Hysteroscopy System Market Research, 2033

The global hysteroscopy system market size was valued at $1.6 billion in 2023, and is projected to reach $3.3 billion by 2033, growing at a CAGR of 7.7% from 2024 to 2033. The hysteroscopy system market is driven by the rising prevalence of gynecological disorders such as fibroids, polyps, and abnormal uterine bleeding, necessitating advanced diagnostic and therapeutic tools. Technological advancements, such as high-definition imaging and improved fluid management systems, enhance procedural safety and effectiveness, boosting market adoption.

Hysteroscopy is a minimally invasive procedure used to examine the inside of the uterus, primarily to diagnose and treat various gynecological conditions. The instruments used in hysteroscopy are specifically designed to facilitate this procedure, allowing for both visualization and intervention. The primary instrument is the hysteroscope, a thin, lighted tube equipped with a camera, which is inserted through the cervix into the uterus. This provides a clear view of the uterine cavity on a monitor, enabling the physician to identify abnormalities such as polyps, fibroids, or adhesions. Accompanying the hysteroscope are a variety of specialized tools, including graspers, scissors, and biopsy forceps, which are introduced through channels in the hysteroscope to perform therapeutic actions. Additionally, distention media, such as saline or carbon dioxide, are used to expand the uterine cavity for better visualization and maneuverability of instruments. The precise and versatile nature of hysteroscopy instruments makes them indispensable in modern gynecological practice, allowing for accurate diagnosis and effective treatment with minimal discomfort and recovery time for patients.

Key Takeaways

The hysteroscopy system industry study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major hysteroscopy industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The hysteroscopy system market size is driven by several factors, primarily the increasing prevalence of gynecological disorders such as uterine fibroids, polyps, and abnormal bleeding, which necessitate diagnostic and therapeutic interventions. The growing preference for minimally invasive procedures, which offer reduced recovery times and lower risk of complications compared to traditional surgical methods, further propels market growth. Technological advancements in hysteroscopic equipment, such as the development of high-definition cameras and more efficient distention media, enhance the effectiveness and safety of these procedures, thereby boosting their adoption.

However, the hysteroscopy system market growth also faces certain restraint such as high costs associated with hysteroscopic instruments and procedures can limit their accessibility, particularly in low-income regions. Additionally, the need for specialized training and expertise to perform hysteroscopy effectively can act as a barrier to widespread implementation. The risk of complications, although generally low, such as infection or uterine perforation, may also deter some patients and healthcare providers from opting for this procedure.

Furthermore, there are significant hysteroscopy system market opportunity for growth in the market. Increasing awareness and acceptance of hysteroscopy as a standard diagnostic and therapeutic tool in gynecology open new avenues for market expansion. The rising demand for outpatient and office-based hysteroscopy procedures, which offer greater convenience and cost-effectiveness, presents a lucrative opportunity for manufacturers. Furthermore, emerging markets, particularly in Asia-Pacific and Latin America, offer substantial growth potential due to improving healthcare infrastructure and rising healthcare expenditure. Continued innovation and the development of more user-friendly, cost-effective instruments can further enhance market prospects, making hysteroscopy a more accessible and widely used procedure globally.

Market Segmentation

The hysteroscopy system industry is segmented into product type, usability, end-user and region. On the basis of product type, the market is classified into hand-held instruments, hysteroscopes, resectoscopes, hysterosheaths, fluid management system, hysteroscopic tissue removal system. Based on usability, the market is divided into reusable and disposable. As per end user, the market is segregated into hospitals, ambulatory surgical centers and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America has largest hysteroscopy system market share and is primarily driven by several key factors. One of the most significant drivers is the advanced healthcare infrastructure, which facilitates the adoption of cutting-edge medical technologies and minimally invasive procedures. The high prevalence of gynecological disorders, such as uterine fibroids, polyps, and abnormal bleeding, creates a substantial demand for diagnostic and therapeutic hysteroscopic procedures. Additionally, the region benefits from a high level of healthcare expenditure and robust insurance coverage, making these advanced procedures more accessible to a larger segment of the population.

In addition, strong presence of key market players and continuous technological advancements further drive growth during hysteroscopy system market forecast. Companies in North America are at the forefront of innovation, developing more efficient, user-friendly, and effective hysteroscopy instruments. These advancements include high-definition imaging systems, improved hysteroscopes, and more sophisticated tissue removal systems, which enhance the accuracy and safety of hysteroscopic procedures.

- In March 2024, U.S. President Biden issued executive order and announced new actions to advance women’s health research and innovation. The President called on Congress to make a bold, transformative investment of $12 billion in new funding for women’s health research. This investment would be used to create a Fund for Women’s Health Research at the National Institutes of Health (NIH) to advance a cutting-edge, interdisciplinary research agenda and to establish a new nationwide network of research centers of excellence and innovation in women’s health—which would serve as a national gold standard for women’s health research across the lifespan.

Industry Trends

- In January 2024, the UK Health Secretary announced new women's health priorities for 2024 including hysteroscopy guidelines.

- In April 2024, Nambour General Hospital (Australia) offered a new service which will allow women to have a hysteroscopy procedure performed under local anesthetic in as little as one to two hours. Currently, patients stay in hospital for six to 14 hours to undergo the procedure. The Outpatient Hysteroscopy Service is set to benefit hundreds of local women each year and minimize disruption to their daily lives.

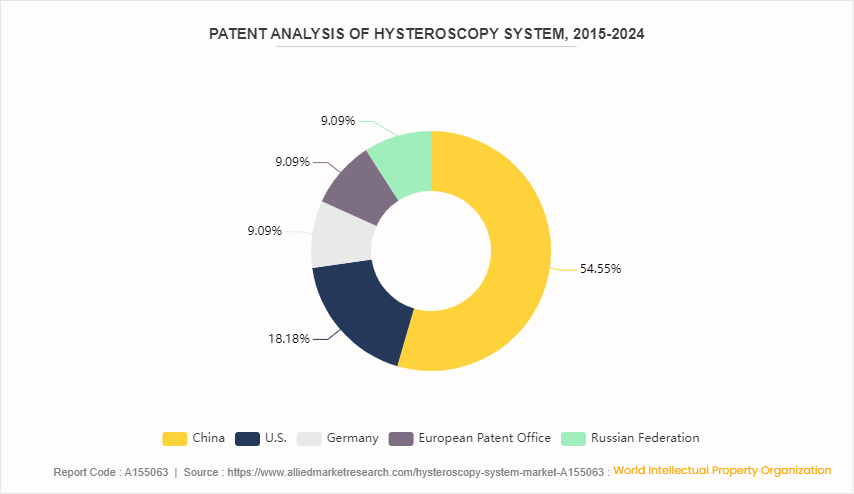

Patent Analysis, By Country, 2015-2024

China witnessed the highest number of patent approvals and applications, due to favorable government policies, new technological advancement and new product launches in the country. The U.S. has 18.18% of the total number of patents, followed by Germany at 9.09% and other countries.

Competitive Landscape

The major hysteroscopy system market share players operating in the market include Karl Storz GmbH & Co. KG, Olympus Corporation, Hologic, Inc., Stryker Corporation, Richard Wolf GmbH, Medtronic plc, Boston Scientific Corporation, Johnson & Johnson, CooperSurgical, Inc., B. Braun Melsungen AG, and Cook Medical Inc. Other players in hysteroscopy system market includes Cook Medical Inc., Smith & Nephew plc., MedGyn Products, Inc., LiNA Medical ApS, Maxer Medizintechnik GmbH, and so on.

Recent Key Strategies and Developments

- In July 2023, GenWorks, a healthcare solutions provider, announced the introduction of its mechanical hysteroscopic tissue removal system that uses a simple mechanical approach for removing intrauterine tissues.

- In November 2022, Medtronic launched the TruClear and HysteroLux System for Diagnostic and Operative Hysteroscopy in India. It is a mechanical hysteroscopic tissue removal system used for the safe and effective treatment of intra uterine abnormalities (IUA) .

- In June 2022, UroViu Corp launched the new Hystero-V, a single-use hysteroscope compatible with UroViu's Always Ready endoscopy platform.

- In January 2022, Inovus Medical announced the launch of a new high fidelity hysteroscopy simulator, HystAR. The simulator combines the company’s patented Augmented Reality technology and cloud-based learning platform with the natural haptics of its simulated tissue models to deliver highly realistic, scalable, tracked hysteroscopy skills training.

- In January 2021, Hologic launched Fluent Fluid Management System for hysteroscopic procedures in Europe. This system is designed to provide healthcare professionals performing hysteroscopic procedures simpler, more effective fluid management.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the Hysteroscopy system market segments, current trends, estimations, and dynamics of the Hysteroscopy system market analysis from 2023 to 2035 to identify the prevailing Hysteroscopy system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Hysteroscopy system market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global Hysteroscopy system market Statistics.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global Hysteroscopy system market trends, key players, market segments, application areas, and market growth strategies.

Key Sources Referred

- Centers for Disease Control and Prevention

- World Health Organization

- National Center for Biotechnology Information

- The Lancet

- National Perinatal Epidemiology and Statistics Unit (NPESU)

- Science Direct

- Health Resources and Services Administration (HRSA)

- Department of Health and Human Services (HHS)

- National Institutes of Health (NIH)

Hysteroscopy System Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 3.3 Billion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 260 |

| By Product Type |

|

| By Usability |

|

| By End User |

|

| By Region |

|

| Key Market Players | Olympus Corporation, CooperSurgical, Inc., Stryker Corporation., Medtronic plc, Boston Scientific Corporation, B. Braun Melsungen AG, Richard Wolf GmbH, Johnson & Johnson, Hologic, Inc., Karl Storz GmbH & Co. KG |

Hysteroscopy is a minimally invasive procedure used to examine the inside of the uterus, primarily to diagnose and treat various gynecological conditions.

The hysteroscopy system market is driven by the rising prevalence of gynecological disorders such as fibroids, polyps, and abnormal uterine bleeding, necessitating advanced diagnostic and therapeutic tools. Technological advancements, such as high-definition imaging and improved fluid management systems, enhance procedural safety and effectiveness, boosting market adoption.

TheKarl Storz GmbH & Co. KG, Olympus Corporation, Hologic, Inc., Stryker Corporation, Richard Wolf GmbH, Medtronic plc, Boston Scientific Corporation, Johnson & Johnson held a high market position in 2023.

The base year is 2023 in hysteroscopy system market.

The forecast period for hysteroscopy system market is 2024 to 2033.

The market value of hysteroscopy system market is projected to reach $3.3 billion by 2033.

The total market value of hysteroscopy system market was $1.6 billion in 2023.

Loading Table Of Content...