareness. These regions often lead in terms of research and development, innovation, and adoption of novel insulin delivery technologies. Asia-Pacific and LAMEA market exhibits robust growth potential driven by increasing diabetes prevalence, improving healthcare infrastructure, and expanding access to healthcare services.

In 2023, the Indian government made significant strides in diabetes care, particularly regarding insulin. The Ministry of Health and Family Welfare launched an initiative to screen and provide standard care for 75 million people with hypertension or diabetes by 2025.

According to U.S. Department of Health and Human Services, the U.S. government took significant steps in 2023 to address the cost of insulin for Americans. President Biden's Inflation Reduction Act led to major savings for insulin users, with Medicare Part B limiting beneficiary cost sharing to $35 for a month's supply of insulin starting July 1, 2023.

Industry Trends

According to World Health Organization (WHO) in 2022, it has been actively involved in promoting better access to biosimilar insulins and medical devices for diabetes care. WHO has published reports outlining barriers to insulin access and proposed actions to address them, including improving availability, enhancing affordability, and supporting research and development.

According to the Assistant Secretary for Planning and Evaluation (ASPE) in 2023, the Inflation Reduction Act capped out-of-pocket costs for insulin at $35 per monthly prescription for Medicare Part D enrollees. A similar cap took effect for Medicare Part B on July 1, 2023.

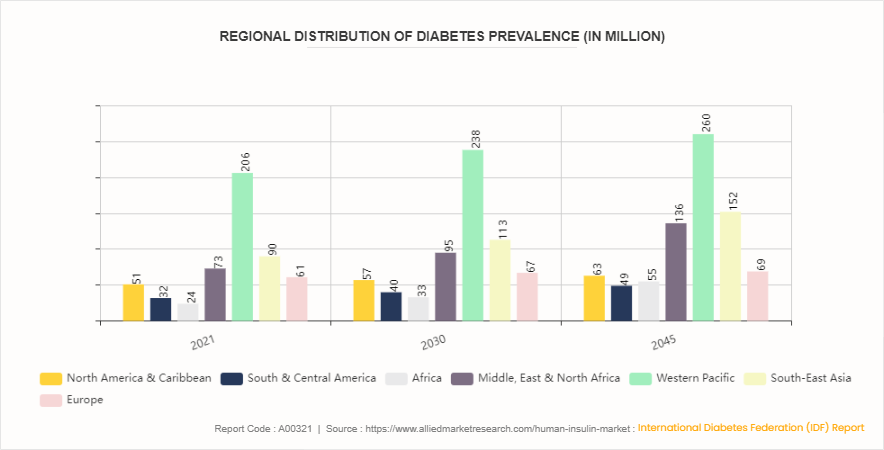

Regional Distribution of Diabetes Prevalence for the Human Insulin Market

According to the International Diabetes Federation (IDF) report, diabetes cases are projected to surge across various regions by 2030 and 2045. In North America & the Caribbean, cases are expected to rise from 51 million in 2021 to 57 million in 2030 and further to 63 million by 2045. Similar trends are observed globally, with significant increases anticipated in South & Central America, Africa, the Middle East & North Africa, the Western Pacific, South-East Asia, and Europe. This escalating prevalence of diabetes underscores the critical role of insulin therapy in managing the condition. As diabetes cases rises, there is expected to be a heightened demand for human insulin, creating opportunities for market expansion and innovation to meet the evolving needs of patients worldwide.

Competitive Landscape

The major players operating in the human insulin market include Eli Lilly and Company, Sanofi, ?Novo Nordisk A/S, Pfizer, Biocon, Wockhardt, MannKind Corporation, Tonghua Dongbao Pharmaceutical Co., Ltd., Medtronic, and Lupin. Other players in human insulin market include Julphar and others.

Recent Key Strategies and Developments in Human Insulin Industry

In October 2022, Novo Nordisk announced headline results from the ONWARDS 5 phase 3a trial with once-weekly insulin icodec in people with type 2 diabetes.

In April 2022, Biocon Biologics Ltd. (BBL) , a subsidiary of Biocon Ltd. announced that European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) has adopted a positive opinion, recommending the granting of a marketing authorization for Inpremzia, a biosimilar version of Actrapid (human insulin) .

In May 2022, MannKind Corporation announced that it has entered into an agreement with Zealand Pharma A/S to acquire V-Go for $10 million, with additional sales-based milestones plus the cost of certain inventory. The acquisition of V-Go allows MannKind to expand its portfolio and strengthen its commitment to providing innovative mealtime diabetes solutions.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the human insulin market analysis from 2024 to 2033 to identify the prevailing human insulin market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the human insulin market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global human insulin market trends, key players, market segments, application areas, and market growth strategies.

Key Sources Referred

National Center for Biotechnology and Information (NCBI)

Centers for Medicare & Medicaid Services (CMS)

National Health Service (NHS)

Australian Government Department of Health and Aged Care

Government of Canada's Health and Wellness

Ministry of Health and Family Welfare (MoHFW)

National Health Mission (NHM)

Ayushman Bharat - Health and Wellness Centres (AB-HWCs)

Centers for Disease Control and Prevention (CDC)

Food and Drug Administration (FDA)

National Institutes of Health (NIH)

World Health Organization (WHO)

Human Insulin Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 24.0 Billion |

| Growth Rate | CAGR of 3.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 245 |

| By Product Type |

|

| By Indication |

|

| By Type Of Insulin |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Biocon, Novo Nordisk A/S, Sanofi, MannKind Corporation, Lupin, Pfizer, Wockhardt, Medtronic, Tonghua Dongbao Pharmaceutical Co., Ltd., Eli Lilly and Company |

Loading Table Of Content...