Hydrogen Powered Truck Market Insights, 2032

The global hydrogen fuel cell truck market size was valued at $0.18 billion in 2022, and is projected to reach $3.7 billion by 2032, growing at a CAGR of 36% from 2023 to 2032.

The hydrogen fuel cell truck is a type of heavy-duty work vehicle that uses electricity generated by a fuel cell to power its electric motor(s). The fuel cell produces electricity by combining hydrogen with oxygen and only emits water vapor as a byproduct. Hydrogen fuel cell trucks are considered zero-emission vehicles and are increasingly being used in commercial, municipal, military, and personal applications. Hydrogen fuel cell trucks typically have large hydrogen tanks that allow them to travel long distances on a single tank, making them well-suited for long-distance hauling and transportation applications.

The hydrogen fuel cell truck market is segmented into Truck Type, Range and Power Output.

Hydrogen fuel cell trucks are gaining increasing attention and demand as a clean and efficient alternative to traditional diesel-powered trucks. The transportation industry is one of the largest contributors to greenhouse gas emissions, and hydrogen fuel cell technology offers a promising solution to help reduce this impact.

One of the primary advantages of hydrogen fuel cell trucks is their significantly lower emissions. These vehicles produce only water as a byproduct, making them an excellent choice for companies looking to reduce their carbon footprint. In addition, hydrogen fuel cell trucks offer longer driving ranges and faster refueling times than battery electric vehicles, which makes them a more practical option for long-haul trucking.

Another driving force behind the rising demand for hydrogen fuel cell trucks is government regulations and incentives. The U.S. and several European countries are implementing stricter emissions standards for heavy-duty trucks, which is encouraging companies to adopt cleaner technologies. In addition, governments are offering financial incentives, such as tax breaks and subsidies, to encourage the adoption of hydrogen fuel cell technology.

Factors such as increase in environmental regulations, development in infrastructure for hydrogen trucks, and longer driving range are the major drivers for hydrogen fuel cell truck market. Moreover, the factors such as limited availability of refueling infrastructure and higher cost of hydrogen fuel cell trucks to restrain the global growth. Furthermore, factors such as lower operating cost and partnership & collaboration between government & private companies create lucrative opportunities for the growth of the leading players of hydrogen fuel cell truck products operating in the market.

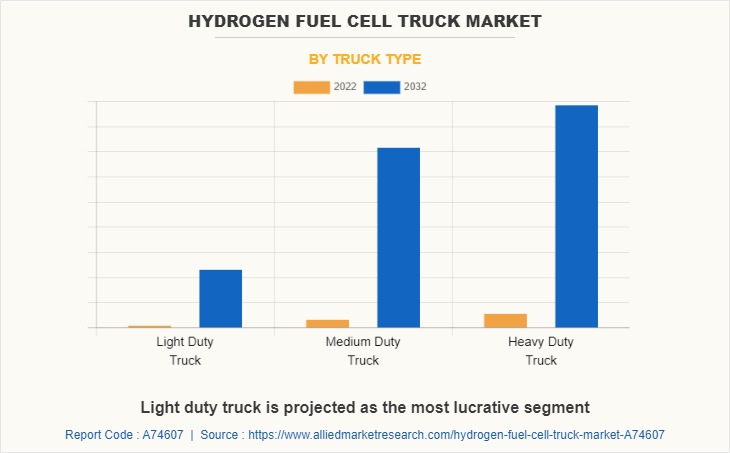

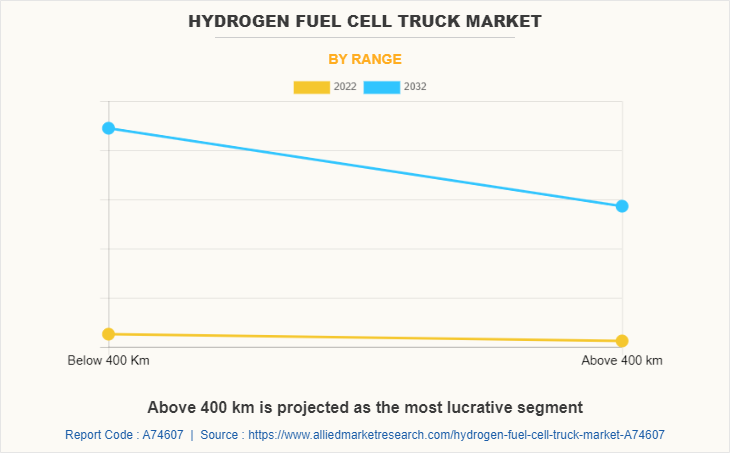

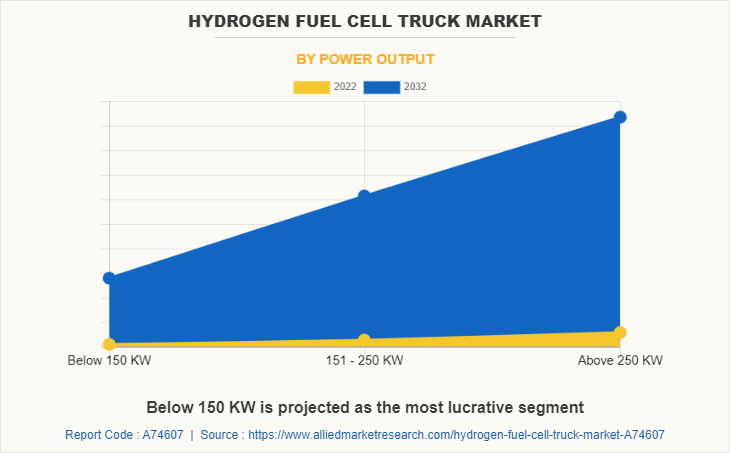

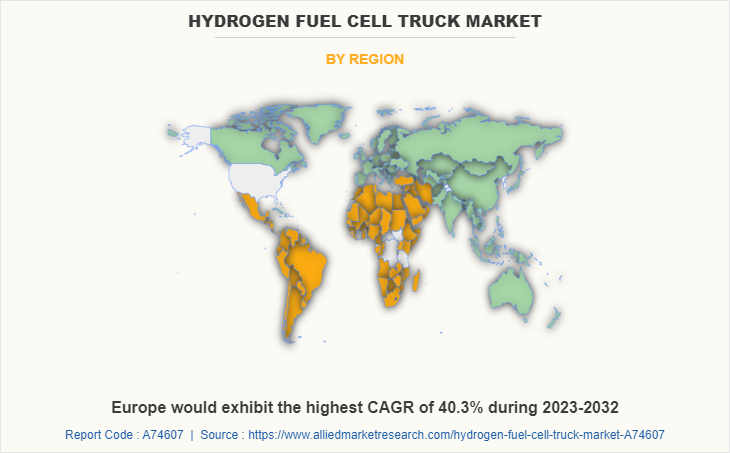

The hydrogen fuel cell truck market is segmented on the basis of truck type, range, power output, and region. On the basis of truck type, it is divided into light duty truck, medium duty truck, and heavy-duty truck. On the basis of range, it is classified into below 400 Km, and above 400 km. On the basis of power output, it is classified into below 150 KW, 151 - 250 KW, and above 250 KW. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Growth drivers, restraints, and opportunities are explained in the study to better understand the market dynamics. This study further highlights key areas of investment. In addition, it includes Porter’s five forces analysis to understand the competitive scenario of the industry and the role of each stakeholder. The study features strategies adopted by key market players to maintain their foothold in the market.

The leading players operating in the hydrogen fuel cell truck market are Dongfeng Motor Company, ESORO AG, Hyundai Motor Company, Hyzon Motors, Kenworth Truck Company, Nikola Corporation, Renault Trucks, SANY Group, XCMG Group, and Xiamen King Long International Trading Co. Ltd.

Increase in Environmental Regulations

Hydrogen fuel cell technology has been around for decades, but it has only recently started to gain traction in the automotive industry as a clean energy alternative. With the rise of environmental regulations across the world, more companies are turning to hydrogen fuel cell trucks as a way to reduce emissions and meet new regulations. This has led to a significant increase in sales of these vehicles in recent years.

The main reason for the increase in sales of hydrogen fuel cell trucks is the growing number of environmental regulations being implemented around the world. Governments and regulatory bodies are setting increasingly stringent emissions standards for vehicles in an effort to reduce greenhouse gas emissions and combat climate change. In response, many companies are turning to hydrogen fuel cell trucks as a way to comply with these regulations.

Hydrogen fuel cell trucks have several advantages over traditional diesel-powered trucks. For one, they produce zero emissions, which means they don't contribute to air pollution or greenhouse gas emissions. They are also much quieter than traditional trucks, which makes them ideal for use in urban areas where noise pollution is a concern. In addition, hydrogen fuel cell trucks have a longer range than electric vehicles, which makes them well-suited for long-haul transport.

The increased demand for hydrogen fuel cell trucks has led to a rise in the number of companies offering these vehicles. Major automotive manufacturers such as Toyota, Hyundai, and Daimler are all investing heavily in hydrogen fuel cell technology and have released hydrogen fuel cell trucks onto the market. In addition, there are a growing number of startups and smaller companies that are developing hydrogen fuel cell trucks as well. Such increasing environmental regulations are expected to increase the demand for hydrogen fuel cell truck market.

Development in infrastructure for hydrogen trucks

Hydrogen fuel cell technology has the potential to revolutionize the transportation industry by offering a clean and renewable energy source for vehicles. One of the main obstacles to the widespread adoption of this technology has been the lack of infrastructure for hydrogen fueling stations. However, in recent years, there has been a significant increase in the development of hydrogen fueling infrastructure, which has led to a corresponding increase in the sales of hydrogen fuel cell trucks.

The growth of hydrogen fueling infrastructure is being driven by several factors, including government policies and incentives, technological advances, and increased demand from both commercial and individual customers. Governments across the world are recognizing the importance of reducing emissions and are providing incentives for the development of clean energy technologies, including hydrogen fuel cell technology. In addition, technological advances in the production and distribution of hydrogen are making it easier and more cost-effective to build and maintain hydrogen fueling stations.

The increase in sales of hydrogen fuel cell trucks is due to the growth of hydrogen fueling infrastructure which is particularly evident in the commercial trucking industry. Companies are increasingly turning to hydrogen fuel cell trucks as a way to meet emissions regulations and reduce their carbon footprint. For example, the California Air Resources Board has set aggressive emissions reduction targets for heavy-duty trucks, which has led many companies in the state to invest in hydrogen fuel cell technology.

Another factor driving the growth of hydrogen fueling infrastructure is the increasing demand for hydrogen fuel cell vehicles from individual customers. As consumers become more aware of the environmental impact of their transportation choices, many are turning to alternative fuel vehicles, including hydrogen fuel cell vehicles. This is particularly true in countries such as Japan and South Korea, where government policies and incentives have made hydrogen fuel cell vehicles more accessible to consumers.

The increase in sales of hydrogen fuel cell trucks due to the growth of hydrogen fueling infrastructure is also being driven by technological advances in the production and distribution of hydrogen. Advances in electrolysis technology, which is used to produce hydrogen, have made it possible to produce hydrogen from renewable energy sources, such as wind and solar power. This has significantly reduced the environmental impact of hydrogen production and made it a more attractive alternative to fossil fuels.

In addition, advances in hydrogen storage technology have made it easier and more cost-effective to transport and store hydrogen. For example, companies such as Air Liquide and Linde are developing advanced hydrogen storage solutions, including high-pressure tanks and cryogenic storage systems, which allow for the safe and efficient transportation and storage of hydrogen.

The growth of hydrogen fueling infrastructure has also been facilitated by partnerships between government agencies, private companies, and academic institutions. For example, in the U.S., the Department of Energy has partnered with companies such as General Motors and Honda to develop and deploy hydrogen fuel cell vehicles and infrastructure. Similarly, in Europe, the European Commission has funded numerous research projects focused on the development of hydrogen fueling infrastructure. These developments in infrastructure are likely to boost the sales for hydrogen fuel cell truck manufacturers.

Higher cost of hydrogen fuel cell trucks

Hydrogen fuel cell trucks are more expensive than diesel-powered trucks for several reasons. Firstly, the technology involved in producing hydrogen fuel cells and hydrogen fuel is still relatively new and developing. This means that the production costs for these components are currently higher than they would be if the technology was more mature and widely adopted. Also, the components of a hydrogen fuel cell truck, such as the fuel cell stack, the hydrogen storage tanks, and the electric motor, are still relatively expensive compared to the components of a diesel-powered truck, such as the engine and transmission. This is partly due to the lower production volumes for these components, which means that economies of scale have not yet been achieved.

Moreover, the higher cost of hydrogen fuel cell trucks can also be attributed to the limited availability of these vehicles. With fewer manufacturers producing hydrogen fuel cell trucks compared to diesel-powered trucks, there is less competition in the market, which can result in higher prices. The higher cost of hydrogen fuel cell trucks has a significant impact on their sales. Primarily, it can make these vehicles less attractive to potential buyers. Companies that operate fleets of trucks are often focused on reducing their costs and maximizing their profits, so the higher upfront cost of a hydrogen fuel cell truck can be a significant barrier to adoption. Even if the long-term savings from reduced fuel costs and maintenance costs are considered, the higher upfront cost can still be a significant deterrent for some buyers.

Also, the higher cost of hydrogen fuel cell trucks can slow down the development and deployment of these vehicles. Many manufacturers are hesitant to invest in hydrogen fuel cell technology until there is more demand for these vehicles. This can make it difficult to justify the cost of research and development, which can slow down the progress of this technology and limit the number of new models that are introduced to the market.

In addition, the higher cost of hydrogen fuel cell trucks can also limit the availability of these vehicles in certain regions. Some countries and regions may not have the financial resources to invest in this technology or may not have the necessary infrastructure to support these vehicles. This can result in a limited availability of hydrogen fuel cell trucks in these areas, which can limit their potential market and slow down their adoption.

Partnership and collaboration between government and private companies

Partnerships and collaboration are becoming increasingly important in the development and commercialization of hydrogen fuel cell trucks. The market is growing rapidly, driven by the need for clean transportation solutions and the advantages of hydrogen fuel cell technology. However, there are still challenges to overcome in terms of infrastructure, cost, and scalability. By working together, companies, governments, and research institutions can create profitable business models that drive innovation and growth in the hydrogen fuel cell truck market.

One of the main benefits of partnerships and collaboration is access to expertise and resources. In order to develop and commercialize hydrogen fuel cell trucks, companies need a range of skills and capabilities, including engineering, manufacturing, marketing, and sales. By partnering with other companies and research institutions, they can tap into a wider pool of expertise and resources, reducing the time and cost of development. Another benefit of partnerships and collaboration is risk sharing. Developing and commercializing hydrogen fuel cell trucks is a risky and capital-intensive process. By sharing the risk and cost with other companies and institutions, companies can reduce their exposure and increase their chances of success.

Partnerships and collaboration can also lead to economies of scale. By pooling resources and expertise, companies can achieve efficiencies in production, distribution, and marketing. This can lead to cost reductions and improved competitiveness and can increase the hydrogen fuel cell truck market share.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hydrogen fuel cell truck market analysis from 2022 to 2032 to identify the prevailing hydrogen fuel cell truck market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hydrogen fuel cell truck market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hydrogen fuel cell truck market trends, key players, market segments, application areas, and market growth strategies.

Hydrogen Fuel Cell Truck Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 3.7 billion |

| Growth Rate | CAGR of 36% |

| Forecast period | 2022 - 2032 |

| Report Pages | 366 |

| By Truck Type |

|

| By Range |

|

| By Power Output |

|

| By Region |

|

| Key Market Players | hyundai motor company, Esoro AG, Renault Trucks, Sany Group Co., Ltd., Hyzon Motors., Nikola Corporation, Kenworth Truck Company, XCMG Group, Xiamen King Long International Trading Co.,Ltd., Dongfeng Motor Company |

Analyst Review

One of the key benefits of hydrogen fuel cell trucks is the potential for significant fuel cost savings over the life of the vehicle. While hydrogen fuel is currently more expensive than diesel fuel, it is expected to become more cost competitive as production scales go up and economies of scale are achieved. One reason for this is the potential for lower energy costs associated with hydrogen production. Hydrogen can be produced using renewable energy sources such as wind and solar power, which can reduce the cost of hydrogen production and make it more cost-competitive with fossil fuels.

In recent interview, Mary Barra, CEO of General Motors, has expressed her company's commitment to investing in hydrogen fuel cell technology, stating that "there is no silver bullet" when it comes to decarbonizing transportation and that a range of technologies, including hydrogen fuel cells, will be needed. Other CXOs, such as Martin Lundstedt, CEO of Volvo Group, and Christian Levin, CEO of Scania, have also expressed their support for hydrogen fuel cells and their belief in their potential to transform the trucking industry. Lundstedt has stated that "hydrogen is definitely going to be a part of the future," while Levin has called for greater investment in hydrogen fueling infrastructure to support the widespread adoption of fuel cell trucks.

In addition, hydrogen fuel cell trucks have higher efficiency ratings than diesel trucks, meaning they can travel further on the same amount of fuel. This can reduce the amount of fuel needed and further increase cost savings over the life of the vehicle. However, hydrogen fuel cell trucks also have the potential for reduced maintenance costs. Diesel engines require frequent oil changes and other maintenance tasks, which can add up over the life of the vehicle. In contrast, hydrogen fuel cell trucks have fewer moving parts and require less maintenance, reducing maintenance costs over the life of the vehicle.

The cost savings associated with hydrogen fuel cell trucks are likely to increase demand for these vehicles, particularly in industries such as transportation and logistics where fuel costs are a major expense. In addition, governments and other organizations may offer incentives or subsidies to encourage the adoption of hydrogen fuel cell trucks, further reducing the cost of ownership and increasing demand for these vehicles. Overall, the potential for fuel cost savings is a significant factor in increasing the sales of hydrogen fuel cell trucks. As hydrogen production scales up and costs decrease, and as more organizations recognize the benefits of this technology, it is expected that demand for hydrogen fuel cell trucks will continue to grow.

The market size for hydrogen fuel cell truck in 2022 is $181.6 Mn.

Limited availability of refueling infrastructure, and higher cost of hydrogen fuel cell trucks are the restraints in hydrogen fuel cell truck market.

Asia-Pacific is the largest regional market for hydrogen fuel cell truck.

The market size of hydrogen fuel cell truck in 2032 will be $ 3,652.1 Mn.

The growth rate of hydrogen fuel cell truck market from 2023-2032 is 36.0%.

Loading Table Of Content...

Loading Research Methodology...