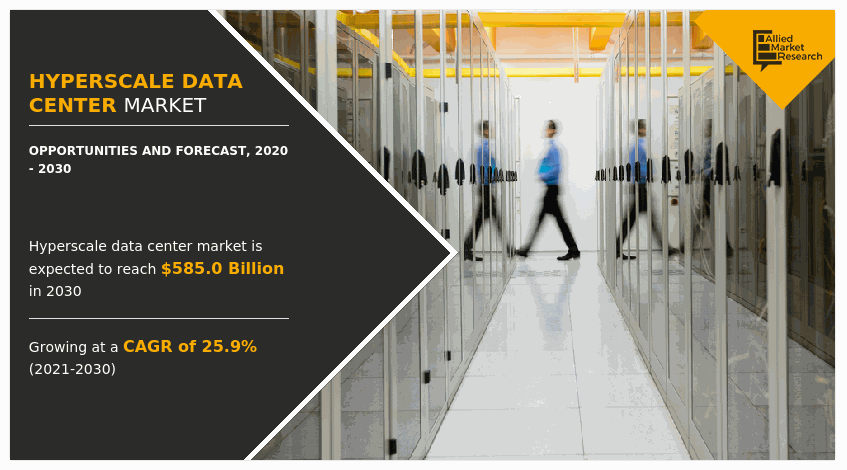

Hyperscale Data Center Market Size & Share:

The global hyperscale data center market was valued at USD 59.0 billion in 2020, and is projected to reach USD 585.0 billion by 2030, growing at a CAGR of 25.9% from 2021 to 2030.

Rise in demand for data centers to enhance productivity and customer experiences propel the growth of the global market. The need to increase the network operational efficiency positively impacts the growth of the market. However, high implementation cost of hyperscale data center solutions hampers the hyperscale data center market growth. On the contrary, increase in cloud dependence and industry 4.0 trends are expected to offer remunerative opportunities for expansion of the market during the forecast period.

The hyperscale data center is geared to provide a unified, generally scalable computational architecture to support the digital and cloud infrastructure of a technology. The hyperscale data center design is built from small, individual servers known as nodes, which are designed to provide computing, networking, and storage solutions to business enterprises. These nodes are combined and operated as a single entity. The primary concept behind designing hyperscale architecture is to begin with minimal infrastructure to keep early investments as low as feasible. As demand grows, more nodes can be added to the cluster to expand the basic infrastructure. Hyperscale data centers have been widely embraced by huge corporations, such as Amazon.com and Google, making them one of the fastest-growing technologies in the IT infrastructure space.

Segment Review:

The hyperscale data center industry is segmented on the basis of component, user type, enterprise size, end user, and region. By component, the market is segmented into solution and service. On the basis of user type, the market is fragmented into cloud providers, colocation providers, and enterprises. By enterprise size, the market is bifurcated into, large enterprise and SMEs. By end user, the hyperscale data center market is classified into BFSI, IT and telecom, government, energy and utilities, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The global hyperscale data center industry is dominated by key players, such as Avago Technologies, Cavium, Inc., Cisco Systems, Inc., Ericsson, Hewlett-Packard, Intel Corporation, International Business Machines Corporation, Mellanox Technologies, Inc., Nlyte Software, and SanDisk Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

By User Type

The necessity to reduce capital and operation expenditure and the need for more energy-efficient solutions are the factors driving the enterprise hyperscale data center market.

By user type, the cloud providers segment dominated the hyperscale data center market share in 2020, and is expected to continue this trend during the forecast period as the hyperscale data centers are being utilized to develop scalable and robust cloud networks that can improve overall customer experience, availability, and operational costs. However, the enterprise segment is expected to witness the highest growth in the upcoming years, owing to growing demand for automation and remote operability in modern enterprises.

Region-wise, the hyperscale data center market share was dominated by North America in 2020, and is expected to retain its position during the forecast period. High concentration of cloud services providers in the region is expected to drive the market for hyperscale data center technology during the forecast period. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to significant economic and technological developments in the region, which is expected to fuel the growth of hyperscale data center solutions in the region in the coming few years.

Top Impacting Factors:

Reduce Operational Costs

Adoption of hyperscale data centers decreases the total cost of ownership due to optimal hardware infrastructure utilization, effective allocation of system workloads, and process transformation. Hyperscale data center architectures are already being used across colocation data center because of their low cost and great performance. Hyperscale data center architecture assists enterprises in lowering their colocation data center OPEX and CAPEX.

Increase in Energy Efficiency

Energy efficiency is a key component that drives the hyperscale data center market, as all businesses strive to improve their total energy efficiency. Organizations seek data centers that use the least amount of energy while having the least impact on the environment. The drive to save money on power rises the demand for energy-efficient hyperscale data centers. In data centers, high-density blade servers, and storage systems provide higher computation capability per Watt of energy consumption.

Key Benefits for Stakeholders:

- The study provides an in-depth analysis of the global hyperscale data center market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on global hyperscale data center market trends is provided in the report.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- Quantitative hyperscale data center market analysis from 2021 to 2030 is provided to determine the market potential.

Hyperscale Data Center Market Report Highlights

| Aspects | Details |

| By Component |

|

| By User Type |

|

| By Enterprise Size |

|

| By End User |

|

| By Region |

|

| Key Market Players | International Business Machines Corporation, Cavium, Inc., Mellanox Technologies, Inc., Intel Corporation, Avago Technologies, SanDisk Corporation, Cisco Systems, Inc., Hewlett-Packard Company, Nlyte Software, Ericsson |

Analyst Review

Demand for hyperscale data center systems has been increasing since the past few years and is expected to continue this trend in the coming years, owing to increase in market competitiveness and rise in demand for cloud-based applications, which are supporting the development of hyperscale data centers that provide dynamically scalable cloud infrastructure to business enterprises at a lower cost. Moreover, increasing automation and IoT trends are further enabling the need for hyperscale data centers. In addition, growing digital and internet penetration in many regions globally are promising new opportunities for the growth of the hyperscale data center market in the coming years.

Key providers of the hyperscale data center market, such as IBM Corporation, Microsoft Corporation, and Cisco system Inc. account for a significant share in the market. With larger requirement from hyperscale data center, various companies are establishing partnerships to increase hyperscale data center capabilities. For instance, in November 2021, Cisco System Inc. announced partnership with Meta Corporation to develop and deploy two new next-generation TOR switches. Under this partnership, Cisco and Meta developed Wedge TOR, such as Wedge 400 and 400C. Both of these switches offer higher front panel port density, and greater performance for AI and machine learning applications, while also enabling future expansions. Such innovations are anticipated to boost the efficiency of large data centers.

In addition, with the increase in demand for hyperscale data center, various companies are expanding their current product portfolio with increase in diversification among customers. For instance, in November 2021, Broadcom Inc., an American IT infrastructure solutions provider announced the launch of its leading-edge 25.6 Tbps Ethernet switch, Broadcom StrataXGS® Tomahawk® 4 switch series. The Tomahawk4 switch series provides the world’s lowest power per bit of throughput, enabling significant savings in operational expense and allowing for ultra-high density network equipment. Such solutions are aimed to reduce the power consumption of data centers and hence, increase its energy efficiency.

Moreover, market players are expanding their business operations and customers by increasing their acquisition. For instance, in January 2022, Nvidia Corporation announced the acquisition of Bright Computing, an American linux cluster automation and management solutions provider. The acquisition extends Nvidia’s software stack for accelerated computing. Nvidia said Bright’s software and expertise are expected to enhance its Nvidia DGX and data center businesses.

Rise in demand for data centers to enhance productivity and customer experiences propel the growth of the global hyperscale data center market. The need to increase the network operational efficiency positively impacts the growth of the hyperscale data center market.

North America is the largest regional market for Hyperscale Data Center.

The global hyperscale data center market size was valued at $58.97 billion in 2020, and is projected to reach $584.96 billion by 2030, growing at a CAGR of 25.9% from 2021 to 2030.

The global hyperscale data center industry is dominated by key players, such as Avago Technologies, Cavium, Inc., Cisco Systems, Inc., Ericsson, Hewlett-Packard, Intel Corporation, International Business Machines Corporation, Mellanox Technologies, Inc., Nlyte Software, and SanDisk Corporation.

Loading Table Of Content...