Hydrofluoric Acid Market Research - 2032

The global hydrofluoric acid market size was valued at $1.9 billion in 2022, and is projected to reach $3.5 billion by 2032, growing at a CAGR of 6.1% from 2023 to 2032. The hydrofluoric acid market is driven by rise in demand in the electronics and semiconductor industry, where it is essential for etching and cleaning processes. In addition, the expansion of the steel and aluminum industry fuels the market growth, as hydrofluoric acid is used for metal treatment and refining. Rise in need for high-quality materials from these industries is significantly contributing to the market's overall growth.

Report Key Highlighters:

The hydrofluoric acid market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) and volume (Kilotons) for the projected period 2023-2032.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The hydrofluoric acid market is highly fragmented, with several players including Daikin Industries Limited, Dongyue Group Ltd, Honeywell International Inc., Lanxess, Solvay S.A., Sinochem Group, Mexichem S.A.B. de C.V., Yingpeng Group, Stella Chemifiae Corporation, and Fluorchemie Group

Hydrofluoric acid (HF) is a highly corrosive inorganic acid with the chemical formula HF, consisting of hydrogen and fluorine atoms. It is notable for its unique ability to etch glass and react with silicate compounds. Contrary to other mineral acids, HF is capable of penetrating glass due to its ability to form stable fluoride complexes with silicon. This property makes it valuable in various industrial applications, such as glass etching, metal cleaning, and the production of fluorocarbons. HF is extremely hazardous and requires careful handling despite its utility. Moreover, diluted hydrogen fluoride is known as hydro fluoric acid.

Increased demand in industrial processes

Hydrofluoric acid (HF) stands as a critical chemical compound with multifaceted applications, prominently contributing to several vital industrial processes. Its indispensability in diverse sectors, such as the production of fluorocarbons, petroleum refining, glass etching, and metal cleaning, underscores its role as a cornerstone in industrial chemistry. One significant application of hydrofluoric acid is in the synthesis of fluorocarbons, where it serves as a key raw material. Fluorocarbons find extensive use in refrigeration, air conditioning, and as propellants in aerosol products. The increase in demand for these products, driven by factors such as population growth, urbanization, and technological advancements, directly influences the need for hydrofluoric acid market growth.

In the realm of petroleum refining, hydrofluoric acid plays a crucial role in alkylation processes. Alkylation is essential for enhancing the octane rating of gasoline, a critical quality parameter for motor fuel energy demand. The petroleum refining industry is compelled to optimize its processes as the global energy demand continues to rise, thereby amplifying the demand for hydrofluoric acid. Glass etching, another significant application, relies on unique ability of hydrofluoric acid to react with silicate compounds in glass, making it invaluable in the production of high-quality glass products. The burgeoning construction and automotive industries, driven by urbanization and consumer preferences for advanced materials, contribute to the sustained demand for hydrofluoric acid in glass manufacturing.

Metal cleaning processes, particularly in industries such as electronics and aerospace, utilize hydrofluoric acid for its effective removal of oxide layers and contaminants from metal surfaces. The requirement for hydrofluoric acid in metal cleaning applications remains robust with continuous advancements in technology and the ever-evolving demands for precision manufacturing. The interconnectedness of hydrofluoric acid with these diverse industries positions it as a linchpin in the intricate web of industrial processes. The demand for hydrofluoric acid is poised to respond dynamically to these shifts, making it a chemical of paramount importance in the tapestry of modern industrial applications as global economic landscapes evolve and industries undergo transformations.

Stringent regulations

The use and handling of hydrofluoric acid are closely regulated due to its significant environmental and health risks, leading to substantial compliance requirements for industries. Governments and regulatory bodies impose stringent standards to ensure the safe production, transportation, and utilization of hydrofluoric acid. Compliance necessitates substantial investments in monitoring systems, comprehensive reporting mechanisms, and the implementation of rigorous safety standards. Industries operating with hydrofluoric acid must navigate evolving regulatory landscapes, which are dynamic and subject to periodic updates. This constant adaptation to regulatory changes adds a layer of complexity and cost to their operations. Companies must invest in continuous training programs to keep employees informed about the latest safety protocols and regulatory requirements. In addition, the need for sophisticated equipment and technologies to monitor and control hydrofluoric acid processes contributes to the financial burden on industries.

These regulations pose challenges for businesses in terms of compliance costs and operational intricacies while they are crucial for safeguarding human health and the environment. The commitment to meeting and exceeding regulatory standards remains paramount, requiring a proactive and adaptive approach to ensure both safety and regulatory compliance within the hydro fluoric acid industry.

Investments in safety technologies

The increase in emphasis on safety in industrial processes, particularly in the handling of hazardous substances such as hydrofluoric acid, creates a notable opportunity for companies specializing in safety technologies. There is a heightened demand for innovative safety solutions as regulations become more stringent and awareness of the potential risks associated with hydrofluoric acid grows. Companies focusing on the development of advanced safety technologies tailored to hydrofluoric acid handling establish themselves as key players in the market. This includes the creation of specialized safety equipment, monitoring systems, and emergency response solutions designed to mitigate the inherent risks posed by hydrofluoric acid.

Investments in R&D to improve safety protocols, enhance protective gear, and implement real-time monitoring technologies significantly contribute to reducing the chances of accidents and minimizing the impact in case of incidents. Such advancements not only align with regulatory requirements but also address the concerns of industries handling hydrofluoric acid, fostering a safer working environment. In essence, the investment and innovation in safety technologies for hydrofluoric acid handling not only meet the growth in demand for improved safety measures but also position companies at the forefront of a critical market segment, driving growth and establishing a reputation for excellence in safety within the hydro fluoric acid industry.

Technology Trend Analysis

The hydrofluoric acid (HF) market is witnessing several technological trends that enhance production efficiency and environmental safety. Advances in production technologies, such as the improved fluorination processes, are leading to higher yields and reduced energy consumption. In addition, innovations in membrane technology for HF recovery are minimizing waste and maximizing resource efficiency, contributing to a more sustainable approach. Rise in demand for fluorinated products in electronics, pharmaceuticals, and specialty chemicals is driving research for safer handling and storage methods, including the development of advanced corrosion-resistant materials.

Furthermore, regulatory pressures are prompting the industry to adopt greener alternatives and implement stringent safety protocols to mitigate the risks associated with HF usage. As companies strive for operational excellence, the integration of digital technologies like IoT and AI in monitoring production processes is becoming more prevalent, enhancing real-time decision-making and improving overall productivity in the hydrofluoric acid market.

Regulatory landscape

Occupational Safety and Health Administration (OSHA) in the U.S.: OSHA has established regulations governing the use of hydrofluoric acid in workplaces to protect workers from exposure and accidents. Employers are required to follow specific safety protocols, provide training, and implement protective measures.

Environmental Protection Agency (EPA) Regulations: EPA regulations focus on environmental protection and waste management related to hydrofluoric acid. These regulations address issues such as emissions, disposal, and spill prevention to mitigate the environmental impact of hydrofluoric acid use.

Globally Harmonized System (GHS) for classification and labelling of chemicals: The GHS, adopted by various countries globally, provides a standardized approach to classifying and labeling chemicals, including hydrofluoric acid. It aims to enhance safety in handling and transportation by ensuring consistent communication of hazards.

International Agency for Research on Cancer (IARC): IARC evaluates the carcinogenicity of substances, including hydrofluoric acid. Understanding the potential health risks associated with hydrofluoric acid exposure is essential for regulatory decision-making.

European Chemicals Agency (ECHA) and Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH): In Europe, ECHA oversees the implementation of REACH regulations, which aim to ensure the safe use of chemicals, including hydrofluoric acid. This involves registration, evaluation, and authorization of chemical substances.

Transportation Regulations: Hydrofluoric acid is subject to specific transportation regulations to ensure its safe movement. This includes regulations set by organizations such as the International Maritime Organization (IMO) for sea transport and the Department of Transportation (DOT) for road and rail transport.

National and Local Regulations: Various countries and local jurisdictions have additional regulations governing the use of hydrofluoric acid, depending on specific industrial applications and safety concerns.

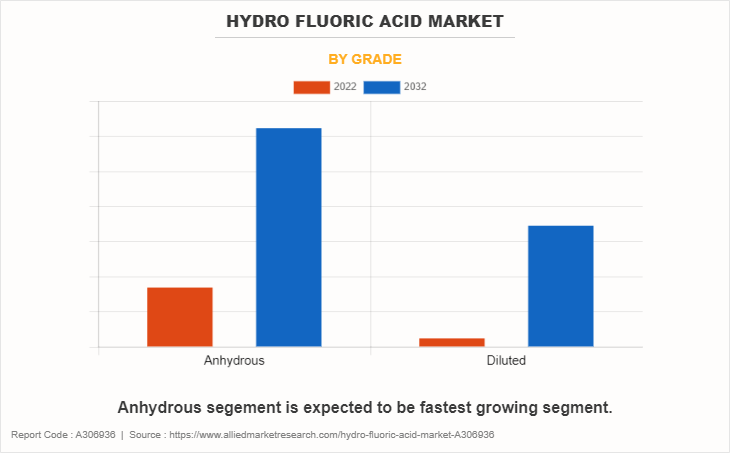

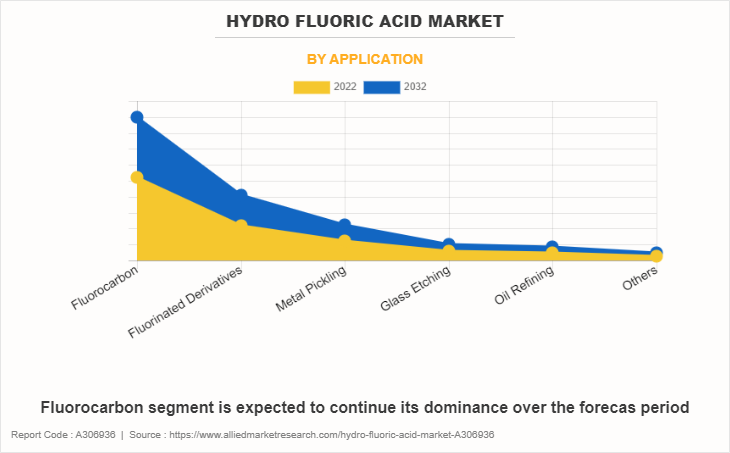

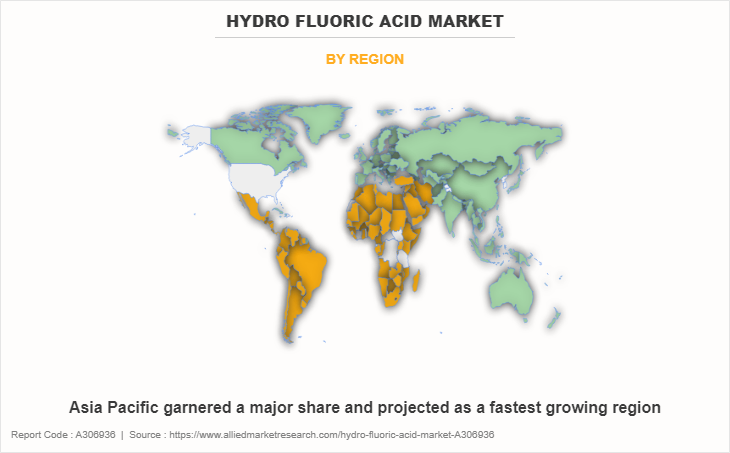

The global hydrofluoric acid market analysis is done on the basis of grade, application, and region. On the basis of grade, the market is bifurcated into anhydrous and diluted. On the basis of application, it is categorized into fluorocarbon, fluorinated derivatives, metal pickling, glass etching, oil refining, and others. On the basis of region, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

In 2022, the anhydrous segment dominated the market, accounting for the largest revenue share in 2022 and also expected to be the fastest growing segment in the near future. Characterized by its water-free composition, anhydrous hydrofluoric acid finds widespread applications in industries such as electronics, petroleum refining, and chemical synthesis. Its versatility and demand in various industrial processes contribute to its dominance, reflecting the significance of anhydrous hydrofluoric acid in the global market.

In 2022, the fluorocarbon segment dominated the market, accounting for the largest revenue share in 2022. Hydrofluoric acid is extensively utilized in the production of fluorocarbons, essential components in refrigeration, air conditioning, and aerosol propellants. The pervasive demand for these applications, driven by technological advancements and consumer needs, positions the fluorocarbon segment as a leading force in the hydrofluoric acid market.

Fluorinated Derivatives are expected to register a highest CAGR of 6.6% over the forecast period. This growth is attributed to the increase in demand for these derivatives in diverse applications, including pharmaceuticals, agrochemicals, and specialty materials. The unique properties conferred by fluorination, such as enhanced stability and performance, drive the rise in adoption of fluorinated derivatives across industries, fostering their anticipated high CAGR in the coming years.

Asia-Pacific hydrofluoric acid market garnered the largest share in 2022. The dominance of this region is fueled by robust industrialization, particularly in countries such China and India. The hydro fluoricacid market size is expected to witness growth in countries including China, India, and South Korea owing to the rapid growth trajectory in the region. Increase in demand for hydrofluoric acid in electronics, manufacturing, and chemical industries contributes to prominent position of Asia-Pacific. The hydrofluoric acid market in Asia-Pacific is expected to maintain its leading share in the foreseeable future as the region continues to witness economic growth and technological advancements.

The hydro fluoric acid market forecast is done based on ongoing industry trends, current industry performance, and historical scenarios. The major players operating in the global hydrofluoric acid market are Daikin Industries Limited, Dongyue Group Ltd, Honeywell International Inc., Lanxess, Solvay S.A., Sinochem Group, Mexichem S.A.B. de C.V., Yingpeng Group, Stella Chemifiae Corporation, and Fluorchemie Group majorly holds the hydrofluoric acid market share. The hydro fluoric acid market share analysis helps analyze the key players and their growth strategies.

Major manufacturers are actively involved in R&D endeavors to create non-toxic offerings. The online distribution of products has experienced rapid growth in contrast to direct sales. Despite this trend, direct sales maintain a larger market value owing to the convenient accessibility they provide to customers. Key industry players prioritize mergers and acquisitions to expand their influence across the entire value chain. These participants engage in various activities, including both production and marketing, aiming to minimize overall operational costs.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hydrofluoric acid market analysis from 2022 to 2032 to identify the prevailing hydro fluoric acid market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hydro fluoric acid market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hydrofluoric acid market trends, key players, market segments, application areas, and market growth strategies.

Hydrofluoric Acid Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.5 billion |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 248 |

| By Grade |

|

| By Application |

|

| By Region |

|

| Key Market Players | Honeywell International, Dongyue Group, Lanxess, Fluorchemie Group, Yingpeng Group, Stella Chemifie Corporation, Daikin, Mexichem, Solvay S.A., Sinochem Group |

Analyst Review

According to the insights of the CXOs of leading companies, hydrofluoric acid (HF) is pivotal in glass etching, a process crucial for the production of electronic components such as semiconductors and solar panels. ’The unique property of HF lies in its ability to selectively dissolve silicon dioxide, the primary component of glass. In semiconductor manufacturing, HF is employed to etch patterns onto silicon wafers, shaping the intricate circuitry that constitutes electronic devices. In solar panel production, HF is utilized to texture the surface of glass, enhancing light absorption and overall solar cell efficiency. This controlled glass etching process, facilitated by HF, is integral to the precision and functionality of electronic components, making it an essential tool in the advancement of semiconductor technology and the growth of renewable energy through solar technologies.

The hydrofluoric acid market faces constraints due to safety concerns linked to its highly corrosive and toxic nature. Stringent safety measures are necessary in handling, storage, and transportation. Accidents result in severe consequences, fostering reluctance in their use and driving the exploration of safer alternatives.

The CXOs further added that, hydrofluoric acid market finds unique opportunities in its role as a catalyst and precursor for fluorine-containing materials crucial in innovative technologies, from semiconductor manufacturing to aerospace applications. The versatility and indispensability of hydrofluoric acid positions it as a key player in advancing diverse industries and applications.

The primary driving factor of the hydrofluoric acid market is its indispensable role in various industries such as electronics, petroleum refining, and chemical synthesis for critical processes.

The global hydrofluoric acid market was valued at $1.9 billion in 2022 and is projected to reach $3.5 billion by 2032, growing at a CAGR of 6.1% from 2023 to 2032.

The major players operating in the global hydrofluoric acid market are Daikin Industries Limited, Dongyue Group Ltd, Honeywell International Inc., Lanxess, Solvay S.A., Sinochem Group, Mexichem S.A.B. de C.V., Yingpeng Group, Stella Chemifiae Corporation, and Fluorchemie Group

Upcoming trends in the global hydrofluoric acid market include increasing demand for non-toxic formulations, growth in online distribution, and strategic mergers and acquisitions.

Asia Pacific has largest market share and expected to continue its dominace due to increase in demand for hydrofluoric acid in electronics, manufacturing, and chemical industries

The hydrofluoric acid Market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The hazardous nature of hydrofluoric acid, posing risks to human health and the environment, coupled with regulatory compliance challenges, serves as a restraining factor.

Loading Table Of Content...

Loading Research Methodology...