Hydraulic Turbines Market Statistics - 2027

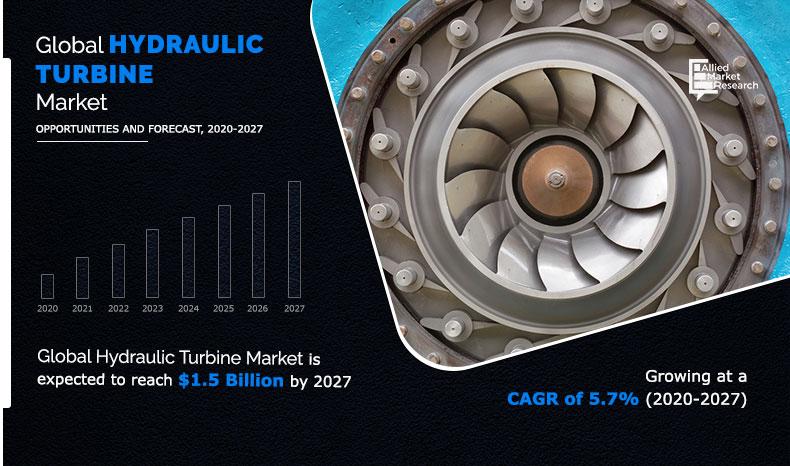

Global hydraulic turbines Market size was valued at $0.9 billion in 2019, and is projected to reach $1.5 billion by 2027, growing at a CAGR of 5.7% from 2020 to 2027. Hydraulic turbine, also known as water turbine, converts kinetic energy of water into mechanical energy. The moment water passes through the turbine, it strikes the blade creating mechanical energy. Then a hydroelectric generator in the system converts this mechanical energy into electrical energy. Generally hydraulic turbine is classified into reaction and impulse turbine. Reaction turbine operates with high water heads and impulse turbine with low water heads. However, reaction turbine is less efficient than impulse turbine. Hydraulic turbine is mostly used for production of clean and sustainable energy.

Significant surge in demand for renewable power sources is expected to drive the hydraulic turbine market growth. Governments across the globe are promoting sustainable energy sources, which can reduce carbon emission, unlike conventional power sources. Furthermore, growth in prominence of various technologies such as run-of-river, low head turbines, and small hydro plants is expected to propel the market demand. In run-of-river, running water from river is guided down to generating house, unlike large hydropower stations. As run-of-river does not require water reservoir and dam system, it leads to reduced cost of infrastructure.

Moreover, replacement of old coal and fossil fuel power plants with renewable power plants is one of the major factors that propels the market growth. In addition, rise in interest of industry players toward hydropower is expected to secure new investments during the forecast period. However, initial installation cost of hydraulic turbine is high and it is suitable only for limited places for construction of hydropower plants. Moreover, location of hydropower plants can be far from cities, which cannot utilize the hydropower. Furthermore, during heavy flood, failure of dam or water reservoirs can lead to serious damage to nearby towns or places. Hence, such factors hamper the growth of the hydraulic turbine market.

Nonetheless, various government initiatives and subsidies is expected to create lucrative opportunities for market players. For instance, in 2014, the U.S. congress approved funds for hydroelectric production incentives under section 242 of the energy policy act of 2005. According to this act, industry players may receive up to 1.8 cents per kilowatt hour (kWh) energy generated with maximum payments up to $750,000 per year. In addition, under renewable electricity production tax credit scheme, industry players are eligible to receive tax credit up to 1.1 cents per kWh.

The global hydraulic turbine market is segmented on the basis of product, rating, and end-user. On the basis of product, it is divided into reaction and impulse. By rating, it is categorized into small (less than 1MW), medium (1MW to 10MW), and large (10MW and above). By end-user, the market is classified into industrial, commercial, and residential. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Major players have adopted business expansion, merger, and acquisition to sustain the intense market competition. Some of the key players profiled in the report include General Electric Company, Siemens AG, Andritz AG, Toshiba Hydroelectric Power, Kirloskar Brothers Ltd, and Litostroj Power Group.

By Region

Asia-Pacific exhibits highest CAGR of 6.3%

Asia-Pacific accounted for the highest revenue share in 2019, owing to rise in concern from governments across emerging nations, such as China, India, and South Korea, regarding zero emission norms. Moreover, China being the largest producer of hydropower is expected to foster growth of the market in Asia-Pacific. Total production of hydropower in China is around 5 times than that of the U.S.

By Type

Impulse Turbine is projected as the most lucrative segment

Impulse turbine accounted for highest revenue share in 2019. This is attributed to rise in demand in small and medium sized hydropower plants, and chemical and pharmaceutical industries. Moreover, the efficiency of energy conversion from kinetic to mechanical energy is higher in case of impulse turbine than that of reaction turbine.

By Rating

10 MW and above is projected as the most lucrative segment

The 10MW and above segment accounted for the highest revenue share in 2019. This was attributed to application of hydraulic turbines in industrial and commercial sectors. Most of these hydraulic turbines are used for hydraulic power plants for power generation. As initial installation and infrastructure cost is high for hydraulic turbines, it is not used for small scale applications.

By End-user

Industrial is projected as the most lucrative segment

The industrial segment is expected to witness highest market growth. This is attributed to strong demand from various industrial end-users for generation of hydropower. Moreover, new incentives and tax credit schemes from governments are expected to further attract new end-users in this sector.

COVID-19 scenario analysis

- The hydraulic turbine industry witnessed mixed impact of COVID-19 pandemic in countries such as China, Brazil, and India.

- In China, hydropower witnessed reduction in demand, however, there has also been a reintroduction of hydropower development.

- Brazil hydraulic turbine market was affected, owing to cancellation of large number of projects

- Moreover, owing to social distancing and lockdown norms, industry players are forces to follow strict restrictions, which affected operations of hydraulic turbines. For instance, in 2020, Statkraft halted construction of its two projects of 100 MW and 52 MW in India and Chile, respectively.

- Supply chain disruption and travel restriction of personnel largely impacted ongoing projects. In addition, restrictions on cross border transport delayed material replenishment.

- Shift in trend toward remote working is considered as a vital solution to improve the market conditions. Various automation companies such as ABB and Siemens are accelerating remote connectivity to ensure access to field operators and service engineers who cannot be on-site at this time.

- These companies are providing control room livestreams, process data, operational insights, and plant key performance indicators to users sheltering at home. Such remote monitoring of critical assets, augmented reality maintenance support, and online tools for training and spare parts stocking are expected to provide new market opportunities post COVID-19.

Key benefits for stakeholders

- The global hydraulic turbine market analysis covers in-depth information of major industry participants.

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- Major countries have been mapped according to their individual revenue contribution to the regional market.

- The report provides in-depth analysis of the global hydraulic turbine market forecast for the period 2020–2027.

- The report outlines the current global hydraulic turbine market trends and future estimations of the market from 2019 to 2027 to understand the prevailing opportunities and potential investment pockets.

- The key drivers, restraints, & market opportunity and their detailed impact analysis are explained in the study.

Key market segments

By Product Type

- Reaction

- Impulse

By Rating

- Small (Less than 1MW)

- Medium (1MW to 10MW)

- Large (10MW and above)

End-User

- Industrial

- Commercial

- Residential

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Saudi Arabia

- South Africa

- Rest of LAMEA

Hydraulic Turbines Market Report Highlights

| Aspects | Details |

| By RATING |

|

| By END USER |

|

| By Region |

|

| Key Market Players | Gilbert Gilkes & Gordon Ltd326, Andritz AG, Siemens AG, Voith GmbH & Co. KGaA, Norcan Hydraulic Turbine Inc., Canyon Industries Inc., General Electric, LITOSTROJ POWER GROUP, KIRLOSKAR BROTHERS LTD. |

Analyst Review

According to CXOs of leading companies, the hydraulic turbine market is expected to witness considerable growth. This is attributed to significant surge in demand for renewable and clean energy. Hydraulic turbine utilizes zero natural resources for power generation, unlike conventional power generation. In addition, rise in concerns from governments across emerging nations, such as China, India, and South Korea, regarding zero emission norms is expected to drive the market growth. Furthermore, various government incentives and subsidy schemes to attract large number of industry players is expected to create lucrative opportunities for the market. This is expected to further create new job opportunities involving more local economic activities in the market. However, at current stage, the market growth is highly volatile, owing to its reliance on government incentives and subsidy schemes.

Industrial, automotive and transport end users are expected to drive the adoption of Hydraulic Turbine.

Industrial en-user is projected to increase the demand for Hydraulic Turbine Market.

To get latest version of hydraulic turbine market report can be obtained on demand from the website.

General Electric Company, Siemens AG, Andritz AG, Toshiba Hydroelectric Power, Kirloskar Brothers Ltd, and Litostroj Power Group are the top companies in the market.

Increase in demand of renewable and sustainable energy sources, replacement of fossil fuel power plants with hydro power plants, and robust investment in new technologies, are the key factors boosting the market growth.

The top ten market players are selected based on two key attributes - competitive strength and market positioning

Hydraulic turbine with 10 MW and above rating accounted for the largest Hydraulic Turbine market share.

The Hydraulic Turbine market was valued at $0.9 billion in 2019, and is projected to reach $1.5 billion by 2027, growing at a CAGR of 5.7% from 2020 to 2027.

Rise in demand for renewable energy sources, coupled with growing application of hydro power plants in industrial and commercial sectors are the main drivers influencing the market growth.

• The hydraulic turbine market witnessed mixed impact of COVID-19 pandemic in countries such as China, Brazil, and India. • In China, hydropower witnessed reduction in demand, however, there has also been a reintroduction of hydropower development. • Brazil hydraulic turbine market was affected, owing to cancellation of large number of projects • Moreover, owing to social distancing and lockdown norms, industry players are forces to follow strict restrictions, which affected operations of hydraulic turbines. For instance, in 2020, Statkraft halted construction of its two projects of 100 MW and 52 MW in India and Chile, respectively. • Supply chain disruption and travel restriction of personnel largely impacted ongoing projects. In addition, restrictions on cross border transport delayed material replenishment. • Shift in trend toward remote working is considered as a vital solution to improve the market conditions. Various automation companies such as ABB and Siemens are accelerating remote connectivity to ensure access to field operators and service engineers who cannot be on-site at this time. • These companies are providing control room livestreams, process data, operational insights, and plant key performance indicators to users sheltering at home. Such remote monitoring of critical assets, augmented reality maintenance support, and online tools for training and spare parts stocking are expected to provide new market opportunities post COVID-19.

Loading Table Of Content...