Hybrid Aircraft Market Outlook, 2033

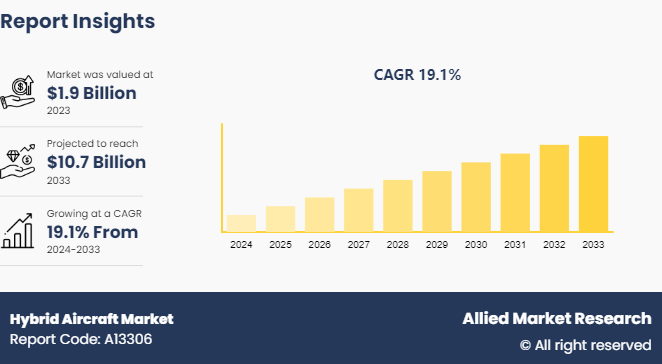

The global hybrid aircraft market size was valued at $1.9 billion in 2023, and is projected to reach $10.7 billion by 2033, growing at a CAGR of 19.1% from 2024 to 2033.

Market Introduction and Definition

The hybrid aircraft market share is a segment of the aerospace industry that focuses on the development and production of hybrid-powered aircraft, which combine both electric and fuel-based propulsion systems to reduce emissions and fuel consumption. These aircraft are designed to offer improved efficiency and reduced environmental impact. Hybrid aircraft utilize a combination of conventional internal combustion engines (typically fueled by jet fuel) and electric propulsion systems. These aircraft aim to combine the advantages of both propulsion methods to achieve improved efficiency, reduced environmental impact, and enhanced performance.

Key Takeaways

The hybrid aircraft market size covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2033.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major hybrid aircraft industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

On May 4, 2024, Ampaire Inc. announced the acquisition of Magpie Aviation Inc., a manufacturer of electric aviation technologies. The acquisition of Magpie's technology will enable Ampaire to continue leading the charge in the electrification of aviation and offer unique solutions to its customers. The acquisition will also broaden Ampaire's IP and contract portfolio through Magpie's multiple pending patents and government contracts. With the acquisition, the company anticipates further revenue growth across both of its commercial and defense sectors while simultaneously enhancing the research and development capabilities.

On May 25, 2021, Faradair Aerospace announced the completion of the project of design for bio electric hybrid aircraft. The company has further announced they have started structural engineering work on the aircraft. Over the eight months, the company has added major partners, including propulsion providers Honeywell and MagniX, and has expanded its workforce to its new headquarters at Duxford airfield in the UK. The initial M1H model is expected to carry 18 passengers or five tons of freight and fly at around 14, 000 feet.

Key Market Dynamics

The global hybrid aircraft market forecast is growing due to several factors, such as growing concerns regarding emission from aviation industry, technological advancements in the electric propulsion technology, and operational cost saving for airline industry. However, high development costs and regulatory challenges restrain the development of the market. In addition, Growing investments in hybrid aircraft technology and growth in air travel provide hybrid aircraft market opportunity during the forecast period.

Hybrid electric aircraft configurations offer substantial fuel savings over conventional platforms through synergistic operation of the gas turbine and electric power. During descent phases, electric motors power the aircraft completely, avoiding fuel burn. During cruising, the load is distributed optimally between the fuel engine and electric propulsion based on efficiency. With the growing volatility in jet fuel prices, these operational cost savings are a major incentive for airlines to adopt hybrid aircraft as they become available. The incorporation of electric propulsion systems, often supplemented by advanced energy storage solutions such as high-capacity batteries, facilitates the optimization of power output, and reduces fuel consumption.

Moreover, with the growing research and development in the hybrid aircraft industry, the market is anticipated to grow significantly. For instance, silicon carbide (SiC) based power electronics allow higher voltage systems improving electric component efficiency. High torque-density electric motors ensure redundancy options for aircraft. For instance, in June 2023 Airbus, a global aerospace company and STMicroelectronics, a global semiconductor company, signed a collaboration agreement for research and development in power electronics. The aim is to improve efficiency and reduce the weight of power electronics, crucial for the advancement of future hybrid-powered aircraft and fully electric urban air vehicles. This joint R&D effort will particularly focus on advanced power semiconductors, playing a pivotal role in propelling the aerospace industry's shift towards hybrid and all-electric systems. These semiconductors are anticipated to be key components in powering upcoming hybrid helicopters, aircraft, the ZEROe initiative, and the CityAirbus NextGen.

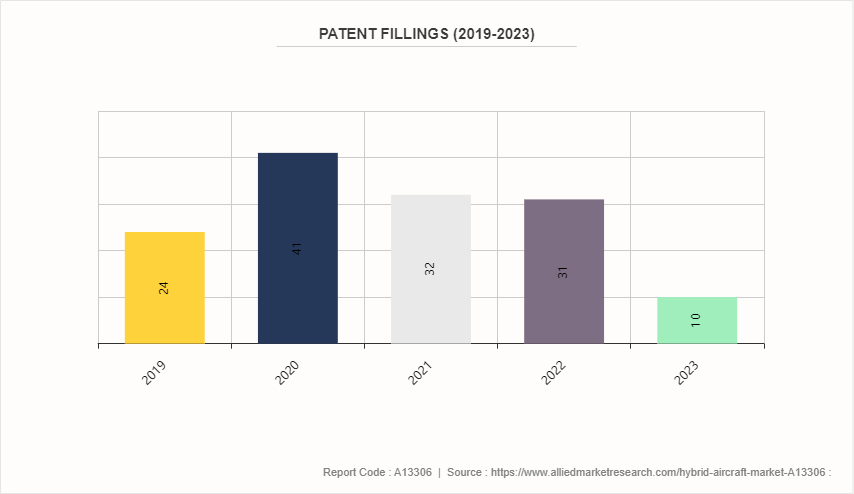

Patent Analysis

A growing inclination has been witnessed among companies toward patents in the aviation industry; the companies operating in the market are working on research and developments and filing patents in hybrid aircraft and electrifications. key players in the aerospace industry have already begun developing hybrid systems and components that rely more heavily on electricity and sustainable fuels, rather than fossil fuel. Many of these patent applications specifically cover hybrid-electric propulsion systems, however, electric motors and improved energy storage technology also form a significant portion of these applications.

Market Segmentation

The hybrid aircraft market is segmented into aircraft type, lift technology, mode of operation, and region. By aircraft type, the market is segregated into business jets & light aircrafts¸ UAVs & AAM, and regional transport aircraft. On the basis of lift technology, the market is divided into conventional takeoff & landing, short takeoff & landing, and vertical takeoff & landing. On the basis of mode of operation, the market is bifurcated into piloted and autonomous. Region-wise, the market is analyzed in North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The growth in air traffic and growth in air freight has led to the growth of the aviation industry; with the growth in passenger travel, the demand for clean and sustainable air travel is growing, thus driving the demand for hybrid aircraft.

The?Asia-Pacific?region witnessed the largest passenger recovery in 2023, after the spread of COVID-19 pandemic. In 2024, the region is expected to continue its growth, at a slower pace, and is expected to reach 3.5 billion, which is around 103% of the 2019 level. According to estimates, the region is forecasted to have nearly 3.9 billion passengers by the end of 2025.

In Europe, passenger traffic to 2.3 billion passengers in 2023. In 2024 it is expected to be around 2.5 billion passengers. After recovering to pre-pandemic levels in the following year, by 2025 passenger traffic is expected to reach 2.7 billion.

The North America region is estimated to reach 2.2 billion passengers or 104% of the 2019 level in 2024. The passenger traffic number is forecast to further increase to 2.3 billion in 2025, returning to its pre-pandemic growth rate.

The?Latin America-Caribbean?region surpassed its passenger traffic to 2019 level in 2023, accounting for 740 million, which is nearly 108% of the 2019 level. In 2024, passenger traffic is expected to reach around 795 million passengers, and 849 million in 2025.

The?Middle East?region is expected to continue to grow from 422 million in 2023 to 466 million in 2024 and then 510 million in 2025. However, certain factors such as geopolitical tension in the region and the growth rate are anticipated to hinder the market growth.

Competitive Landscape

The major players operating in the hybrid Aircraft market include Faradair Aerospace, Ampaire Inc., Embraer S.A, Rolls-Royce Holdings plc., Safran S.A., Raytheon Technologies Corporation, General Electric Company, Airbus SE, Pipistrel and Heart Aerospace.

Other players in the hybrid aircraft market include RTX Corporation, Textron Inc, ZeroAvia¸ GKN Aerospace, Crane Aerospace and so on.

Industry Trends

In 2021, the International Civil Aviation Organisation (ICAO) has set a goal to achieve net zero emissions from the global aviation industry by 2050. The organization unveiled its plan at the IATA Annual General Meeting in Boston, U.S. This pledge brings air transport in line with supporting efforts of the Paris Agreement temperature goal. To achieve this goal the committee is focusing on utilizing 65% sustainable aviation fuels, 13% new technology including electric and hydrogen fuel, 19% offset and carbon capture technologies and improving infrastructure and operational efficiencies by 3%. The collaboration aimed to work collectively with airlines operators, airports, air navigation service providers, and aviation components manufacturers to achieve this objective.

Key Sources Referred

Airports Council International (ACI)

Federal Aviation Administration (FAA)

European Union Aviation Safety Agency (EASA)

Motor & Equipment Manufacturers Association (MEMA) ?

Society of Automotive Engineers (SAE) ?

Aerospace Component Manufacturers Association (ACMA)

European Association of Aerospace Industries (ASD)

Aerospace Industries Association (AIA)

International Aerospace Quality Group (IAQG)

Japan Aerospace Exploration Agency (JAXA)

National Aerospace Standards (NAS)

German Aerospace Industries Association (BDLI)

Key Benefits for Stakeholders

This report provides a quantitative analysis of the hybrid aircraft market growth, segments, current trends, estimations, and dynamics of the hybrid aircraft market analysis from 2023 to 2033 to identify the prevailing hybrid aircraft market opportunities.

Market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the hybrid aircraft market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global hybrid aircraft market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional and global hybrid aircraft market trends, key players, market segments, application areas, and market growth strategies.

Hybrid Aircraft Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 10.7 Billion |

| Growth Rate | CAGR of 19.1% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Aircraft Type |

|

| By Lift Technology |

|

| By Mode Of Operation |

|

| By Region |

|

| Key Market Players | Raytheon Technologies Corporation, Heart Aerospace, Embraer S.A, Ampaire Inc., General Electric Company, Faradair Aerospace, Safran S.A., Pipistrel, Rolls-Royce Holdings plc., Airbus |

Adoption of sustainable aviation fuels are the upcoming trend in the hybrid aircraft market in the globe.

Business jets and light aircrafts are the major application of hybrid aircrafts.

The Asia-Pacific is the largest regional market for hybrid aircrafts.

The hybrid aircraft market will be valued at $10.7 billion by 2033.

Faradair Aerospace, Ampaire Inc., Embraer S.A, Rolls-Royce Holdings plc. are some of the major companies operating in the hybrid aircraft market.

Loading Table Of Content...

Loading Research Methodology...