Hydrogen Cyanide Market Outlook - 2032

The global hydrogen cyanide market size was valued at $1.2 billion in 2022 and is projected to reach $1.5 billion by 2032, growing at a CAGR of 2.2% from 2023 to 2032. The hydrogen cyanide market is driven by its critical role in producing various chemicals, including adiponitrile for nylon production, sodium cyanide for gold mining, and acrylonitrile for plastics. The demand for these downstream products, particularly in textiles, mining, and polymer industries, fuels the HCN market. Additionally, growing industrialization, especially in emerging economies, and advancements in chemical manufacturing processes are further boosting hydrogen cyanide's market growth, despite safety and environmental concerns surrounding its use.

Introduction

Hydrogen cyanide (HCN) is a colorless, fairly toxic, and volatile chemical compound with the formula, HCN. It is composed of a hydrogen atom bonded to a carbon atom, which is in addition related to a nitrogen atom. HCN is especially used in the manufacturing of a number of chemicals, such as nylon, acrylic fibers, and plastics. It has a different bitter almond odor, though some people can also no longer perceive it due to a genetic trait. HCN is relatively reactive and can release poisonous gases when combusted. It poses significant health risks to humans, with inhalation or ingestion, leading to severe respiratory, cardiovascular, and neurological effects, and even death if inhaled in high concentrations.

Report Key Highlighters:

- The hydrogen cyanide market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The hydrogen cyanide market is highly fragmented, with several players including Air Liquide, Evonik Industries AG, INEOS, SUMITOMO CHEMICAL CO., LTD., Ascend Performance Materials, Kuraray Co., Ltd., Cyanco International, LLC, Cornerstone Chemical, Asahi Kasei Corporation., and Mitsubishi Gas Chemical Company, Inc.

Increasing demand for hydrogen cyanide (HCN) from the chemical enterprise is a great driver for the hydrogen cyanide market.

Market Dynamics

Hydrogen cyanide is a vital uncooked cloth used in the manufacturing of a range of chemicals, such as acrylic fibers, plastics, artificial rubber, and dyes. These chemical compounds have wide-ranging purposes throughout industries such as textiles, automotive, construction, and more. As these sectors proceed to amplify and evolve, the demand for chemicals derived from HCN rises accordingly. The chemical enterprise depends on HCN for its unique chemical houses and reactivity, enabling the synthesis of integral products. HCN acts as a building block for the manufacturing of numerous chemical compounds, enabling the improvement of progressive substances and solutions.

With advancements in technology and the growing focal point on the area of expertise chemicals, the demand for HCN is anticipated to develop further. The growth of the chemical industry, pushed by factors such as industrialization, economic development, and evolving consumer needs, creates opportunities for the hydrogen cyanide market. Market players in the HCN industry are strategically located to meet the upward push in demand for chemical substances and capitalize on the increasing market.

The rise in demand for hydrogen cyanide (HCN) from the pharmaceutical industry serves as a considerable driver for the hydrogen cyanide market.

Hydrogen cyanide is broadly utilized in the synthesis of pharmaceuticals, inclusive of sedatives, anesthetics, and analgesics. These pharmaceutical merchandise are indispensable for clinical procedures, pain management, and affected person care, leading to a continuous demand for HCN. The pharmaceutical enterprise is experiencing a terrific boom globally due to quite a few factors. The expanding global population, aging demographics, and the occurrence of chronic diseases power the need for fine and innovative pharmaceutical solutions. As healthcare systems strive to meet these growing demands, the manufacturing of pharmaceuticals is on the rise, consequently growing the demand for HCN. Hydrogen cyanide performs an essential role in pharmaceutical synthesis as a constructing block for many drug compounds. It enables the introduction of chemically numerous molecules with suited residences for therapeutic applications.

Moreover, HCN's unique chemical homes enable the development of particular pills that target a number of medical conditions. In addition, developments in clinical research and drug discovery make contributions to the growth of the pharmaceutical industry. The demand for HCN in pharmaceutical synthesis is anticipated to rise, as new tablets and treatments are developed. The consistent pursuit of novel and more fantastic prescribed drugs fuels the demand for HCN as a fundamental raw material. As a result, the increasing demand for hydrogen cyanide from the pharmaceutical enterprise drives the hydrogen cyanide market.

Hydrogen cyanide is specially produced from natural gas or coal, each of which is a finite resource. The availability and value of these raw substances can have an impact on the manufacturing and furnishing of HCN. Fluctuations in the availability or expenses of natural fuel or coal can disrupt the manufacturing procedure and lead to supply chain challenges. Limited availability can end result from factors such as geopolitical tensions, extraction difficulties, or modifications in useful resource allocation.

In addition, environmental issues and guidelines surrounding the extraction and use of these raw substances can further impact their availability and increase costs. Limited availability of raw substances can lead to charge volatility, making it difficult for HCN producers to preserve steady pricing and profitability. This can have implications for downstream industries that rely on HCN as a key raw material. It can also additionally encourage manufacturers to seek choice sources of uncooked materials or explore extra sustainable production techniques to mitigate the influence of restrained availability. Thus, the limited availability of raw substances can impede the hydrogen cyanide market.

Increasing research and innovation efforts have the potential to create lucrative possibilities for the hydrogen cyanide (HCN) market. Research and innovation can lead to the discovery of new applications, accelerated production methods, and more desirable safety measures, thereby riding the boom and profitability of the HCN industry. Innovative research can explore novel catalysts and processes that decorate the efficiency of HCN manufacturing whilst minimizing waste and electricity consumption. These developments are expected to end result in low-cost and environmentally pleasant production methods, making HCN a more pleasing choice for a number of industries. Moreover, researchers can focus on creating safer coping with and storage methods for HCN, addressing the worries concerning its toxicity. This can assist alleviate public apprehension and regulatory scrutiny, facilitating market increase and acceptance.

Furthermore, exploring new applications for HCN beyond its typical makes use in chemical synthesis and mining can open up new avenues of profitability. Through R&D activities producers use innovative methods to utilize HCN in emerging sectors such as power storage, renewable energy, and high-tech materials, as a consequence tapping into new markets and expanding the demand for HCN. By investing in research and innovation, the hydrogen cyanide market can adapt to evolving needs and overcome environmental challenges. This, in turn, can create profitable opportunities for the market.

Segments Overview

The hydrogen cyanide market is segmented on the basis of product, application, and region. By product, the market is divided into hydrogen cyanide liquid and hydrogen cyanide gas. On the basis of application, it is categorized into sodium cyanide and potassium cyanide, adiponitrile, acetone cyanohydrin, cyanogen chloride, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

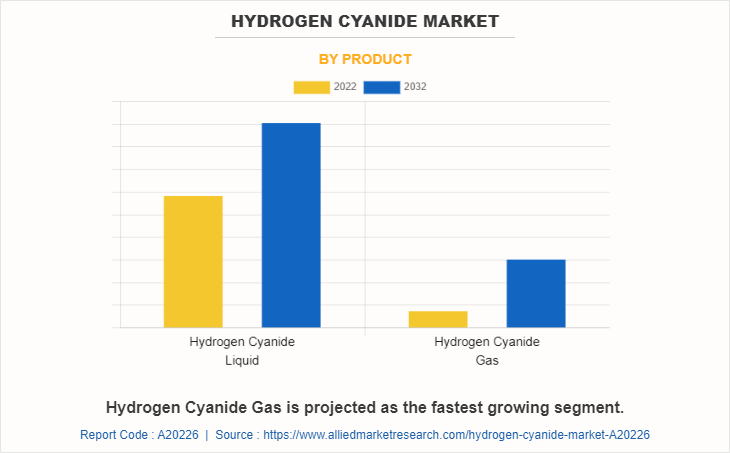

Hydrogen Cyanide Market By Product

The hydrogen cyanide liquid segment held the highest market share in 2022, accounting for more than half of the global hydrogen cyanide market revenue. The increasing use of hydrogen cyanide liquid in chemical synthesis, pharmaceuticals, and electroplating industries is growing the demand for hydrogen cyanide liquid. Additionally, its use in the production of artificial fibers and plastics contributes to its demand. Safety guidelines and developments in manufacturing science additionally affect the market's growth.

Hydrogen cyanide gas registered the highest CAGR of 2.2% in 2022. Its use is in a number of industrial methods like the manufacturing of artificial fibers, plastics, and pharmaceuticals. Additionally, it is employed in the mining industry for gold extraction. The developing demand for this merchandise and purposes contributes to the expansion of the hydrogen cyanide gasoline segment. However, strict rules and security issues may additionally restrict its growth and require cautious handling and monitoring.

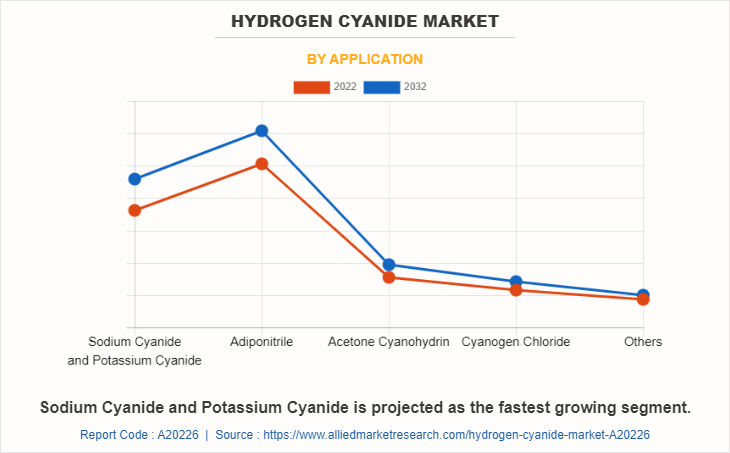

Hydrogen Cyanide Market By Application

The Adiponitrile held the highest market share in 2022, accounting for more than two-fifths of the global hydrogen cyanide market revenue. Increasing demand for nylon production, growth in the automotive and electronics industries, and increasing applications in textiles and purchaser goods. Additionally, advancements in chemical synthesis applied sciences and the upward push of sustainable initiatives are also contributing to the market's growth.

Sodium cyanide and potassium cyanide are anticipated to register the highest CAGR of 2.5%. The increasing demand for sodium cyanide and potassium cyanide from industries such as gold mining, chemical synthesis, and electroplating. The growing utility in these sectors, coupled with developing industrialization and monetary development in a number of regions, is expected to gasoline the market's growth. Strict security regulations and environmental issues may have an impact on market dynamics.

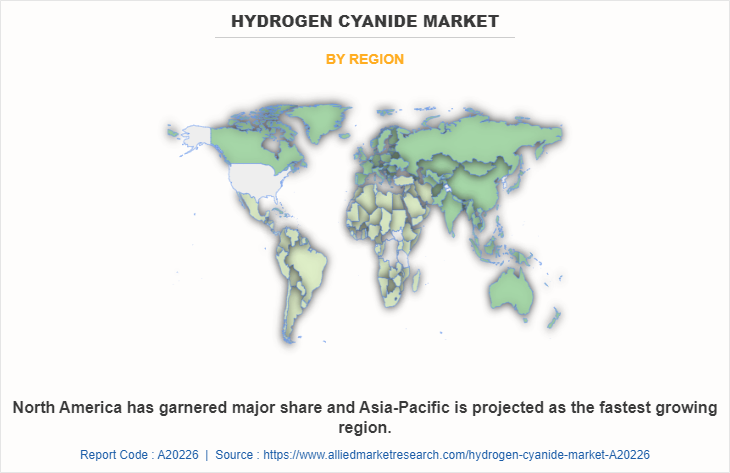

Hydrogen Cyanide Market By Region

North America garnered the largest in terms of revenue in 2022, accounting for more than two-fifths of the global Hydrogen cyanide market revenue. Increasing demand from chemical industries for the manufacturing of acrylonitrile, pharmaceutical applications, and mining processes. Additionally, the rising focus on renewable energy and the viable utilization of hydrogen cyanide in strength storage options make a contribution to hydrogen cyanide market growth. Stringent security guidelines and environmental worries are also influencing factors.

Public Policies

REACH is a comprehensive regulation that applies to the registration, evaluation, authorization, and restriction of chemicals within Europe. It requires companies to register and provide data on the properties and safe use of chemicals, including hydrogen cyanide, produced, or imported in quantities above certain thresholds.

The European Agreement concerning the International Carriage of Dangerous Goods by Road (ADR) and the Regulation concerning the International Carriage of Dangerous Goods by Rail (RID) provides regulations for the transport of dangerous goods, including hydrogen cyanide, by road and rail within Europe. These regulations set out requirements for packaging, labeling, documentation, and safety measures during transport.

The CLP Regulation aligns the classification, labeling, and packaging of chemicals with the Globally Harmonized System of Classification and Labelling of Chemicals (GHS). It ensures that substances, including hydrogen cyanide, are classified and labeled appropriately to communicate their hazards and risks to users and consumers.

The Seveso III Directive aims to prevent major accidents involving hazardous substances and limit their consequences on human health and the environment. It applies to industrial facilities handling and storing hazardous substances, including hydrogen cyanide, above specified threshold quantities. The directive establishes requirements for risk assessment, emergency planning, and communication of information to the public.

OSHA requires employers to provide information and training to employees regarding the hazards associated with hydrogen cyanide and to have safety data sheets available. OSHA has set a permissible exposure limit for hydrogen cyanide in the workplace, which is the maximum allowable concentration of hydrogen cyanide in the air to which workers may be exposed over a specific time period. OSHA's PSM standard provides requirements for managing highly hazardous chemicals, including hydrogen cyanide, to prevent or minimize the occurrence of catastrophic releases.

Impact Of Russia Ukraine War On the Hydrogen Cyanide Market

Hydrogen cyanide (HCN) was primarily used in the production of various chemicals, including acrylic fibers, plastics, dyes, and pesticides. The availability and pricing of hydrogen cyanide could have been influenced by factors such as supply disruptions, political instability, trade restrictions, and regional conflicts.

During the conflict between Russia and Ukraine, there were disruptions in the supply chain of hydrogen cyanide due to political tensions and military activities. Ukraine, being one of the major global producers and exporters of hydrogen cyanide, was directly affected as production facilities and transportation routes faced supply shortages and logistical challenges.

Geopolitical tensions impacted international trade, leading to trade restrictions or sanctions imposed by various countries. These restrictions further disrupted the hydrogen cyanide market by limiting imports or exports from the region affected by the conflict.

However, the actual impact on the hydrogen cyanide market depended on the specific circumstances and the extent of the conflict. Other factors, such as the global demand for chemical products, alternative sources of supply, and the ability of producers to adapt, also influenced the market dynamics during that period.

Competitive Analysis

The major players operating in the global hydrogen cyanide market are Air Liquide, Evonik Industries AG, INEOS, SUMITOMO CHEMICAL CO., LTD., Ascend Performance Materials, Kuraray Co., Ltd., Cyanco International, LLC, Cornerstone Chemical, Asahi Kasei Corporation., and Mitsubishi Gas Chemical Company, Inc.

Other players include MATHESON TRI-GAS, INC, TAEKWANG INDUSTRIAL CO., LTD., Triveni Chemicals, Hindusthan Chemicals Company, Sinopec, Bluestar Adisseo, BP Chemicals.

Industry Trends:

The hydrogen cyanide market is experiencing growth driven by its essential role in various industrial applications, particularly in the production of chemicals like sodium cyanide, adiponitrile, and acrylonitrile. As of 2023, governments are emphasizing the importance of HCN in critical sectors such as textiles, automotive, and mining. For instance, the U.S. Bureau of Economic Analysis reported a 6% year-over-year growth in the production of HCN-related chemicals, largely driven by increased demand in nylon manufacturing and gold mining, two key industries utilizing hydrogen cyanide derivatives.

In emerging economies, industrial expansion is further accelerating demand for HCN. China's National Bureau of Statistics noted a 10% rise in HCN consumption in 2022, mainly due to the country's rapidly growing automotive and polymer sectors. Additionally, several governments are implementing regulations to manage the safety and environmental impact of HCN production and usage. This is prompting innovations in safer production methods, such as the Andrussow and BMA processes, to mitigate risks while maintaining output levels.

Sustainability trends are also shaping the hydrogen cyanide market. The European Union's stringent environmental regulations, part of the Green Deal, are pushing industries to adopt greener and more efficient processes. Governments are increasingly encouraging the development of alternatives and improvements in HCN production to reduce emissions and environmental risks. These regulatory shifts, combined with strong industrial demand, are driving both innovation and growth in the global hydrogen cyanide market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hydrogen cyanide market analysis from 2022 to 2032 to identify the prevailing hydrogen cyanide market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hydrogen cyanide market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hydrogen cyanide market trends, key players, market segments, application areas, and market growth strategies.

Hydrogen Cyanide Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.5 billion |

| Growth Rate | CAGR of 2.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 227 |

| By Product |

|

| By Application |

|

| By Region |

|

| Key Market Players | Evonik Industries AG, Kuraray Co., Ltd., Cyanco International, LLC, Cornerstone Chemical, SUMITOMO CHEMICAL CO., LTD., Asahi Kasei Corporation., INEOS, Ascend Performance Materials, Mitsubishi Gas Chemical Company, Inc., Air Liquide |

Analyst Review

According to the insights of CXOs of leading companies, rise in demand for hydrogen cyanide in various industries, such as chemicals, pharmaceuticals, and agriculture drives the growth of the market. Hydrogen cyanide is a vital raw material in the production of chemicals such as acrylic fibers, plastics, and dyes, as well as pharmaceuticals like sedatives and anesthetics. Furthermore, opportunities arise from the growing focus on sustainable practices and environmental regulations. Hydrogen cyanide has applications in wastewater treatment, where it helps to remove pollutants and cyanides, reducing environmental contamination. As governments and industries emphasize pollution control and sustainable solutions, the demand for hydrogen cyanide in such applications is expected to increase.

The CXOs further added that companies are exploring new applications and derivatives of hydrogen cyanide, such as in specialty chemicals and organic synthesis, which open up new markets and avenues for growth. Moreover, advancements in technology and process optimization can lead to improved production efficiencies and cost-effectiveness in the hydrogen cyanide market.

The hydrogen cyanide market attained $1.2 billion in 2022 and is projected to reach $1.5 billion by 2032, growing at a CAGR of 2.2% from 2023 to 2032.

The Hydrogen Cyanide Market is studied across North America, Europe, Asia-Pacific, and LAMEA.

North America is the largest regional market for Hydrogen Cyanide.

Increase in demand for HCN from aerospace and defense industry is the upcoming trend of Hydrogen Cyanide Market in the world.

Increase in demand for hydrogen cyanide from the agricultural sector and Increase in demand for hydrogen cyanide from the pharmaceutical industry are the driving factor of Hydrogen Cyanide Market.

Air Liquide, Evonik Industries AG, INEOS, SUMITOMO CHEMICAL CO., LTD., Ascend Performance Materials, Kuraray Co., Ltd., Cyanco International, LLC, Cornerstone Chemical, Asahi Kasei Corporation., and Mitsubishi Gas Chemical Company, Inc. are the top companies to hold the market share in Hydrogen Cyanide.

The Adiponitrile is the leading application of Hydrogen Cyanide Market.

Loading Table Of Content...

Loading Research Methodology...