Hydrographic Survey Equipment Market Research, 2033

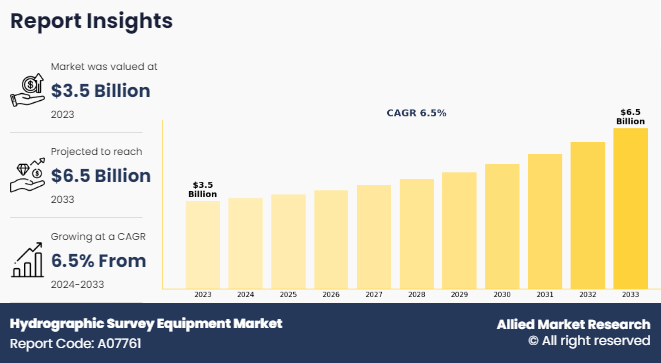

The global hydrographic survey equipment market size was valued at $3.5 billion in 2023, and is projected to reach $6.5 billion by 2033, growing at a CAGR of 6.5% from 2024 to 2033.

Hydrographic survey equipment is specialized technology used to measure and map underwater terrain and features. This equipment includes multibeam and single-beam sonar systems, echo sounders, GPS devices, and autonomous underwater vehicles (AUVs). These tools are vital for producing detailed bathymetric charts, enabling the study of water depth, underwater topography, and sediment distribution. Hydrographic surveys are essential for safe navigation, coastal management, offshore oil and gas exploration, and environmental monitoring. Furthermore, advancements in hydrographic survey equipment, such as improved sonar technology and autonomous systems, have enhanced data accuracy, efficiency, and the ability to conduct surveys in challenging environments like deep-sea or icy waters.

Key Takeaways

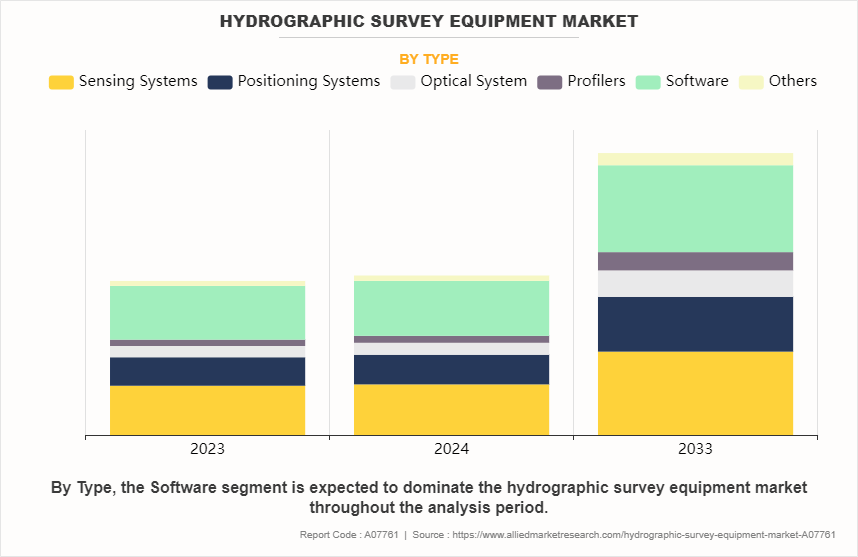

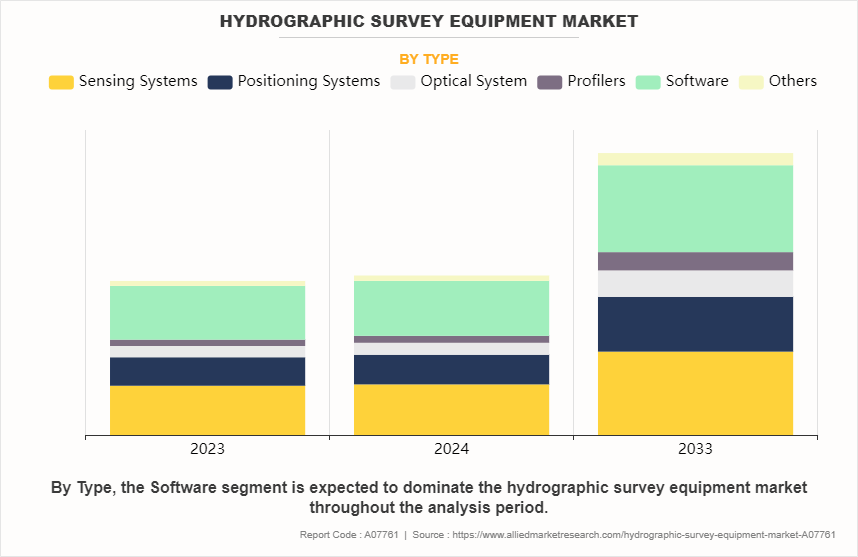

- On the basis of type, the software segment held the largest share in the hydrographic survey equipment in 2023.

- By Platform, the surface vessels segment held the largest share in the market in 2023.

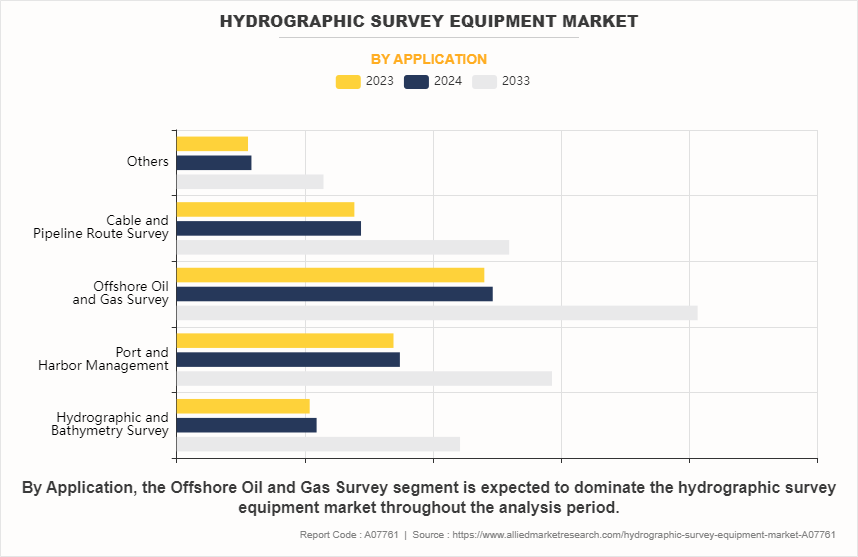

- By Application, the offshore oil and gas survey segment held the largest share in the market in 2023.

- By End User, the commercial segment held the largest share in the market in 2023.

- By Depth, the shallow water segment held the largest share in the market in 2023.

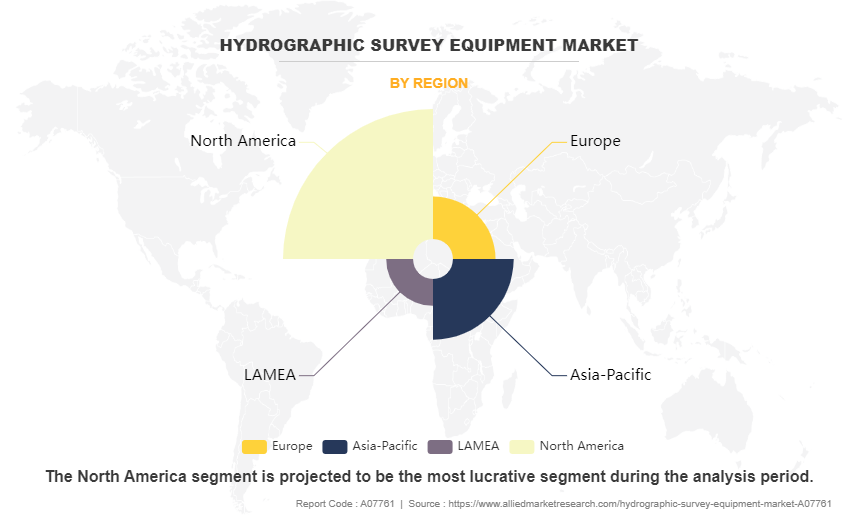

- On the basis of region, North America held the largest market share in 2023.

Hydrographic survey or bathymetric survey can be defined as technique that is used to measure and describe physical properties of the underwater surface. Hydrographic surveyors examine water bodies to view the seabed. It involves measurement and description of underwater characteristics that impact several activities, such as marine construction, offshore oil exploration/offshore oil drilling, maritime navigation, dredging, and other related activities. This data is used to prepare raster and electronic nautical charts for vessels that cross the waterways.

For instance, in June 2024, Exail launched its new DriX O-16 uncrewed surface vehicle (USV) at sea, showcasing its capabilities to high-profile customers, including major hydrographic institutes and navies worldwide. The DriX O-16 is designed for full ocean depth scientific and hydrographic surveys, as well as geophysical assessments and unexploded ordnance (UXO) surveys. It is particularly effective for subsea infrastructure inspections, which often necessitate the deployment of multiple robotic systems for comprehensive data collection. This innovative USV is set to enhance operational efficiency in marine research and security operations, representing a significant advancement in oceanographic technology.

The rise in adoption of advanced technologies in hydrographic survey equipment is significantly driving the demand for the hydrographic survey equipment market share. Innovations such as multibeam echosounders, autonomous underwater vehicles (AUVs), and cloud-based data processing platforms enable more efficient and precise data collection. These technologies enhance operational capabilities, allowing for real-time data analysis and improved mapping accuracy. Increased focus on marine conservation, offshore resource exploration, and coastal management fuels the need for sophisticated survey tools. As industries recognize the importance of accurate hydrographic data for navigation and environmental monitoring, the market continues to expand‐‹. Furthermore, application of hydrographic surveys in multiple domains, and shift toward renewable energy resources have driven the demand for hydrographic survey equipment market trends.

However, lack of skilled labor is significantly hampering the demand for the hydrographic survey equipment market growth. The rise in complexity of modern hydrographic tools, such as multibeam echosounders and autonomous underwater vehicles, requires specialized training and expertise that are currently in short supply. These skills gap not only affects the efficiency of survey operations but also limits the industry's ability to adopt advanced technologies and innovative practices. As organizations struggle to find qualified personnel, the demand for hydrographic survey equipment remains constrained, impacting overall market growth‐‹. Moreover, high initial investments and peripheral costs is major factors that hamper the growth of hydrographic survey equipment market demand.

On the contrary, the increase in reliance on advanced computing systems presents a lucrative opportunity for the hydrographic survey equipment market forecast. As technologies such as artificial intelligence, machine learning, and cloud computing evolve, they enable more efficient data processing and analysis in hydrographic surveys. These systems facilitate real-time data visualization and improve decision-making processes, allowing surveyors to achieve higher accuracy and productivity. The integration of data analytics with hydrographic tools enhances the capability to interpret complex datasets, supporting various applications from marine resource management to environmental monitoring. This trend is driving demand for innovative hydrographic survey solutions and expanding hydrographic survey equipment market opportunities.

Segment Review

The hydrographic survey equipment market is segmented into type, platform, application, end user, depth, and region. By type, the market divided into sensing systems, positioning systems, optical systems, profilers, software, and others. As per platform, the market is segmented surface vessels, unmanned surface vehicles (USVs) and unmanned underwater vehicles (UUVs), and aircraft. By application, the market is segmented into hydrographic and bathymetry surveys, port and harbor management, offshore oil and gas surveys, cable and pipeline route surveys, and others. As per end-user, the market is segmented into commercial, research, and defense sectors. By Depth, the market is bifurcated into shallow water and deep water. On the basis of region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

By End User

On the basis of end user, the commercial segment attained the highest market share in 2023 in the hydrographic survey equipment market, driven by increased investments in infrastructure development, offshore exploration, and environmental monitoring. The growing demand for precise data in commercial applications emphasizes the importance of advanced hydrographic technologies‐‹. Meanwhile, the defense segment is projected to be the fastest-growing segment during the forecast period due to increasing investments in naval operations, maritime security, and underwater surveillance. Hydrographic survey equipment industry is essential for mapping ocean floors, detecting mines, and supporting submarine navigation. Technological advancements in unmanned systems and sonar technologies further drive the defense sector’s demand for accurate and real-time underwater data.

By Type

On the basis of type, the software segment attained the highest market share in 2023 in the hydrographic survey equipment market. Due to rise in integration of advanced software solutions in survey operations. These software applications enhance data processing, analysis, and visualization, enabling more efficient decision-making in hydrographic surveys. As the demand for accurate and timely marine data rises, the reliance on sophisticated software continues to grow, driving its dominance in the market. Meanwhile, the profiler segment is projected to be the fastest-growing segment during the forecast period due to the rise in demand for precise underwater measurements and environmental monitoring. Profilers provide detailed data on water column characteristics, such as temperature, salinity, and currents, which are essential for offshore oil and gas exploration, coastal management, and marine research, driving their rapid adoption across various industries.

By Application

On the basis of application, the offshore oil and gas segment attained the highest market share in 2023 in the hydrographic survey equipment market, driven by rise in investments in offshore exploration and production activities. The need for accurate seabed mapping and underwater inspections in oil and gas operations has heightened, leading to a greater demand for advanced hydrographic survey equipment. This segment's growth reflects the industry's focus on ensuring safe and efficient operations in challenging underwater environments‐‹. Meanwhile, the hydrographic and bathymetry survey segment is projected to be the fastest-growing segment during the forecast period due to the rising demand for accurate underwater mapping and depth measurement. These surveys are critical for navigation safety, offshore oil and gas exploration, and coastal management. The growing focus on maritime trade, environmental conservation, and seabed resource exploration has further accelerated its adoption.

By Region

On the basis of region, North America attained the highest market share in 2023 and emerged as the leading region in the hydrographic survey equipment market due to advanced technological adoption and a robust marine infrastructure. The region's significant investments in offshore oil and gas exploration, along with extensive research initiatives, have driven demand for accurate and efficient survey equipment. Collaborations between government and private sectors have further enhanced the capabilities of hydrographic surveys, solidifying North America's position as a leader in this market. Meanwhile, The Asia-Pacific region experienced the fastest market share growth in the hydrographic survey equipment market due to increased investment in maritime infrastructure and offshore resource exploration. Rapid industrialization and urbanization in countries like China and India have heightened demand for precise hydrographic data for navigation and resource management. Government initiatives promoting sustainable ocean practices and advancements in survey technology further bolster the market's expansion, making it a key player in global hydrographic activities

The report focuses on growth prospects, restraints, and trends of the hydrographic survey equipment market analysis. The study provides Porter’s five forces analysis to understand the impact of numerous factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the hydrographic survey equipment industry.

Competitive Analysis

The report analyzes the profiles of key players operating in the hydrographic survey equipment such as Edgetech, Fugro N.V., Innomar Technologie GmbH, Ixblue SAS, Kongsberg Gruppen ASA, Mind Technology, Inc., Sonardyne International Ltd., Syqwest Inc., Teledyne Technologies Inc., Tritech International Ltd., and Valeport Ltd. These players have adopted various strategies to increase their market penetration and strengthen their position in the Hydrographic survey equipment market.

Rise in Adoption of New Technologies within the Hydrographic Survey Equipment

The demand for hydrographic survey equipment is significantly driven by the adoption of new technologies that enhance data accuracy, efficiency, and usability. Advanced tools such as autonomous underwater vehicles (AUVs), remote sensing systems, and integrated software solutions facilitate real-time data collection and analysis, improving the overall effectiveness of hydrographic surveys.

Furthermore, innovations like 3D mapping, artificial intelligence, and machine learning are transforming traditional survey methods, enabling quicker and more precise assessments of underwater environments. As industries such as offshore oil and gas, maritime navigation, and environmental monitoring expand, the need for reliable and advanced hydrographic equipment becomes increasingly critical.

For instance, in September 2024, the MoLaS (Multi-Layered Sonar) launched underwater Lidar and 3D mapping technology, which are integral components of modern hydrographic survey equipment. By enhancing the capabilities of underwater mapping, these technologies provide high-resolution data crucial for marine research, habitat mapping, and resource management. This product aims to bring together experts to discuss innovations, applications, and the future of Lidar technology in hydrographic surveys, ultimately contributing to more efficient and precise underwater assessments. This aligns with the growing demand for advanced methodologies in oceanographic research and environmental monitoring.

Moreover, governments and organizations worldwide are prioritizing investments in modern surveying technologies to ensure sustainable development and resource management. This convergence of technological advancement and industry demand is expected to fuel market growth in the coming years. Therefore, rise in adoption of new technologies within the hydrographic survey equipment is driving the demand for hydrographic survey equipment market.

Application of Hydrographic Surveys in Multiple Domains

The rise in application of hydrographic surveys across multiple domains is driving demand for hydrographic survey equipment. These surveys play a crucial role in various industries, including marine navigation, offshore oil and gas exploration, coastal management, and environmental monitoring. In marine navigation, accurate depth measurements and seabed mapping are essential for safe navigation and port operations. The offshore oil and gas sector relies heavily on hydrographic surveys for pipeline routing and site assessments, ensuring operational efficiency and safety.

For instance, in September 2024, OceanAlpha expanded its advanced uncrewed surface vessels (USVs) throughout the Middle East, beginning in Doha, Qatar. This expansion targets key sectors, including offshore oil and gas, offshore wind, marine survey companies, maritime enforcement authorities, and fishery management departments. Designed to provide potential users with an in-depth, hands-on experience, the showcase aims to demonstrate the capabilities, solutions, and applications of OceanAlpha’s cutting-edge USV products.

Furthermore, environmental agencies utilize these surveys to monitor changes in aquatic ecosystems, assess coastal erosion, and plan conservation efforts. The versatility of hydrographic surveys makes them indispensable for infrastructure development, disaster management, and maritime security. As industries increasingly recognize the value of precise underwater data, the demand for advanced hydrographic survey equipment continues to rise, positioning this market for significant growth in the coming years. Therefore, application of hydrographic surveys in multiple domains is driving the demand for hydrographic survey equipment market.

Lack Of Skilled Labour

The hydrographic survey equipment market is currently facing challenges due to a significant lack of skilled labor. As the demand for precise hydrographic data grows across various sectors, including renewable energy and marine exploration, the shortage of qualified professionals hampers the industry's ability to meet these needs effectively. Many organizations struggle to find individuals who are trained in advanced surveying technologies and methodologies, which limits operational efficiency and innovation.

Furthermore, this skill gap not only affects the implementation of new technologies but also impacts the overall quality of surveys conducted, leading to delays and potential inaccuracies in data collection. The industry needs to invest in training programs and partnerships with educational institutions to develop a workforce capable of leveraging the latest advancements in hydrographic surveying. Addressing this issue is crucial for ensuring the sustainable growth of the market and the successful execution of critical projects across various domains. Therefore, lack of skilled labour is hampering the growth of the hydrographic survey equipment market.

Increase in Reliance on Computing System

The increase in reliance on computing systems presents a lucrative opportunity for the hydrographic survey equipment market. Advanced software and data analytics capabilities enhance the efficiency and accuracy of hydrographic surveys, allowing for real-time data processing and visualization. By integrating cloud computing, surveyors can access and share data seamlessly, leading to quicker decision-making and operational efficiency.

Furthermore, the rise in use of artificial intelligence and machine learning in data analysis enables the extraction of valuable insights from complex datasets, optimizing survey planning and execution. This shift towards digitization and automation not only improves the quality of hydrographic surveys but also expands their application across various sectors, including renewable energy, coastal management, and maritime navigation. As organizations recognize the benefits of sophisticated computing solutions, the demand for advanced hydrographic survey equipment that incorporates these technologies is expected to rise, driving market growth. Therefore, increase in reliance on computing systems is a lucrative opportunity for the hydrographic survey equipment market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Hydrographic survey equipment analysis from 2023 to 2033 to identify the prevailing Hydrographic survey equipment opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Hydrographic survey equipment segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global Hydrographic survey equipment trends, key players, market segments, application areas, and market growth strategies.

Hydrographic Survey Equipment Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 6.5 billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2023 - 2033 |

| Report Pages | 386 |

| By Type |

|

| By Platform |

|

| By Application |

|

| By End User |

|

| By Depth |

|

| By Region |

|

| Key Market Players | EdgeTech, Kongsberg Gruppen ASA, Valeport Ltd., iXblue SAS, Sonardyne International Ltd., Teledyne Technologies Inc., Xylem, Syqwest Inc., Innomar Technologies GmbH, Tritech International Ltd. |

The hydrographic survey equipment market is witnessing trends like advancements in autonomous survey vessels, increased adoption of AI and IoT for data processing, and growing demand for coastal and offshore mapping for renewable energy projects globally.

Offshore Oil and Gas Survey is the leading application of Hydrographic Survey Equipment Market

North America is the largest regional market for Hydrographic Survey Equipment

$6471.1 million is the estimated industry size of Hydrographic Survey Equipment

Edgetech, Fugro N.V., Innomar Technologie GmbH, Ixblue SAS, Kongsberg Gruppen ASA, Mind Technology, Inc., Sonardyne International Ltd., Syqwest Inc., Teledyne Technologies Inc., Tritech International Ltd., and Valeport Ltd. are the top companies to hold the market share in Hydrographic Survey Equipment

Loading Table Of Content...

Loading Research Methodology...