Hydraulic Attachments Market Research, 2032

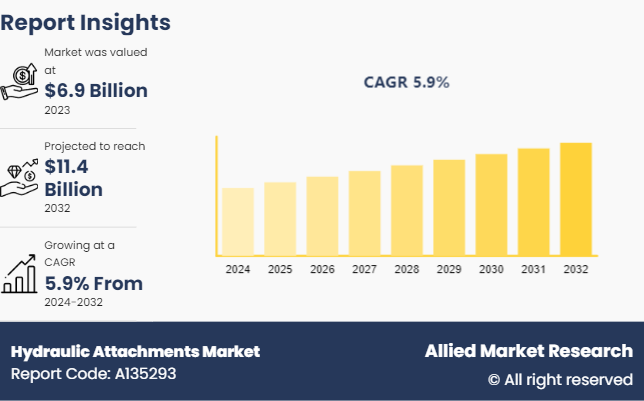

The global Hydraulic Attachments Market was valued at $6.9 billion in 2023, and is projected to reach $11.4 billion by 2032, growing at a CAGR of 5.9% from 2024 to 2032.

Market Introduction and Definition

Hydraulic attachments are specialized tools and equipment designed to be used with hydraulic systems, typically attached to heavy machinery such as excavators, backhoes, and loaders. These attachments harness the power of hydraulic fluid under pressure to perform various tasks, enhancing the versatility and efficiency of the machinery. Common hydraulic attachments include breakers, which are used for demolition work; shears, for cutting metal and other materials; grapples, for handling bulk materials; augers, for drilling holes; and compactors, for soil and asphalt compaction.

The hydraulic system provides a consistent and powerful force, making these attachments essential in industries such as construction, mining, forestry, and recycling. The ease of switching between different attachments allows for greater flexibility and productivity on job sites. Innovations in hydraulic technology continue to improve the performance, durability, and energy efficiency of these attachments, thereby expanding their applications and hydraulic attachments market demand.

Key Takeaways

The hydraulic attachments market forecast study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major hydraulic attachments industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global hydraulic attachments market and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The hydraulic attachments market is growing due to increasing construction and infrastructure development worldwide. Factors such as efficiency in heavy machinery operations, enhanced productivity, and versatility in applications are key factors boosting hydraulic attachments market growth. However, challenges such as high initial costs, maintenance requirements, and technical complexities hinder market expansion.

The opportunities lie in technological advancements, including the integration of IoT and automation, which improve attachment performance and operational efficiency. In addition, rising environmental concerns are pushing demand for eco-friendly hydraulic attachments with reduced emissions and noise levels.

Hydraulic attachments market growth is also influenced by regulatory trends favoring sustainable practices and safety standards, impacting attachment design and manufacturing processes. Global economic fluctuations and geopolitical tensions pose potential restraints, affecting market dynamics.

Value Chain Analysis of Global Hydraulic Attachments Market

Raw Material Supply

Key Materials: The primary raw materials for hydraulic attachments include high-strength steel, hydraulic components, and rubber seals.

Suppliers: Steel manufacturers, hydraulic component producers, and rubber product manufacturers supply the essential materials.

Component Manufacturing

Hydraulic Systems: Production of hydraulic cylinders, pumps, motors, valves, and hoses is critical. These components are specialized and often sourced from established hydraulic system manufacturers.

Structural Components: This involves the fabrication of the steel structures that form the main body of attachments like breakers, shears, and grapples. This stage requires precision machining, welding, and assembly.

Product Assembly

Assembly: The hydraulic systems are integrated with the structural components to create the final hydraulic attachment. This process may involve both automated and manual assembly lines.

Quality Control: Rigorous testing ensures the reliability and durability of the attachments under various operational conditions.

Distribution

Distribution Channels: Hydraulic attachments are distributed through multiple channels, including direct sales from manufacturers, distributors, and online platforms.

Logistics: Efficient logistics and transportation networks are crucial, as hydraulic attachments are often large and heavy. Manufacturers may have global distribution networks to reach diverse markets.

Marketing & Sales

Marketing: Companies invest in marketing to reach potential customers, including contractors, construction companies, and mining firms. Trade shows, digital marketing, and direct sales teams are commonly used.

Sales Channels: These include direct sales, dealer networks, and partnerships with original equipment manufacturers (OEMs) . Aftermarket sales and support are also significant revenue streams.

End-Use Applications

Construction Industry: Hydraulic attachments are widely used in construction for demolition, excavation, and material handling.

Mining Industry: Attachments like rock breakers and crushers are critical in mining operations for breaking down rocks and minerals.

Infrastructure Development: Attachments are also used in infrastructure projects, including road construction, pipelines, and urban development.

Aftermarket Services

Maintenance and Repair: Providing maintenance, repair, and spare parts services is crucial for extending the lifespan of hydraulic attachments.

Upgrades and Retrofitting: Some companies offer services to upgrade or retrofit older models with new technology to improve efficiency and performance.

Recycling and Disposal

End-of-Life Management: At the end of their lifecycle, hydraulic attachments may be recycled or disposed of. Steel and other metals can be recovered and reused, contributing to the circular economy.

Key Value Drivers

Innovation: Continuous innovation in materials, hydraulics, and design to improve the efficiency, durability, and versatility of attachments.

Cost Efficiency: Streamlining manufacturing processes and optimizing the supply chain to reduce costs.

Customer Support: Providing robust after-sales service, including maintenance, spare parts, and technical support, to ensure customer satisfaction.

Market Segmentation

The hydraulic attachments market is segmented into type, end user, and region. On the basis of type, the market is divided into excavators, loaders, dozers, auger, grapple, others. On the basis of end user, the market is classified into construction, mining, agriculture, material handling, excavation, others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Market Segment Outlook

Based on type, the excavators held the highest market share in 2023, accounting for nearly half of hydraulic attachments market size. Excavators are versatile machines used in construction, mining, and infrastructure projects for digging, trenching, and material handling tasks. Their ability to accommodate a wide range of hydraulic attachments like buckets, breakers, and augers enhances their utility and market demand.

Based on end user, the construction segment held the highest market share in 2023, accounting for nearly half of the hydraulic attachments market share. Hydraulic attachments such as excavator buckets, breakers, and augers are extensively used for tasks like digging, trenching, demolition, and foundation work in construction projects worldwide. The continuous demand for infrastructure development, urbanization, and building construction drives this market segment.

Regional/Country Market Outlook

The Asia-Pacific hydraulic attachments market is experiencing significant growth driven by rapid urbanization, industrialization, and infrastructure projects. For example, in China, the Belt and Road Initiative (BRI) has spurred extensive construction and mining activities across the region, boosting demand for advanced hydraulic attachments such as breakers, augers, and grapples. Innovations in technology aimed at enhancing attachment efficiency and performance. Manufacturers are increasingly integrating IoT sensors and automation features into hydraulic attachments, allowing for remote monitoring and operation. This trend is particularly evident in Japan and South Korea, where smart hydraulic attachments are being deployed in construction projects for increased productivity and safety. Furthermore, environmental sustainability is influencing market developments. There is a growing demand for eco-friendly attachments that reduce emissions and noise levels, driven by regulatory initiatives in countries like Australia and Singapore.

- BPH attachments has expanded its range of PRODEM hydraulic attachments with three new launches: the PCB Crusher Bucket, the PRW Rock Wheel, and the PP Patch Planer1. These new products are designed to increase productivity and efficiency in construction, demolition, and excavation projects.

In June 2024, Volvo Construction Equipment (Volvo CE India) unveiled the new EC210, a ‘Built for Bharat’ 20-tonne class hydraulic excavator. The EC210 is designed to offer superior performance, exceptional fuel efficiency, and lower maintenance costs. It is now available at over 300 outlets across the country.

In November 2023, Epiroc, a leading productivity and sustainability partner for the mining and construction industries, announced plans to consolidate its European manufacturing of hydraulic attachment tools. This consolidation will result in the closure of its manufacturing facility in Essen, Germany, by the end of 2025. The production of hydraulic attachment tools will be transferred to other existing Epiroc production facilities in Kalmar and Fagersta, Sweden, and Dermbach, Germany.

Competitive Landscape

The major players operating in the hydraulic attachments market include Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., Liebherr Group, Doosan Corporation, Atlas Copco AB, Sandvik AB, J C Bamford Excavators Ltd., and CNH Industrial N.V. (Case Construction Equipment) .

Other Hyundai Construction Equipment Co., Ltd., Kubota Corporation, Bobcat Company (Doosan Bobcat) , Terex Corporation, Wacker Neuson SE and others.

Recent Key Strategies and Developments

In December 2023, Bobcat expanded its product offerings to include more time- and labor-saving components, such as hydraulic tilt couplers and mechanical pin grabbers for excavators, as well as more laser-guided technology offerings

In May 2023, Caterpillar introduced a hydraulic attachment for backhoe loaders and small excavators. These products were showcased at the ConExpo-Con/Agg 2023 event and are designed to enhance the adaptability of these machines in various applications.

In February 2023, Bosch Rexroth AG inaugurated a cutting-edge Hydraulics Training Center aimed at catering to the technical education requirements within the fluid power industry. This advanced facility is designed to facilitate skills enhancement for newcomers and experienced professionals alike, addressing the diverse learning needs of individuals across various stages of their careers in the industry.

Industry Trends

In June 2024, the upcoming IvT Expo USA in Chicago is set to grow, boasting over 130 exhibitors. The focus will be on showcasing cutting-edge components, materials, systems, and technologies for next-generation off-highway vehicles used in construction, mining, agriculture, and forestry. Expert speakers, numbering over 50, will address key topics including electric and hybrid powertrains, autonomous vehicle advancements, and more.

In May 2024, Epiroc, a global leader in productivity and sustainability solutions for the mining and construction industries, agreed to acquire ACB+, a French manufacturer of attachments and related couplers. ACB+ is based in Saint Lager, France, and is known for its high-quality products and solutions. The acquisition will strengthen Epiroc’s offering of quick couplers and attachments, providing customers with a more complete portfolio of productivity-enhancing products and solutions.

In August 2022, Britlift introduced a new line of forklift attachments, specializing in design and engineering to work safely and easily with fork trucks.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hydraulic attachments market analysis from 2024 to 2032 to identify the prevailing hydraulic attachments market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hydraulic attachments market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hydraulic attachments market trends, key players, market segments, application areas, and market growth strategies.

Hydraulic Attachments Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 11.4 Billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2024 - 2032 |

| Report Pages | 220 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Atlas Copco AB, Komatsu Ltd., Hitachi Construction Machinery Co., Ltd., Caterpillar Inc., Volvo Construction Equipment, Sandvik AB, Doosan Corporation, J C Bamford Excavators Ltd. (JCB), Liebherr Group, CNH Industrial N.V. |

Rise of automated and remotely operated machinery, growing demand for hydraulic attachments that consume less energy and have lower environmental impact and increasing trend towards modular and customizable attachments are the upcoming trends of Hydraulic Attachments Market in the globe.

The leading application of the Hydraulic Attachments market is in the construction industry.

Asia-Pacific is the largest regional market for Hydraulic Attachments.

The hydraulic attachments market was valued at $6,855.8 million in 2023.

Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Hitachi Construction Machinery Co., Ltd., Liebherr Group, Doosan Corporation, Atlas Copco AB, Sandvik AB, JCB, and CNH Industrial N.V. (Case Construction Equipment) are the top companies to hold the market share in Hydraulic Attachments.

Loading Table Of Content...