Hydraulic And Electric Linear Actuators Market Research, 2032

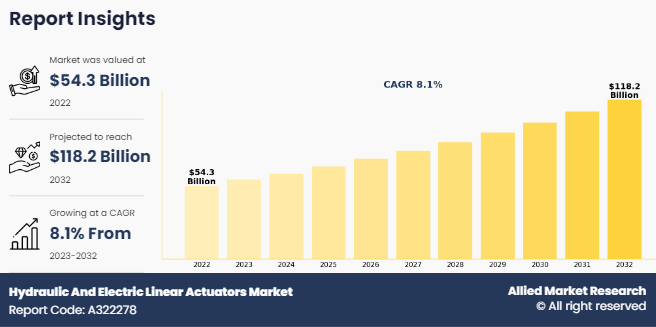

The global hydraulic and electric linear actuators market size was valued at $54.3 billion in 2022, and is projected to reach $118.2 billion by 2032, growing at a CAGR of 8.1% from 2023 to 2032. Linear actuators, both hydraulic and electric, have varied uses and are necessary to provide linear motion. Hydraulic linear actuators harness the power of compressed hydraulic fluid for heavy-duty applications such as construction machinery through the use of a hydraulic cylinder, piston, and control valves. Despite its durability, the possibility of fluid leakage necessitates maintenance. On the other hand, precise and regulated movement is provided by electric linear actuators, which are driven by an electric motor, screw, or rod, and control system. These actuators, which are highly versatile and have applications in robotics, aircraft, and other fields, guarantee energy economy, quiet operation, and adaptability without posing the risk of hydraulic fluid leaks.

Report Key Highlighters

The hydraulic and electric linear actuators market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2022 to 2032.

The research combined high-quality data, professional opinion, and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

The hydraulic and electric linear actuators market share is marginally fragmented, with players such as Bosch Rexroth AG, Eaton Corporation plc, Emerson Electric Co., KYB Corporation, Flowserve Corp., Thomson Industries, Inc., Parker Hannifin Corporation, LINAK A/S, SKF Group AB, and SMC Corporation. Major strategies such as product launch, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Market Dynamics

The global industry's heightened emphasis on efficiency and precision has fueled a surge in demand for advanced motion control systems like linear actuators. Both hydraulic and electric variants are crucial for precise component movement in industrial automation. Electric linear actuators, especially in automated systems, are preferred for their precision, adaptability, and controllability, making them indispensable for activities like material handling and robotic assembly lines. In healthcare, particularly in robotically assisted operations and medical imaging systems, there is a growing reliance on linear actuators, predominantly electric ones, due to their silent operation, compact design, and precision. The increase in adoption of automation and robotics in healthcare drives demand for advanced linear actuators, showcasing their flexibility in meeting diverse sector needs and propelling market growth.

The handling and disposal of hydraulic fluid pose environmental risks, which hampers the hydraulic and electric linear actuators market growth as hydraulic linear actuators rely on hydraulic fluid for force transmission. Stricter environmental laws are challenging due to spill risks and disposal requirements. Improper management leads to water and soil contamination, harming ecosystems. This constraint is pronounced with the growing emphasis on sustainability. In contrast, electric linear actuators, being fluid-free, are preferable for environmentally sensitive applications. To mitigate impacts and meet evolving environmental standards, enterprises in the hydraulic and electric linear actuators market need to develop eco-friendly hydraulic fluids and robust containment systems. Such factors are expected to restrain the growth of market.

The rapid advancement of electric actuator technology presents manufacturers with the opportunity to offer superior precision, quieter, and more effective electric linear actuators. Key developments include the adoption of brushless DC motors, smart sensors, and advanced control algorithms. Electric actuators are gaining robustness and weather adaptability via using novel substances and design techniques. By staying at the vanguard of electric actuator generation, manufacturers capitalize on the developing emphasis on technological breakthroughs in automation systems' performance development. Allocating assets to analyze and improvement for incorporating cutting-edge capabilities allows producers to put themselves as significant contributors to automation development. These elements collectively are predicted to create lucrative growth possibilities for the global hydraulic and electric linear actuators market throughout the forecast period.

Segmental Overview

The hydraulic and electric linear actuators market overview is segmented on the basis of type, sales type, end-user industry and force capacity. On the basis of type, the market is divided into hydraulic and electric. On the basis of sales type, the market is divided into OEM and aftermarket. On the basis of end-user industry, the market is divided into manufacturing and industrial automation, aerospace, construction and heavy machinery, oil & gas, mining, automotive, marine, power generation, renewable energy, medical equipment, material handling, defense and military, and others. On the basis of force capacity, the market is segmented into up to 250 pounds, 250 pounds to 1,000 pounds, and above 1,000 pounds.Region-wise, it is analyzed across North, Europe, Asia-Pacific, and LAMEA.

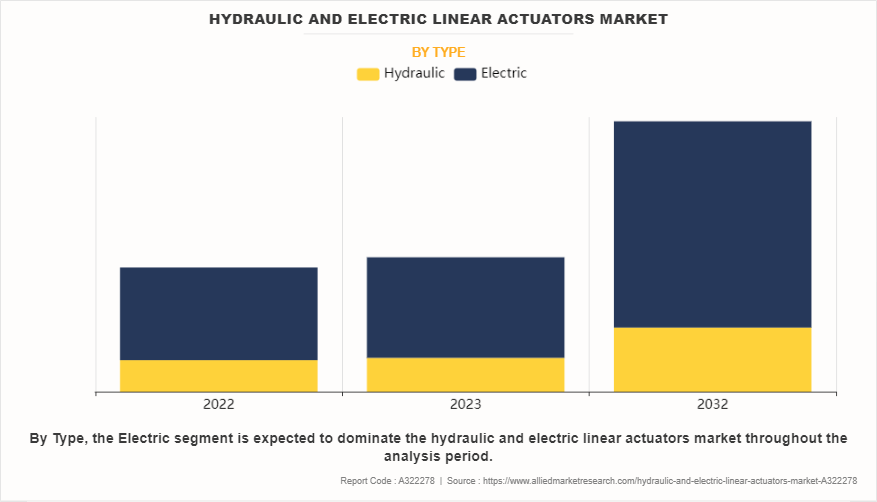

By type: The hydraulic and electric linear actuators market is divided into hydraulic and electric. In 2022, the electric segment dominated the market, in terms of revenue, and the same segment is expected to grow with a higher CAGR during the forecast period. Hydraulic linear actuators convert hydraulic power into straight-line mechanical motion, includes a cylinder and piston system wherein pressurized hydraulic fluid extends or retracts the piston. Valued for high pressure and precision, they're usually utilized in heavy machinery. On the opposite hand, electric linear actuators convert electrical energy into linear motion using an electric motor, eliminating the want for hydraulic or pneumatic structures. Widely applied in automation, robotics, and home automation, electric linear actuators offer precise control, flexibility, and ease of integration. Notable for quieter operation, energy efficiency, and suitability for clean and simple applications, they are favored in various industries.

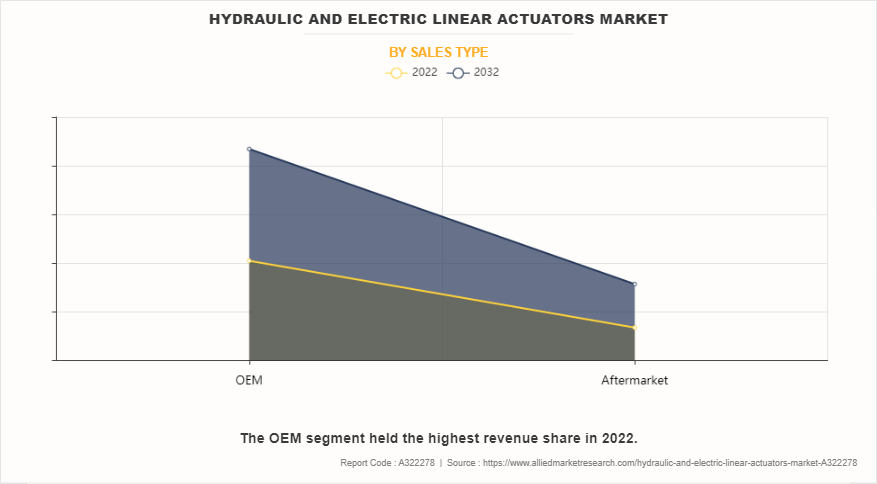

By sales type: The hydraulic and electric linear actuators market forecast is divided into OEM and aftermarket. In 2022, the OEM segment dominated the market, in terms of revenue, and the aftermarket segment is expected to witness growth at a higher CAGR during the forecast period.

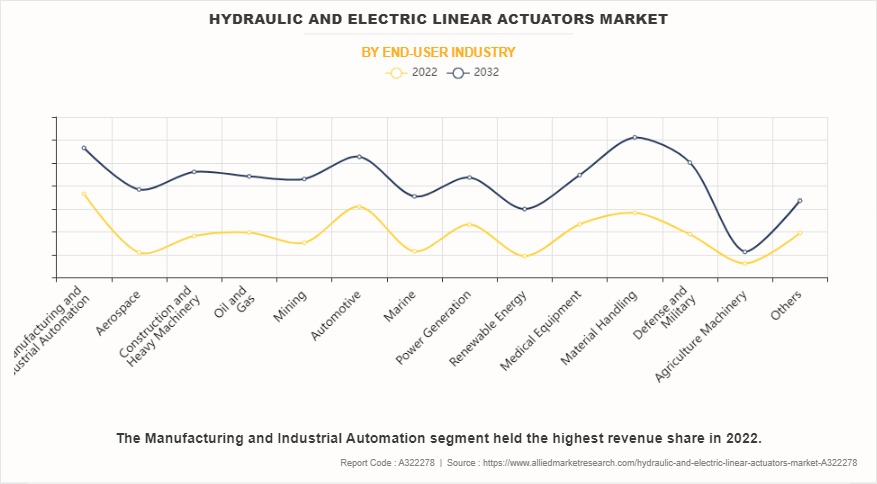

By end-user industry: The hydraulic and electric linear actuators market serves a wide range of industries, from manufacturing and aerospace to construction, automotive, and more. In 2022, the manufacturing and industrial automation sector has highest share in revenue, showing how crucial these actuators are for streamlining production processes. Furthermore, the aerospace industry is expected to see the most significant growth rate, indicating a growing reliance on these actuators for precision and efficiency in aircraft systems.

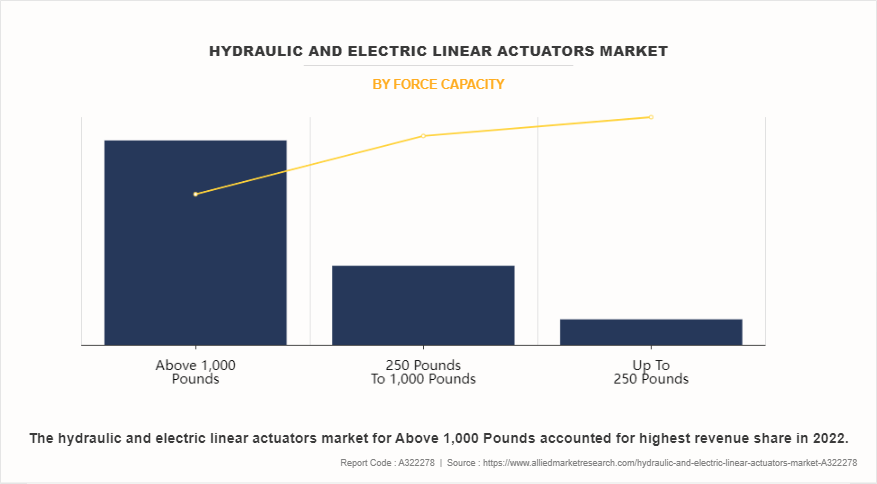

By force capacity: The hydraulic and electric linear actuators market is divided into up to 250 pounds, 250 pounds to 1,000 pounds, and above 1,000 pounds. In 2022, the above 1,000 pounds segment dominated the market, in terms of revenue, and the up to 250 pounds segment is expected to witness growth at a higher CAGR during the forecast period.

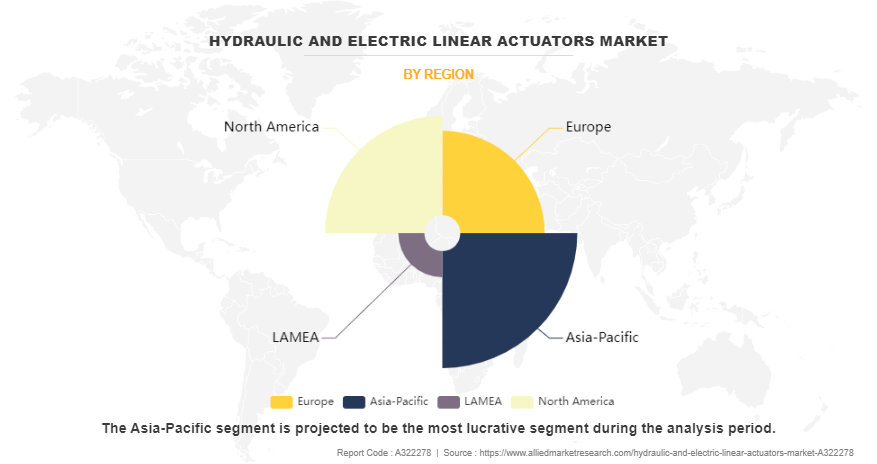

By region: Region wise, the global Hydraulic and electric linear actuators market analysis is conducted across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific accounted for the highest market share in 2022 and is expected to grow with a highest CAGR during the forecast period.

Competition Analysis

Key companies profiled in the hydraulic and electric linear actuators market report include Bosch Rexroth AG, Eaton Corporation plc, Emerson Electric Co., KYB Corporation, Flowserve Corp., Thomson Industries, Inc., Parker Hannifin Corporation, LINAK A/S, SKF Group AB, and SMC Corporation. The major players that operate in the global market have adopted key strategies such as acquisition, business expansion, product launch, and other strategies to strengthen their market outreach and sustain the stiff competition in the market.

Recent developments in hydraulic and electric linear actuators industry

In November 2023, SMC Corporation launched 3 new product lines, together with a pressure regulator and two linear actuators for controlling movement in both pneumatic and electrical structures. Each one of the three lines of products has some advantages that should be weighed against the layout necessities to ensure lengthy-lasting, efficient solutions.

In May 2023, Bosch Rexroth expanded its offerings to include individual linear axes and actuators, in addition to its existing multi-axis systems. These individual linear components are now combined with an automation package, optionally including operating software. This enhancement provides users with more flexibility and options for configuring their linear motion systems according to specific application requirements.

In June 2022, Emerson launched new electric actuators offer superior application flexibility, precision, and repeatability. VENTICS Series SPRA rod-style electric actuators offer unmatched versatility that can better meet exacting application requirements.

In January 2024, Emerson's latest innovation, the Fisher Easy-Drive 200R Electric Actuator was launched, specifically designed to enhance the performance of Fisher butterfly and ball valves. This cutting-edge actuator ensures precise and dependable operation, even in the harshest environments commonly seen in heavy industries like oil and gas facilities located in cold, remote areas.

In November 2023, Flowserve launched new Limitorque QX Series B quarter-turn smart electric actuator. The Limitorque QXb electric actuator provides unmatched reliability and precision while lowering the cost of ownership in a range of demanding applications.

February 2023, Thomson Industries launched Electrak XD actuator, which is the ideal solution for heavy-duty applications, with the capability to handle loads up to 5000 lb and deliver a power output exceeding 450 W. With operating speeds reaching up to 3 in/sec and a duty cycle of up to 100%, this actuator is a reliable and efficient choice for your industrial needs.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hydraulic and electric linear actuators market analysis from 2022 to 2032 to identify the prevailing hydraulic and electric linear actuators market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hydraulic and electric linear actuators market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hydraulic and electric linear actuators market trends, key players, market segments, application areas, and market growth strategies.

Hydraulic And Electric Linear Actuators Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 118.2 billion |

| Growth Rate | CAGR of 8.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 1516 |

| By Type |

|

| By Sales Type |

|

| By End-user Industry |

|

| By Force Capacity |

|

| By Region |

|

| Key Market Players | SMC Corporation, KYB Corporation, Eaton Corporation plc, Flowserve Corp., LINAK A/S, Thomson Industries, Inc., SKF Group AB, Emerson Electric Co., Parker Hannifin Corporation, Bosch Rexroth AG |

Analyst Review

The global hydraulic and electric linear actuators market witnessed a huge demand in Asia-Pacific followed by North America. The highest share of the Asia-Pacific market is attributed to the increase in demand for hydraulic and electric linear actuators in the commercial and industrial sectors.

Rise in the demand for heating and cooling equipment across several industries has been brought on by increased commercial development activity, which is expected to enhance demand for hydraulic and electric linear actuators. The expanding utilization of linear actuators, especially electric ones, is evident in key healthcare applications such as robotically assisted operations and medical imaging systems. Electric linear actuators are well-suited for tasks demanding precise and regulated linear motion due to their silent operation, compact design, and precision. In addition, within industrial automation, hydraulic and electric linear actuators have gained popularity as manufacturing and processing sectors relentlessly pursue heightened productivity, reduced operating costs, and overall efficiency improvement. These trends are poised to contribute significantly to the growth of the hydraulic and electric linear actuators market.

Moreover, manufacturers position themselves as pivotal contributors to the ongoing evolution of automation in various sectors by investing in R&D. By incorporating cutting-edge features, they meet current demands for advanced linear actuators and create lucrative opportunities for market growth.

The hydraulic and electric linear actuators market was valued at $54,287.50 million in 2022 and is estimated to reach $118,182.80 million by 2032, exhibiting a CAGR of 8.1% from 2023 to 2032.

The forecast period considered for the global hydraulic and electric linear actuators is 2022 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year.

The latest version of global hydraulic and electric linear actuators report can be obtained on demand from the website.

The base year considered in the global hydraulic and electric linear actuators report is 2022.

The major players profiled in the hydraulic and electric linear actuators include Bosch Rexroth AG, Eaton Corporation plc, Emerson Electric Co., KYB Corporation, Flowserve Corp., Thomson Industries, Inc., Parker Hannifin Corporation, LINAK A/S, SKF Group AB, and SMC Corporation.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Based on type, the electric segment was the largest revenue generator in 2022.

Loading Table Of Content...

Loading Research Methodology...