HVAC Electronics Market Research, 2031

The global HVAC electronics market size was valued at $21.9 billion in 2021, and is projected to reach $38 billion by 2031, growing at a CAGR of 5.7% from 2022 to 2031.

Heating, Ventilation, And Air Conditioning (HVAC) electronic is used to regulate operations of air conditioning, heating, and ventilation systems. It is basically an electronic system equipped with a sensing device, which is used to compare an actual state, such as temperature, with a target state.

Increase in commercial and industrial construction has led to surge in demand for cooling, heating, and ventilation equipment in various industries such as manufacturing, mining, automotive, and power generation. Moreover, strict regulations considering environmental norms and increase in energy bills have forced various commercial and industrial sectors to install HVAC systems in their manufacturing and operating areas. Hence, such factors are anticipated to create demand for HVAC electronics and drive the market growth. In addition, surge in demand for remote access electronics systems and investing in advanced HVAC technology, which are easy to operate and are considerably adopted in commercial and industrial sectors. This growth in investments has led to development of advanced HVAC electronics with various drives, inverters, and sensors. Furthermore, retrofitting of existing infrastructure such as airports, malls, and railway sectors has increased the demand for HVAC electronics.

Increase in population in developing economies such as China, India, and the U.S., has resulted in rapid urbanization, which is expected to boost development of the industrial sector is expected to increase the demand for HAVC electronics. According to the United Nations (UN), around 68% of the global population is expected to live in urban areas by 2050. This is expected to result in an increase in industrial construction activities around the globe and create a need for HVAC electronics.

However, lack of awareness among end users, complexity in upgrading existing HVAC systems, and fluctuations in raw material prices, hinder the HVAC electronics market growth.

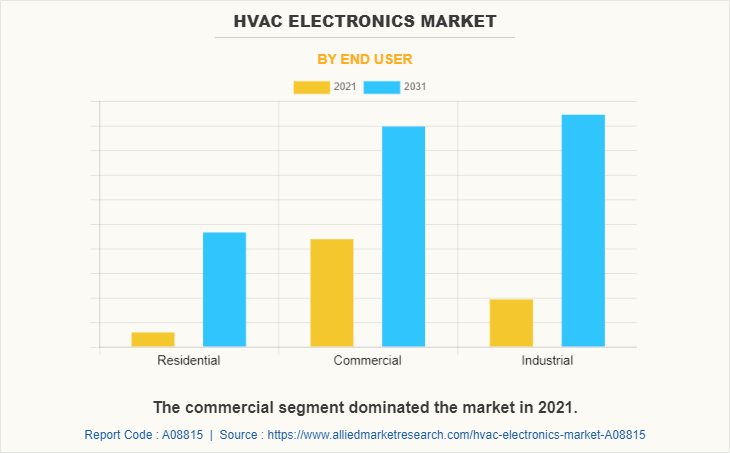

On the basis of end users, the commercial segment has generated the highest revenue in 2021. This is attributed to rise in government investment in new construction and retrofitting of commercial buildings. Similarly, governments across the globe are helping in development of commercial infrastructure. For instance, in August 2020, Tokyo International Conference on African Development (TICAD) planned to invest $20 billion in Africa in the next three years. This is expected to boost growth of the HVAC electronics market during the forecast period.

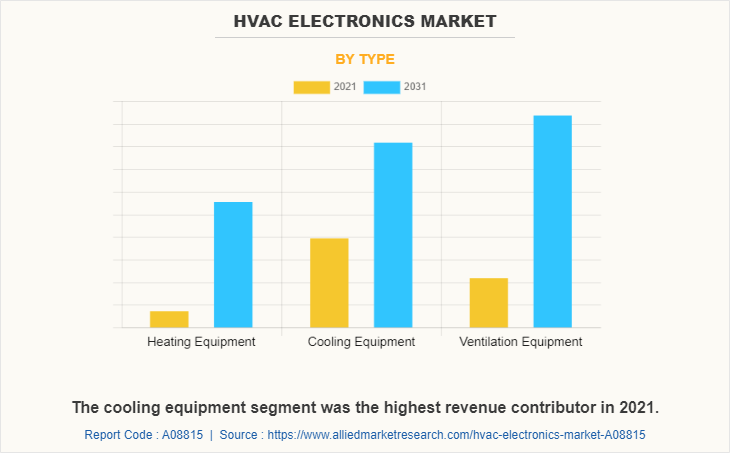

On the basis of type, the cooling equipment segment has accounted the highest HVAC Electronics Market share in 2021. Growth in HVAC industries across the globe and rise in demand for cloud computing in HVAC are anticipated to drive the market growth during the forecast period. Moreover, cooling equipment offers better humidity control with energy-efficient cooling systems in industrial and commercial sectors. In addition, to improve manufacturing and production in industries, manufacturers are continuously introducing new types of HVAC electronics for industrial sector.

The novel coronavirus (COVID-19) rapidly spread across various countries and regions in 2019, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and has now become a significant threat to global trade, the economy, and finance. The COVID-19 pandemic halted production of many products in the HVAC electronics market, owing to lockdowns. Furthermore, the number of COVID-19 cases is expected to reduce in the future with the introduction of the vaccine for COVID-19 on the market. This has led to the reopening of HVAC electronics companies at their full-scale capacities. This is expected to help the market recover by the end of 2022. After COVID-19 infection cases begin to decline, equipment & machinery producers must focus on protecting their staff, operations, and supply networks to respond to urgent emergencies and establish new methods of working.

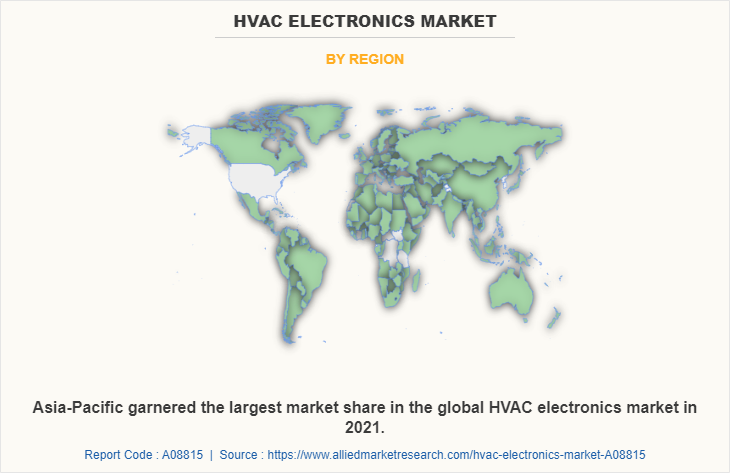

Asia-Pacific dominated the market in 2021, accounting for the highest market share, and is anticipated to maintain this trend throughout the HVAC electronics market forecast period. This is attributed to increasing in population, urbanization, and industry. In addition, China’s 14th Five-Year Plan, covering the years 2021 to 2025, includes government-driven efforts to apply digital technology to the construction and building process. In infrastructure, the central government is expected to focus on transportation and energy. Thus, all such factors are expected to drive the HVAC electronics market growth in Asia-Pacific.

The hvac electronics market is segmented into Type, Installation type and End User. By type, the market is categorized into the heating equipment, cooling equipment, and ventilation equipment. Depending on the implementation type, it is fragmented into new construction and retrofit. On the basis of end-user, it is categorized into residential, commercial, and industrial. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Competition Analysis

Key companies profiled in the HVAC electronics industry include ABB, Carrier Global Corporation, Daikin Industries, Ltd., Danfoss, Delta Controls, Emerson Electric Co., Hitachi Air Conditioning, Honeywell International Inc., Johnson Controls International Plc., Lennox International, LG Corp., Mitsubishi Electric Corporation, Nortek Inc., Raytheon Technologies, Samsung Electronics, Schneider Electric, and Siemens AG.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the HVAC Electronics market analysis from 2021 to 2031 to identify the prevailing HVAC Electronics Market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the HVAC electronics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global HVAC Electronics Market trends, key players, market segments, application areas, and market growth strategies.

HVAC Electronics Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Installation type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Siemens AG, Johnson Controls, Hitachi,Ltd, Samsung Electronics Co Ltd, Carrier Global Corporation, Honeywell, Delta Controls, Mitsubishi Electric, Emerson, Nortek, Lennox, ABB, LG Electronics, United Technologies, Schneider Electric, Daikin Industries, Danfoss |

Analyst Review

The HVAC control market has witnessed significant growth in the past few years, owing to increase in urban population, industrialization, and stringent government norms for installing highly energy-efficient heating, ventilation, and cooling systems. Moreover, increase in government and private sector investments in industrial and commercial construction is fueling the market growth. Rise in industrialization has led to surge in demand for HVAC control in various industries such as manufacturing, foods & beverages, automation, mining, and power generation. Increase in energy bills and stringent regulations considering environmental norms have forced various commercial organizations and industries to install HVAC electronics in their manufacturing areas. Moreover, the adoption of IoT-enabled HVAC systems in industries is increasing considerably, owing to its advantageous features such as high operating speed, better time management for operation, efficient resource utilization, minimized human effort, and increase in productivity.

Moreover, key players are launching advanced HVAC electronics products for enhancing HVAC system performance. For instance, Danfoss unveiled the new VACON 1000 medium-voltage drive in September 2021. The VACON 1000 air-cooled MV drive is the top option for industrial medium-voltage general purpose applications, especially for variable torque loads such as pumps and fans, owing to Danfoss' unmatched competence in cutting-edge AC drive technologies. Such factors are providing lucrative growth in the HVAC electronics market.

The global HVAC electronics market size was valued at $21,850.5 million in 2021.

Asia-Pacific is the largest regional market for HVAC Electronics.

The global HVAC electronics market size is projected to reach $38,037.2 million by 2031.

Low adoption of HVAC controls and complexity in upgrading the existing HVAC systems are the HVAC electronics market effecting factors

The commercial segment is the leading end user of the HVAC Electronics Market

Development of the construction market and rise in demand for building automation systems (BASs) are the upcoming trends of HVAC Electronics Market in the world.

The product launch are the key growth strategies of HVAC electronics industry players.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Loading Table Of Content...