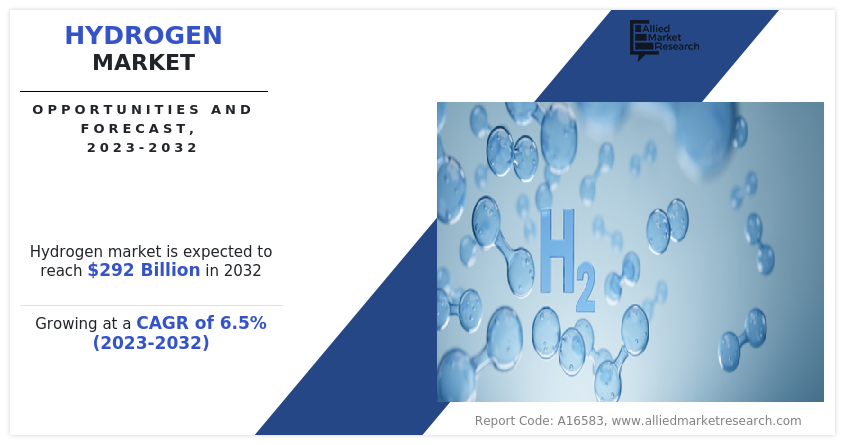

Hydrogen Market Outlook - 2032

The global hydrogen market size was valued at $155.9 billion in 2022, and is projected to reach $292 billion by 2032, growing at a CAGR of 6.5% from 2023 to 2032.

Report Key Highlighters:

- The hydrogen market is highly fragmented, with several players including Air Liquide S.A.; Messer Group GmbH.; Plug Power Inc.; NEL ASA; Linde plc; FuelCell Energy, Inc.; Air Products and Chemicals, Inc.; Shell Plc.; Reliance Industries Ltd; and Indian Oil Corporation Ltd.

- More than 6,765 product literatures, industry releases, annual reports, and other such documents of major industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study covers nearly 20 countries. The segment analysis of each country in terms of value and volume during the forecast period 2022-2032 is covered in the hydrogen market report.

Hydrogen is the lightest and most abundant element in the universe. It is an odorless, colorless, and tasteless gas in its pure form. Hydrogen can be made from a variety of resources, including nuclear power, natural gas, biogas and renewable power such as solar and wind.

Increase in demand for hydrogen from chemical, refining, energy & power, and transportation industries is driving the hydrogen market growth.

Hydrogen has myriad applications in chemical, refining, energy & power, and transportation industry. It is employed in the chemical industry for manufacturing methanol, ammonia, and other vital chemicals. It is used for refining petroleum, metal production, and as a reducing agent in diverse industrial processes.

Moreover, hydrogen is regarded as a crucial element in the decarbonization of power generation. In addition, hydrogen can be utilized in combined heat and power (CHP) systems, where waste heat from power generation can be captured and used for heating or industrial processes, increasing overall energy efficiency. Also, hydrogen is utilized as a fuel for powering vehicles, especially in fuel cell vehicles. Besides, rising investments and government support for FCEVs propel the hydrogen demand as a fuel in the transportation sector.

However, the high cost associated with hydrogen production is likely to act as a major restraint for market growth. Developing the infrastructure required for hydrogen production, storage, and distribution is a noteworthy investment. This includes constructing hydrogen storage facilities, refueling stations, and retrofitting existing infrastructure. Nevertheless, technological advancement is anticipated to propel the market growth in the coming years. In addition, advancements in hydrogen distribution systems and infrastructure enable the efficient and reliable transportation of hydrogen from production sites to end users.

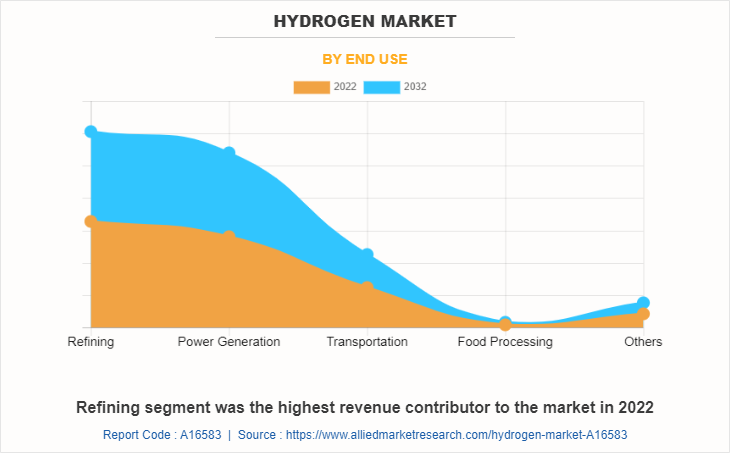

The hydrogen market is segmented on the basis of delivery mode, type, end-use, and region. By delivery mode, the market is classified into captive and merchant. By type, the market is categorized into blue hydrogen, grey hydrogen, and green hydrogen. By end-use, the market is divided into refining, power generation, transportation, food processing, and others. By region, the hydrogen market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Hydrogen Market By Region

Asia-Pacific was the highest revenue contributor to the market in 2022. The hydrogen market in the Asia-Pacific is undergoing rapid growth and is likely to become a primary hub for hydrogen utilization, production, and innovation. Besides, the region is investing in hydrogen-powered transportation, industrial applications, and the development of hydrogen fuel cell technologies. Also, the region, including countries such as Japan, China, South Korea, and Australia, has set objectives to lower greenhouse gas emissions and transition towards low-carbon economies.

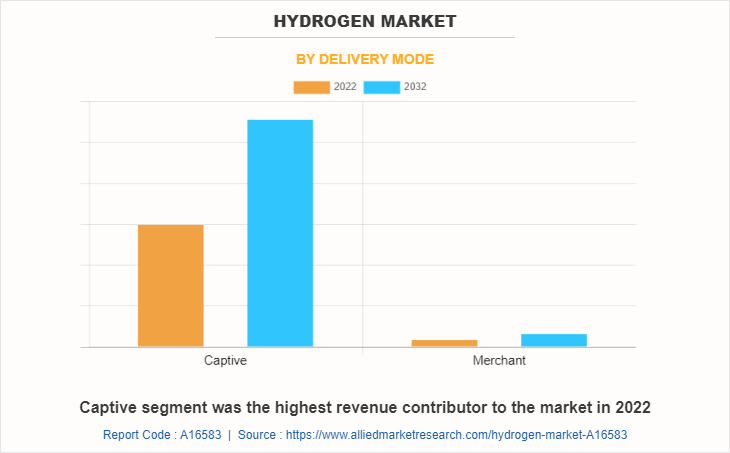

Hydrogen Market By Delivery Mode

Captive segment was the highest revenue contributor to the market in 2022. Captive generation of hydrogen refers to the production of hydrogen within a specific facility or system for on-site use. The facility generates its own hydrogen in order to meet its specific needs instead of purchasing hydrogen from suppliers. This can be achieved through different methods, such as electrolysis, steam methane reforming, or other hydrogen production technologies.

Captive hydrogen is widely utilized in industrial processes, including chemical manufacturing, petroleum refining, and metal production. Also, captive hydrogen can be utilized as a reactant or feedstock in varied chemical reactions, such as desulfurization, hydrogenation, and hydrocracking.

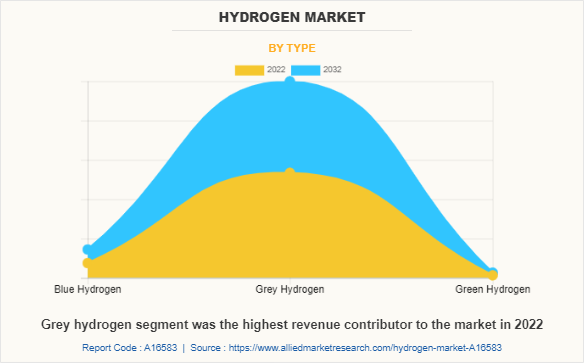

Hydrogen Market By Type

Grey hydrogen segment was the highest revenue contributor to the market in 2022. Grey hydrogen is made from natural gas, or methane, utilizing steam methane reformation without capturing the greenhouse gases produced in the procedure. Besides, grey hydrogen is employed in different industries and applications, such as producing ammonia for fertilizers, refining petroleum, and as a feedstock for chemical manufacturing. Grey hydrogen is utilized in the refining process of petroleum in order to remove impurities such as nitrogen and sulfur.

Hydrogen Market By End Use

Refining segment was the highest revenue contributor to the market in 2022. Hydrogen is utilized in desulfurization processes for removing sulfur compounds from petroleum feedstocks. Hydrocracking is a refining method that utilizes hydrogen in order to break down heavy hydrocarbon molecules into lighter fractions. Besides, hydrogen is used to remove impurities from petroleum feedstocks. It involves the reaction of the feedstock with hydrogen in the presence of a catalyst, which helps to remove nitrogen, sulfur, and other impurities.

Key Players & Strategies:

Key players in the hydrogen industry include Air Liquide S.A.; Messer Group GmbH.; Plug Power Inc.; NEL ASA; Linde plc; FuelCell Energy, Inc.; Air Products and Chemicals, Inc.; Shell Plc.; Reliance Industries Ltd; and Indian Oil Corporation Ltd. Nowadays, the key manufacturers operating in the hydrogen market have been engaged in strategies such as product innovation, joint venture, expansion, partnership, agreement, investment, and collaboration.

Key Developments

In June 2023, during the 10th Paris Air Forum, Air Liquide and Groupe ADP announced the launch of "Hydrogen Airport," the first engineering and consulting joint venture dedicated to helping airports integrate hydrogen projects into their infrastructures. This venture follows a 2021 feasibility study conducted with Airbus, aimed at introducing hydrogen-powered planes in approximately 30 airports worldwide. The joint venture underscores the companies' shared ambition to prepare for the rollout of carbon-free aviation on a global scale.

In March 2023, Air Liquide announced plans to construct an industrial-scale ammonia (NH3) cracking pilot plant at the Port of Antwerp in Belgium. Since hydrogen can be easily transported over long distances in the form of ammonia, this plant will use innovative technology to convert ammonia back into hydrogen (H2) with an optimized carbon footprint. This cracking technology will play a key role in advancing hydrogen as a crucial enabler of the energy transition.

In February 2023, Air Liquide and TotalEnergies announced a joint venture, equally owned by both companies, to develop a network of hydrogen stations for heavy-duty vehicles along major European road corridors. This initiative aims to make hydrogen more accessible, supporting its adoption in goods transportation and strengthening the hydrogen sector. The plan includes deploying over 100 hydrogen stations under the TotalEnergies brand across strategic corridors in France, Benelux, and Germany. This partnership will create a major player in hydrogen refueling solutions and contribute to the decarbonization of road transport in Europe, leveraging the companies' expertise in infrastructure, hydrogen distribution, and mobility.

In January 2023, Air Liquide's Autothermal Reforming (ATR) technology was selected for Japan's first demonstration project, owned and operated by INPEX CORPORATION, to produce low-carbon hydrogen and ammonia. Air Liquide, through its Engineering & Construction division, is utilizing its full portfolio of innovative technologies to support the decarbonization efforts of its industrial clients. Autothermal Reforming, combined with carbon capture technology, enables the efficient production of large-scale, low-carbon hydrogen and ammonia.

In May 2023, Plug Power Inc., a leading provider of hydrogen solutions, announced its plan to build three large-scale plants in Finland, with an estimated investment of $6 billion. The primary goal of these plants is to produce green hydrogen and ammonia, specifically for the Europe market. Green hydrogen is produced using renewable energy sources, such as wind or solar power, making it a key component in reducing carbon emissions and advancing sustainability in various sectors, including industry, transportation, and energy. The production of green ammonia, which is derived from green hydrogen, has significant potential in agriculture (for fertilizers) and as a carbon-free fuel for shipping and power generation. By building these plants, Plug Power aims to contribute to Europe’s energy transition towards cleaner fuels and help reduce the region's dependency on fossil fuels. This initiative also positions Plug Power as a major player in the rapidly growing green hydrogen economy, supporting the European Union’s goals for carbon neutrality by 2050. These plants will increase the availability of sustainable energy solutions as well as create jobs and stimulate economic growth in Finland and across Europe.

Latest Development Strategies Implemented by Key Players:

In April 2023, Linde plc signed a long-term agreement to supply green hydrogen to Evonik. The company will build, own, and operate a nine-megawatt alkaline electrolyzer plant on Jurong Island, Singapore. The plant will manufacture green hydrogen, which Evonik will use to produce methionine, which is an essential component in animal feed.

- In March 2023, Air Liquide announced the construction of an industrial-scale ammonia (NH3) cracking pilot plant in the port of Antwerp, Belgium. Hydrogen converted into ammonia can easily be transported over long distances. Using innovative technology, this plant will convert ammonia into hydrogen (H2) with an optimized carbon footprint.

- In March 2023, Plug Power Inc. announced its aims to build three plants in Finland costing about $6 billion to produce green hydrogen and ammonia for the European market.

- In February 2023, Linde plc signed a long-term agreement for supplying clean hydrogen and other industrial gases to OCI's new blue ammonia plant in Beaumont, Texas.

- In September 2022, Linde plc announced its plans to build a 35-megawatt Proton Exchange Membrane electrolyzer for the production of green hydrogen in Niagara Falls, New York.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the hydrogen market analysis from 2022 to 2032 to identify the prevailing hydrogen market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the hydrogen market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global hydrogen market trends, key players, market segments, application areas, and market growth strategies.

Hydrogen Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 292 billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 300 |

| By Delivery Mode |

|

| By Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | FuelCell Energy, Inc., Shell Plc., Air Liquide S.A., Indian Oil Corporation Ltd., Messer Group GmbH., Linde plc, Reliance Industries Ltd, NEL ASA, Plug Power Inc., Air Products and Chemicals, Inc. |

Analyst Review

According to the opinions of various CXOs of leading companies, the hydrogen market is expected to witness increased demand during the forecast period due to surge in demand for hydrogen in power generation. Many governments have implemented policies to promote the adoption of hydrogen in power generation. These include financial incentives, research funding, and regulatory frameworks aimed at accelerating the deployment of hydrogen technologies in the energy sector.

Furthermore, Efficient and safe storage of hydrogen is crucial for its practical use. Technological advancements have focused on developing storage methods that enhance hydrogen's volumetric and gravimetric density while ensuring safety. These advancements include compressed hydrogen gas storage, liquid hydrogen storage, and materials-based hydrogen storage methods, such as metal hydrides and carbon-based materials. The development of an extensive hydrogen infrastructure is essential for the production, storage, transportation, and distribution of hydrogen. Technological advancements aim to improve the efficiency and cost-effectiveness of hydrogen infrastructure, including hydrogen production plants, refueling stations, pipelines, and transportation methods.

The global hydrogen market size was valued at $155.9 billion in 2022, and is projected to reach $292 billion by 2032, growing at a CAGR of 6.5% from 2023 to 2032.

Key players in the hydrogen market include Air Liquide S.A.; Messer Group GmbH.; Plug Power Inc.; NEL ASA; Linde plc; FuelCell Energy, Inc.; Air Products and Chemicals, Inc.; Shell Plc.; Reliance Industries Ltd; and Indian Oil Corporation Ltd.

Asia-Pacific is the largest regional market for Hydrogen.

Refining is the leading application of Hydrogen Market.

Rising demand for hydrogen in industries such as refining, power generation, transportation, and chemicals is anticipated to drive market growth during the forecast period.

Loading Table Of Content...

Loading Research Methodology...