Hydrogen Infrastructure Market Research, 2032

The global hydrogen infrastructure market was valued at $4.9 billion in 2022, and is projected to reach $13.5 billion by 2032, growing at a CAGR of 10% from 2023 to 2032.

Key Report Highlights:

- The hydrogen infrastructure has been analyzed in terms of value ($ million), covering more than 15 countries.

- For growth prediction, we have looked into historical trends including present and future activities of key business players.

- The report covers detailed profiling of the major 10 market players.

Hydrogen infrastructure refers to the network of facilities and systems required for the production, storage, transportation, and distribution of hydrogen as an energy carrier. Hydrogen infrastructure is essential for the development and widespread adoption of hydrogen-based technologies, such as fuel cells and hydrogen-powered vehicles. Hydrogen can be produced through various methods, including steam methane reforming (SMR) which is the most common method, which uses natural gas and steam to produce hydrogen and carbon dioxide. It is also produced through electrolysis which splits water molecules into hydrogen and oxygen using electricity, with renewable sources like solar or wind power being preferable to reduce carbon emissions. Another method of hydrogen production is biomass gasification which requires converting organic materials, such as agricultural waste or wood chips, into hydrogen through gasification.

Hydrogen is typically stored in three main forms which are Compressed Gas, Liquid Hydrogen, and chemical hydrides. Hydrogen is compressed and stored in high-pressure tanks. In liquid form, hydrogen is cooled and stored as a cryogenic liquid at extremely low temperatures. As a chemical hydride, hydrogen is stored within solid materials capable of absorbing and releasing hydrogen. Hydrogen can be transported from production sites to consumption centers through different methods such as pipelines, trucks & trailers, and chemical carriers. Dedicated hydrogen pipelines, similar to natural gas pipelines, can transport large quantities of hydrogen. Hydrogen can be transported in specially designed trucks and trailers, either as compressed gas or cryogenic liquid. Hydrogen can be stored and transported in chemical compounds, such as ammonia, which is easier to handle and has existing infrastructure.

At the distribution level, hydrogen can be delivered to end-users such as fueling stations or industrial facilities. Hydrogen refueling stations provide the infrastructure for fueling hydrogen-powered vehicles, either through compressed gas or liquid hydrogen dispensers. Hydrogen can be distributed to industrial customers for various applications, such as refining, chemical manufacturing, or power generation.

Hydrogen has different safety considerations compared to conventional fuels, and proper safety measures must be in place. These include proper ventilation, leak detection systems, and adherence to industry standards and regulations. Ongoing research and development efforts focus on improving the efficiency, cost-effectiveness, and sustainability of hydrogen infrastructure. This includes advancements in hydrogen production methods, storage technologies, transportation options, and safety measures.

Market Dynamics

Hydrogen can play a crucial role in energy storage, helping to balance intermittent renewable energy sources like wind and solar power. Excess electricity generated during peak periods can be used for electrolysis to produce hydrogen, which can be stored and later converted back to electricity through fuel cells when demand rises. Hydrogen can be used in various sectors, such as transportation, power generation, industrial processes, and heating applications. Its versatility makes it a valuable option for decarbonizing different industries and reducing reliance on fossil fuels. Hydrogen can be produced from a variety of sources, including renewables, natural gas with carbon capture and storage (CCS), and nuclear power. This diversity reduces dependency on a single energy source and enhances energy security.

Governments and policymakers worldwide are implementing supportive policies, financial incentives, and regulatory frameworks to accelerate the adoption of clean energy solutions. Hydrogen is a key beneficiary of such policies, fostering investment in hydrogen infrastructure development. As countries strive to reduce greenhouse gas emissions and meet climate targets outlined in international agreements like the Paris Agreement, hydrogen is considered a viable option to decarbonize various sectors and support the transition to a low-carbon economy.

Hydrogen has a high energy density by weight, making it suitable for applications where weight is a critical factor, such as in transportation, especially for long-range heavy-duty vehicles. Hydrogen production, especially through electrolysis, can be relatively expensive compared to conventional fossil fuels. As a result, the cost of hydrogen-based technologies and products may still be higher than their fossil-fuel counterparts, hampering mass adoption. Hydrogen has a low volumetric energy density, which makes it challenging to store and transport efficiently. Specialized storage tanks and pipelines are required, adding to the overall infrastructure cost. Hydrogen is highly flammable and has a wide flammability range, posing safety challenges in handling, storage, and transportation. These concerns act as restraints for hydrogen infrastructure market growth.

Building hydrogen infrastructure requires continuous technological innovation. Research and development in areas like hydrogen production, storage, transportation, and utilization can lead to breakthroughs and cost reductions, further enhancing the viability of hydrogen as an energy solution. Hydrogen infrastructure presents opportunities for international collaboration and cooperation. Countries can work together to develop standardized safety protocols, share knowledge, and trade hydrogen to support each other's energy transition goals.

The hydrogen infrastructure market size is studied on the basis of production, storage, delivery, and region.

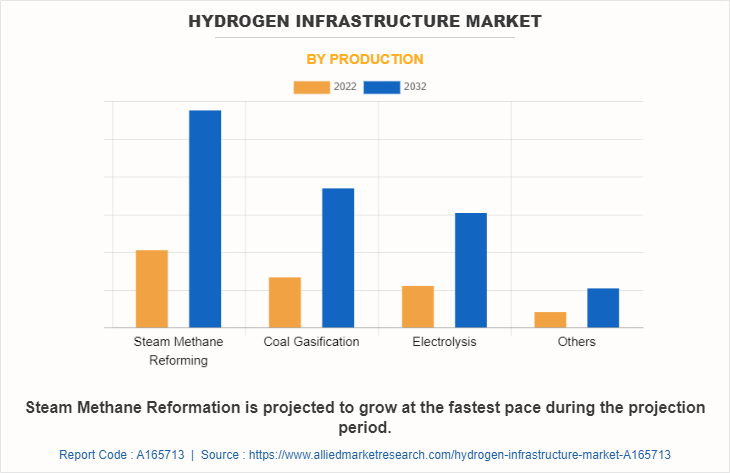

By production, the hydrogen infrastructure market is divided into steam methane reforming, coal gasification, electrolysis, and others. Steam methane reformation dominated the hydrogen infrastructure market share in 2022. It is also projected to continue its dominance during the hydrogen infrastructure market forecast period. Steam reforming (SMR) is the most common method for producing grey hydrogen, which involves reacting natural gas with steam in the presence of a catalyst to produce hydrogen and carbon monoxide. The resulting mixture, known as synthesis gas or syngas, is then further processed to remove impurities and separate the hydrogen from the carbon monoxide. According to data from the International Energy Agency (IEA), in 2019, approximately 75 million tons of hydrogen were produced globally, with 95% of this production coming from SMR. The majority of this hydrogen was used in industrial processes, with the remaining hydrogen being used for transportation, power generation, and other applications.

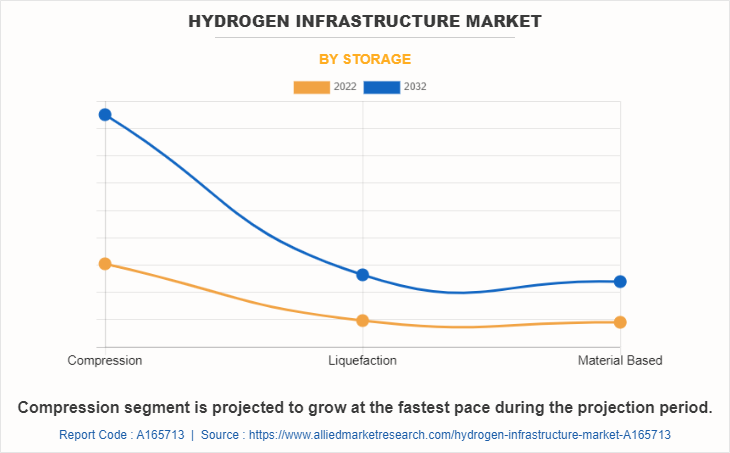

By storage, the market is categorized into compression, liquefaction, and material based. The compression segment contributed largely to the hydrogen infrastructure market size in 2022. It is also projected to grow at a higher CAGR during the projection years. Compressing hydrogen is a critical step in its distribution and transportation. The compression process increases the hydrogen's energy density, making it more practical for storage and transport. Hydrogen can be compressed using various methods, such as reciprocating compressors, diaphragm compressors, and centrifugal compressors. The compression process consumes energy, so it is essential to use efficient compression technologies to minimize energy losses. Hydrogen compression stations are key components of the hydrogen infrastructure, strategically placed along transportation routes to ensure a steady supply of compressed hydrogen.

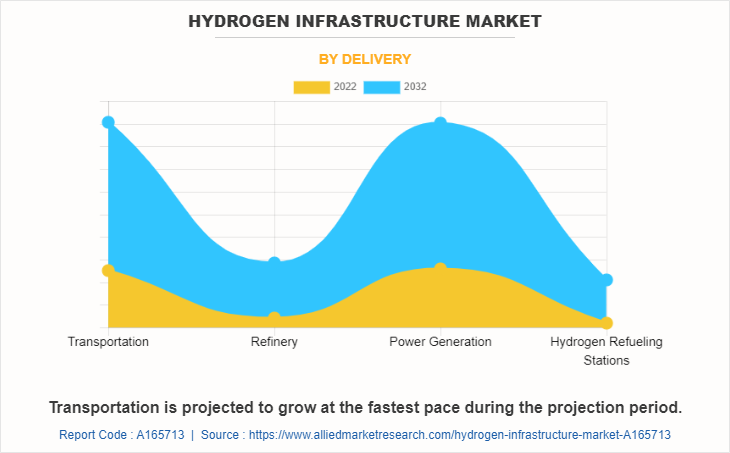

Depending on the delivery, the market is classified into transportation, refinery, power generation, and hydrogen refueling stations. The power generation segment dominated the market share for 2022. However, the transportation segment is expected to grow at a higher CAGR during the forecast period. Hydrogen is rapidly being used for power generation as a clean energy source. Since the hydrogen generated from electrolysis leaves out a lower carbon footprint, thus the hydrogen generated through electrolysis is used as a conventional energy alternative. The power generation segment significantly contributes to the growth of the hydrogen infrastructure market. Hydrogen is considered an alternative to fossil fuels, as the reuse of water keeps continuing. Moreover, the use of wind and solar energy sources for electricity used in electrolysis has driven clean market growth. However, large investment costs hamper the market growth.

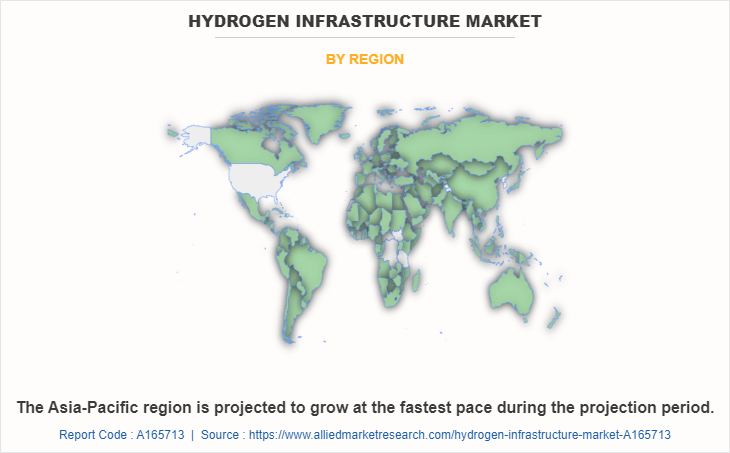

By region, the hydrogen infrastructure market analysis is done across North America, Europe, Asia-Pacific, and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific dominated the market share for 2022 and is expected to grow at a higher CAGR during the forecast period. Asia-Pacific region has been actively investing in hydrogen infrastructure development, recognizing the potential of hydrogen as a clean and sustainable energy carrier. Several countries in the region have formulated hydrogen strategies and initiatives to promote hydrogen production, distribution, and utilization.

Japan has been a frontrunner in hydrogen infrastructure development. The country has set ambitious goals for the widespread adoption of hydrogen as an energy source and has been investing in research, development, and demonstration projects for hydrogen production, storage, and utilization. Japan has also been expanding its hydrogen refueling station network to support the growth of fuel cell electric vehicles (FCEVs). South Korea has been actively promoting hydrogen as part of its energy transition strategy. The country has launched various projects to develop hydrogen infrastructure, including the establishment of hydrogen refueling stations and the implementation of hydrogen-powered buses and trucks. China has also been investing in hydrogen infrastructure and has included hydrogen as part of its energy and climate goals. The country has launched pilot projects for hydrogen production and distribution, and it aims to scale up hydrogen deployment in various sectors, including transportation, industry, and power generation.

The major players operating in the hydrogen infrastructure industry are Air Liquide, Linde plc, Nel Hydrogen ASA, Plug Power, Inc., Shell plc, ITM Power plc, Ballard Power Systems, McPhy Energy, Cummins, Inc., and Engie SA. Engie SA consists of developed the first kind of 100 MW electrolyzer to produce green hydrogen from new fields of renewable electricity. This system will make it possible to best absorb the intermittency of the production of renewable fields and secure the hydrogen supply for industrial uses.

Cummins Inc., a global power solutions and hydrogen technologies provider, and Tata Motors, the largest commercial vehicle manufacturer in India, signed a Memorandum of Understanding to collaborate on the design and development of low and zero-emission propulsion technology.

Recent Trends

States in the Northeast of the U.S., including New York, Connecticut, Massachusetts, and New Jersey, have collaborated on regional initiatives to promote clean energy, including hydrogen. Various research projects and public-private partnerships are advancing hydrogen infrastructure in this region.

British Columbia in Canada has made strides in developing hydrogen infrastructure and promoting the use of FCEVs. The province has implemented programs to support the deployment of hydrogen refueling stations and has been involved in research and development projects related to hydrogen utilization.

The Netherlands has been actively working to advance its hydrogen infrastructure, with a focus on producing green hydrogen from offshore wind energy. The Dutch government has set targets for increasing the number of hydrogen refueling stations for FCEVs and supporting other hydrogen applications. The UK has been developing its hydrogen infrastructure, with projects focusing on hydrogen production, storage, and utilization. The UK government's Hydrogen Strategy aims to accelerate the use of low-carbon hydrogen in various sectors.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hydrogen infrastructure market scope from 2022 to 2032 to identify the prevailing hydrogen infrastructure market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hydrogen infrastructure market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hydrogen infrastructure market trends, key players, market segments, application areas, and market growth strategies.

Hydrogen Infrastructure Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 13.5 billion |

| Growth Rate | CAGR of 10% |

| Forecast period | 2022 - 2032 |

| Report Pages | 348 |

| By Production |

|

| By Storage |

|

| By Delivery |

|

| By Region |

|

| Key Market Players | ITM Power PLC, Shell Plc., Cummins, Inc., Air Liquide, McPhy Energy, Ballard Power Systems, Linde Plc, Plug Power Inc., Nel Hydrogen AS, Engie SA |

Analyst Review

According to the insights from the CXO’s, the hydrogen infrastructure market is highly fragmented in nature. The market is gaining high traction owing to a boost in the production of hydrogen. The circular economy and net zero targets aim to reduce carbon emissions and adopt a clean energy source for primary energy requirements has led to advancement in hydrogen technologies which further is propelling the hydrogen infrastructure market. To transition from a fossil-based fuel economy to a hydrogen-based economy, the need for complete hydrogen infrastructure has risen tenfold. Governments across the globe have launched several projects and initiatives to foster the hydrogen infrastructure and thus act as a driving factor for industry growth.

The hydrogen infrastructure market faces several challenges such as lacking development in the field, high cost of installation, and high investment. However, technological advancements and energy shift targets are expected to foster the opportunity for market growth

$13.5 billion is the estimated industry size of Hydrogen Infrastructure.

Energy storage & security, energy transition & climate change policies, and clean energy source & high energy density of hydrogen are the upcoming trends of Hydrogen Infrastructure Market in the world.

Steam methane reformation is the leading production of Hydrogen Infrastructure Market.

The Asia-Pacific region is the largest regional market for Hydrogen Infrastructure.

Air Liquide, Linde plc, Nel Hydrogen ASA, Plug Power, Inc., Shell plc, ITM Power plc, Ballard Power Systems, McPhy Energy, Cummins, Inc., and Engie SA are the top companies to hold the market share in Hydrogen Infrastructure.

Loading Table Of Content...

Loading Research Methodology...